by Calculated Risk on 3/18/2024 10:00:00 AM

Monday, March 18, 2024

NAHB: Builder Confidence Increased in March

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 51, up from 48 last month. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Sentiment Rises Above Breakeven Point

A lack of existing inventory that continues to drive buyers to new home construction, coupled with strong demand and mortgage rates below last fall’s cycle peak helped push builder sentiment above a key marker in March.

Builder confidence in the market for newly built single-family homes climbed three points to 51 in March, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This is the highest level since July 2023 and marks the fourth consecutive monthly gain for the index. It is also the first time that the sentiment level has surpassed the breakeven point of 50 since last July.

“Buyer demand remains brisk and we expect more consumers to jump off the sidelines and into the marketplace if mortgage rates continue to fall later this year,” said NAHB Chairman Carl Harris, a custom home builder from Wichita, Kan. “But even though there is strong pent-up demand, builders continue to face several supply-side challenges, including a scarcity of buildable lots and skilled labor, and new restrictive codes that continue to increase the cost of building homes.”

“With the Federal Reserve expected to announce future rate cuts in the second half of 2024, lower financing costs will draw many prospective buyers into the market,” said NAHB Chief Economist Robert Dietz. “However, as home building activity picks up, builders will likely grapple with rising material prices, particularly for lumber.”

With mortgage rates below 7% since mid-December per Freddie Mac, more builders are cutting back on reducing home prices to boost sales. In March, 24% of builders reported cutting home prices, down from 36% in December 2023 and the lowest share since July 2023. However, the average price reduction in March held steady at 6% for the ninth straight month. Meanwhile, the use of sales incentives is holding firm. The share of builders offering some form of incentive in March was 60%, and this has remained between 58% and 62% since last September.

...

All three of the major HMI indices posted gains in March. The HMI index charting current sales conditions increased four points to 56, the component measuring sales expectations in the next six months rose two points to 62 and the component gauging traffic of prospective buyers increased two points to 34.

Looking at the three-month moving averages for regional HMI scores, the Northeast increased two points to 59, the Midwest gained five points to 41, the South rose four points to 50 and the West registered a five-point gain to 43.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was above the consensus forecast.

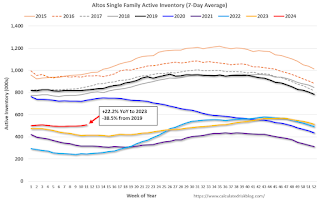

Housing March 18th Weekly Update: Inventory Up 1.3% Week-over-week, Up 22.2% Year-over-year

by Calculated Risk on 3/18/2024 08:17:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, March 17, 2024

Sunday Night Futures

by Calculated Risk on 3/17/2024 09:05:00 PM

Weekend:

• Schedule for Week of March 17, 2024

Monday:

• At 10:00 AM ET, The March NAHB homebuilder survey. The consensus is for a reading of 48, unchanged from 48. Any number below 50 indicates that more builders view sales conditions as poor than good.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 5 and DOW futures are down 27 (fair value).

Oil prices were up over the last week with WTI futures at $81.14 per barrel and Brent at $85.40 per barrel. A year ago, WTI was at $67, and Brent was at $71 - so WTI oil prices are up 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.44 per gallon. A year ago, prices were at $3.40 per gallon, so gasoline prices are up $0.04 year-over-year.

FOMC Preview: No Change to Policy Expected

by Calculated Risk on 3/17/2024 10:22:00 AM

Most analysts expect there will be no change to FOMC policy at the meeting this week, keeping the target range for the federal funds rate at 5‑1/4 to 5-1/2 percent. Some analysts expect Fed Chair Powell to take a slightly hawkish stance during the press conference, since the last two CPI reports were above expectations.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| Dec 2023 | 1.2 to 1.7 | 1.5 to 2.0 | 1.8 to 2.0 | |

| Sept 2023 | 1.2 to 1.8 | 1.6 to 2.0 | 1.7 to 2.0 | |

The unemployment rate was at 3.9% in February and will likely be unrevised.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| Dec 2023 | 4.0 to 4.2 | 4.0 to 4.2 | 3.9 to 4.3 | |

| Sept 2023 | 3.9 to 4.4 | 3.9 to 4.3 | 3.8 to 4.3 | |

As of January 2024, PCE inflation increased 2.4 percent year-over-year (YoY). The projections for PCE inflation will likely not be revised.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| Dec 2023 | 2.2 to 2.5 | 2.0 to 2.2 | 2.0 | |

| Sept 2023 | 2.3 to 2.7 | 2.0 to 2.3 | 2.0 to 2.2 | |

PCE core inflation increased 2.8 percent YoY in January. This will likely be unrevised.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| Dec 2023 | 2.4 to 2.7 | 2.0 to 2.2 | 2.0 to 2.1 | |

| Sept 2023 | 2.5 to 2.8 | 2.0 to 2.4 | 2.0 to 2.3 | |

Saturday, March 16, 2024

Real Estate Newsletter Articles this Week: Current State of the Housing Market

by Calculated Risk on 3/16/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Part 1: Current State of the Housing Market; Overview for mid-March 2024

• Part 2: Current State of the Housing Market; Overview for mid-March 2024

• Q4 Update: Delinquencies, Foreclosures and REO

• 3rd Look at Local Housing Markets in February

• Lawler: Rent Trends at some Large Holders of Multifamily Properties

• 2nd Look at Local Housing Markets in February

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of March 17, 2024

by Calculated Risk on 3/16/2024 08:11:00 AM

The key reports this week are February Housing Starts and Existing Home Sales.

The FOMC meets this week, and no change to policy is expected.

10:00 AM: The March NAHB homebuilder survey. The consensus is for a reading of 48, unchanged from 48. Any number below 50 indicates that more builders view sales conditions as poor than good.

8:30 AM: Housing Starts for February.

8:30 AM: Housing Starts for February. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.435 million SAAR, up from 1.331 million SAAR.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:00 PM: FOMC Projections. This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with updated economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 212 thousand initial claims, up from 209 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for March. The consensus is for a reading of -2.5, down from 5.2.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 3.94 million SAAR, down from 4.00 million.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 3.94 million SAAR, down from 4.00 million.The graph shows existing home sales from 1994 through the report last month.

10:00 AM: State Employment and Unemployment (Monthly) for February 2024

Friday, March 15, 2024

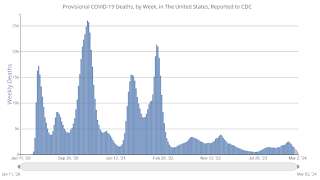

March 15th COVID Update: Weekly Deaths Decreased

by Calculated Risk on 3/15/2024 07:46:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 12,259 | 14,270 | ≤3,0001 | |

| Deaths per Week2 | 1,259 | 1,518 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

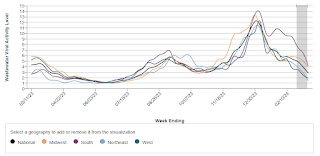

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Lawler: Early Read on Existing Home Sales in February

by Calculated Risk on 3/15/2024 04:15:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.40 million in February, up 10% from January’s preliminary pace but down 2.9% from last February’s seasonally adjusted pace. Unadjusted sales should show a small YOY gain, with the SA/NSA difference reflecting the higher business day count this February compared with last February.

Local realtor/MLS reports suggest that the median existing single-family home sales price last month was up by about 6.5% from last February.

CR Note: The National Association of Realtors (NAR) is scheduled to release February existing home sales on Thursday, March 21st, at 10:00 AM ET. The consensus is for 3.94 million SAAR.

3rd Look at Local Housing Markets in February

by Calculated Risk on 3/15/2024 01:44:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in February

A brief excerpt:

NOTE: The tables for active listings, new listings and closed sales all include a comparison to February 2019 for each local market (some 2019 data is not available).There is much more in the article.

This is the third look at several local markets in February. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Closed sales in February were mostly for contracts signed in December and January when 30-year mortgage rates averaged 6.82% and 6.64%, respectively. This is down from the 7%+ mortgage rates in the August through November period.

...

In February, sales in these markets were up 1.4% YoY. In January, these same markets were up 2.4% year-over-year Not Seasonally Adjusted (NSA).

Sales in most of these markets are down compared to January 2019.

...

More local markets to come!

GDP Tracking: Around 2%

by Calculated Risk on 3/15/2024 11:31:00 AM

From BofA:

Since our update last week, 1Q GDP tracking is up one-tenth to 2.4% q/q saar; 4Q tracking is up three-tenths to 3.6% q/q saar. [Mar 15th estimate]From Goldman:

emphasis added

We lowered our Q1 GDP tracking estimate by 0.1pp to +1.6% (qoq ar) and our Q1 domestic final sales forecast by 0.2pp to +2.0% (qoq ar), mainly reflecting the normalization of utilities output in February. [Mar 15th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2024 is 2.3 percent on March 14, down from 2.5 percent from March 7. After recent releases from the US Department of the Treasury's Bureau of the Fiscal Service, the US Bureau of Labor Statistics, and the US Census Bureau, a decrease in the nowcast of first-quarter real personal consumption expenditures growth from 2.9 percent to 2.2 percent was slightly offset by increases in the nowcasts of first-quarter real gross private domestic investment growth and first-quarter real government spending growth from 1.7 and 2.4 percent, respectively, to 3.0 and 2.7 percent. [March 14th estimate]