by Calculated Risk on 2/27/2024 01:13:00 PM

Tuesday, February 27, 2024

Lawler: Update on American Homes for Rent (AMH)

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Update on American Homes for Rent (AMH)

A brief excerpt:

From housing economist Tom Lawler:There is much more in the article.

Below is a table derived from the Q4/2023 (and earlier) “Earnings Release and Supplemental Information Package” from American Homes for Rent (AMH), a large institutional investor in single-family rental homes. Also below is the table shown in last week’s report for Invitation Homes (INVH).

Recall that INVH said that last quarter it was focused on improving its occupancy rate and told teams to “negotiate” to do so. AMH, in contrast, saw its occupancy rate decline last quarter.

Comments on December Case-Shiller and FHFA House Prices

by Calculated Risk on 2/27/2024 09:48:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Up 5.5% year-over-year in December; FHFA: House Prices Up 6.5% Q4 over Q4

Excerpt:

S&P/Case-Shiller released the monthly Home Price Indices for December ("December" is a 3-month average of October, November and December closing prices). December closing prices include some contracts signed in August, so there is a significant lag to this data. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in the seasonally adjusted (SA) Case-Shiller National Index was at 0.19%. This was the eleventh consecutive MoM increase, but the smallest increase since prices declined (SA) in January 2023.

On a seasonally adjusted basis, prices increased in 13 of the 20 Case-Shiller cities on a month-to-month basis. Seasonally adjusted, San Francisco has fallen 8.7% from the recent peak, Seattle is down 7.0% from the peak, Portland down 4.7%, and Phoenix is down 3.2%.

Case-Shiller: National House Price Index Up 5.5% year-over-year in December

by Calculated Risk on 2/27/2024 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for December ("December" is a 3-month average of October, November and December closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index Reports 5.5% Annual Home Price Gain for Calendar 2023

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.5% annual gain in December, up from a 5.0% rise in the previous month. The 10-City Composite showed an increase of 7.0%, up from a 6.3% increase in the previous month. The 20-City Composite posted a year-over-year increase of 6.1%, up from a 5.4% increase in the previous month. San Diego reported the highest year-over-year gain among the 20 cities with an 8.8% increase in December, followed by Los Angeles and Detroit, each with an 8.3% increase. Portland showed a 0.3% increase this month, holding the lowest rank after reporting the smallest year-over-year growth.

...

The U.S. National Index showed a continued decrease of 0.4%, while the 20-City Composite and 10- City Composite posted 0.3% and 0.2% month-over-month decreases respectively in December.

After seasonal adjustment, the U.S. National Index, the 20-City Composite, and the 10-City Composite all posted month-over-month increases of 0.2%.

“U.S. home prices faced significant headwinds in the fourth quarter of 2023,” says Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. “However, on a seasonally adjusted basis, the S&P Case-Shiller Home Price Indices continued its streak of seven consecutive record highs in 2023. Ten of 20 markets beat prior records, with San Diego registering an 8.9% gain and Las Vegas the fastest rising market in December, after accounting for seasonal impacts.”

“2023 U.S. housing gains haven’t followed such a synchronous pattern since the COVID housing boom. The term ‘a rising tide lifts all boats’ seems appropriate given broad-based performance in the U.S. housing sector. All 20 markets reported yearly gains for the first time this year, with four markets rising over 8%. Portland eked out a positive annual gain after 11 months of declines. Regionally, the Midwest and Northeast both experienced the greatest annual appreciation with 6.7%.”

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 0.2% in December (SA) and is at a new all-time high.

The Composite 20 index is up 0.2% (SA) in December and is also at a new all-time high.

The National index is up 0.2% (SA) in December and is also at a new all-time high.

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 7.0% year-over-year. The Composite 20 SA is up 6.1% year-over-year.

The National index SA is up 5.5% year-over-year.

Annual price changes were at expectations. I'll have more later.

Monday, February 26, 2024

Tuesday: Case-Shiller House Prices, Durable Goods, Richmond Fed Mfg

by Calculated Risk on 2/26/2024 07:16:00 PM

Mortgage rates moved moderately higher to begin the new week, but they remained just under the highest recent levels seen last Thursday. Many lenders were closer to 'unchanged' at the outset but were then forced to issue mid-day increases in response to weakness in the bond market.Tuesday:

...

Some of this week's data could have an impact, but next week's data represents a much bigger risk (or opportunity). [30 year fixed 7.13%]

emphasis added

• At 8:30 AM ET, Durable Goods Orders for January from the Census Bureau. The consensus is for a 4.5% decrease in durable goods orders.

• At 9:00 AM, FHFA House Price Index for December 2023. This was originally a GSE only repeat sales, however there is also an expanded index.

• Also at 9:00 AM, S&P/Case-Shiller House Price Index for December. The consensus is for a 5.5% year-over-year increase in the National index for December, up from 5.1% in November.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for February.

Final Look at Local Housing Markets in January

by Calculated Risk on 2/26/2024 03:02:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in January

A brief excerpt:

After the National Association of Realtors® (NAR) releases the monthly existing home sales report, I pick up additional local market data that is reported after the NAR. This is the final look at local markets in January.There is much more in the article.

I’ve added a comparison of active listings, new listings, and closings to the same month in 2019 (for markets with available data). This gives us a sense of the current low level of sales and inventory, and also shows some significant regional differences.

The big stories for January were that existing home sales were very low, at 4.00 million on a seasonally adjusted annual rate basis (SAAR), and new listings were up YoY for the 4th consecutive month!

...

And a table of January sales.

In January, sales in these markets were up 3.0%. In December, these same markets were down 7.9% year-over-year Not Seasonally Adjusted (NSA).

Sales in most of these markets are down sharply compared to January 2019.

...

It is unlikely sales will be up year-over-year in February since sales were reported at 4.53 million SAAR in February 2023. The comparison will be easier later in the year.

More local data coming in March for activity in February!

New Home Sales at 661,000 Annual Rate in January; Median New Home Price is Down 15% from the Peak

by Calculated Risk on 2/26/2024 10:50:00 AM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales at 661,000 Annual Rate in January

Brief excerpt:

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 661 thousand. The previous three months were revised down.There is much more in the article.

...

The next graph shows new home sales for 2023 and 2024 by month (Seasonally Adjusted Annual Rate). Sales in January 2024 were up 1.8% from January 2023.

New Home Sales at 661,000 Annual Rate in January

by Calculated Risk on 2/26/2024 10:00:00 AM

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 661 thousand.

The previous three months were revised down.

Sales of new single‐family houses in January 2024 were at a seasonally adjusted annual rate of 661,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.5 percent above the revised December rate of 651,000 and is 1.8 percent above the January 2023 estimate of 649,000.

emphasis added

Click on graph for larger image.

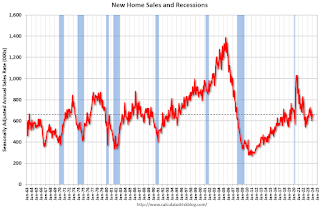

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales were close to pre-pandemic levels.

The second graph shows New Home Months of Supply.

The months of supply was unchanged in January at 8.3 months from 8.3 months in December.

The months of supply was unchanged in January at 8.3 months from 8.3 months in December. The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of January was 456,000. This represents a supply of 8.3 months at the current sales rate."Sales were below expectations of 675 thousand SAAR, and sales for the three previous months were revised down. I'll have more later today.

Housing February 26th Weekly Update: Inventory Up 0.7% Week-over-week, Up 15.6% Year-over-year

by Calculated Risk on 2/26/2024 08:21:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, February 25, 2024

Monday: New Home Sales

by Calculated Risk on 2/25/2024 09:23:00 PM

Weekend:

• Schedule for Week of February 25, 2024

Monday:

• At 10:00 AM ET, New Home Sales for January from the Census Bureau. The consensus is that new home sales increased to 675 thousand SAAR, up from 646 thousand in December.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for February.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 10 and DOW futures are down 60 (fair value).

Oil prices were down over the last week with WTI futures at $76.49 per barrel and Brent at $81.62 per barrel. A year ago, WTI was at $76, and Brent was at $82 - so WTI oil prices are unchanged year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.26 per gallon. A year ago, prices were at $3.33 per gallon, so gasoline prices are down $0.07 year-over-year.

February Vehicle Sales Forecast: 15.5 million SAAR, Up 4% YoY

by Calculated Risk on 2/25/2024 08:21:00 AM

From WardsAuto: February U.S. Light-Vehicle Sales to Rebound from January's Slide (pay content). Brief excerpt:

Sales are bouncing back in February, thanks mostly to a surge in estimated fleet volume, while the retail sector posts tepid growth. Higher interest rates, negative aspects of the inventory mix and lack of fresh product are keeping demand from being even stronger. One take away from February is that the month’s results will be more proof seasonal trends in the U.S. are resuming pre-2020 norms, which also means sales should strengthen again in March.

emphasis added

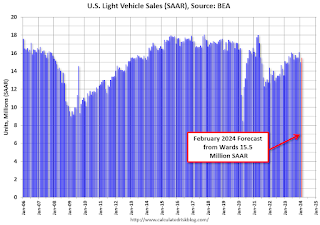

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for February (Red).

On a seasonally adjusted annual rate basis, the Wards forecast of 15.5 million SAAR, would be up 3.3% from last month, and up 4.2% from a year ago.