by Calculated Risk on 2/26/2024 10:50:00 AM

Monday, February 26, 2024

New Home Sales at 661,000 Annual Rate in January; Median New Home Price is Down 15% from the Peak

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales at 661,000 Annual Rate in January

Brief excerpt:

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 661 thousand. The previous three months were revised down.There is much more in the article.

...

The next graph shows new home sales for 2023 and 2024 by month (Seasonally Adjusted Annual Rate). Sales in January 2024 were up 1.8% from January 2023.

New Home Sales at 661,000 Annual Rate in January

by Calculated Risk on 2/26/2024 10:00:00 AM

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 661 thousand.

The previous three months were revised down.

Sales of new single‐family houses in January 2024 were at a seasonally adjusted annual rate of 661,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.5 percent above the revised December rate of 651,000 and is 1.8 percent above the January 2023 estimate of 649,000.

emphasis added

Click on graph for larger image.

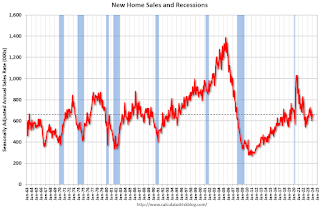

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales were close to pre-pandemic levels.

The second graph shows New Home Months of Supply.

The months of supply was unchanged in January at 8.3 months from 8.3 months in December.

The months of supply was unchanged in January at 8.3 months from 8.3 months in December. The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of January was 456,000. This represents a supply of 8.3 months at the current sales rate."Sales were below expectations of 675 thousand SAAR, and sales for the three previous months were revised down. I'll have more later today.

Housing February 26th Weekly Update: Inventory Up 0.7% Week-over-week, Up 15.6% Year-over-year

by Calculated Risk on 2/26/2024 08:21:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, February 25, 2024

Monday: New Home Sales

by Calculated Risk on 2/25/2024 09:23:00 PM

Weekend:

• Schedule for Week of February 25, 2024

Monday:

• At 10:00 AM ET, New Home Sales for January from the Census Bureau. The consensus is that new home sales increased to 675 thousand SAAR, up from 646 thousand in December.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for February.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 10 and DOW futures are down 60 (fair value).

Oil prices were down over the last week with WTI futures at $76.49 per barrel and Brent at $81.62 per barrel. A year ago, WTI was at $76, and Brent was at $82 - so WTI oil prices are unchanged year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.26 per gallon. A year ago, prices were at $3.33 per gallon, so gasoline prices are down $0.07 year-over-year.

February Vehicle Sales Forecast: 15.5 million SAAR, Up 4% YoY

by Calculated Risk on 2/25/2024 08:21:00 AM

From WardsAuto: February U.S. Light-Vehicle Sales to Rebound from January's Slide (pay content). Brief excerpt:

Sales are bouncing back in February, thanks mostly to a surge in estimated fleet volume, while the retail sector posts tepid growth. Higher interest rates, negative aspects of the inventory mix and lack of fresh product are keeping demand from being even stronger. One take away from February is that the month’s results will be more proof seasonal trends in the U.S. are resuming pre-2020 norms, which also means sales should strengthen again in March.

emphasis added

Click on graph for larger image.

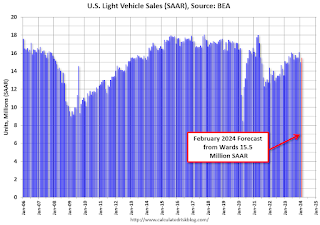

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for February (Red).

On a seasonally adjusted annual rate basis, the Wards forecast of 15.5 million SAAR, would be up 3.3% from last month, and up 4.2% from a year ago.

Saturday, February 24, 2024

Real Estate Newsletter Articles this Week: Existing-Home Sales Increased to 4.00 million SAAR in January

by Calculated Risk on 2/24/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• NAR: Existing-Home Sales Increased to 4.00 million SAAR in January

• Lawler: Update on Invitation Homes Rental Trends

• Single Family Built-for-Rent Almost Doubled Since 2020

• 3rd Look at Local Housing Markets in January; California Home Sales Up 5.9% YoY in January

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of February 25, 2024

by Calculated Risk on 2/24/2024 08:11:00 AM

The key reports this week are January New Home sales, the second estimate of Q4 GDP, Personal Income and Outlays for January, Case-Shiller house prices and February vehicle sales.

For manufacturing, the February ISM Index, and the February Dallas, Kansas City, and Richmond Fed manufacturing surveys will be released.

10:00 AM: New Home Sales for January from the Census Bureau.

10:00 AM: New Home Sales for January from the Census Bureau. This graph shows New Home Sales since 1963.

The dashed line is the sales rate for last month.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for February.

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 4.5% decrease in durable goods orders.

9:00 AM: FHFA House Price Index for December 2023. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM: S&P/Case-Shiller House Price Index for December.

9:00 AM: S&P/Case-Shiller House Price Index for December.This graph shows the year-over-year change for the Case-Shiller National, Composite 10 and Composite 20 indexes, through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 5.5% year-over-year increase in the National index for December, up from 5.1% in November.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February.

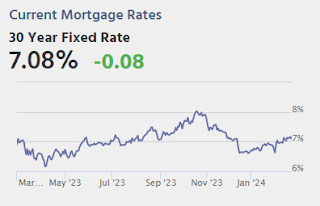

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Gross Domestic Product, 4th Quarter and Year 2023 (Second Estimate) The consensus is that real GDP increased 3.3% annualized in Q4, unchanged from the advance estimate of 3.3%.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 195 thousand initial claims, down from 201 thousand last week.

8:30 AM ET: Personal Income and Outlays for January. The consensus is for a 0.5% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.4%. PCE prices are expected to be up 2.4% YoY, and core PCE prices up 2.8% YoY.

9:45 AM: Chicago Purchasing Managers Index for February.

10:00 AM: Pending Home Sales Index for January. The consensus is for a 1.0% increase in the index.

11:00 AM: the Kansas City Fed manufacturing survey for February.

10:00 AM: ISM Manufacturing Index for February. The consensus is for the ISM to be at 49.2, up from 49.1 in January.

10:00 AM: Construction Spending for January. The consensus is for a 0.2% increase in construction spending.

10:00 AM: University of Michigan's Consumer sentiment index (Final for February).

All day: Light vehicle sales for February. Sales were at 15.0 million in January (Seasonally Adjusted Annual Rate). The consensus is for sales of 15.5 million SAAR.

All day: Light vehicle sales for February. Sales were at 15.0 million in January (Seasonally Adjusted Annual Rate). The consensus is for sales of 15.5 million SAAR.This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.

Friday, February 23, 2024

Feb 23rd COVID Update: Weekly Deaths Decreased

by Calculated Risk on 2/23/2024 07:51:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 16,536 | 18,024 | ≤3,0001 | |

| Deaths per Week2 | 1,883 | 2,210 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Hotels: Occupancy Rate Decreased 2.5% Year-over-year

by Calculated Risk on 2/23/2024 04:03:00 PM

.S. hotel performance increased from the previous week, while year-over-year comparisons remained mixed, according to CoStar’s latest data through 17 February. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

11-17 February 2024 (percentage change from comparable week in 2023):

• Occupancy: 59.2% (-2.5%)

• Average daily rate (ADR): US$162.24 (+4.2%)

• Revenue per available room (RevPAR): US$96.10 (+1.6%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, black is 2020, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

GDP Tracking: Q1 Boosted Slightly

by Calculated Risk on 2/23/2024 11:43:00 AM

From BofA:

On net, this week’s data boosted our 1Q US GDP tracking estimate by a tenth to 1.0% q/q saar. Our 4Q tracking estimate also increased by a tenth to 3.2% q/q saar [Feb 23rd estimate]From Goldman:

emphasis added

We boosted our Q1 GDP tracking estimate by 0.1pp to +2.4% (qoq ar) and our Q1 domestic final sales growth forecast by 0.1pp to +2.7% (qoq ar). [Feb 22nd estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2024 is 2.9 percent on February 16, unchanged from February 15. [Feb 16th estimate] (next release will be on Feb 27th)