by Calculated Risk on 3/11/2024 02:13:00 PM

Monday, March 11, 2024

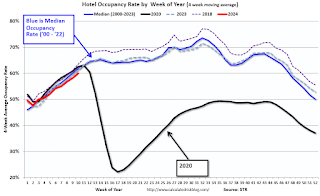

Hotels: Occupancy Rate Decreased 0.3% Year-over-year

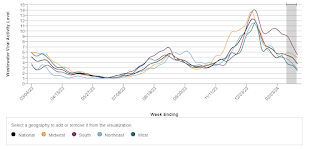

U.S. hotel performance was mostly positive year over year, according to CoStar’s latest data through 2 March.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

25 February through 2 March 2024 (percentage change from comparable week in 2023):

• Occupancy: 62.5% (-0.3%)

• Average daily rate (ADR): US$155.29 (+2.7%)

• Revenue per available room (RevPAR): US$97.12 (+2.4%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, black is 2020, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Lawler: Rent Trends at some Large Holders of Multifamily Properties

by Calculated Risk on 3/11/2024 11:19:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Rent Trends at some Large Holders of Multifamily Properties

A brief excerpt:

Below tables showing rent trends at three publicly traded companies owning large numbers of multifamily units – MAA, Equity Residential (EQR), and Avalon Bay Communities (AVB). ...There is much more in the article.

Not surprisingly, rent growth at all three companies has slowed sharply over the last year. Moreover, rent changes on new move-in’s slowed sharply beginning in the fourth quarter of last year, and were negative for all three companies last quarter.

Note also, however, that the YOY growth in rent renewals, while also down sharply from mid-2022, was still running in the 4 ½% - 5% range in January.

Housing March 11th Weekly Update: Inventory Up 0.4% Week-over-week, Up 21.1% Year-over-year

by Calculated Risk on 3/11/2024 08:19:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, March 10, 2024

Sunday Night Futures

by Calculated Risk on 3/10/2024 06:06:00 PM

Weekend:

• Schedule for Week of March 10, 2024

Monday:

• At 10:00 AM ET, State Employment and Unemployment (Monthly) for January 2024

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 8 and DOW futures are up 50 (fair value).

Oil prices were down over the last week with WTI futures at $78.01 per barrel and Brent at $82.08 per barrel. A year ago, WTI was at $77, and Brent was at $82 - so WTI oil prices are up slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.40 per gallon. A year ago, prices were at $3.44 per gallon, so gasoline prices are down $0.04 year-over-year.

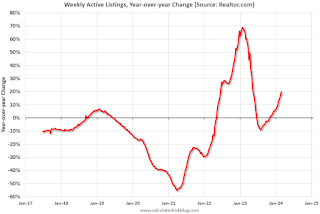

Realtor.com Reports Active Inventory UP 19.9% YoY; New Listings up 17.4% YoY

by Calculated Risk on 3/10/2024 08:21:00 AM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For February, Realtor.com reported inventory was up 14.8% YoY, but still down almost 40% compared to February 2019.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View — Data Week Ending March 2, 2024

• Active inventory increased, with for-sale homes 19.9% above year ago levels. For a 17th straight week, active listings registered above prior year level, which means that today’s home shoppers see more for-sale homes. In fact, the February Realtor.com Housing Trends Report showed that 2024 had the most abundant level of inventory since 2020, and inventory held relatively steady relative to January, counter to typical monthly trend over the last four years. Nevertheless, the number of homes on the market is still down nearly 40% compared to what was typical in 2017 to 2019.;

• New listings–a measure of sellers putting homes up for sale–were up this week, by 17.4% from one year ago. Newly listed homes reached above year ago levels for the 19th week in a row.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 17th consecutive week following 20 consecutive weeks with a YoY decrease in inventory.

Saturday, March 09, 2024

Real Estate Newsletter Articles this Week: Price-to-rent index is 7.3% below recent peak

by Calculated Risk on 3/09/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• The "Home ATM" Closed in Q4

• Inflation Adjusted House Prices 2.4% Below Peak Price-to-rent index is 7.3% below recent peak

• Asking Rents Mostly Unchanged Year-over-year

• 1st Look at Local Housing Markets in February

• Lawler: Some Thoughts on Quantitative Easing and Quantitative Tightening

• ICE Mortgage Monitor: "First-Time Homebuyers Make Up Record 47% of GSE Purchase Loans"

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of March 10, 2024

by Calculated Risk on 3/09/2024 08:11:00 AM

The key reports this week are February CPI and Retail Sales.

For manufacturing, the February Industrial Production report and the March NY Fed manufacturing survey will be released.

10:00 AM: State Employment and Unemployment (Monthly) for January 2024

6:00 AM ET: NFIB Small Business Optimism Index for February.

8:30 AM: The Consumer Price Index for February from the BLS. The consensus is for a 0.4% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 3.1% Year-over-year (YoY), and core CPI to be up 3.7% YoY.

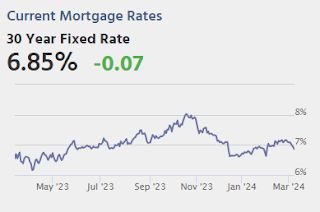

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 221 thousand initial claims, up from 217 thousand last week.

8:30 AM: Retail sales for February is scheduled to be released. The consensus is for a 0.7% increase in retail sales.

8:30 AM: Retail sales for February is scheduled to be released. The consensus is for a 0.7% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

8:30 AM: The Producer Price Index for February from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.3% increase in core PPI.

8:30 AM: The New York Fed Empire State manufacturing survey for March. The consensus is for a reading of -8.0, down from -2.4.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.This graph shows industrial production since 1967.

The consensus is no changed in Industrial Production, and for Capacity Utilization to decrease to 78.4%.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for March).

Friday, March 08, 2024

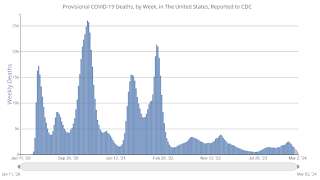

March 8th COVID Update: Weekly Deaths Decreased

by Calculated Risk on 3/08/2024 07:45:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 13,905 | 15,699 | ≤3,0001 | |

| Deaths per Week2 | 1,477 | 1,642 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.AAR: Rail Traffic Recovered in February

by Calculated Risk on 3/08/2024 03:12:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

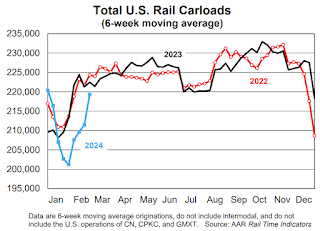

U.S. rail traffic recovered in February after severe weather constrained volumes in January.

Total originated carloads on U.S. railroads averaged 221,387 per week in February, up from 205,034 in January. Total carloads were down 1.3% in February 2024 from February 2023. That’s a big improvement from January’s 7.2% decline.

...

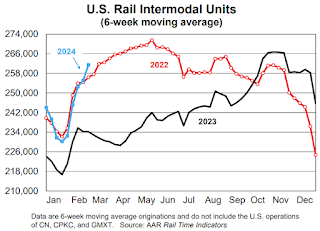

Meanwhile, U.S. intermodal originations in February 2024 were up 10.9% over February 2023. That’s their biggest percentage gain in 32 months and the sixth straight gain of any size. Intermodal averaged 260,078 units per week in February 2024, the second most in 16 months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2022, 2023 and 2024:

In February, originated carloads on U.S. railroads were 885,548, down 1.3% (11,410 carloads) from last year. That’s a big improvement from January’s 7.2% decline. Carloads averaged 221,387 per week in February, up from 205,034 in January. Generally speaking, carload volumes remain constrained in part because the goods-side of the U.S. economy, including manufacturing as a whole (see pages 7 and 8), is not doing as well as it could be.

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2022, 2023 and 2024: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2022, 2023 and 2024: (using intermodal or shipping containers):U.S. intermodal originations in February 2024 totaled 1.04 million containers and trailers, up 10.9% (102,140 units) over February 2023. That’s the biggest year-over-year percentage gain for intermodal in 32 months and the sixth straight gain of any size. Intermodal averaged 260,078 units per week in February, up from 241,203 in January and the second most in 16 months.

GDP Tracking: Low 2% Range

by Calculated Risk on 3/08/2024 02:34:00 PM

From BofA:

Since our update last week, 1Q GDP tracking is down two-tenths to 2.3% q/q saar, and 4Q GDP tracking is up a tenth to 3.3% q/q saar from its second estimate print of 3.2% q/q saar. [Mar 8th estimate]From Goldman:

emphasis added

We left our Q1 GDP tracking estimate unchanged after rounding at +2.2% (qoq ar) and our Q1 domestic final sales forecast also unchanged at +2.5% (qoq ar). [Mar 6th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2024 is 2.5 percent on March 7, unchanged from March 6. [March 7th estimate]