by Calculated Risk on 2/16/2024 01:21:00 PM

Friday, February 16, 2024

GDP Tracking: Q1 Moving Down

From BofA:

Overall, this left our 1Q US GDP tracking estimate, which kicks off with today’s print at 0.9% q/q saar, one-tenth below our official forecast. Our 4Q tracking estimate declined by three-tenths to 3.1% q/q saar. [Feb 16th comment]From Goldman:

emphasis added

We lowered our Q1 GDP tracking estimate by 0.2pp to +2.3% (qoq ar) and our domestic final sales forecast by the same amount to +2.6%. We left out our past-quarter GDP tracking for Q4 unchanged at +3.2%, compared to +3.3% as previously reported. [Feb 16th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2024 is 2.9 percent on February 16, unchanged from February 15. [Feb 16th estimate]

Single Family Starts Up 22% Year-over-year in January; Multi-Family Starts Down Sharply

by Calculated Risk on 2/16/2024 09:20:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Single Family Starts Up 22% Year-over-year in January; Multi-Family Starts Down Sharply

A brief excerpt:

Note that permits held up better than starts in January, and housing starts were probably impacted by the severe weather last month.There is much more in the article.

...

The third graph shows the month-to-month comparison for total starts between 2023 (blue) and 2024 (red).

Total starts were down 0.7% in January compared to January 2023.

Starts were down year-over-year for 17 of the last 21 months, although starts were up year-over-year in 4 of the last 9 months.

Housing Starts Decreased to 1.331 million Annual Rate in January

by Calculated Risk on 2/16/2024 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in January were at a seasonally adjusted annual rate of 1,331,000. This is 14.8 percent below the revised December estimate of 1,562,000 and is 0.7 percent below the January 2023 rate of 1,340,000. Single‐family housing starts in January were at a rate of 1,004,000; this is 4.7 percent below the revised December figure of 1,054,000. The January rate for units in buildings with five units or more was 314,000.

Building Permits:

Privately‐owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 1,470,000. This is 1.5 percent below the revised December rate of 1,493,000, but is 8.6 percent above the January 2023 rate of 1,354,000. Single‐family authorizations in January were at a rate of 1,015,000; this is 1.6 percent above the revised December figure of 999,000. Authorizations of units in buildings with five units or more were at a rate of 405,000 in January.

emphasis added

Click on graph for larger image.

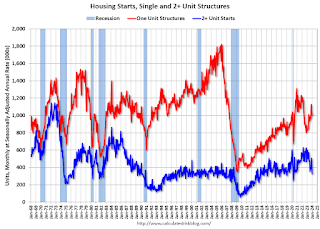

Click on graph for larger image.The first graph shows single and multi-family housing starts since 2000.

Multi-family starts (blue, 2+ units) decreased in January compared to December. Multi-family starts were down 36.8% year-over-year in January.

Single-family starts (red) decreased in January and were up 22.0% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery - and the recent collapse and recovery in single-family starts.

Total housing starts in January were below expectations, however, starts in November and December were revised up sharply, combined.

I'll have more later …

Thursday, February 15, 2024

Friday: Housing Starts, PPI

by Calculated Risk on 2/15/2024 07:11:00 PM

Friday:

• At 8:30 AM ET, Housing Starts for January. The consensus is for 1.470 million SAAR, up from 1.460 million SAAR.

• Also at 8:30 AM, The Producer Price Index for January from the BLS. The consensus is for a 0.1% increase in PPI, and a 0.1% increase in core PPI.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for February). The consensus is for a reading of 79.0.

Fannie "Real Estate Owned" inventory Decreased in Q4 2023

by Calculated Risk on 2/15/2024 01:31:00 PM

Fannie reported results for Q4 2023. Here is some information on single-family Real Estate Owned (REOs).

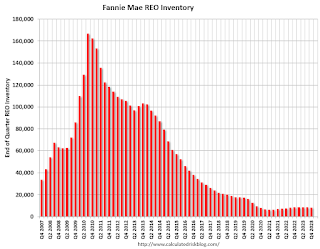

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie Real Estate Owned (REO).

This is well below the normal level of REOs for Fannie, and although REO levels might increase in 2024, there will not be a huge wave of foreclosures.

NAHB: Builder Confidence Increased in February

by Calculated Risk on 2/15/2024 10:00:00 AM

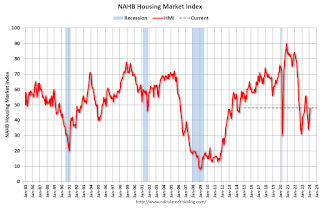

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 48, up from 44 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Sentiment Posts Third Consecutive Monthly Gain

Expectations that mortgage rates will continue to moderate in the coming months, the prospect of future rate cuts by the Federal Reserve later this year, and a protracted lack of existing inventory helped provide a boost to builder sentiment for the third straight month.

Builder confidence in the market for newly built single-family homes climbed four points to 48 in February, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This is the highest level since August 2023.

“Buyer traffic is improving as even small declines in interest rates will produce a disproportionate positive response among likely home purchasers,” said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Ala. “And while mortgage rates still remain too high for many prospective buyers, we anticipate that due to pent-up demand, many more buyers will enter the marketplace if mortgage rates continue to decline this year.”

“With future expectations of Fed rate cuts in the latter half of 2024, NAHB is forecasting that single-family starts will rise about 5% this year,” said NAHB Chief Economist Robert Dietz. “But as builders break ground on more homes, lot availability is expected to be a growing concern, along with persistent labor shortages. And as a further reminder that the recovery will be bumpy as buyers remain sensitive to interest rate and construction cost changes, the 10-year Treasury rate is up more than 40 basis points since the beginning of the year.”

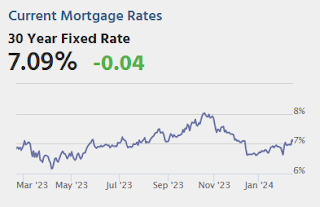

With mortgage rates now below 7% since mid-December, more builders are cutting back on reducing home prices to boost sales. In February, 25% of builders reported cutting home prices, down from 31% in January and 36% in the last two months of 2023. However, the average price reduction in February held steady at 6% for the eighth straight month. Meanwhile, the use of sales incentives is also diminishing. The share of builders offering some form of incentive dropped to 58% in February, down from 62% in January and the lowest share since last August.

...

All three of the major HMI indices posted gains in February. The HMI index charting current sales conditions increased four points to 52, the component measuring sales expectations in the next six months rose three points to 60 and the component gauging traffic of prospective buyers increased four points to 33.

Looking at the three-month moving averages for regional HMI scores, the Northeast increased three points to 57, the Midwest gained two points to 36, the South rose five points to 46 and the West registered a six-point gain to 38.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was above the consensus forecast.

Industrial Production Decreased 0.1% in January

by Calculated Risk on 2/15/2024 09:15:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged down 0.1 percent in January after recording no change in December. In January, manufacturing output declined 0.5 percent and mining output fell 2.3 percent; winter weather contributed to the declines in both sectors. The index for utilities jumped 6.0 percent, as demand for heating surged following a move from unusually mild temperatures in December to unusually cold temperatures in January. At 102.6 percent of its 2017 average, total industrial production in January was identical to its year-earlier level. Capacity utilization for the industrial sector moved down 0.2 percentage point in January to 78.5 percent, a rate that is 1.1 percentage points below its long-run (1972–2023) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.5% is 1.1% below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased to 102.6. This is above the pre-pandemic level.

Industrial production was below consensus expectations.

Retail Sales Decreased 0.8% in January

by Calculated Risk on 2/15/2024 08:35:00 AM

On a monthly basis, retail sales were down 0.8% from December to January (seasonally adjusted), and sales were up 0.6 percent from January 2023.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for January 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $700.3 billion, down 0.8 percent from the previous month, and up 0.6 percent above January 2023. ... The November 2023 to December 2023 percent change was revised from up 0.6 percent to up 0.4 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline was down 0.8% in December.

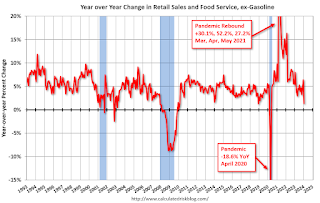

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 1.4% on a YoY basis.

The decrease in sales in January was below expectations, and sales in November and December were down.

The decrease in sales in January was below expectations, and sales in November and December were down.

Weekly Initial Unemployment Claims Decrease to 212,000

by Calculated Risk on 2/15/2024 08:30:00 AM

The DOL reported:

In the week ending February 10, the advance figure for seasonally adjusted initial claims was 212,000, a decrease of 8,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 218,000 to 220,000. The 4-week moving average was 218,500, an increase of 5,750 from the previous week's revised average. The previous week's average was revised up by 500 from 212,250 to 212,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 218,500.

The previous week was revised up.

Weekly claims were at the consensus forecast.

Wednesday, February 14, 2024

Thursday: Retail Sales, Unemployment Claims, NY & Philly Fed Mfg, Industrial Production, Homebuilder Survey

by Calculated Risk on 2/14/2024 07:11:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 212 thousand initial claims, down from 218 thousand last week.

• Also at 8:30 AM, Retail sales for January is scheduled to be released. The consensus is for a 0.1% decrease in retail sales.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for February. The consensus is for a reading of -12.5, up from -43.7.

• Also at 8:30 AM, The Philly Fed manufacturing survey for February. The consensus is for a reading of -8.0, up from -10.6.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for January. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.0%.

• At 10:00 AM,The February NAHB homebuilder survey. The consensus is for a reading of 46, up from 44. Any number below 50 indicates that more builders view sales conditions as poor than good.