by Calculated Risk on 2/22/2024 08:30:00 AM

Thursday, February 22, 2024

Weekly Initial Unemployment Claims Decrease to 201,000

The DOL reported:

In the week ending February 17, the advance figure for seasonally adjusted initial claims was 201,000, a decrease of 12,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 212,000 to 213,000. The 4-week moving average was 215,250, a decrease of 3,500 from the previous week's revised average. The previous week's average was revised up by 250 from 218,500 to 218,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 215,250.

The previous week was revised up.

Weekly claims were below the consensus forecast.

Wednesday, February 21, 2024

Thursday: Existing Home Sales, Unemployment Claims

by Calculated Risk on 2/21/2024 07:40:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, up from 212 thousand last week.

• Also at 8:30 AM, Chicago Fed National Activity Index for January. This is a composite index of other data.

• At 10:00 AM, Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 3.97 million SAAR, up from 3.78 million. Housing economist Tom Lawler estimates the NAR will report sales of 4.02 million SAAR.

• At 11:00 AM, the Kansas City Fed manufacturing survey for February.

FOMC Minutes: "Most participants noted the risks of moving too quickly to ease the stance of policy"

by Calculated Risk on 2/21/2024 02:00:00 PM

From the Fed: Minutes of the Federal Open Market Committee, January 30–31, 2024. Excerpt:

In discussing risk-management considerations that could bear on the policy outlook, participants remarked that while the risks to achieving the Committee's employment and inflation goals were moving into better balance, they remained highly attentive to inflation risks. In particular, they saw upside risks to inflation as having diminished but noted that inflation was still above the Committee's longer-run goal. Some participants noted the risk that progress toward price stability could stall, particularly if aggregate demand strengthened or supply-side healing slowed more than expected. Participants highlighted the uncertainty associated with how long a restrictive monetary policy stance would need to be maintained. Most participants noted the risks of moving too quickly to ease the stance of policy and emphasized the importance of carefully assessing incoming data in judging whether inflation is moving down sustainably to 2 percent. A couple of participants, however, pointed to downside risks to the economy associated with maintaining an overly restrictive stance for too long.

Participants observed that the continuing process of reducing the size of the Federal Reserve's balance sheet was an important part of the Committee's overall approach to achieving its macroeconomic objectives and that balance sheet runoff had so far proceeded smoothly. In light of ongoing reductions in usage of the ON RRP facility, many participants suggested that it would be appropriate to begin in-depth discussions of balance sheet issues at the Committee's next meeting to guide an eventual decision to slow the pace of runoff. Some participants remarked that, given the uncertainty surrounding estimates of the ample level of reserves, slowing the pace of runoff could help smooth the transition to that level of reserves or could allow the Committee to continue balance sheet runoff for longer. In addition, a few participants noted that the process of balance sheet runoff could continue for some time even after the Committee begins to reduce the target range for the federal funds rate.

emphasis added

AIA: "Architecture Billings Index Reports Sluggish Conditions to Start 2024"; Multi-family Billings Decline for 18th Consecutive Month

by Calculated Risk on 2/21/2024 10:49:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: AIA/Deltek Architecture Billings Index Reports Sluggish Conditions to Start 2024

Architecture firm billings remained soft entering into 2024, with an AIA/Deltek Architecture Billings Index (ABI) score of 46.2 in January. Any score below 50.0 indicates decreasing business conditions.• Regional averages: Northeast (43.6); Midwest (50.9); South (45.2); West (46.6)

“This now marks the lengthiest period of declining billings since 2010, although it is reassuring that the pace of this decline is less rapid and the broader economy showed improvement in January,” said Kermit Baker, PhD, AIA Chief Economist. "Firms are seeing growth with inquiries into new projects and value of newly signed design contracts is holding steady, showing potential signs of interest from clients in new projects.”

Business conditions remained weak at firms in all regions of the country except the Midwest, where modest growth was seen in three of the last four months. Firms with a multifamily residential specialization continue to report the softest business conditions of all specializations.

emphasis added

• Sector index breakdown: commercial/industrial (47.0); institutional (48.5); mixed practice (firms that do not have at least half of their billings in any one other category) (42.9); multifamily residential (44.6)

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 46.2 in January, down from 46.5 in December. Anything below 50 indicates a decrease in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment in 2024.

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 2/21/2024 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

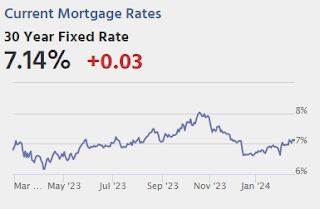

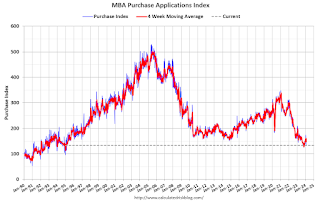

Mortgage applications decreased 10.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 16, 2024.

The Market Composite Index, a measure of mortgage loan application volume, decreased 10.6 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 8 percent compared with the previous week. The Refinance Index decreased 11 percent from the previous week and was 0.1 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 10 percent from one week earlier. The unadjusted Purchase Index decreased 6 percent compared with the previous week and was 13 percent lower than the same week one year ago.

"Mortgage rates moved back above 7 percent last week following news that inflation picked up in January, dimming hopes of a near term rate cut,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “Mortgage applications dropped as a result with a larger decline in refinance applications. Potential homebuyers are quite sensitive to these rate changes, as affordability is strained with both higher rates and higher home values in this supply-constrained market."

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) increased to 7.06 percent from 6.87 percent, with points increasing to 0.66 from 0.65 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 13% year-over-year unadjusted.

Tuesday, February 20, 2024

Wednesday: FOMC Minutes, Architecture Billings Index

by Calculated Risk on 2/20/2024 08:18:00 PM

Most mortgage lenders set rates for the first time this week on Tuesday (today) due to yesterday's holiday. ... In the bigger picture, rates are still very close to their highest levels in more than 2 months following a series of higher inflation readings last week. [30 year fixed 7.11%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day, The AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Minutes, Meeting of Meeting of January 30-31, 2024

MBA Survey: Share of Mortgage Loans in Forbearance Decreases to 0.22% in January

by Calculated Risk on 2/20/2024 04:20:00 PM

From the MBA: Share of Mortgage Loans in Forbearance Decreases Slightly to 0.22% in January

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 1 basis point from 0.23% of servicers’ portfolio volume in the prior month to 0.22% as of January 31, 2024. According to MBA’s estimate, 110,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 8.1 million borrowers since March 2020.At the end of January, there were about 110,000 homeowners in forbearance plans.

In January 2024, the share of Fannie Mae and Freddie Mac loans in forbearance declined 2 basis points to 0.13%. Ginnie Mae loans in forbearance remained the same at 0.39%, and the forbearance share for portfolio loans and private-label securities (PLS) increased 1 basis point to 0.28%.

“The combination of a potential economic slowdown in 2024, and indications that consumer debt balances and delinquencies are on the rise, could lead to more homeowners struggling to make their mortgage payments and inquire about forbearance and available loan workout options,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Most pandemic-related protocols have sunset, which gives mortgage servicers different rules of engagement when it comes to assisting borrowers through loan forbearance or a loan workout.”

emphasis added

Lawler: Update on Invitation Homes Rental Trends

by Calculated Risk on 2/20/2024 02:49:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Update on Invitation Homes Rental Trends

A brief excerpt:

From housing economist Tom Lawler:There is much more in the article.

Below is a table derived from the Q4/2023 (and earlier) Earnings Release and Supplemental Information from Invitation Homes, one of the largest institutional investors in single-family rental homes. (The January figures are based on figures from officials on the earnings conference call.)

Note that while the YOY increase in rent renewals last quarter actually rose slightly from the previous quarter, the YOY increase in new leases was zero, and according to officials on the conference call was negative in January.

DOT: Vehicle Miles Driven Increased 2.1% year-over-year in 2023

by Calculated Risk on 2/20/2024 02:19:00 PM

This is something I check occasionally.

The Department of Transportation (DOT) reported:

• Travel on all roads and streets changed by +2.2% (+5.7 billion vehicle miles) for December 2023 as compared with December 2022. Travel for the month is estimated to be 263.7 billion vehicle miles.

• The seasonally adjusted vehicle miles traveled for December 2023 is 273.0 billion miles, a +2.7% ( +7.3 billion vehicle miles) change over December 2022. It also represents a -0.2% change (-0.5 billion vehicle miles) compared with November 2023.

• Cumulative Travel for 2023 changed by +2.1% (+67.5 billion vehicle miles). The cumulative estimate for the year is 3,263.7 billion vehicle miles of travel.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the monthly total vehicle miles driven, seasonally adjusted.

Miles driven declined sharply in March 2020, and really collapsed in April 2020. Miles driven are now at pre-pandemic levels.

Single Family Built-for-Rent Almost Doubled Since 2020

by Calculated Risk on 2/20/2024 10:50:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Single Family Built-for-Rent Almost Doubled Since 2020

A brief excerpt:

Along with the monthly housing starts report for January released last week, the Census Bureau also released Housing Units Started by Purpose and Design through Q4 2023.There is much more in the article.

The first graph shows the number of single family and multi-family units started with the intent to rent. This data is quarterly and Not Seasonally Adjusted (NSA). Although the majority of units built-for-rent’ are still multi-family (blue), there has been a significant pickup in single family units started built-for-rent (red).

In 2020, there were 44,000 single family units started with the intent to rent. In 2023, that number almost doubled to 85,000 units. For multi-family, there were 327,000 units started to rent in 2020, and 393,000 in 2023. About 18% of the built-for-rent units started in 2023 were single family units.