by Calculated Risk on 2/08/2024 02:30:00 PM

Thursday, February 08, 2024

Realtor.com Reports Active Inventory UP 12.2% YoY; New Listings up 12.8% YoY

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View — Data Week Ending February 3rd, 2024

• Active inventory increased, with for-sale homes 12.2% above year ago levels.

For a 13th consecutive week, active listings registered above prior year level, which means that today’s home shoppers have more homes to choose from that aren’t already in the process of being sold. The added inventory has certainly improved conditions from this time one year ago, but overall inventory is still low. For the month as a whole, January inventory is down nearly 40% below 2017 to 2019 levels.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 12.8% from one year ago.

Newly listed homes were above last year’s levels for the 15th week in a row. It was the biggest jump in nearly three years, which could further contribute to a recovery in active listings meaning more options for home shoppers.

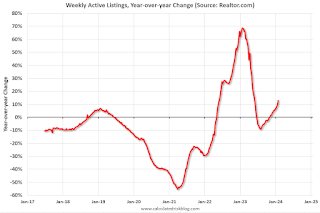

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 13th consecutive week following 20 consecutive weeks with a YoY decrease in inventory.

MBA: Mortgage Delinquencies Increase in Q4 2023

by Calculated Risk on 2/08/2024 11:23:00 AM

Today, in the Calculated Risk Real Estate Newsletter: MBA: Mortgage Delinquencies Increase in Q4 2023

A brief excerpt:

From the MBA: Mortgage Delinquencies Increase in the Fourth Quarter of 2023There is much more in the article.The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.88 percent of all loans outstanding at the end of the fourth quarter of 2023, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey....

The following graph shows the percent of loans delinquent by days past due. Overall delinquencies increased in Q4. The sharp increase in 2020 in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

The percent of loans in the foreclosure process decreased year-over-year from 0.57 percent in Q4 2022 to 0.47 percent in Q4 2023 (red), even with the end of the foreclosure moratoriums, and remain historically low.

The primary concern is the increase in 30- and 60-day delinquencies (blue), although still historically low. I don’t think this increase is much of a concern.

Weekly Initial Unemployment Claims Decrease to 218,000

by Calculated Risk on 2/08/2024 08:30:00 AM

The DOL reported:

In the week ending February 3, the advance figure for seasonally adjusted initial claims was 218,000, a decrease of 9,000 from the previous week's revised level. The previous week's level was revised up by 3,000 from 224,000 to 227,000. The 4-week moving average was 212,250, an increase of 3,750 from the previous week's revised average. The previous week's average was revised up by 750 from 207,750 to 208,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 212,250.

The previous week was revised up.

Weekly claims were below the consensus forecast.

Wednesday, February 07, 2024

Thursday: Unemployment Claims

by Calculated Risk on 2/07/2024 07:20:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, down from 224 thousand last week.

Update: Lumber Prices Up 6% YoY

by Calculated Risk on 2/07/2024 03:39:00 PM

This graph shows CME random length framing futures through last August (blue), and the new physically-delivered Lumber Futures (LBR) contract starting in August 2022 (Red).

1st Look at Local Housing Markets in January

by Calculated Risk on 2/07/2024 01:15:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in December

A brief excerpt:

NOTE: The tables for active listings, new listings and closed sales all include a comparison to January 2019 for each local market (some 2019 data is not available).There is much more in the article.

This is the first look at several early reporting local markets in December. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Closed sales in January were mostly for contracts signed in November and December when 30-year mortgage rates averaged 7.44% and 6.82%, respectively.

...

And a table of January sales.

In January, sales in these markets were up 3.1%. In December, these same markets were down 7.2% year-over-year Not Seasonally Adjusted (NSA).

Sales in all of these markets are down sharply compared to January 2019.

...

This was just several early reporting markets. Many more local markets to come!

Wholesale Used Car Prices "Flat" in December; Down 9.2% Year-over-year

by Calculated Risk on 2/07/2024 09:10:00 AM

From Manheim Consulting today: Wholesale Used-Vehicle Prices Flat in January

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) were unchanged in January compared to December. The Manheim Used Vehicle Value Index (MUVVI) remained at 204.0 but down 9.2% from a year ago. The index experienced the same 0.0% monthly change from December 2021 to January 2022.

“With the volatility we saw last year, it was a welcome sign for the industry to have a calmer month,” said Jeremy Robb, senior director of Economic and Industry Insights for Cox Automotive. “We observed some price declines in the market in the first couple of weeks of January before the winter storm slowed activity in the wholesale markets during the King holiday week. As activity picked up later in the month, we saw more buying activity, which led to flat values in January. The 0.0% month-over-month change showed stronger values than the 0.2% decline we typically see in January. As we move into tax refund season, we expect to see a bit more activity in the wholesale market, and we maintain that 2024 should show more normal market trends through the year.”

The seasonal adjustment countered the January non-adjusted decrease. The non-adjusted price in January declined by 0.2% compared to December, moving the unadjusted average price down 9.3% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Trade Deficit at $62.2 Billion in December

by Calculated Risk on 2/07/2024 08:30:00 AM

The Census Bureau and the Bureau of Economic Analysis reported:

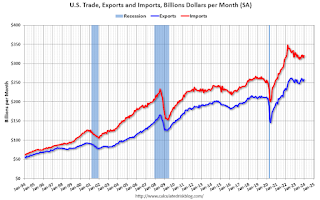

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $62.2 billion in December, up $0.3 billion from $61.9 billion in November, revised.

December exports were $258.2 billion, $3.9 billion more than November exports. December imports were $320.4 billion, $4.2 billion more than November imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports imports increased in December.

Exports are up 3.2% year-over-year; imports are down 0.4$ year-over-year.

Both imports and exports decreased sharply due to COVID-19 and then bounced back - imports and exports are moving sideways recently.

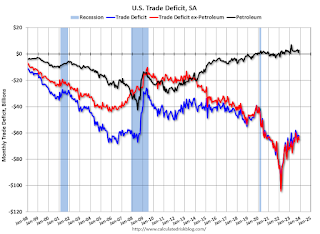

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, exports of petroleum products are positive and have been increasing.

The trade deficit with China decreased to $22.1 billion from $23.6 billion a year ago.

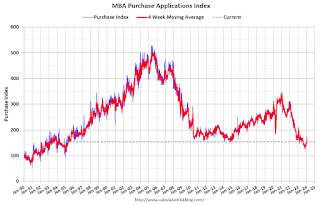

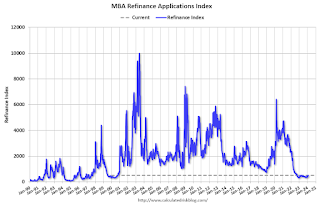

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 2/07/2024 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

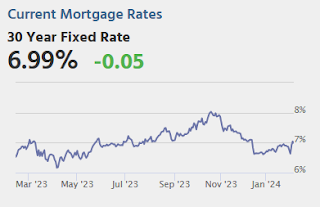

Mortgage applications increased 3.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 2, 2024.

The Market Composite Index, a measure of mortgage loan application volume, increased 3.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 8 percent compared with the previous week. The Refinance Index increased 12 percent from the previous week and was 1 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index increased 6 percent compared with the previous week and was 19 percent lower than the same week one year ago.

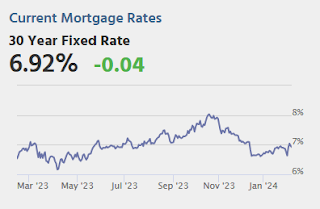

“Mortgage rates have stayed close to where they started the year, despite swings in Treasury yields because of slowing inflation offset by stronger than expected readings on the job market. The 30-year fixed mortgage rate was 6.8 percent, a slight increase from last week,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Rates at these levels have not prompted much of a reaction in the refinance market, as most homeowners have mortgages with much lower rates. However, purchase activity has been strong to start 2024 compared to the final quarter of 2023. However, activity is still weaker than a year ago because of low housing supply.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) increased to 6.80 percent from 6.78 percent, with points decreasing to 0.59 from 0.65 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 19% year-over-year unadjusted.

Tuesday, February 06, 2024

Wednesday: Trade Deficit

by Calculated Risk on 2/06/2024 07:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Trade Balance report for December from the Census Bureau. The consensus is the trade deficit to be $62.3 billion. The U.S. trade deficit was at $63.2 billion in November.