by Calculated Risk on 1/28/2024 08:31:00 AM

Sunday, January 28, 2024

FOMC Preview: No Change to Policy Expected

Most analysts expect there will be no change to FOMC policy at the meeting this week, keeping the target range for the federal funds rate at 5‑1/4 to 5-1/2 percent.

"The FOMC will likely aim to keep a March cut on the table without sending a decisive signal by removing the outdated hiking bias from its statement and noting that future policy changes will depend on upcoming inflation and other data."

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | 2026 |

| Dec 2023 | 2.5 to 2.7 | 1.2 to 1.7 | 1.5 to 2.0 | 1.8 to 2.0 |

| Sept 2023 | 1.9 to 2.2 | 1.2 to 1.8 | 1.6 to 2.0 | 1.7 to 2.0 |

The unemployment rate was at 3.7% in December and averaged just under 3.8% for Q4. The FOMC's unemployment rate projection for Q4 was close.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | 2026 |

| Dec 2023 | 3.8 | 4.0 to 4.2 | 4.0 to 4.2 | 3.9 to 4.3 |

| Sept 2023 | 3.7 to 3.9 | 3.9 to 4.4 | 3.9 to 4.3 | 3.8 to 4.3 |

As of December 2023, PCE inflation increased 2.6 percent year-over-year (YoY). On a Q4-over-Q4 basis, PCE inflation increased 2.6%, lower than the December projection.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | 2026 |

| Dec 2023 | 2.7 to 2.9 | 2.2 to 2.5 | 2.0 to 2.2 | 2.0 |

| Sept 2023 | 3.2 to 3.4 | 2.3 to 2.7 | 2.0 to 2.3 | 2.0 to 2.2 |

PCE core inflation increased 2.9 percent YoY in December. On a Q4-over-Q4 basis, PCE inflation increased 3.0%, lower than the December projection.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2023 | 2024 | 2025 | 2026 |

| Dec 2023 | 3.2 to 3.3 | 2.4 to 2.7 | 2.0 to 2.2 | 2.0 to 2.1 |

| Sept 2023 | 3.6 to 3.9 | 2.5 to 2.8 | 2.0 to 2.4 | 2.0 to 2.3 |

Saturday, January 27, 2024

Real Estate Newsletter Articles this Week: New Home Sales increase to 664,000 Annual Rate

by Calculated Risk on 1/27/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• New Home Sales increase to 664,000 Annual Rate in December

• NMHC: "Apartment Market Continues to Loosen"

• 1.54 million Total Housing Completions in 2023 including Manufactured Homes; Most Since 2007

• Final Look at Local Housing Markets in December

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of January 28, 2024

by Calculated Risk on 1/27/2024 08:11:00 AM

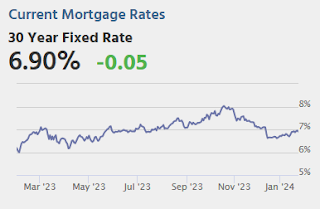

The key reports scheduled for this week are the January employment report and November Case-Shiller house prices.

Other key indicators include the January ISM manufacturing index and January vehicle sales.

The FOMC meets this week, and no change to policy is expected.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for January. This is the last of the regional Fed manufacturing surveys for January.

9:00 AM: FHFA House Price Index for November. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM ET: S&P/Case-Shiller House Price Index for November.

9:00 AM ET: S&P/Case-Shiller House Price Index for November.This graph shows the Year over year change in the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 5.8% year-over-year increase.

10:00 AM ET: Job Openings and Labor Turnover Survey for December from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for December from the BLS. This graph shows job openings (black line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in November to 8.79 million from 8.85 million in October.

10:00 AM: The Q4 Housing Vacancies and Homeownership report from the Census Bureau.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 130,000 payroll jobs added in January, down from 164,000 added in December.

9:45 AM: Chicago Purchasing Managers Index for January. The consensus is for a reading of 48.0, up from 46.9 in December.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims, down from 214 thousand last week.

10:00 AM: Construction Spending for December. The consensus is for a 0.5% increase in construction spending.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 47.3, down from 47.4 in December.

8:30 AM: Employment Report for December. The consensus is for 162,000 jobs added, and for the unemployment rate to increase to 3.8%.

8:30 AM: Employment Report for December. The consensus is for 162,000 jobs added, and for the unemployment rate to increase to 3.8%.There were 216,000 jobs added in December, and the unemployment rate was at 3.7%.

This graph shows the jobs added per month since January 2021.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for January).

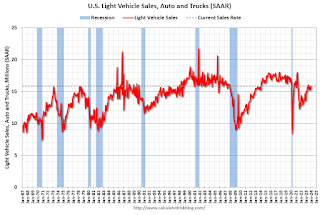

All day: Light vehicle sales for January. Sales were at 15.8 million in December (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for January. Sales were at 15.8 million in December (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate.

Friday, January 26, 2024

Jan 26th COVID Update: Weekly Deaths Increased

by Calculated Risk on 1/26/2024 07:02:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 24,718 | 28,154 | ≤3,0001 | |

| Deaths per Week2🚩 | 1,978 | 1,806 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

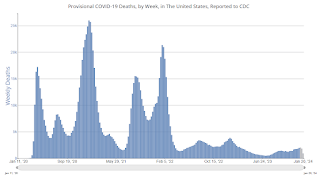

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

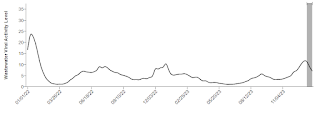

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.U.S. Courts: Bankruptcy Filings Increase 17 Percent in 2023; 42% Below Pre-Pandemic Levels

by Calculated Risk on 1/26/2024 12:59:00 PM

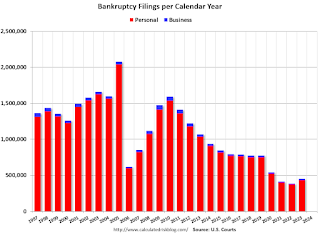

From the U.S. Courts: Bankruptcy Filings Rise 16.8 Percent

Total bankruptcy filings rose 16.8 percent, with significant increases in both business and non-business bankruptcies, in the twelve-month period ending Dec. 31, 2023. This accelerates a continuing rebound in filings after more than a decade of sharply dropping totals.

According to statistics released by the Administrative Office of the U.S. Courts, annual bankruptcy filings totaled 452,990 in the year ending December 2023, compared with 387,721 cases in the previous year.

Business filings rose 40.4 percent, from 13,481 to 18,926, in the year ending Dec. 31, 2023. Non-business bankruptcy filings rose 16 percent to 434,064, compared with 374,240 in December 2022.

Bankruptcy totals for the previous 12 months are reported four times annually.

This is the fourth straight quarter that total bankruptcy filings have risen, following a decade-plus decline. Bankruptcies fell especially sharply after the pandemic began in early 2020, despite some COVID-related disruptions to the economy.

Despite the recent increases, the newest totals remain far lower than in December 2010, when filings peaked at just less than 1.6 million.

Click on graph for larger image.

Click on graph for larger image.This graph shows the business and non-business bankruptcy filings by calendar year since 1997.

The sharp decline in 2006 was due to the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005".

2023 was the 3rd lowest year for bankruptcy filings, and 42% below the pre-pandemic level in 2019.

NAR: Pending Home Sales Increase 8.3% December; Up 1.3% Year-over-year

by Calculated Risk on 1/26/2024 10:00:00 AM

From the NAR: Pending Home Sales Climbed 8.3% in December

Pending home sales in December elevated 8.3%, according to the National Association of REALTORS®. The Midwest, South and West posted monthly gains in transactions while the Northeast recorded a loss. The Midwest, South and West also registered year-over-year increases while the Northeast had a decline in transactions compared to last year.This was well above expectations. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in January and February.

The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – increased to 77.3 in December. Year over year, pending transactions were up 1.3%. An index of 100 is equal to the level of contract activity in 2001.

...

The Northeast PHSI dropped 3.0% from last month to 62.3, a decline of 3.9% from December 2022. The Midwest index increased 5.6% to 80.5 in December, up 4.3% from one year ago.

The South PHSI jumped 11.9% to 93.0 in December, rising 1.5% from the prior year. The West index surged 14.0% in December to 61.0, up 1.5% from December 2022.

emphasis added

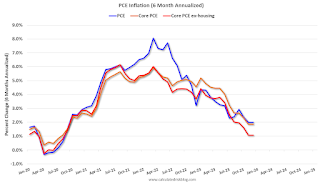

PCE Measure of Shelter Slows to 6.4% YoY in December

by Calculated Risk on 1/26/2024 08:59:00 AM

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through December 2023.

Since asking rents are mostly flat year-over-year, these measures will continue to slow over coming months.

The second graph shows PCE prices, Core PCE prices and Core ex-housing over the last 6 months (annualized):

Key measures are now at or below the Fed's target on a 6-month basis.

Key measures are now at or below the Fed's target on a 6-month basis.PCE Price Index: 2.0%

Core PCE Prices: 1.9%

Core minus Housing: 1.1%

Personal Income increased 0.3% in December; Spending increased 0.7%

by Calculated Risk on 1/26/2024 08:30:00 AM

The BEA released the Personal Income and Outlays report for December:

Personal income increased $60.0 billion (0.3 percent at a monthly rate) in December, according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $51.8 billion (0.3 percent) and personal consumption expenditures (PCE) increased $133.9 billion (0.7 percent).The December PCE price index increased 2.6 percent year-over-year (YoY), unchanged from 2.6 percent YoY in November, and down from the recent peak of 7.0 percent in June 2022.

The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.2 percent. Real DPI increased 0.1 percent in December and real PCE increased 0.5 percent; goods increased 1.1 percent and services increased 0.3 percent

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through December 2023 (2017 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was at expectations, and PCE was well above expectations.

Thursday, January 25, 2024

Friday: Personal Income and Outlays, Pending Home Sales

by Calculated Risk on 1/25/2024 07:55:00 PM

Friday:

• At 8:30 AM ET, Personal Income and Outlays for December. The consensus is for a 0.3% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%. PCE prices are expected to be up 2.6% YoY, and core PCE prices up 3.0% YoY.

• At 10:00 AM, Pending Home Sales Index for December. The consensus is for a 2.0% increase in the index.

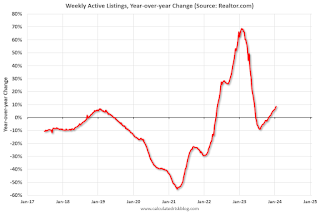

Realtor.com Reports Active Inventory UP 8.6% YoY; New Listings up 3.4% YoY

by Calculated Risk on 1/25/2024 02:55:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View — Data Week Ending January 20, 2024

• Active inventory increased, with for-sale homes 8.6% above year ago levels.

Active listings in the past week grew by 8.6% above the previous year, the 11th straight week of annual growth with no sign yet of a slowdown as growth in inventory increased from the previous week’s 7.9% rate. Should the uptick in new listings persist, the added inventory would greatly improve availability and affordability heading into the spring homebuying season but overall inventory is still 37.5% below similar weeks in 2017 to 2020.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 3.4% from one year ago.

Newly listed homes continue to rise above last year’s levels for the 13th week in a row. However, this past week the number of newly listed homes grew by only 3.4% over last year, a slowing down of the 7.0% growth rate seen in the previous week. During the winter season, there is a smaller pool of both home buyers and sellers active in the market, which could lead to more week-to-week fluctuations. Nonetheless, this past week’s new listing count still represents a decline of 25.9% compared to similar weeks in 2017 to 2020.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 11th consecutive week following 20 consecutive weeks with a YoY decrease in inventory.