by Calculated Risk on 3/09/2024 02:11:00 PM

Saturday, March 09, 2024

Real Estate Newsletter Articles this Week: Price-to-rent index is 7.3% below recent peak

At the Calculated Risk Real Estate Newsletter this week:

• The "Home ATM" Closed in Q4

• Inflation Adjusted House Prices 2.4% Below Peak Price-to-rent index is 7.3% below recent peak

• Asking Rents Mostly Unchanged Year-over-year

• 1st Look at Local Housing Markets in February

• Lawler: Some Thoughts on Quantitative Easing and Quantitative Tightening

• ICE Mortgage Monitor: "First-Time Homebuyers Make Up Record 47% of GSE Purchase Loans"

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of March 10, 2024

by Calculated Risk on 3/09/2024 08:11:00 AM

The key reports this week are February CPI and Retail Sales.

For manufacturing, the February Industrial Production report and the March NY Fed manufacturing survey will be released.

10:00 AM: State Employment and Unemployment (Monthly) for January 2024

6:00 AM ET: NFIB Small Business Optimism Index for February.

8:30 AM: The Consumer Price Index for February from the BLS. The consensus is for a 0.4% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 3.1% Year-over-year (YoY), and core CPI to be up 3.7% YoY.

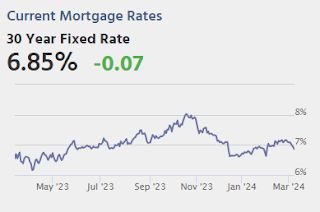

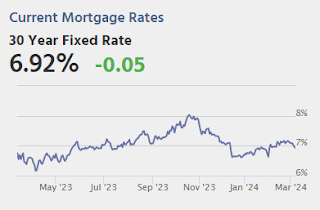

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 221 thousand initial claims, up from 217 thousand last week.

8:30 AM: Retail sales for February is scheduled to be released. The consensus is for a 0.7% increase in retail sales.

8:30 AM: Retail sales for February is scheduled to be released. The consensus is for a 0.7% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

8:30 AM: The Producer Price Index for February from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.3% increase in core PPI.

8:30 AM: The New York Fed Empire State manufacturing survey for March. The consensus is for a reading of -8.0, down from -2.4.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.This graph shows industrial production since 1967.

The consensus is no changed in Industrial Production, and for Capacity Utilization to decrease to 78.4%.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for March).

Friday, March 08, 2024

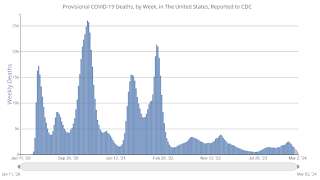

March 8th COVID Update: Weekly Deaths Decreased

by Calculated Risk on 3/08/2024 07:45:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 13,905 | 15,699 | ≤3,0001 | |

| Deaths per Week2 | 1,477 | 1,642 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

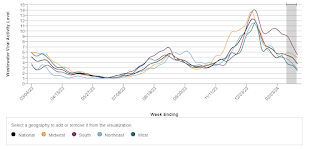

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.AAR: Rail Traffic Recovered in February

by Calculated Risk on 3/08/2024 03:12:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

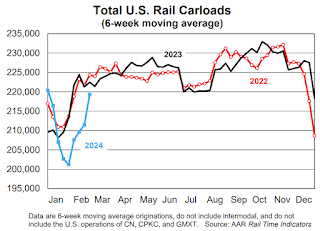

U.S. rail traffic recovered in February after severe weather constrained volumes in January.

Total originated carloads on U.S. railroads averaged 221,387 per week in February, up from 205,034 in January. Total carloads were down 1.3% in February 2024 from February 2023. That’s a big improvement from January’s 7.2% decline.

...

Meanwhile, U.S. intermodal originations in February 2024 were up 10.9% over February 2023. That’s their biggest percentage gain in 32 months and the sixth straight gain of any size. Intermodal averaged 260,078 units per week in February 2024, the second most in 16 months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2022, 2023 and 2024:

In February, originated carloads on U.S. railroads were 885,548, down 1.3% (11,410 carloads) from last year. That’s a big improvement from January’s 7.2% decline. Carloads averaged 221,387 per week in February, up from 205,034 in January. Generally speaking, carload volumes remain constrained in part because the goods-side of the U.S. economy, including manufacturing as a whole (see pages 7 and 8), is not doing as well as it could be.

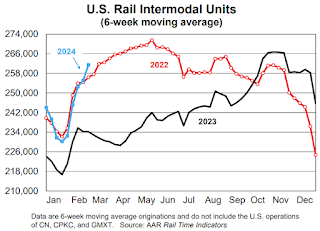

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2022, 2023 and 2024: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2022, 2023 and 2024: (using intermodal or shipping containers):U.S. intermodal originations in February 2024 totaled 1.04 million containers and trailers, up 10.9% (102,140 units) over February 2023. That’s the biggest year-over-year percentage gain for intermodal in 32 months and the sixth straight gain of any size. Intermodal averaged 260,078 units per week in February, up from 241,203 in January and the second most in 16 months.

GDP Tracking: Low 2% Range

by Calculated Risk on 3/08/2024 02:34:00 PM

From BofA:

Since our update last week, 1Q GDP tracking is down two-tenths to 2.3% q/q saar, and 4Q GDP tracking is up a tenth to 3.3% q/q saar from its second estimate print of 3.2% q/q saar. [Mar 8th estimate]From Goldman:

emphasis added

We left our Q1 GDP tracking estimate unchanged after rounding at +2.2% (qoq ar) and our Q1 domestic final sales forecast also unchanged at +2.5% (qoq ar). [Mar 6th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2024 is 2.5 percent on March 7, unchanged from March 6. [March 7th estimate]

Comments on February Employment Report

by Calculated Risk on 3/08/2024 09:30:00 AM

The headline jobs number in the February employment report was above expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the unemployment rate was increased to 3.9%.

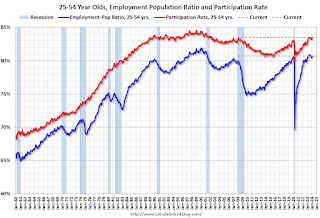

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 years old participation rate increased in February to 83.5% from 83.3% in January, and the 25 to 54 employment population ratio increased to 80.7% from 80.6% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.3% YoY in February.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.4 million, changed little in February. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in February to 4.36 million from 4.42 million in February. This is slightly above pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.3% from 7.2% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.203 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.277 million the previous month.

This is close to pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 38 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline monthly jobs number was above consensus expectations; however, December and January payrolls were revised down by 167,000 combined. The participation rate was unchanged, the employment population ratio decreased, and the unemployment rate was increased to 3.9%. Another solid report.

February Employment Report: 275 thousand Jobs, 3.9% Unemployment Rate

by Calculated Risk on 3/08/2024 08:30:00 AM

From the BLS:

Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

...

The change in total nonfarm payroll employment for December was revised down by 43,000, from +333,000 to +290,000, and the change for January was revised down by 124,000, from +353,000 to +229,000. With these revisions, employment in December and January combined is 167,000 lower than previously reported.

emphasis added

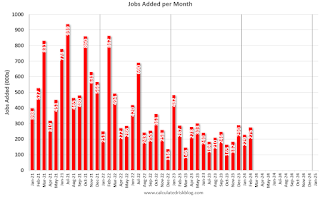

Click on graph for larger image.

Click on graph for larger image.The first graph shows the jobs added per month since January 2021.

Payrolls for December and January were revised down 167 thousand, combined.

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In February, the year-over-year change was 2.75 million jobs. Employment was up solidly year-over-year.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged at 62.5% in February, from 62.5% in January. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate was unchanged at 62.5% in February, from 62.5% in January. This is the percentage of the working age population in the labor force. The Employment-Population ratio decreased to 60.1% from 60.2% (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate increased to 3.9% in February from 3.7% in January.

This was well above consensus expectations; however, December and January payrolls were revised down by 167,000 combined.

Thursday, March 07, 2024

Friday: Employment Report

by Calculated Risk on 3/07/2024 08:26:00 PM

Friday:

• At 8:30 AM ET,: Employment Report for February. The consensus is for 188,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

February Employment Preview

by Calculated Risk on 3/07/2024 05:16:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for February. The consensus is for 188,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

There were 353,000 jobs added in January, and the unemployment rate was at 3.7%.

From Goldman Sachs economist Spencer Hill

We estimate nonfarm payrolls rose by 215k in February—somewhat above consensus of +200k but well below the +353k pace in January. We believe fewer end-of-year layoffs produced last month’s temporary spike, and with the seasonal layoff period now behind us, we assume a return towards a more normal pace of job gains. That said, our forecast also reflects a 30-50k weather boost from workers returning after the mid-January storms. ... We estimate that the unemployment rate was unchanged at 3.7%• ADP Report: The ADP employment report showed 140,000 private sector jobs were added in February. This suggests job gains slightly below consensus expectations, however, in general, ADP hasn't been very useful in forecasting the BLS report.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased in February to 45.9%, down from 47.1% last month. This would suggest about 40,000 jobs lost in manufacturing. The ADP report indicated 6,000 manufacturing jobs added in February.

The ISM® services employment index decreased to 48.0%, from 50.5%. This would suggest about 20,000 jobs added in the service sector. Combined this suggests job losses of 20,000 in February, far below consensus expectations.

• Unemployment Claims: The weekly claims report showed a larger number of initial unemployment claims during the reference week from 189,000 in January to 202,000 in February. This suggests slightly more layoffs in February compared to January.

The "Home ATM" Closed in Q4

by Calculated Risk on 3/07/2024 12:49:00 PM

Today, in the Real Estate Newsletter: The "Home ATM" Closed in Q4

Excerpt:

During the housing bubble, many homeowners borrowed heavily against their perceived home equity - jokingly calling it the “Home ATM” - and this contributed to the subsequent housing bust, since so many homeowners had negative equity in their homes when house prices declined. Note: Very few homeowners have negative equity now - unlike during the housing bubble.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/.

...

Here is the quarterly increase in mortgage debt from the Federal Reserve’s Financial Accounts of the United States - Z.1 (sometimes called the Flow of Funds report) released today. In the mid ‘00s, there was a large increase in mortgage debt associated with the housing bubble.

In Q4 2024, mortgage debt increased $90 billion, down from $119 billion in Q3, and down from the cycle peak of $467 billion in Q2 2021. Note the almost 7 years of declining mortgage debt as distressed sales (foreclosures and short sales) wiped out a significant amount of debt.

However, some of this debt is being used to increase the housing stock (purchase new homes), so this isn’t all Mortgage Equity Withdrawal (MEW).