by Calculated Risk on 2/01/2024 10:20:00 AM

Thursday, February 01, 2024

Construction Spending Increased 0.9% in December

From the Census Bureau reported that overall construction spending increased:

Construction spending during December 2023 was estimated at a seasonally adjusted annual rate of $2,096.0 billion, 0.9 percent above the revised November estimate of $2,078.3 billion. The December figure is 13.9 percent above the December 2022 estimate of $1,840.9 billion.Both private and public spending increased:

The value of construction in 2023 was $1,978.7 billion, 7.0 percent above the $1,848.7 billion spent in 2022.

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,619.7 billion, 0.7 percent above the revised November estimate of $1,608.0 billion. ...

In December, the estimated seasonally adjusted annual rate of public construction spending was $476.3 billion, 1.3 percent above the revised November estimate of $470.3 billion.

Click on graph for larger image.

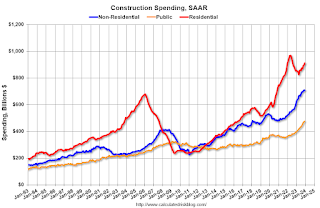

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 6.0% below the recent peak.

Non-residential (blue) spending is slightly below the peak in the previous month.

Public construction spending is at a new peak.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 6.8%. Non-residential spending is up 19.1% year-over-year. Public spending is up 21.3% year-over-year.

ISM® Manufacturing index Increased to 49.1% in January

by Calculated Risk on 2/01/2024 10:00:00 AM

(Posted with permission). The ISM manufacturing index indicated contraction. The PMI® was at 49.1% in January, up from 47.1% in December. The employment index was at 47.1%, down from 47.5% the previous month, and the new orders index was at 52.5%, up from 47.0%.

From ISM: Manufacturing PMI® at 49.1% January 2024 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in January for the 15th consecutive month following one month of “unchanged” status (a PMI® reading of 50 percent) and 28 months of growth prior to that, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing contracted slightly in January. This was above the consensus forecast.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The Manufacturing PMI® registered 49.1 percent in January, up 2 percentage points from the seasonally adjusted 47.1 percent recorded in December. The overall economy continued in expansion for the 45th month after one month of contraction in April 2020. (A Manufacturing PMI® above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy.) The New Orders Index moved into expansion territory at 52.5 percent, 5.5 percentage points higher than the seasonally adjusted figure of 47 percent recorded in December. The January reading of the Production Index (50.4 percent) is 0.5 percentage point higher than December’s seasonally adjusted figure of 49.9 percent. The Prices Index registered 52.9 percent, up 7.7 percentage points compared to the reading of 45.2 percent in December. The Backlog of Orders Index registered 44.7 percent, 0.6 percentage point lower than the 45.3 percent recorded in December. The Employment Index registered 47.1 percent, down 0.4 percentage point from December’s seasonally adjusted figure of 47.5 percent.

emphasis added

Weekly Initial Unemployment Claims Increase to 224,000

by Calculated Risk on 2/01/2024 08:30:00 AM

The DOL reported:

In the week ending January 27, the advance figure for seasonally adjusted initial claims was 224,000, an increase of 9,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 214,000 to 215,000. The 4-week moving average was 207,750, an increase of 5,250 from the previous week's revised average. The previous week's average was revised up by 250 from 202,250 to 202,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 207,750.

The previous week was revised up.

Weekly claims were above the consensus forecast.

Wednesday, January 31, 2024

Thursday: Unemployment Claims, ISM Mfg, Construction Spending

by Calculated Risk on 1/31/2024 08:45:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims, down from 214 thousand last week.

• At 10:00 AM, Construction Spending for December. The consensus is for a 0.5% increase in construction spending.

• Also at 10:00 AM, ISM Manufacturing Index for January. The consensus is for the ISM to be at 47.3, down from 47.4 in December.

Freddie Mac House Price Index Increased in December; Up 6.6% Year-over-year

by Calculated Risk on 1/31/2024 05:07:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Increased in December; Up 6.6% Year-over-year

A brief excerpt:

On a year-over-year basis, the National FMHPI was up 6.6% in December, from up 6.1% YoY in November. The YoY increase peaked at 19.1% in July 2021, and for this cycle, bottomed at up 0.9% YoY in April 2023. ...

As of December, 10 states were below their previous peaks, Seasonally Adjusted. The largest seasonally adjusted declines from the recent peak were in Maine (-3.4%), Idaho (-2.3%), Louisiana (-1.9%), and Washington (-1.8%).

For cities (Core-based Statistical Areas, CBSA), here are the 30 cities with the largest declines from the peak, seasonally adjusted. Austin continues to be the worst performing city.

FOMC Statement: No Change to Policy

by Calculated Risk on 1/31/2024 02:00:00 PM

Fed Chair Powell press conference video here or on YouTube here, starting at 2:30 PM ET.

FOMC Statement:

Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have moderated since early last year but remain strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are moving into better balance. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Michael S. Barr; Raphael W. Bostic; Michelle W. Bowman; Lisa D. Cook; Mary C. Daly; Philip N. Jefferson; Adriana D. Kugler; Loretta J. Mester; and Christopher J. Waller.

emphasis added

ADP: Private Employment Increased 107,000 in January

by Calculated Risk on 1/31/2024 08:30:00 AM

Private sector employment increased by 107,000 jobs in January and annual pay was up 5.2 percent year-over-year, according to the January ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”). The ADP National Employment Report is an independent measure and high-frequency view of the private-sector labor market based on actual, anonymized payroll data of more than 25 million U.S. employees.This was below the consensus forecast of 130,000. The BLS report will be released Friday, and the consensus is for 162 thousand non-farm payroll jobs added in January.

...

“Progress on inflation has brightened the economic picture despite a slowdown in hiring and pay,” said Nela Richardson, chief economist, ADP. “Wages adjusted for inflation have improved over the past six months, and the economy looks like it's headed toward a soft landing in the U.S. and globally.”

emphasis added

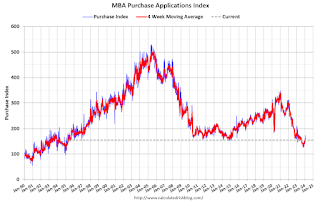

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 1/31/2024 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 7.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 26, 2024. Last week’s results included an adjustment to account for the MLK holiday.

The Market Composite Index, a measure of mortgage loan application volume, decreased 7.2 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 8 percent compared with the previous week. The Refinance Index increased 2 percent from the previous week and was 3 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 11 percent from one week earlier. The unadjusted Purchase Index increased 6 percent compared with the previous week and was 20 percent lower than the same week one year ago.

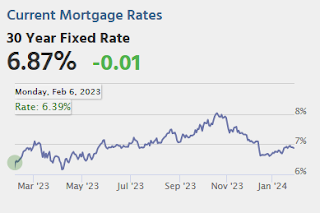

“Mortgage rates changed little last week, with the 30-year fixed rate at 6.78 percent, which is close to where it has been for the past month, but lower than the recent peak of 7.9 percent in October 2023,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Applications decreased compared to a holiday-adjusted week, driven by a decline in purchase applications that offset a slight increase in refinance activity. Low existing housing supply is limiting options for prospective buyers and is keeping home-price growth elevated, resulting in a one-two punch that continues to constrain home purchase activity. The average loan size for purchase applications has picked up in recent weeks to $444,100, the largest average loan size since May 2022.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) remained unchanged at 6.78 percent, with points increasing to 0.65 from 0.63 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 20% year-over-year unadjusted.

Tuesday, January 30, 2024

Wednesday: FOMC Statement, ADP Employment, Chicago PMI

by Calculated Risk on 1/30/2024 08:12:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 130,000 payroll jobs added in January, down from 164,000 added in December.

• At 9:45 AM: Chicago Purchasing Managers Index for January. The consensus is for a reading of 48.0, up from 46.9 in December.

• At 2:00 PM: FOMC Meeting Announcement. No change to policy is expected.

• At 2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

Fannie and Freddie: Single Family Serious Delinquency Rate Increased Slightly, Multi-family Unchanged in December

by Calculated Risk on 1/30/2024 04:29:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Fannie and Freddie: Single Family Serious Delinquency Rate Increased Slightly, Multi-family Unchanged in December

Brief excerpt:

Single-family serious delinquencies increased slightly in December, and multi-family serious delinquencies were unchanged.

...

Freddie Mac reports that the multi-family delinquencies rate was unchanged at 0.28% in December, and up from 0.12% in December 2022.

This graph shows the Freddie multi-family serious delinquency rate since 2012. Rates were still high in 2012 following the housing bust and financial crisis.

The multi-family rate increased following the pandemic and has increased recently as rent growth has slowed, vacancy rates have increased, and borrowing rates have increased sharply. This will be something to watch as more apartments come on the market.