by Calculated Risk on 2/19/2024 08:12:00 AM

Monday, February 19, 2024

Housing February 19th Weekly Update: Inventory Down 0.2% Week-over-week, Up 12.9% Year-over-year

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, February 18, 2024

Hotels: Occupancy Rate Decreased 2.7% Year-over-year

by Calculated Risk on 2/18/2024 08:31:00 AM

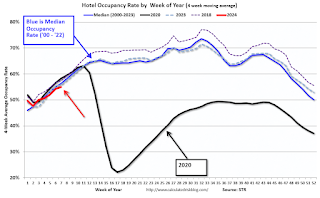

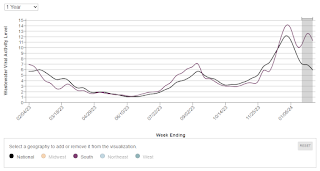

U.S. hotel performance increased from the previous week, while year-over-year comparisons remained mixed, according to CoStar’s latest data through 10 February. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

4-10 February 2024 (percentage change from comparable week in 2023):

• Occupancy: 56.2% (-2.7%)

• Average daily rate (ADR): US$160.96 (+6.8%)

• Revenue per available room (RevPAR): US$90.40 (+3.9%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, black is 2020, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Saturday, February 17, 2024

Real Estate Newsletter Articles this Week: Current State of the Housing Market for Mid-February

by Calculated Risk on 2/17/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Single Family Starts Up 22% Year-over-year in January; Multi-Family Starts Down Sharply

• Part 1: Current State of the Housing Market; Overview for mid-February 2024

• Part 2: Current State of the Housing Market; Overview for mid-February 2024

• 2nd Look at Local Housing Markets in January

• Lawler: Update on “Is the “Natural” Rate of Interest Back to Pre-Financial Crisis Levels” Early Read on Existing Home Sales in January

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of February 18, 2024

by Calculated Risk on 2/17/2024 08:11:00 AM

The key report this week is January Existing Home sales.

All US markets will be closed in observance of Washington's Birthday.

No major economic releases scheduled.

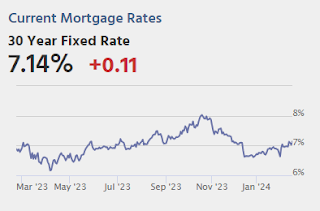

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes, Meeting of Meeting of January 30-31, 2024

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, up from 212 thousand last week.

8:30 AM ET: Chicago Fed National Activity Index for January. This is a composite index of other data.

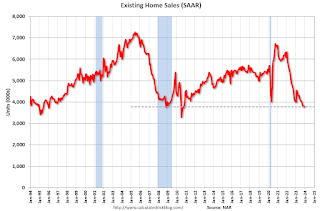

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 3.97 million SAAR, up from 3.78 million.

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 3.97 million SAAR, up from 3.78 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler estimates the NAR will report sales of 4.02 million SAAR.

11:00 AM: the Kansas City Fed manufacturing survey for February.

No major economic releases scheduled.

Friday, February 16, 2024

Feb 16th COVID Update: Weekly Deaths Decreased

by Calculated Risk on 2/16/2024 08:11:00 PM

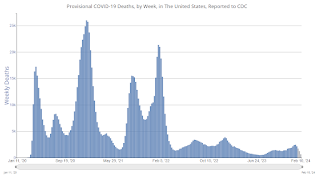

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 17,840 | 19,796 | ≤3,0001 | |

| Deaths per Week2 | 2,152 | 2,457 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Lawler: Update on “Is the “Natural” Rate of Interest Back to Pre-Financial Crisis Levels”

by Calculated Risk on 2/16/2024 04:39:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Update on “Is the “Natural” Rate of Interest Back to Pre-Financial Crisis Levels”

A brief excerpt:

First, from housing economist Tom Lawler:There is more in the article.

Early Read on Existing Home Sales in January

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.02 million in January, up 6.3% from December’s preliminary pace and up 0.5% from last January’s seasonally adjusted pace. Unadjusted sales should show a slightly higher YOY gain, reflecting this January’s higher business day count compared to last January’s.

Note that this month’s NAR release will incorporate updated seasonal adjustment factors for the previous few years.

Local realtor/MLS reports suggest that the median existing single-family home sales price last month was up by about 5.4%

Realtor.com Reports Active Inventory UP 13.9% YoY; New Listings up 9.5% YoY

by Calculated Risk on 2/16/2024 03:41:00 PM

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View — Data Week Ending February 10, 2024

• Active inventory increased, with for-sale homes 13.9% above year ago levels.

For a 14th consecutive week, active listings registered above prior year level, which means that today’s home shoppers have more homes to choose from that aren’t already in the process of being sold. The added inventory has certainly improved conditions from this time one year ago, but overall inventory is still low. For the month as a whole, January inventory is down nearly 40% below 2017 to 2019 levels.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 9.5% from one year ago.

Newly listed homes were above last year’s levels for the 16th week in a row. While the jump was not as big as the one we observed in the previous week (12.8%), it was still an encouraging rate, which could further contribute to a recovery in active listings meaning more options for home shoppers

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 14th consecutive week following 20 consecutive weeks with a YoY decrease in inventory.

GDP Tracking: Q1 Moving Down

by Calculated Risk on 2/16/2024 01:21:00 PM

From BofA:

Overall, this left our 1Q US GDP tracking estimate, which kicks off with today’s print at 0.9% q/q saar, one-tenth below our official forecast. Our 4Q tracking estimate declined by three-tenths to 3.1% q/q saar. [Feb 16th comment]From Goldman:

emphasis added

We lowered our Q1 GDP tracking estimate by 0.2pp to +2.3% (qoq ar) and our domestic final sales forecast by the same amount to +2.6%. We left out our past-quarter GDP tracking for Q4 unchanged at +3.2%, compared to +3.3% as previously reported. [Feb 16th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2024 is 2.9 percent on February 16, unchanged from February 15. [Feb 16th estimate]

Single Family Starts Up 22% Year-over-year in January; Multi-Family Starts Down Sharply

by Calculated Risk on 2/16/2024 09:20:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Single Family Starts Up 22% Year-over-year in January; Multi-Family Starts Down Sharply

A brief excerpt:

Note that permits held up better than starts in January, and housing starts were probably impacted by the severe weather last month.There is much more in the article.

...

The third graph shows the month-to-month comparison for total starts between 2023 (blue) and 2024 (red).

Total starts were down 0.7% in January compared to January 2023.

Starts were down year-over-year for 17 of the last 21 months, although starts were up year-over-year in 4 of the last 9 months.

Housing Starts Decreased to 1.331 million Annual Rate in January

by Calculated Risk on 2/16/2024 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

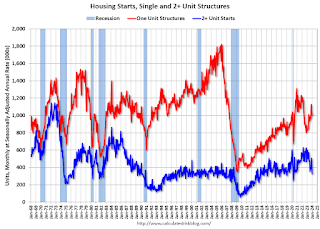

Privately‐owned housing starts in January were at a seasonally adjusted annual rate of 1,331,000. This is 14.8 percent below the revised December estimate of 1,562,000 and is 0.7 percent below the January 2023 rate of 1,340,000. Single‐family housing starts in January were at a rate of 1,004,000; this is 4.7 percent below the revised December figure of 1,054,000. The January rate for units in buildings with five units or more was 314,000.

Building Permits:

Privately‐owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 1,470,000. This is 1.5 percent below the revised December rate of 1,493,000, but is 8.6 percent above the January 2023 rate of 1,354,000. Single‐family authorizations in January were at a rate of 1,015,000; this is 1.6 percent above the revised December figure of 999,000. Authorizations of units in buildings with five units or more were at a rate of 405,000 in January.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts since 2000.

Multi-family starts (blue, 2+ units) decreased in January compared to December. Multi-family starts were down 36.8% year-over-year in January.

Single-family starts (red) decreased in January and were up 22.0% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery - and the recent collapse and recovery in single-family starts.

Total housing starts in January were below expectations, however, starts in November and December were revised up sharply, combined.

I'll have more later …