by Calculated Risk on 3/25/2024 01:47:00 PM

Monday, March 25, 2024

March Vehicle Sales Forecast: 15.6 million SAAR, Up 5% YoY

From WardsAuto: March U.S. Light-Vehicle Sales Tracking a Steady Course with Potential Upside (pay content). Brief excerpt:

If the March forecast holds firm, the first quarter will total a 15.5 million-unit seasonally adjusted annual rate, down from Q4-2023’s 15.7 million but up from like-2023’s 15.0 million. However, the forecasted steady climb in inventory should put sales in good stead to rise above 16-million-unit annualized rates for most of the remainder of 2024.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for March (Red).

On a seasonally adjusted annual rate basis, the Wards forecast of 15.6 million SAAR, would be down 1% from last month, and up 5% from a year ago.

New Home Sales at 662,000 Annual Rate in February; Median New Home Price is Down 19% from the Peak

by Calculated Risk on 3/25/2024 10:43:00 AM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales at 662,000 Annual Rate in February

Brief excerpt:

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 662 thousand. The previous three months were revised up slightly.There is much more in the article.

...

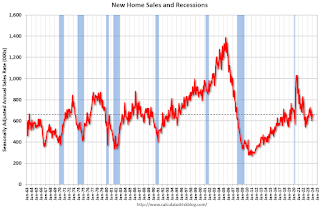

The next graph shows new home sales for 2023 and 2024 by month (Seasonally Adjusted Annual Rate). Sales in February 2024 were up 5.9% from February 2023.

...

Note that the median and average price are down due to the mix of homes sold, not because of large price declines. Homebuilders are building less expensive homes to keep up volumes.

New Home Sales at 662,000 Annual Rate in February

by Calculated Risk on 3/25/2024 10:00:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 662 thousand.

The previous three months were revised up slightly.

Sales of new single‐family houses in February 2024 were at a seasonally adjusted annual rate of 662,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.3 percent below the revised January rate of 664,000, but is 5.9 percent above the February 2023 estimate of 625,000.

emphasis added

Click on graph for larger image.

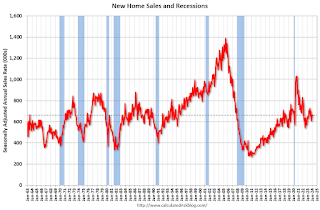

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales were close to pre-pandemic levels.

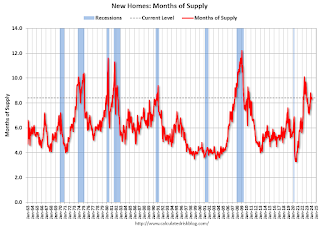

The second graph shows New Home Months of Supply.

The months of supply increased in February to 8.4 months from 8.3 months in January.

The months of supply increased in February to 8.4 months from 8.3 months in January. The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of February was 463,000. This represents a supply of 8.4 months at the current sales rate."Sales were below expectations of 673 thousand SAAR, however, sales for the three previous months were revised up slightly. I'll have more later today.

Housing March 25th Weekly Update: Inventory Up 1.1% Week-over-week, Up 23.9% Year-over-year

by Calculated Risk on 3/25/2024 08:16:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, March 24, 2024

Monday: New Home Sales

by Calculated Risk on 3/24/2024 07:24:00 PM

Weekend:

• Schedule for Week of March 24, 2024

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for February. This is a composite index of other data.

• At 10:00 AM, New Home Sales for February from the Census Bureau. The consensus is for 673 thousand SAAR, up from 661 thousand in January.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 4 and DOW futures are down 47 (fair value).

Oil prices were down over the last week with WTI futures at $80.63 per barrel and Brent at $85.43 per barrel. A year ago, WTI was at $69, and Brent was at $74 - so WTI oil prices are up 17% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.53 per gallon. A year ago, prices were at $3.41 per gallon, so gasoline prices are up $0.12 year-over-year.

Existing Home Sales: Lawler vs. the Consensus

by Calculated Risk on 3/24/2024 08:21:00 AM

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for almost 14 years. He has graciously allowed me to share his predictions with the readers of this blog.

The table below shows the consensus for each month, Lawler's predictions, and the NAR's initially reported level of sales. Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | 5.60 |

| Apr-18 | 5.60 | 5.48 | 5.46 |

| May-18 | 5.56 | 5.47 | 5.43 |

| Jun-18 | 5.45 | 5.35 | 5.38 |

| Jul-18 | 5.43 | 5.40 | 5.34 |

| Aug-18 | 5.36 | 5.36 | 5.34 |

| Sep-18 | 5.30 | 5.20 | 5.15 |

| Oct-18 | 5.20 | 5.31 | 5.22 |

| Nov-18 | 5.19 | 5.23 | 5.32 |

| Dec-18 | 5.24 | 4.97 | 4.99 |

| Jan-19 | 5.05 | 4.92 | 4.94 |

| Feb-19 | 5.08 | 5.46 | 5.51 |

| Mar-19 | 5.30 | 5.40 | 5.21 |

| Apr-19 | 5.36 | 5.31 | 5.19 |

| May-19 | 5.29 | 5.40 | 5.34 |

| Jun-19 | 5.34 | 5.25 | 5.27 |

| Jul-19 | 5.39 | 5.40 | 5.42 |

| Aug-19 | 5.38 | 5.42 | 5.49 |

| Sep-19 | 5.45 | 5.36 | 5.38 |

| Oct-19 | 5.49 | 5.36 | 5.46 |

| Nov-19 | 5.45 | 5.43 | 5.35 |

| Dec-19 | 5.43 | 5.40 | 5.54 |

| Jan-20 | 5.45 | 5.42 | 5.46 |

| Feb-20 | 5.50 | 5.58 | 5.77 |

| Mar-20 | 5.30 | 5.25 | 5.27 |

| Apr-20 | 4.30 | 4.17 | 4.33 |

| May-20 | 4.38 | 3.80 | 3.91 |

| Jun-20 | 4.86 | 4.65 | 4.72 |

| Jul-20 | 5.39 | 5.85 | 5.86 |

| Aug-20 | 6.00 | 5.92 | 6.00 |

| Sep-20 | 6.25 | 6.38 | 6.54 |

| Oct-20 | 6.45 | 6.63 | 6.85 |

| Nov-20 | 6.70 | 6.50 | 6.69 |

| Dec-20 | 6.55 | 6.62 | 6.76 |

| Jan-21 | 6.60 | 6.48 | 6.69 |

| Feb-21 | 6.51 | 6.29 | 6.22 |

| Mar-21 | 6.17 | 6.02 | 6.01 |

| Apr-21 | 6.09 | 5.96 | 5.85 |

| May-21 | 5.74 | 5.78 | 5.80 |

| Jun-21 | 5.90 | 5.79 | 5.86 |

| Jul-21 | 5.84 | 5.86 | 5.99 |

| Aug-21 | 5.88 | 5.90 | 5.88 |

| Sep-21 | 6.06 | 6.20 | 6.29 |

| Oct-21 | 6.20 | 6.34 | 6.34 |

| Nov-21 | 6.20 | 6.45 | 6.46 |

| Dec-21 | 6.45 | 6.33 | 6.18 |

| Jan-22 | 6.12 | 6.36 | 6.50 |

| Feb-22 | 6.16 | 5.97 | 6.02 |

| Mar-22 | 5.80 | 5.74 | 5.77 |

| Apr-22 | 5.62 | 5.57 | 5.61 |

| May-22 | 5.41 | 5.35 | 5.41 |

| Jun-22 | 5.40 | 5.12 | 5.12 |

| Jul-22 | 4.88 | 4.90 | 4.81 |

| Aug-22 | 4.70 | 4.84 | 4.80 |

| Sep-22 | 4.69 | 4.82 | 4.71 |

| Oct-22 | 4.39 | 4.49 | 4.43 |

| Nov-22 | 4.20 | 4.16 | 4.09 |

| Dec-22 | 3.95 | 3.96 | 4.02 |

| Jan-23 | 4.10 | 4.18 | 4.00 |

| Feb-23 | 4.18 | 4.51 | 4.58 |

| Mar-23 | 4.50 | 4.51 | 4.44 |

| Apr-23 | 4.30 | 4.33 | 4.28 |

| May-23 | 4.24 | 4.25 | 4.30 |

| Jun-23 | 4.23 | 4.26 | 4.16 |

| Jul-23 | 4.15 | 4.06 | 4.07 |

| Aug-23 | 4.10 | 4.07 | 4.04 |

| Sep-23 | 3.94 | 4.00 | 3.96 |

| Oct-23 | 3.93 | 3.94 | 3.79 |

| Nov-23 | 3.78 | 3.87 | 3.82 |

| Dec-23 | 3.84 | 3.84 | 3.78 |

| Jan-24 | 3.97 | 4.02 | 4.00 |

| Feb-24 | 3.94 | 4.40 | 4.38 |

| 1NAR initially reported before revisions. | |||

Saturday, March 23, 2024

Real Estate Newsletter Articles this Week: Single Family Starts Up 35% Year-over-year in February

by Calculated Risk on 3/23/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• NAR: Existing-Home Sales Increased to 4.38 million SAAR in February

• Single Family Starts Up 35% Year-over-year in February; Multi-Family Starts Down Sharply

• "The Lock-In Effect of Rising Mortgage Rates"

• California February Existing Home Sales increase 1.3% YoY, Prices up 9.7% YoY

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of March 24, 2024

by Calculated Risk on 3/23/2024 08:11:00 AM

The key reports scheduled for this week include February New Home sales, the 3rd estimate of Q4 GDP, February Personal Income & Outlays, and January Case-Shiller house prices.

For manufacturing, the March Dallas, Richmond and Kansas City Fed surveys will be released.

8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

10:00 AM: New Home Sales for February from the Census Bureau.

10:00 AM: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 673 thousand SAAR, up from 661 thousand in January.

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 1.0% increase in durable goods orders.

9:00 AM: S&P/Case-Shiller House Price Index for January.

9:00 AM: S&P/Case-Shiller House Price Index for January.This graph shows the year-over-year change for the Case-Shiller National, Composite 10 and Composite 20 indexes, through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 5.8% year-over-year increase in the National index for January, up from 5.5% YoY in December.

9:00 AM: FHFA House Price Index for January 2021. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for March.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM, Gross Domestic Product, 4th Quarter and Year 2023 (Third Estimate), GDP by Industry, and Corporate Profits. The consensus is that real GDP increased 3.2% annualized in Q4, unchanged from the second estimate.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 208 thousand initial claims, down from 210 thousand last week.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a reading of 43.0, down from 44.0 in February.

10:00 AM: Pending Home Sales Index for February. The consensus is for a 2.0% increase in the index.

10:00 AM: University of Michigan's Consumer sentiment index (Final for March). The consensus is for a reading of 76.5.

11:00 AM: the Kansas City Fed manufacturing survey for March. This is the last of the regional surveys for March.

All US markets will be closed in observance of Good Friday.

8:30 AM: Personal Income and Outlays for February. The consensus is for a 0.4% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 2.5% YoY, and core PCE prices up 2.8% YoY.

11:30 AM: Discussion, Fed Chair Jerome Powell, Moderated Discussion with Kai Ryssdal, At the Federal Reserve Bank of San Francisco Macroeconomics and Monetary Policy Conference, San Francisco, Calif

Friday, March 22, 2024

March 22nd COVID Update: Weekly Deaths Decreased

by Calculated Risk on 3/22/2024 07:46:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 10,163 | 12,438 | ≤3,0001 | |

| Deaths per Week2 | 1,190 | 1,318 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.ICE: Mortgage Delinquency Rate Decreased in February

by Calculated Risk on 3/22/2024 12:06:00 PM

From ICE (formerly Black Knight): ICE First Look at Mortgage Performance: Delinquencies Improve and Foreclosures Drop as Prepayments Rise Modestly

• The national delinquency rate eased to 3.34% in February, down 4 basis points (bps) from the month before and 11 bps lower than in February 2023Note: that last column below is for the same month in 2019 to show the change from pre-pandemic levels.

• While the number of borrowers one payment behind rose modestly by 10K, those 60 days late as well as those 90 or more days past due both fell to their lowest levels in three months

• Delinquency inflows rose 6.5% from January’s eight-month low, while rolls to later stages continued their recent improvement

• Serious delinquencies (loans 90+ days past due but not in active foreclosure) are down 103K (-18%) year over year, with the population now standing at 459K

• Representing 5.3% of serious delinquencies, February’s 25K foreclosure starts is the second lowest in the last twelve months

• The number of loans in active foreclosure fell -7K to 211K, remaining 25% (-72K) below pre-pandemic levels

• 6K foreclosure sales were completed nationally in February, a 9% decrease from the previous month and the second lowest level in the trailing 12-month period

• Prepayment activity rose 3 bps in February to a level not seen since October, as a brief dip in rates heading into the month provided a modest increase in refinance incentive

emphasis added

| ICE: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Feb 2024 | Jan 2024 | Feb 2023 | Feb 2019 | |

| Delinquent | 3.34% | 3.38% | 3.45% | 3.89% |

| In Foreclosure | 0.40% | 0.41% | 0.46% | 0.51% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,782,000 | 1,803,000 | 1,811,000 | 2,019,000 |

| Number of properties in foreclosure pre-sale inventory: | 211,000 | 219,000 | 240,000 | 264,000 |

| Total Properties | 1,993,000 | 2,022,000 | 2,050,000 | 2,284,000 |