by Calculated Risk on 3/07/2024 09:23:00 AM

Thursday, March 07, 2024

Wholesale Used Car Prices Declined in February; Down 13.1% Year-over-year

From Manheim Consulting today: Wholesale Used-Vehicle Prices Declined in February

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) were down in February compared to January. The Manheim Used Vehicle Value Index (MUVVI) fell to 203.8, a decline of 13.1% from a year ago. The index was down 0.1% against the month of January 2024. The seasonal adjustment magnified February’s results. The non-adjusted price in February increased by 1.7% compared to January, moving the unadjusted average price down 11.0% year over year.

Though February activity was muted as we started the month, we saw more activity in the lanes at Manheim in the second half of the month and finished the last week of February with some of the strongest weekly gains in wholesale prices for many years,” said Jeremy Robb, senior director of Economic and Industry Insights for Cox Automotive. “Tax refunds have picked up over the last two weeks, with the average refund now 4% higher than 2023 levels at this time. This has put money into consumers’ pockets, and retail purchase activity is increasing. In turn, dealers are coming to the lanes and buying units at Manheim right at the start of the spring selling season for wholesale markets.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Trade Deficit at $67.4 Billion in January

by Calculated Risk on 3/07/2024 08:35:00 AM

The Census Bureau and the Bureau of Economic Analysis reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $67.4 billion in January, up $3.3 billion from $64.2 billion in December, revised.

January exports were $257.2 billion, $0.3 billion more than December exports. January imports were $324.6 billion, $3.6 billion more than December imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports imports increased in January.

Exports are down 0.4% year-over-year; imports are down 1.2% year-over-year.

Both imports and exports decreased sharply due to COVID-19 and then bounced back - imports and exports are moving sideways recently.

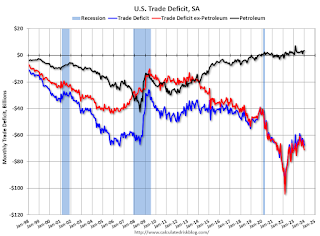

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, exports of petroleum products are positive and have been increasing.

The trade deficit with China decreased to $23.7 billion from $25.2 billion a year ago.

Weekly Initial Unemployment Claims Increase to 217,000

by Calculated Risk on 3/07/2024 08:30:00 AM

The DOL reported:

In the week ending March 2, the advance figure for seasonally adjusted initial claims was 217,000, unchanged from the previous week's revised level. The previous week's level was revised up by 2,000 from 215,000 to 217,000. The 4-week moving average was 212,250, a decrease of 750 from the previous week's revised average. The previous week's average was revised up by 500 from 212,500 to 213,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 212,250.

The previous week was revised up.

Weekly claims were below the consensus forecast.

Wednesday, March 06, 2024

Thursday: Unemployment Claims, Trade Balance, Fed Chair Powell, Flow of Funds

by Calculated Risk on 3/06/2024 07:47:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 216 thousand last week.

• At 8:30 AM, Trade Balance report for January from the Census Bureau. The consensus is the trade deficit to be $61.7 billion. The U.S. trade deficit was at $62.2 billion in December.

• At 10:00 AM, Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the U.S. Senate Committee on Banking, Housing, and Urban Affairs

• At 12:00 PM, Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

Fed's Beige Book: "Economic activity increased slightly"

by Calculated Risk on 3/06/2024 02:00:00 PM

Economic activity increased slightly, on balance, since early January, with eight Districts reporting slight to modest growth in activity, three others reporting no change, and one District noting a slight softening. Consumer spending, particularly on retail goods, inched down in recent weeks. Several reports cited heightened price sensitivity by consumers and noted that households continued to trade down and to shift spending away from discretionary goods. Activity in the leisure and hospitality sector varied by District and segment; while air travel was robust overall, demand for restaurants, hotels, and other establishments softened due to elevated prices, as well as to unusual weather conditions in certain regions. Manufacturing activity was largely unchanged, and supply bottlenecks normalized further. Nevertheless, delivery delays for electrical components continued. Ongoing shipping disruptions in the Red Sea and Panama Canal did not generally have a notable impact on businesses during the reporting period, although some contacts reported rising pressures on international shipping costs. Several reports highlighted a pickup in demand for residential real estate in recent weeks, largely owing to some moderation in mortgage rates, but noted that limited inventories hindered actual home sales. Commercial real estate activity was weak, particularly for office space, although there were reports of robust demand for new data centers, industrial and manufacturing spaces, and large infrastructure projects. Loan demand was stable to down, and credit quality was generally healthy despite a few reports of rising delinquencies. The outlook for future economic growth remained generally positive, with contacts noting expectations for stronger demand and less restrictive financial conditions over the next 6 to 12 months.

Labor Markets

Employment rose at a slight to modest pace in most Districts. Overall, labor market tightness eased further, with nearly all Districts highlighting some improvement in labor availability and employee retention. Businesses generally found it easier to fill open positions and to find qualified applicants, although difficulties persisted attracting workers for highly skilled positions, including health-care professionals, engineers, and skilled trades specialists such as welders and mechanics. Wages grew further across Districts, although several reports indicated a slower pace of increase. Employee expectations of pay adjustments were reportedly more in line with historical averages.

Prices

Price pressures persisted during the reporting period, but several Districts reported some degree of moderation in inflation. Contacts highlighted increases in freight costs and several insurance categories, including employer-sponsored health insurance. Nevertheless, businesses found it harder to pass through higher costs to their customers, who became increasingly sensitive to price changes. The cost of many manufacturing and construction inputs, such as steel, cement, paper, and fuel, reportedly fell in recent weeks.

emphasis added

Asking Rents Mostly Unchanged Year-over-year

by Calculated Risk on 3/06/2024 12:37:00 PM

Today, in the Real Estate Newsletter: Asking Rents Mostly Unchanged Year-over-year

Brief excerpt:

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. Most of these measures are through January 2024, except CoreLogic is through December and Apartment List is through February 2024.There is much more in the article.

The CoreLogic measure is up 2.8% YoY in December, up from 2.7% in November, and down from a peak of 13.9% in April 2022.

The Zillow measure is up 3.4% YoY in January, mostly unchanged from 3.4% YoY in December, and down from a peak of 16.0% YoY in February 2022.

The ApartmentList measure is down 1.0% YoY as of February, mostly unchanged from -0.9% in January, and down from a peak of 18.2% YoY November 2021.

...

The YoY change in OER and in PCE housing have peaked, but will stay elevated for some time, even though asking rent growth has mostly flattened YoY.

BLS: Job Openings Little Changed at 8.9 million in January

by Calculated Risk on 3/06/2024 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

he number of job openings changed little at 8.9 million on the last business day of January, the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations were little changed at 5.7 million and 5.3 million, respectively. Within separations, quits (3.4 million) and layoffs and discharges (1.6 million) changed little.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for January; the employment report this Friday will be for February.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings decreased slightly in January to 8.86 million from 8.89 million in December.

The number of job openings (black) were down 15% year-over-year.

Quits were down 13% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

Fed Chair Powell: Semiannual Monetary Policy Report to the Congress

by Calculated Risk on 3/06/2024 08:48:00 AM

This testimony will be live here at 10:00 AM ET.

Report here.

From Fed Chair Powell: Semiannual Monetary Policy Report to the Congress. An excerpt on policy:

We believe that our policy rate is likely at its peak for this tightening cycle. If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year. But the economic outlook is uncertain, and ongoing progress toward our 2 percent inflation objective is not assured. Reducing policy restraint too soon or too much could result in a reversal of progress we have seen in inflation and ultimately require even tighter policy to get inflation back to 2 percent. At the same time, reducing policy restraint too late or too little could unduly weaken economic activity and employment. In considering any adjustments to the target range for the policy rate, we will carefully assess the incoming data, the evolving outlook, and the balance of risks. The Committee does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.

emphasis added

ADP: Private Employment Increased 140,000 in February

by Calculated Risk on 3/06/2024 08:15:00 AM

Private sector employment increased by 140,000 jobs in February and annual pay was up 5.1 percent year-over-year, according to the February ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”). ...This was below the consensus forecast of 150,000. The BLS report will be released Friday, and the consensus is for 188 thousand non-farm payroll jobs added in February.

“Job gains remain solid. Pay gains are trending lower but are still above inflation,” said Nela Richardson, chief economist, ADP. “In short, the labor market is dynamic, but doesn't tip the scales in terms of a Fed rate decision this year.”

emphasis added

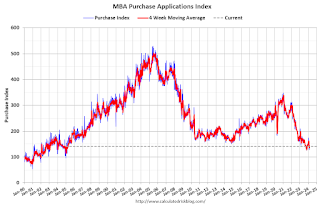

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 3/06/2024 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 9.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 1, 2024.

The Market Composite Index, a measure of mortgage loan application volume, increased 9.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 12 percent compared with the previous week. The Refinance Index increased 8 percent from the previous week and was 2 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 11 percent from one week earlier. The unadjusted Purchase Index increased 13 percent compared with the previous week and was 8 percent lower than the same week one year ago.

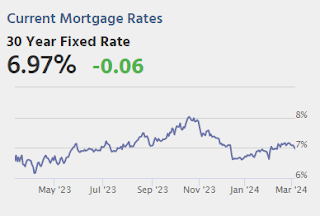

"The latest data on inflation was not markedly better nor worse than expected, which was enough to bring mortgage rates down a bit, with the 30-year fixed mortgage rate declining slightly last week to 7.02 percent,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “Mortgage applications were up considerably relative to the prior week, which included the President's Day holiday. Of note, purchase volume – particularly for FHA loans – was up strongly, again showing how sensitive the first-time homebuyer segment is to relatively small changes in the direction of rates. Other sources of housing data are showing increases in new listings, which is a real positive for the spring buying season given the lack of for-sale inventory."

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 7.02 percent from 7.04 percent, with points unchanged at 0.67 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 8% year-over-year unadjusted.