by Calculated Risk on 2/05/2024 02:00:00 PM

Monday, February 05, 2024

Fed SLOOS Survey: Banks reported Tighter Standards, Weaker Demand for almost All Loan Types

From the Federal Reserve: he January 2024 Senior Loan Officer Opinion Survey on Bank Lending Practices

The January 2024 Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the fourth quarter of 2023.

Regarding loans to businesses, survey respondents, on balance, reported tighter standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes over the fourth quarter. Furthermore, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.

For loans to households, banks, on balance, reported that lending standards tightened across all categories of residential real estate (RRE) loans other than government residential mortgages and government-sponsored enterprise (GSE)-eligible residential mortgages, for which standards remained basically unchanged. Meanwhile, demand weakened for all RRE loan categories. In addition, banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Moreover, for credit card, auto, and other consumer loans, standards reportedly tightened, and demand weakened on balance.

While banks, on balance, reported having tightened lending standards further for most loan categories in the fourth quarter, lower net shares of banks reported tightening lending standards than in the third quarter across all loan categories.

The January SLOOS also included a set of special questions inquiring about banks’ expectations for changes in lending standards, borrower demand, and loan performance over 2024. Banks, on balance, reported expecting lending standards to remain basically unchanged for C&I and RRE loans, but to tighten further for CRE, credit card, and auto loans. In addition, banks reported expecting loan demand to strengthen across all loan categories, and loan quality to deteriorate across most loan types.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph on Residential Real Estate demand is from the Senior Loan Officer Survey Charts.

The upper graphs are for standards and shows standards have tightened.

Lawler: Update on Mortgage Rates and Spreads

by Calculated Risk on 2/05/2024 10:08:00 AM

Today, in the Real Estate Newsletter: Lawler: Update on Mortgage Rates and Spreads

Brief excerpt:

From housing economist Tom Lawler:There is much more in the article.

For the second consecutive year 2023 saw high levels of volatility in the US fixed-income markets in general and the mortgage/MBS markets in particular. Unlike in 2022, however, key Treasury rates and mortgage/MBS yields ended 2023 close to where they began.

30-Yr CCMBS: Yield on “notional par” MBS derived from price for coupon closest to but below par and price for coupon closest to but above par.

30-Yr FRM: Optimal Blue 30-year index for borrowers with LTV<=80 and FICO>740.

...

Much of the “angst” in the MBS market over the last year and a half (aside from high interest rate volatility) was associated with “extension risk” – that is, the slowdown in MBS prepayments when interest rates increase. The sharp increase in mortgage rates following the uber-low rates of the previous few years resulted in a huge number of mortgages with rates well over 300 basis points below current market rates. That had not been seen in over 40 years, and most prepayment models had little or no data on how slow mortgage prepayments could get. In turned out that the answer was “really low” and lower than many models projected, meaning that MBS backed by these low-rate mortgages saw their duration extend by much more than many MBS investors had expected, leading to much larger than “expected” mark-to-market losses.

ISM® Services Index Increases to 53.4% in January

by Calculated Risk on 2/05/2024 10:00:00 AM

(Posted with permission). The ISM® Services index was at 53.4%, up from 50.5% last month. The employment index increased to 50.5%, from 43.8%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 53.4% January 2024 Services ISM® Report On Business®

Economic activity in the services sector expanded in January for the 13th consecutive month as the Services PMI® registered 53.4 percent, say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®. The sector has grown in 43 of the last 44 months, with the lone contraction in December 2022.The PMI was above expectations.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In January, the Services PMI® registered 53.4 percent, 2.9 percentage points higher than December’s seasonally adjusted reading of 50.5 percent. The composite index indicated growth in January for the 13th consecutive month after a seasonally adjusted reading of 49 percent in December 2022, which was the first contraction since May 2020 (45.4 percent). The Business Activity Index registered 55.8 percent in January, matching the seasonally adjusted reading of 55.8 percent in December. The New Orders Index expanded in January for the 13th consecutive month after contracting in December 2022 for the first time since May 2020; the figure of 55 percent is 2.2 percentage points higher than the seasonally adjusted December reading of 52.8 percent.

emphasis added

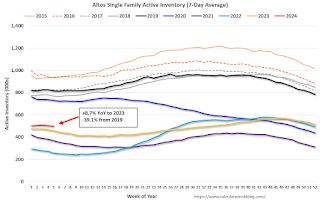

Housing February 5th Weekly Update: Inventory Down 1.2% Week-over-week, Up 8.7% Year-over-year

by Calculated Risk on 2/05/2024 08:12:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, February 04, 2024

Sunday Night Futures

by Calculated Risk on 2/04/2024 07:07:00 PM

Weekend:

• Schedule for Week of February 4, 2024

Monday:

• At 10:00 AM ET, ISM Services Index for January.

• At 2:00 PM, Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS).

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were down over the last week with WTI futures at $72.85 per barrel and Brent at $78.00 per barrel. A year ago, WTI was at $73, and Brent was at $79 - so WTI oil prices were mostly unchanged year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.12 per gallon. A year ago, prices were at $3.44 per gallon, so gasoline prices are down $0.32 year-over-year.

Heavy Truck Sales Increased in January

by Calculated Risk on 2/04/2024 09:04:00 AM

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the January 2024 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new record high of 570 thousand SAAR in April 2019.

Click on graph for larger image.

Click on graph for larger image.Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 308 thousand SAAR in May 2020.

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Vehicle sales were at 15.00 million SAAR in January, down 6.9% from 16.12 million in December, and down 0.7% from 15.11 million in January 2023.

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Vehicle sales were at 15.00 million SAAR in January, down 6.9% from 16.12 million in December, and down 0.7% from 15.11 million in January 2023.Saturday, February 03, 2024

Real Estate Newsletter Articles this Week: Case-Shiller National House Price Index Up 5.1% YoY

by Calculated Risk on 2/03/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Case-Shiller: National House Price Index Up 5.1% year-over-year in November

• Inflation Adjusted House Prices 2.3% Below Peak

• Asking Rents Mostly Unchanged Year-over-year

• Fannie and Freddie: Single Family Serious Delinquency Rate Increased Slightly, Multi-family Unchanged in December

• Freddie Mac House Price Index Increased in December; Up 6.6% Year-over-year

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of February 4, 2024

by Calculated Risk on 2/03/2024 08:11:00 AM

This will be light week for economic data.

10:00 AM: ISM Services Index for January.

2:00 PM: Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS).

8:00 AM ET: Corelogic House Price index for December.

11:00 AM: NY Fed: Q4 Quarterly Report on Household Debt and Credit

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Trade Balance report for December from the Census Bureau.

8:30 AM: Trade Balance report for December from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $62.3 billion. The U.S. trade deficit was at $63.2 billion in November.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, down from 224 thousand last week.

8:30 AM: Updated Seasonal Factors for CPI (January 2019 through December 2023)

Friday, February 02, 2024

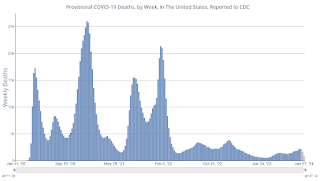

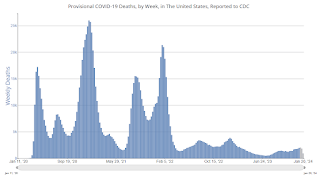

Feb 2nd COVID Update: Weekly Deaths Increased

by Calculated Risk on 2/02/2024 07:02:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 21,659 | 25,041 | ≤3,0001 | |

| Deaths per Week2🚩 | 2,258 | 2,076 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Early GDP Tracking: Solid Start for Q1

by Calculated Risk on 2/02/2024 03:18:00 PM

From Goldman:

We left our Q1 GDP tracking estimate unchanged on net at +2.8% (qoq ar) and our Q1 domestic final sales estimate also unchanged at +3.2%. [Feb 2nd estimate]emphasis addedAnd from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2024 is 4.2 percent on February 1, up from 3.0 percent on January 26. [Feb 1st estimate]