by Calculated Risk on 2/21/2024 10:49:00 AM

Wednesday, February 21, 2024

AIA: "Architecture Billings Index Reports Sluggish Conditions to Start 2024"; Multi-family Billings Decline for 18th Consecutive Month

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: AIA/Deltek Architecture Billings Index Reports Sluggish Conditions to Start 2024

Architecture firm billings remained soft entering into 2024, with an AIA/Deltek Architecture Billings Index (ABI) score of 46.2 in January. Any score below 50.0 indicates decreasing business conditions.• Regional averages: Northeast (43.6); Midwest (50.9); South (45.2); West (46.6)

“This now marks the lengthiest period of declining billings since 2010, although it is reassuring that the pace of this decline is less rapid and the broader economy showed improvement in January,” said Kermit Baker, PhD, AIA Chief Economist. "Firms are seeing growth with inquiries into new projects and value of newly signed design contracts is holding steady, showing potential signs of interest from clients in new projects.”

Business conditions remained weak at firms in all regions of the country except the Midwest, where modest growth was seen in three of the last four months. Firms with a multifamily residential specialization continue to report the softest business conditions of all specializations.

emphasis added

• Sector index breakdown: commercial/industrial (47.0); institutional (48.5); mixed practice (firms that do not have at least half of their billings in any one other category) (42.9); multifamily residential (44.6)

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 46.2 in January, down from 46.5 in December. Anything below 50 indicates a decrease in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment in 2024.

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 2/21/2024 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 10.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 16, 2024.

The Market Composite Index, a measure of mortgage loan application volume, decreased 10.6 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 8 percent compared with the previous week. The Refinance Index decreased 11 percent from the previous week and was 0.1 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 10 percent from one week earlier. The unadjusted Purchase Index decreased 6 percent compared with the previous week and was 13 percent lower than the same week one year ago.

"Mortgage rates moved back above 7 percent last week following news that inflation picked up in January, dimming hopes of a near term rate cut,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “Mortgage applications dropped as a result with a larger decline in refinance applications. Potential homebuyers are quite sensitive to these rate changes, as affordability is strained with both higher rates and higher home values in this supply-constrained market."

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) increased to 7.06 percent from 6.87 percent, with points increasing to 0.66 from 0.65 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

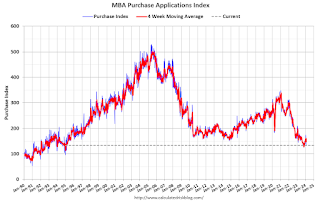

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 13% year-over-year unadjusted.

Tuesday, February 20, 2024

Wednesday: FOMC Minutes, Architecture Billings Index

by Calculated Risk on 2/20/2024 08:18:00 PM

Most mortgage lenders set rates for the first time this week on Tuesday (today) due to yesterday's holiday. ... In the bigger picture, rates are still very close to their highest levels in more than 2 months following a series of higher inflation readings last week. [30 year fixed 7.11%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day, The AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Minutes, Meeting of Meeting of January 30-31, 2024

MBA Survey: Share of Mortgage Loans in Forbearance Decreases to 0.22% in January

by Calculated Risk on 2/20/2024 04:20:00 PM

From the MBA: Share of Mortgage Loans in Forbearance Decreases Slightly to 0.22% in January

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 1 basis point from 0.23% of servicers’ portfolio volume in the prior month to 0.22% as of January 31, 2024. According to MBA’s estimate, 110,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 8.1 million borrowers since March 2020.At the end of January, there were about 110,000 homeowners in forbearance plans.

In January 2024, the share of Fannie Mae and Freddie Mac loans in forbearance declined 2 basis points to 0.13%. Ginnie Mae loans in forbearance remained the same at 0.39%, and the forbearance share for portfolio loans and private-label securities (PLS) increased 1 basis point to 0.28%.

“The combination of a potential economic slowdown in 2024, and indications that consumer debt balances and delinquencies are on the rise, could lead to more homeowners struggling to make their mortgage payments and inquire about forbearance and available loan workout options,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Most pandemic-related protocols have sunset, which gives mortgage servicers different rules of engagement when it comes to assisting borrowers through loan forbearance or a loan workout.”

emphasis added

Lawler: Update on Invitation Homes Rental Trends

by Calculated Risk on 2/20/2024 02:49:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Update on Invitation Homes Rental Trends

A brief excerpt:

From housing economist Tom Lawler:There is much more in the article.

Below is a table derived from the Q4/2023 (and earlier) Earnings Release and Supplemental Information from Invitation Homes, one of the largest institutional investors in single-family rental homes. (The January figures are based on figures from officials on the earnings conference call.)

Note that while the YOY increase in rent renewals last quarter actually rose slightly from the previous quarter, the YOY increase in new leases was zero, and according to officials on the conference call was negative in January.

DOT: Vehicle Miles Driven Increased 2.1% year-over-year in 2023

by Calculated Risk on 2/20/2024 02:19:00 PM

This is something I check occasionally.

The Department of Transportation (DOT) reported:

• Travel on all roads and streets changed by +2.2% (+5.7 billion vehicle miles) for December 2023 as compared with December 2022. Travel for the month is estimated to be 263.7 billion vehicle miles.

• The seasonally adjusted vehicle miles traveled for December 2023 is 273.0 billion miles, a +2.7% ( +7.3 billion vehicle miles) change over December 2022. It also represents a -0.2% change (-0.5 billion vehicle miles) compared with November 2023.

• Cumulative Travel for 2023 changed by +2.1% (+67.5 billion vehicle miles). The cumulative estimate for the year is 3,263.7 billion vehicle miles of travel.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the monthly total vehicle miles driven, seasonally adjusted.

Miles driven declined sharply in March 2020, and really collapsed in April 2020. Miles driven are now at pre-pandemic levels.

Single Family Built-for-Rent Almost Doubled Since 2020

by Calculated Risk on 2/20/2024 10:50:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Single Family Built-for-Rent Almost Doubled Since 2020

A brief excerpt:

Along with the monthly housing starts report for January released last week, the Census Bureau also released Housing Units Started by Purpose and Design through Q4 2023.There is much more in the article.

The first graph shows the number of single family and multi-family units started with the intent to rent. This data is quarterly and Not Seasonally Adjusted (NSA). Although the majority of units built-for-rent’ are still multi-family (blue), there has been a significant pickup in single family units started built-for-rent (red).

In 2020, there were 44,000 single family units started with the intent to rent. In 2023, that number almost doubled to 85,000 units. For multi-family, there were 327,000 units started to rent in 2020, and 393,000 in 2023. About 18% of the built-for-rent units started in 2023 were single family units.

Existing Home Sales: Lawler vs. the Consensus

by Calculated Risk on 2/20/2024 08:59:00 AM

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for almost 14 years. He has graciously allowed me to share his predictions with the readers of this blog.

The table below shows the consensus for each month, Lawler's predictions, and the NAR's initially reported level of sales. Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | 5.60 |

| Apr-18 | 5.60 | 5.48 | 5.46 |

| May-18 | 5.56 | 5.47 | 5.43 |

| Jun-18 | 5.45 | 5.35 | 5.38 |

| Jul-18 | 5.43 | 5.40 | 5.34 |

| Aug-18 | 5.36 | 5.36 | 5.34 |

| Sep-18 | 5.30 | 5.20 | 5.15 |

| Oct-18 | 5.20 | 5.31 | 5.22 |

| Nov-18 | 5.19 | 5.23 | 5.32 |

| Dec-18 | 5.24 | 4.97 | 4.99 |

| Jan-19 | 5.05 | 4.92 | 4.94 |

| Feb-19 | 5.08 | 5.46 | 5.51 |

| Mar-19 | 5.30 | 5.40 | 5.21 |

| Apr-19 | 5.36 | 5.31 | 5.19 |

| May-19 | 5.29 | 5.40 | 5.34 |

| Jun-19 | 5.34 | 5.25 | 5.27 |

| Jul-19 | 5.39 | 5.40 | 5.42 |

| Aug-19 | 5.38 | 5.42 | 5.49 |

| Sep-19 | 5.45 | 5.36 | 5.38 |

| Oct-19 | 5.49 | 5.36 | 5.46 |

| Nov-19 | 5.45 | 5.43 | 5.35 |

| Dec-19 | 5.43 | 5.40 | 5.54 |

| Jan-20 | 5.45 | 5.42 | 5.46 |

| Feb-20 | 5.50 | 5.58 | 5.77 |

| Mar-20 | 5.30 | 5.25 | 5.27 |

| Apr-20 | 4.30 | 4.17 | 4.33 |

| May-20 | 4.38 | 3.80 | 3.91 |

| Jun-20 | 4.86 | 4.65 | 4.72 |

| Jul-20 | 5.39 | 5.85 | 5.86 |

| Aug-20 | 6.00 | 5.92 | 6.00 |

| Sep-20 | 6.25 | 6.38 | 6.54 |

| Oct-20 | 6.45 | 6.63 | 6.85 |

| Nov-20 | 6.70 | 6.50 | 6.69 |

| Dec-20 | 6.55 | 6.62 | 6.76 |

| Jan-21 | 6.60 | 6.48 | 6.69 |

| Feb-21 | 6.51 | 6.29 | 6.22 |

| Mar-21 | 6.17 | 6.02 | 6.01 |

| Apr-21 | 6.09 | 5.96 | 5.85 |

| May-21 | 5.74 | 5.78 | 5.80 |

| Jun-21 | 5.90 | 5.79 | 5.86 |

| Jul-21 | 5.84 | 5.86 | 5.99 |

| Aug-21 | 5.88 | 5.90 | 5.88 |

| Sep-21 | 6.06 | 6.20 | 6.29 |

| Oct-21 | 6.20 | 6.34 | 6.34 |

| Nov-21 | 6.20 | 6.45 | 6.46 |

| Dec-21 | 6.45 | 6.33 | 6.18 |

| Jan-22 | 6.12 | 6.36 | 6.50 |

| Feb-22 | 6.16 | 5.97 | 6.02 |

| Mar-22 | 5.80 | 5.74 | 5.77 |

| Apr-22 | 5.62 | 5.57 | 5.61 |

| May-22 | 5.41 | 5.35 | 5.41 |

| Jun-22 | 5.40 | 5.12 | 5.12 |

| Jul-22 | 4.88 | 4.90 | 4.81 |

| Aug-22 | 4.70 | 4.84 | 4.80 |

| Sep-22 | 4.69 | 4.82 | 4.71 |

| Oct-22 | 4.39 | 4.49 | 4.43 |

| Nov-22 | 4.20 | 4.16 | 4.09 |

| Dec-22 | 3.95 | 3.96 | 4.02 |

| Jan-23 | 4.10 | 4.18 | 4.00 |

| Feb-23 | 4.18 | 4.51 | 4.58 |

| Mar-23 | 4.50 | 4.51 | 4.44 |

| Apr-23 | 4.30 | 4.33 | 4.28 |

| May-23 | 4.24 | 4.25 | 4.30 |

| Jun-23 | 4.23 | 4.26 | 4.16 |

| Jul-23 | 4.15 | 4.06 | 4.07 |

| Aug-23 | 4.10 | 4.07 | 4.04 |

| Sep-23 | 3.94 | 4.00 | 3.96 |

| Oct-23 | 3.93 | 3.94 | 3.79 |

| Nov-23 | 3.78 | 3.87 | 3.82 |

| Dec-23 | 3.84 | 3.84 | 3.78 |

| Jan-24 | 3.97 | 4.02 | NA |

| 1NAR initially reported before revisions. | |||

Monday, February 19, 2024

Tuesday: No major economic releases scheduled

by Calculated Risk on 2/19/2024 06:18:00 PM

Weekend:

• Schedule for Week of February 18, 2024

Tuesday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $79.28 per barrel and Brent at $83.28 per barrel. A year ago, WTI was at $76, and Brent was at $83 - so WTI oil prices were up 4% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.25 per gallon. A year ago, prices were at $3.36 per gallon, so gasoline prices are down $0.11 year-over-year.

3rd Look at Local Housing Markets in January; California Home Sales Up 5.9% YoY in January

by Calculated Risk on 2/19/2024 11:02:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in January; California Home Sales Up 5.9% YoY in January

A brief excerpt:

NOTE: The tables for active listings, new listings and closed sales all include a comparison to January 2019 for each local market (some 2019 data is not available).There is much more in the article.

This is the third look at several local markets in January. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

...

Note: The National Association of Realtors (NAR) is scheduled to release January existing home sales on Thursday, February 22nd, at 10:00 AM ET. The consensus is for 3.97 million SAAR, up from 3.78 million.

Housing economist Tom Lawler expects the NAR to report sales of 4.02 million SAAR for January.

...

And a table of January sales.

In January, sales in these markets were up 3.0%. In December, these same markets were down 7.3% year-over-year Not Seasonally Adjusted (NSA).

Sales in most of these markets are down sharply compared to January 2019.

...

More local markets to come!