by Calculated Risk on 3/06/2024 10:00:00 AM

Wednesday, March 06, 2024

BLS: Job Openings Little Changed at 8.9 million in January

From the BLS: Job Openings and Labor Turnover Summary

he number of job openings changed little at 8.9 million on the last business day of January, the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively. Within separations, quits (3.4 million) and layoffs and discharges (1.6 million) changed little.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for January; the employment report this Friday will be for February.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings decreased slightly in January to 8.86 million from 8.89 million in December.

The number of job openings (black) were down 15% year-over-year.

Quits were down 13% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

Fed Chair Powell: Semiannual Monetary Policy Report to the Congress

by Calculated Risk on 3/06/2024 08:48:00 AM

This testimony will be live here at 10:00 AM ET.

Report here.

From Fed Chair Powell: Semiannual Monetary Policy Report to the Congress. An excerpt on policy:

We believe that our policy rate is likely at its peak for this tightening cycle. If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year. But the economic outlook is uncertain, and ongoing progress toward our 2 percent inflation objective is not assured. Reducing policy restraint too soon or too much could result in a reversal of progress we have seen in inflation and ultimately require even tighter policy to get inflation back to 2 percent. At the same time, reducing policy restraint too late or too little could unduly weaken economic activity and employment. In considering any adjustments to the target range for the policy rate, we will carefully assess the incoming data, the evolving outlook, and the balance of risks. The Committee does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.

emphasis added

ADP: Private Employment Increased 140,000 in February

by Calculated Risk on 3/06/2024 08:15:00 AM

Private sector employment increased by 140,000 jobs in February and annual pay was up 5.1 percent year-over-year, according to the February ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”). ...This was below the consensus forecast of 150,000. The BLS report will be released Friday, and the consensus is for 188 thousand non-farm payroll jobs added in February.

“Job gains remain solid. Pay gains are trending lower but are still above inflation,” said Nela Richardson, chief economist, ADP. “In short, the labor market is dynamic, but doesn't tip the scales in terms of a Fed rate decision this year.”

emphasis added

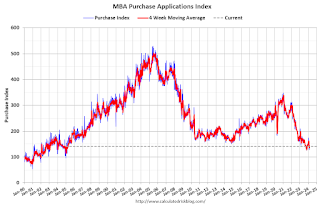

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 3/06/2024 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 9.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 1, 2024.

The Market Composite Index, a measure of mortgage loan application volume, increased 9.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 12 percent compared with the previous week. The Refinance Index increased 8 percent from the previous week and was 2 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 11 percent from one week earlier. The unadjusted Purchase Index increased 13 percent compared with the previous week and was 8 percent lower than the same week one year ago.

"The latest data on inflation was not markedly better nor worse than expected, which was enough to bring mortgage rates down a bit, with the 30-year fixed mortgage rate declining slightly last week to 7.02 percent,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “Mortgage applications were up considerably relative to the prior week, which included the President's Day holiday. Of note, purchase volume – particularly for FHA loans – was up strongly, again showing how sensitive the first-time homebuyer segment is to relatively small changes in the direction of rates. Other sources of housing data are showing increases in new listings, which is a real positive for the spring buying season given the lack of for-sale inventory."

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 7.02 percent from 7.04 percent, with points unchanged at 0.67 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 8% year-over-year unadjusted.

Tuesday, March 05, 2024

Wednesday: Job Openings, Fed Chair Powell Testimony, Beige Book, ADP Employment

by Calculated Risk on 3/05/2024 07:49:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 150,000 payroll jobs added in February, up from 107,000 added in January.

• At 10:00 AM, Job Openings and Labor Turnover Survey for January from the BLS. Jobs openings increased in December to 9.03 million from 8.93 million in November.

• Also at 10:00 AM, Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the U.S. House Financial Services Committee

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Inflation Adjusted House Prices 2.4% Below Peak; Price-to-rent index is 7.3% below recent peak

by Calculated Risk on 3/05/2024 11:41:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 2.4% Below Peak

Excerpt:

It has been over 17 years since the bubble peak. In the December Case-Shiller house price index released last week, the seasonally adjusted National Index (SA), was reported as being 70% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 10% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is 1% above the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $300,000 in January 2010, the price would be $426,000 today adjusted for inflation (42% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index.

...

The second graph shows the same two indexes in real terms (adjusted for inflation using CPI).

In real terms (using CPI), the National index is 2.4% below the recent peak, and the Composite 20 index is 3.2% below the recent peak in 2022. Both indexes declined slightly in December in real terms.

In real terms, national house prices are 10.2% above the bubble peak levels. There is an upward slope to real house prices, and it has been over 17 years since the previous peak, but real prices are historically high.

ISM® Services Index decreases to 52.6% in February

by Calculated Risk on 3/05/2024 10:00:00 AM

(Posted with permission). The ISM® Services index was at 52.6%, down from 53.4% last month. The employment index decreased to 48.0%, from 50.5%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 52.6% February 2024 Services ISM® Report On Business®

Economic activity in the services sector expanded in February for the 14th consecutive month as the Services PMI® registered 52.6 percent, say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®. The sector has grown in 44 of the last 45 months, with the lone contraction in December 2022.The PMI was slightly below expectations.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In February, the Services PMI® registered 52.6 percent, 0.8 percentage point lower than January’s reading of 53.4 percent. The composite index indicated growth in February for the 14th consecutive month after a reading of 49 percent in December 2022, which was the first contraction since May 2020 (45.4 percent). The Business Activity Index registered 57.2 percent in February, which is 1.4 percentage points higher than the 55.8 percent recorded in January. The New Orders Index expanded in February for the 14th consecutive month after contracting in December 2022 for the first time since May 2020; the figure of 56.1 percent is 1.1 percentage points higher than the January reading of 55 percent. The Employment Index contracted for the second time in three months with a reading of 48 percent, a 2.5-percentage point decrease compared to the 50.5 percent recorded in January.

emphasis added

CoreLogic: US Home Prices Increased 5.8% Year-over-year in January

by Calculated Risk on 3/05/2024 08:55:00 AM

Notes: This CoreLogic House Price Index report is for January. The recent Case-Shiller index release was for December. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic: Annual US Home Price Growth Moves Up Gradually Again in January

• U.S. single-family home prices (including distressed sales) increased by 5.8% year over year in January 2024 compared with January 2023. On a month-over-month basis, home prices increased by 0.1% compared with December 2023.

• In January, the annual appreciation of detached properties (6%) was 1.1 percentage points higher than that of attached properties (4.9%).

• CoreLogic’s forecast shows annual U.S. home price gains relaxing to 2.6% in January 2025.

• Miami posted the highest year-over-year home price increase of the country’s 10 highlighted metro areas in January, at 10.2%. San Diego saw the next-highest gain at 8.5%.

• Among states, Rhode Island ranked first for annual appreciation in January (up by 13.2%), followed by New Jersey (up by 11.6%) and Connecticut (up by 11%). No states recorded year-over-year home price losses.

...

“U.S. annual home price growth strengthened to 5.8% in January 2024,” said Dr. Selma Hepp, chief economist for CoreLogic. “And while the acceleration continues to reflect the residual impact of strong appreciation in early 2023, the annual rate of growth is expected to taper off in coming months.”

“Home prices further increased in late 2023 despite high mortgage rates, which surged to the highest level since the beginning of the millennium,” Hepp continued. “But metro areas that have struggled with the impact of higher rates continue to see downward movement on home prices. Generally, pressures from higher mortgage rates tend to occur in markets where the higher cost of homeownership pushes against the affordability ceiling.”

emphasis added

Monday, March 04, 2024

Tuesday: ISM Services

by Calculated Risk on 3/04/2024 08:54:00 PM

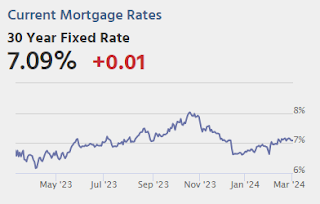

Mortgage rates were at the best levels in 2 weeks as of last Friday and today's offerings are only modestly higher.Tuesday:

...

The two reports above all others are CPI (the Consumer Price Index) and the big jobs report. CPI caused a stir just before the sideways vibes set in and this Friday's jobs report is just as capable. [30 year fixed 7.09%]

emphasis added

• At 10:00 AM: the ISM Services Index for February.

Heavy Truck Sales Increased in February

by Calculated Risk on 3/04/2024 05:07:00 PM

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the February 2024 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new record high of 570 thousand SAAR in April 2019.

Click on graph for larger image.

Click on graph for larger image.Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales declined sharply at the beginning of the pandemic, falling to a low of 308 thousand SAAR in May 2020.