by Calculated Risk on 3/08/2024 09:30:00 AM

Friday, March 08, 2024

Comments on February Employment Report

The headline jobs number in the February employment report was above expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the unemployment rate was increased to 3.9%.

Prime (25 to 54 Years Old) Participation

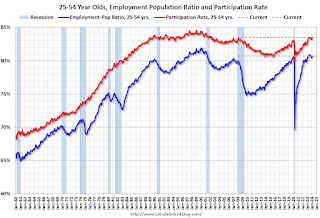

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 years old participation rate increased in February to 83.5% from 83.3% in January, and the 25 to 54 employment population ratio increased to 80.7% from 80.6% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.3% YoY in February.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.4 million, changed little in February. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in February to 4.36 million from 4.42 million in February. This is slightly above pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.3% from 7.2% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.203 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.277 million the previous month.

This is close to pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 38 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline monthly jobs number was above consensus expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the unemployment rate was increased to 3.9%. Another solid report.

February Employment Report: 275 thousand Jobs, 3.9% Unemployment Rate

by Calculated Risk on 3/08/2024 08:30:00 AM

From the BLS:

Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

...

The change in total nonfarm payroll employment for December was revised down by 43,000, from +333,000 to +290,000, and the change for January was revised down by 124,000, from +353,000 to +229,000. With these revisions, employment in December and January combined is 167,000 lower than previously reported.

emphasis added

Click on graph for larger image.

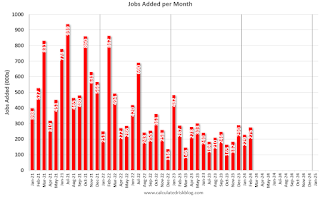

Click on graph for larger image.The first graph shows the jobs added per month since January 2021.

Payrolls for December and January were revised down 167 thousand, combined.

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In February, the year-over-year change was 2.75 million jobs. Employment was up solidly year-over-year.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged at 62.5% in February, from 62.5% in January. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate was unchanged at 62.5% in February, from 62.5% in January. This is the percentage of the working age population in the labor force. The Employment-Population ratio decreased to 60.1% from 60.2% (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate increased to 3.9% in February from 3.7% in January.

This was well above consensus expectations; however, December and January payrolls were revised down by 167,000 combined.

Thursday, March 07, 2024

Friday: Employment Report

by Calculated Risk on 3/07/2024 08:26:00 PM

Friday:

• At 8:30 AM ET,: Employment Report for February. The consensus is for 188,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

February Employment Preview

by Calculated Risk on 3/07/2024 05:16:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for February. The consensus is for 188,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

There were 353,000 jobs added in January, and the unemployment rate was at 3.7%.

From Goldman Sachs economist Spencer Hill

We estimate nonfarm payrolls rose by 215k in February—somewhat above consensus of +200k but well below the +353k pace in January. We believe fewer end-of-year layoffs produced last month’s temporary spike, and with the seasonal layoff period now behind us, we assume a return towards a more normal pace of job gains. That said, our forecast also reflects a 30-50k weather boost from workers returning after the mid-January storms. ... We estimate that the unemployment rate was unchanged at 3.7%• ADP Report: The ADP employment report showed 140,000 private sector jobs were added in February. This suggests job gains slightly below consensus expectations, however, in general, ADP hasn't been very useful in forecasting the BLS report.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased in February to 45.9%, down from 47.1% last month. This would suggest about 40,000 jobs lost in manufacturing. The ADP report indicated 6,000 manufacturing jobs added in February.

The ISM® services employment index decreased to 48.0%, from 50.5%. This would suggest about 20,000 jobs added in the service sector. Combined this suggests job losses of 20,000 in February, far below consensus expectations.

• Unemployment Claims: The weekly claims report showed a larger number of initial unemployment claims during the reference week from 189,000 in January to 202,000 in February. This suggests slightly more layoffs in February compared to January.

The "Home ATM" Closed in Q4

by Calculated Risk on 3/07/2024 12:49:00 PM

Today, in the Real Estate Newsletter: The "Home ATM" Closed in Q4

Excerpt:

During the housing bubble, many homeowners borrowed heavily against their perceived home equity - jokingly calling it the “Home ATM” - and this contributed to the subsequent housing bust, since so many homeowners had negative equity in their homes when house prices declined. Note: Very few homeowners have negative equity now - unlike during the housing bubble.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/.

...

Here is the quarterly increase in mortgage debt from the Federal Reserve’s Financial Accounts of the United States - Z.1 (sometimes called the Flow of Funds report) released today. In the mid ‘00s, there was a large increase in mortgage debt associated with the housing bubble.

In Q4 2024, mortgage debt increased $90 billion, down from $119 billion in Q3, and down from the cycle peak of $467 billion in Q2 2021. Note the almost 7 years of declining mortgage debt as distressed sales (foreclosures and short sales) wiped out a significant amount of debt.

However, some of this debt is being used to increase the housing stock (purchase new homes), so this isn’t all Mortgage Equity Withdrawal (MEW).

Fed's Flow of Funds: Household Net Worth Increased $4.8 Trillion in Q4

by Calculated Risk on 3/07/2024 12:17:00 PM

The Federal Reserve released the Q4 2023 Flow of Funds report today: Financial Accounts of the United States.

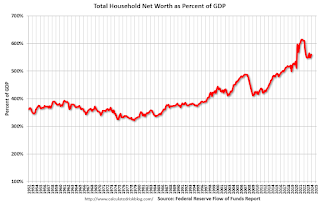

The net worth of households and nonprofits rose to $156.2 trillion during the fourth quarter of 2023. The value of directly and indirectly held corporate equities increased $4.7 trillion and the value of real estate decreased $0.6 trillion.

...

Household debt increased 2.4 percent at an annual rate in the fourth quarter of 2023. Consumer credit grew at an annual rate of 3.3 percent, while mortgage debt (excluding charge-offs) grew at an annual rate of 2.1 percent.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP.

The second graph shows homeowner percent equity since 1952.

The second graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q4 2023, household percent equity (of household real estate) was at 73.4% - down from 73.9% in Q3, 2023. This is close to the highest percent equity since the 1960s.

Note: This includes households with no mortgage debt.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $90 billion in Q4.

Mortgage debt is up $2.36 trillion from the peak during the housing bubble, but, as a percent of GDP is at 46.78% - down from Q3 - and down from a peak of 73.3% of GDP during the housing bust.

The value of real estate, as a percent of GDP, decreased in Q4 - and is below the peak in Q3 2022 - but is well above the average of the last 30 years.

Wholesale Used Car Prices Declined in February; Down 13.1% Year-over-year

by Calculated Risk on 3/07/2024 09:23:00 AM

From Manheim Consulting today: Wholesale Used-Vehicle Prices Declined in February

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) were down in February compared to January. The Manheim Used Vehicle Value Index (MUVVI) fell to 203.8, a decline of 13.1% from a year ago. The index was down 0.1% against the month of January 2024. The seasonal adjustment magnified February’s results. The non-adjusted price in February increased by 1.7% compared to January, moving the unadjusted average price down 11.0% year over year.

Though February activity was muted as we started the month, we saw more activity in the lanes at Manheim in the second half of the month and finished the last week of February with some of the strongest weekly gains in wholesale prices for many years,” said Jeremy Robb, senior director of Economic and Industry Insights for Cox Automotive. “Tax refunds have picked up over the last two weeks, with the average refund now 4% higher than 2023 levels at this time. This has put money into consumers’ pockets, and retail purchase activity is increasing. In turn, dealers are coming to the lanes and buying units at Manheim right at the start of the spring selling season for wholesale markets.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Trade Deficit at $67.4 Billion in January

by Calculated Risk on 3/07/2024 08:35:00 AM

The Census Bureau and the Bureau of Economic Analysis reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $67.4 billion in January, up $3.3 billion from $64.2 billion in December, revised.

January exports were $257.2 billion, $0.3 billion more than December exports. January imports were $324.6 billion, $3.6 billion more than December imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports imports increased in January.

Exports are down 0.4% year-over-year; imports are down 1.2% year-over-year.

Both imports and exports decreased sharply due to COVID-19 and then bounced back - imports and exports are moving sideways recently.

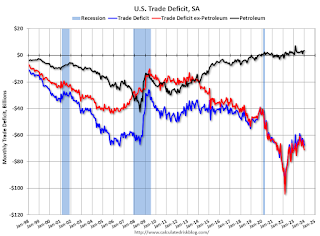

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, exports of petroleum products are positive and have been increasing.

The trade deficit with China decreased to $23.7 billion from $25.2 billion a year ago.

Weekly Initial Unemployment Claims Increase to 217,000

by Calculated Risk on 3/07/2024 08:30:00 AM

The DOL reported:

In the week ending March 2, the advance figure for seasonally adjusted initial claims was 217,000, unchanged from the previous week's revised level. The previous week's level was revised up by 2,000 from 215,000 to 217,000. The 4-week moving average was 212,250, a decrease of 750 from the previous week's revised average. The previous week's average was revised up by 500 from 212,500 to 213,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 212,250.

The previous week was revised up.

Weekly claims were below the consensus forecast.

Wednesday, March 06, 2024

Thursday: Unemployment Claims, Trade Balance, Fed Chair Powell, Flow of Funds

by Calculated Risk on 3/06/2024 07:47:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 216 thousand last week.

• At 8:30 AM, Trade Balance report for January from the Census Bureau. The consensus is the trade deficit to be $61.7 billion. The U.S. trade deficit was at $62.2 billion in December.

• At 10:00 AM, Testimony, Fed Chair Jerome Powell, Semiannual Monetary Policy Report to the Congress, Before the U.S. Senate Committee on Banking, Housing, and Urban Affairs

• At 12:00 PM, Q4 Flow of Funds Accounts of the United States from the Federal Reserve.