by Calculated Risk on 3/15/2024 07:46:00 PM

Friday, March 15, 2024

March 15th COVID Update: Weekly Deaths Decreased

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 12,259 | 14,270 | ≤3,0001 | |

| Deaths per Week2 | 1,259 | 1,518 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

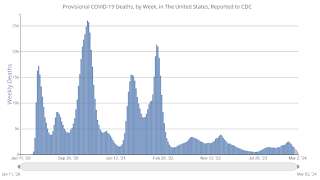

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

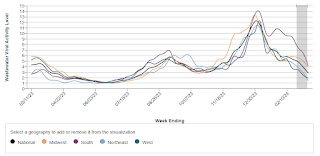

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Lawler: Early Read on Existing Home Sales in February

by Calculated Risk on 3/15/2024 04:15:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.40 million in February, up 10% from January’s preliminary pace but down 2.9% from last February’s seasonally adjusted pace. Unadjusted sales should show a small YOY gain, with the SA/NSA difference reflecting the higher business day count this February compared with last February.

Local realtor/MLS reports suggest that the median existing single-family home sales price last month was up by about 6.5% from last February.

CR Note: The National Association of Realtors (NAR) is scheduled to release February existing home sales on Thursday, March 21st, at 10:00 AM ET. The consensus is for 3.94 million SAAR.

3rd Look at Local Housing Markets in February

by Calculated Risk on 3/15/2024 01:44:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in February

A brief excerpt:

NOTE: The tables for active listings, new listings and closed sales all include a comparison to February 2019 for each local market (some 2019 data is not available).There is much more in the article.

This is the third look at several local markets in February. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

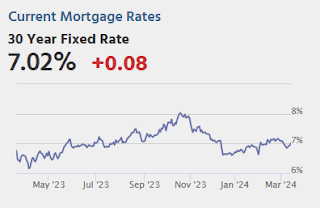

Closed sales in February were mostly for contracts signed in December and January when 30-year mortgage rates averaged 6.82% and 6.64%, respectively. This is down from the 7%+ mortgage rates in the August through November period.

...

In February, sales in these markets were up 1.4% YoY. In January, these same markets were up 2.4% year-over-year Not Seasonally Adjusted (NSA).

Sales in most of these markets are down compared to January 2019.

...

More local markets to come!

GDP Tracking: Around 2%

by Calculated Risk on 3/15/2024 11:31:00 AM

From BofA:

Since our update last week, 1Q GDP tracking is up one-tenth to 2.4% q/q saar; 4Q tracking is up three-tenths to 3.6% q/q saar. [Mar 15th estimate]From Goldman:

emphasis added

We lowered our Q1 GDP tracking estimate by 0.1pp to +1.6% (qoq ar) and our Q1 domestic final sales forecast by 0.2pp to +2.0% (qoq ar), mainly reflecting the normalization of utilities output in February. [Mar 15th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2024 is 2.3 percent on March 14, down from 2.5 percent from March 7. After recent releases from the US Department of the Treasury's Bureau of the Fiscal Service, the US Bureau of Labor Statistics, and the US Census Bureau, a decrease in the nowcast of first-quarter real personal consumption expenditures growth from 2.9 percent to 2.2 percent was slightly offset by increases in the nowcasts of first-quarter real gross private domestic investment growth and first-quarter real government spending growth from 1.7 and 2.4 percent, respectively, to 3.0 and 2.7 percent. [March 14th estimate]

Industrial Production Increased 0.1% in February

by Calculated Risk on 3/15/2024 09:15:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged up 0.1 percent in February after declining 0.5 percent in January. In February, the output of manufacturing rose 0.8 percent and the index for mining climbed 2.2 percent. Both gains partly reflected recoveries from weather-related declines in January. The index for utilities fell 7.5 percent in February because of warmer-than-typical temperatures. At 102.3 percent of its 2017 average, total industrial production in February was 0.2 percent below its year-earlier level. Capacity utilization for the industrial sector remained at 78.3 percent in February, a rate that is 1.3 percentage points below its long-run (1972–2023) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.3% is 1.3% below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased to 102.3. This is above the pre-pandemic level.

Industrial production was above consensus expectations.

Thursday, March 14, 2024

Friday: NY Fed Mfg, Industrial Production

by Calculated Risk on 3/14/2024 08:01:00 PM

Friday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for March. The consensus is for a reading of -8.0, down from -2.4.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for February. The consensus is no changed in Industrial Production, and for Capacity Utilization to decrease to 78.4%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for March).

Realtor.com Reports Active Inventory UP 21.7% YoY; New Listings up 15.8% YoY

by Calculated Risk on 3/14/2024 02:21:00 PM

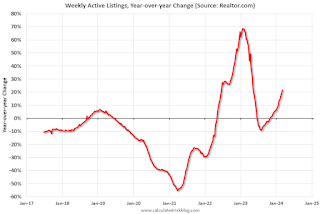

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For February, Realtor.com reported inventory was up 14.8% YoY, but still down almost 40% compared to February 2019.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data Week Ending March 9, 2024

• Active inventory increased, with for-sale homes 21.7% above year-ago levels. For an 18th straight week, active listings registered above the prior-year level, which means that today’s home shoppers see more for-sale homes. In fact, the February Realtor.com Housing Trends Report showed that 2024 had the most abundant level of inventory since 2020, and inventory held relatively steady relative to January, counter to the typical monthly trend over the past four years. Nevertheless, the number of homes on the market is still down nearly 40% compared with what was typical in 2017 to 2019.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 15.8% from one year ago. For the 20th consecutive week, newly listed homes have surpassed levels from a year ago.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 18th consecutive week following 20 consecutive weeks with a YoY decrease in inventory.

Part 2: Current State of the Housing Market; Overview for mid-March 2024

by Calculated Risk on 3/14/2024 11:10:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-March 2024

A brief excerpt:

Yesterday, in Part 1: Current State of the Housing Market; Overview for mid-March 2024 I reviewed home inventory, housing starts and sales.There is much more in the article.

In Part 2, I will look at house prices, mortgage rates, rents and more - and review the house price outlook for 2024.

...

Other measures of house prices suggest prices will be up a little further YoY in the January Case-Shiller index. The NAR reported median prices were up 5.1% YoY in January, up from 4.1% YoY in December. ICE reported prices were up 5.6% YoY in January, and Freddie Mac reported house prices were up 6.2% YoY in January, down from 6.3% YoY in December.

Here is a comparison of year-over-year change in the FMHPI, median house prices from the NAR, and the Case-Shiller National index.

The FMHPI and the NAR median prices appear to be leading indicators for Case-Shiller. Based on recent monthly data, and the FMHPI, the YoY change in the Case-Shiller index will likely increase a little further in the report for January.

Retail Sales Increased 0.6% in February

by Calculated Risk on 3/14/2024 08:35:00 AM

On a monthly basis, retail sales were up 0.6% from January to February (seasonally adjusted), and sales were up 1.5 percent from February 2023.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for February 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $700.7 billion, up 0.6 percent from the previous month, and up 1.5 percent above February 2023. ... The December 2023 to January 2024 percent change was revised from down 0.8 percent to down 1.1 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.6% in February.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 2.0% on a YoY basis.

The increase in sales in February was above expectations, however, sales in December and January were revised down.

The increase in sales in February was above expectations, however, sales in December and January were revised down.

Weekly Initial Unemployment Claims Decrease to 209,000

by Calculated Risk on 3/14/2024 08:30:00 AM

The DOL reported:

In the week ending March 9, the advance figure for seasonally adjusted initial claims was 209,000, a decrease of 1,000 from the previous week's revised level. The previous week's level was revised down by 7,000 from 217,000 to 210,000. The 4-week moving average was 208,000, a decrease of 500 from the previous week's revised average. The previous week's average was revised down by 3,750 from 212,250 to 208,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 208,000.

The previous week was revised down.

Weekly claims were below the consensus forecast.