by Calculated Risk on 2/12/2024 02:19:00 PM

Monday, February 12, 2024

Trends in Educational Attainment in the U.S. Labor Force

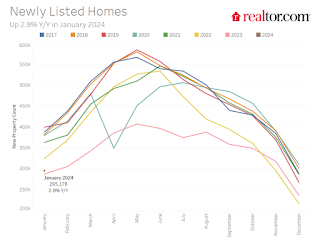

The first graph shows the unemployment rate by four levels of education (all groups are 25 years and older) through January 2024. Note: This is an update to a post from a few years ago.

Unfortunately, this data only goes back to 1992 and includes only three recessions (the stock / tech bust in 2001, and the housing bust/financial crisis, and the 2020 pandemic). Clearly education matters with regards to the unemployment rate, with the lowest rate for college graduates at 2.1% in January, and highest for those without a high school degree at 6.0% in January.

All four groups were generally trending down prior to the pandemic. And all are close to pre-pandemic levels now (less than high school is a little higher than pre-pandemic).

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This brings up an interesting question: What is the composition of the labor force by educational attainment, and how has that been changing over time?

Here is some data on the U.S. labor force by educational attainment since 1992.

This is the only category trending up. "Some college", "high school" and "less than high school" have been trending down.

Based on current trends, probably half the labor force will have at least a bachelor's degree sometime next decade (2030s).

Some thoughts: Since workers with bachelor's degrees typically have a lower unemployment rate, rising educational attainment is probably a factor in pushing down the overall unemployment rate over time.

Also, I'd guess more education would mean less labor turnover, and that education is a factor in lower weekly claims.

A more educated labor force is a positive for the future.

Part 1: Current State of the Housing Market; Overview for mid-February 2024

by Calculated Risk on 2/12/2024 11:10:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-February 2024

A brief excerpt:

This 2-part overview for mid-February provides a snapshot of the current housing market.There is much more in the article.

Let’s talk house prices, sales, inventory, mortgage rates, rents and more!

I always like to start with inventory, since inventory usually tells the tale!

...

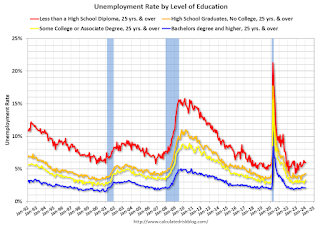

Here is a graph of new listing from Realtor.com’s January 2024 Monthly Housing Market Trends Report showing new listings were up 2.8% year-over-year in January. This is just a slight increase from the record low for January set in 2023. From Realtor.com:

Providing a boost to overall inventory, sellers turned out in higher numbers this January as newly listed homes were 2.8% above last year’s levels. This marked the third month of increasing listing activity after a 17-month streak of decline, however this month’s improvement is lower than last month’s 9.1% growth rate.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings. It seems very likely that new listings will be up year-over-year in 2024, but we will have to wait for the March data to see how close new listings are to normal levels.

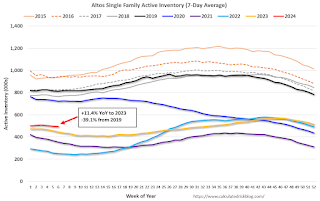

Housing February 12th Weekly Update: Inventory Down 0.5% Week-over-week, Up 11.4% Year-over-year

by Calculated Risk on 2/12/2024 08:12:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, February 11, 2024

Sunday Night Futures

by Calculated Risk on 2/11/2024 11:23:00 PM

Weekend:

• Schedule for Week of February 11, 2024

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $76.84 per barrel and Brent at $82.19 per barrel. A year ago, WTI was at $80, and Brent was at $85 - so WTI oil prices were down slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.18 per gallon. A year ago, prices were at $3.39 per gallon, so gasoline prices are down $0.21 year-over-year.

By Request: Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 2/11/2024 10:13:00 AM

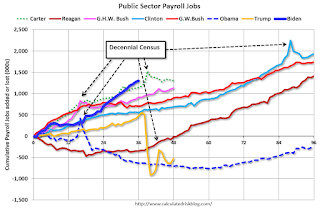

Note: I used to post this monthly, but I stopped during the COVID-19 pandemic. I've received a number of requests lately to post this again, so here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter, George H.W. Bush and Trump only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr. Clinton (light blue) served for eight years without a recession. And there was a pandemic related recession in 2020.

First, here is a table for private sector jobs. The top two previous private sector terms were both under President Clinton.

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Biden | 13,4811 |

| Clinton 1 | 10,876 |

| Clinton 2 | 10,094 |

| Obama 2 | 9,926 |

| Reagan 2 | 9,351 |

| Carter | 9,039 |

| Reagan 1 | 5,363 |

| Obama 1 | 1,907 |

| GHW Bush | 1,507 |

| GW Bush 2 | 443 |

| GW Bush 1 | -820 |

| Trump | -2,192 |

| 1After 36 months. | |

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

Private sector employment increased by 9,039,000 under President Carter (dashed green), by 14,714,000 under President Reagan (dark red), 1,507,000 under President G.H.W. Bush (light purple), 20,970,000 under President Clinton (light blue), lost 377,000 under President G.W. Bush, and gained 11,833,000 under President Obama (dark dashed blue). During Trump's term (Orange), the economy lost 2,135,000 private sector jobs.

A big difference between the presidencies has been public sector employment. Note: the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, 2010 and 2020.

A big difference between the presidencies has been public sector employment. Note: the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, 2010 and 2020. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However, the public sector declined significantly while Mr. Obama was in office (down 263,000 jobs). During Trump's term, the economy lost 528,000 public sector jobs.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Reagan 2 | 1,438 |

| Carter | 1,304 |

| Biden | 1,3031 |

| Clinton 2 | 1,242 |

| GHW Bush | 1,127 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Clinton 1 | 692 |

| Obama 2 | 447 |

| Reagan 1 | -24 |

| Trump | -528 |

| Obama 1 | -710 |

| 1After 36 months. | |

Saturday, February 10, 2024

Real Estate Newsletter Articles this Week: Update on Mortgage Rates and Spreads

by Calculated Risk on 2/10/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Lawler: Update on Mortgage Rates and Spreads

• MBA: Mortgage Delinquencies Increase in Q4 2023

• 1st Look at Local Housing Markets in January

• ICE (Black Knight) Mortgage Monitor: "Positive Signs in Housing, Mortgage Markets"

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of February 11, 2024

by Calculated Risk on 2/10/2024 08:11:00 AM

The key reports this week are January CPI, Housing Starts, and Retail sales.

For manufacturing, the January Industrial Production report, and the February NY and Philly Fed manufacturing surveys will be released this week.

No major economic releases scheduled.

6:00 AM: NFIB Small Business Optimism Index for January.

8:30 AM: The Consumer Price Index for January from the BLS. The consensus is for 0.2% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 3.0% year-over-year and core CPI to be up 3.8% YoY.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 212 thousand initial claims, down from 218 thousand last week.

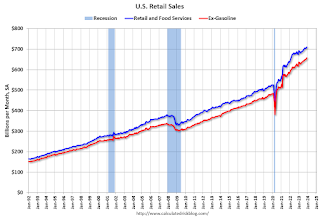

8:30 AM: Retail sales for January is scheduled to be released. The consensus is for a 0.1% decrease in retail sales.

8:30 AM: Retail sales for January is scheduled to be released. The consensus is for a 0.1% decrease in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

8:30 AM: The New York Fed Empire State manufacturing survey for February. The consensus is for a reading of -12.5, up from -43.7.

8:30 AM: The Philly Fed manufacturing survey for February. The consensus is for a reading of -8.0, up from -10.6.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.0%.

10:00 AM: The February NAHB homebuilder survey. The consensus is for a reading of 46, up from 44. Any number below 50 indicates that more builders view sales conditions as poor than good.

8:30 AM: Housing Starts for January.

8:30 AM: Housing Starts for January. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.470 million SAAR, up from 1.460 million SAAR.

8:30 AM ET: The Producer Price Index for January from the BLS. The consensus is for a 0.1% increase in PPI, and a 0.1% increase in core PPI.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for February). The consensus is for a reading of 79.0.

Friday, February 09, 2024

Feb 9th COVID Update: Weekly Deaths Increased

by Calculated Risk on 2/09/2024 07:16:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 19,458 | 22,057 | ≤3,0001 | |

| Deaths per Week2🚩 | 2,318 | 2,278 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

AAR: January Carloads Down and Intermodal Up YoY

by Calculated Risk on 2/09/2024 03:10:00 PM

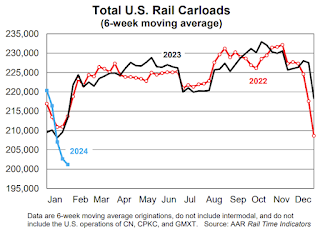

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

In January, severe winter weather significantly disrupted railroad and rail customer operations in much of the country. Moreover, uncertainty remains in the economy, especially in sectors that are important to railroads, like manufacturing. Because of these factors, January is not necessarily a harbinger of what’s to come for rail traffic in the months ahead. That’s important to note, because total carloads on U.S. railroads fell 7.2%, or 79,725 carloads, in January 2024 from January 2023. It’s the largest year-over-year percentage decline for total carloads since February 2021 (another month when rail volumes were impacted by severe winter weather).

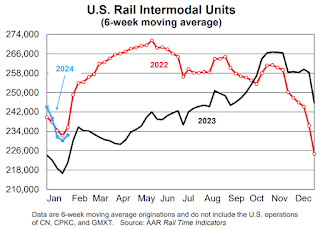

Intermodal (which is not included in carloads) fared better in January: intermodal originations were up 5.5% over last year, their fifth consecutive gain following 18 consecutive declines. Gains in intermodal are partly due to higher port volumes over the past six months

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2022, 2023 and 2024:

n January, U.S. railroads (excluding the U.S. operations of Canadian and Mexican railroads) originated 1.03 million total carloads, down 7.2% (79,725 carloads) from January 2023. Total carloads averaged 205,034 per week in January 2024, the smallest weekly average for January in our records that go back to 1988. (Since 1988, six months overall had lower weekly average carloads, most recently December 2022.)

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2022, 2023 and 2024: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2022, 2023 and 2024: (using intermodal or shipping containers):Intermodal fared better than carloads in January: intermodal originations totaled 1.21 million containers and trailers, up 5.5% (63,195 units) over January 2023. That’s intermodal’s fifth consecutive year-over-year monthly gain following 18 consecutive declines.

Poor Weather Reduced Employment by About 50,000 in January

by Calculated Risk on 2/09/2024 01:20:00 PM

The BLS also reported 1.794 million people that are usually full-time employees were working part time in January due to bad weather. The average for January over the previous 10 years was 835 thousand (the median was 645 thousand). This series suggests weather negatively impacted employment more than usual.

The San Francisco Fed estimates Weather-Adjusted Change in Total Nonfarm Employment (monthly change, seasonally adjusted). They use local area weather to estimate the impact on employment. For January, the San Francisco Fed estimated that weather reduced employment by 40 to 60 thousand jobs.

It appears weather adjusted job gains were around 400 thousand in January (seasonally adjusted)