by Calculated Risk on 4/01/2024 10:00:00 AM

Monday, April 01, 2024

ISM® Manufacturing index Increased to 50.3% in March

(Posted with permission). The ISM manufacturing index indicated expansion. The PMI® was at 50.3% in March, up from 47.8% in February. The employment index was at 47.4%, up from 45.9% the previous month, and the new orders index was at 51.4%, up from 49.2%.

From ISM: Manufacturing PMI® at 50.3% March 2024 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in March after contracting for 16 consecutive months, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing expanded slightly in March. This was above the consensus forecast.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The Manufacturing PMI® registered 50.3 percent in March, up 2.5 percentage points from the 47.8 percent recorded in February. The overall economy continued in expansion for the 47th month after one month of contraction in April 2020. (A Manufacturing PMI® above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy.) The New Orders Index moved back into expansion territory at 51.4 percent, 2.2 percentage points higher than the 49.2 percent recorded in February. The March reading of the Production Index (54.6 percent) is 6.2 percentage points higher than February’s figure of 48.4 percent. The Prices Index registered 55.8 percent, up 3.3 percentage points compared to the reading of 52.5 percent in February. The Backlog of Orders Index registered 46.3 percent, the same reading as in February. The Employment Index registered 47.4 percent, up 1.5 percentage points from February’s figure of 45.9 percent.

emphasis added

Housing April 1st Weekly Update: Inventory Up 0.9% Week-over-week, Up 26.0% Year-over-year

by Calculated Risk on 4/01/2024 08:21:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, March 31, 2024

Monday: ISM Mfg, Construction Spending

by Calculated Risk on 3/31/2024 06:11:00 PM

Weekend:

• Schedule for Week of March 31, 2024

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for March. The consensus is for the ISM to be at 48.5, up from 47.8 in February.

• Also at 10:00 AM, Construction Spending for February. The consensus is for 0.5% increase in construction spending.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 8 and DOW futures are up 67 (fair value).

Oil prices were up over the last week with WTI futures at $83.17 per barrel and Brent at $87.00 per barrel. A year ago, WTI was at $76, and Brent was at $79 - so WTI oil prices are up about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.51 per gallon. A year ago, prices were at $3.49 per gallon, so gasoline prices are up $0.02 year-over-year.

Las Vegas February 2024: Visitor Traffic Up 9.5% YoY; Convention Traffic Up 15%

by Calculated Risk on 3/31/2024 08:21:00 AM

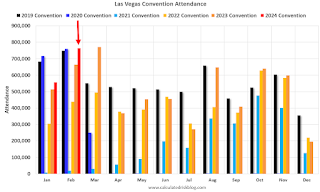

From the Las Vegas Visitor Authority: February 2024 Las Vegas Visitor Statistics

With an extra day from the leap year, a notable YoY increase in available rooms, a strong group segment and of course, a Super Bowl, the destination saw a robust YoY increase in visitors and record‐breaking room rates. Visitation for the month saw a 9.5% increase to reach 3.37M visitors, or roughly 300,000 more visitors than last February.

With the recurring NAHB Int'l Builders' Show and Kitchen & Bath Industry Show, along with the rotational returns of National Auto Dealers Association (24k attendees) and Int’l Roofing Expo (13k attendees) and several mid‐sized shows at properties across the destination, estimated convention attendance reached nearly 765k, +15.3% vs. last Feb.

Despite the larger room inventory vs. last year, overall hotel occupancy for the month surpassed last February by 1.7 pts to reach 83.9% as Weekend occupancy reached 90.3%, up 1.0 pts YoY, and Midweek occupancy came in at 81%, up 2.2 pts YoY.

Driven by dramatically strong rates during Super Bowl, ADR for the month exceeded $248 while RevPAR hit a record $208, +43.5% YoY

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (Black), 2020 (dark blue), 2021 (light blue), 2022 (light orange), 2023 (dark orange) and 2024 (red).

Visitor traffic was up 9.5% compared to last February. Visitor traffic was up 5.8% compared to the same month in 2019.

Saturday, March 30, 2024

Real Estate Newsletter Articles this Week: House Price Index Up 6.0% year-over-year

by Calculated Risk on 3/30/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Case-Shiller: National House Price Index Up 6.0% year-over-year in January

• New Home Sales at 662,000 Annual Rate in February

• Inflation Adjusted House Prices 2.4% Below Peak

• FHFA’s National Mortgage Database: Outstanding Mortgage Rates, LTV and Credit Scores

• Fannie and Freddie: Single Family Serious Delinquency Rate Decreased, Multi-family Decreased in February

• Final Look at Local Housing Markets in February

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of March 31, 2024

by Calculated Risk on 3/30/2024 08:11:00 AM

The key report scheduled for this week is the March employment report on Friday.

Other key reports include the February Trade Deficit and March Auto Sales.

For manufacturing, the March ISM Manufacturing survey will be released.

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 48.5, up from 47.8 in February.

10:00 AM: Construction Spending for February. The consensus is for 0.5% increase in construction spending.

8:00 AM: Corelogic House Price index for February.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased slightly in January to 8.86 million from 8.89 million in December.

The number of job openings (black) were down 15% year-over-year. Quits were down 13% year-over-year.

All Day: Light vehicle sales for March. The consensus is for light vehicle sales to be 15.9 million SAAR in March, up from 15.8 million in February (Seasonally Adjusted Annual Rate).

All Day: Light vehicle sales for March. The consensus is for light vehicle sales to be 15.9 million SAAR in March, up from 15.8 million in February (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 155,000 payroll jobs added in March, up from 140,000 added in February.

10:00 AM: the ISM Services Index for March.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 208 thousand initial claims, down from 210 thousand last week.

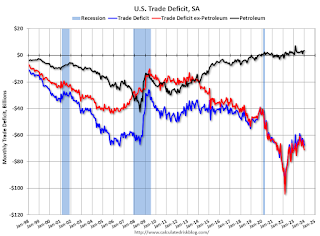

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $66.5 billion. The U.S. trade deficit was at $67.4 billion in January.

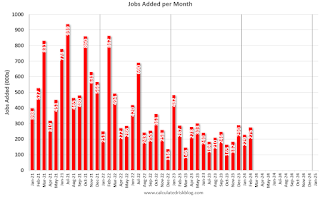

8:30 AM: Employment Report for March. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.

8:30 AM: Employment Report for March. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.There were 275,000 jobs added in February, and the unemployment rate was at 3.9%.

This graph shows the jobs added per month since January 2021.

Friday, March 29, 2024

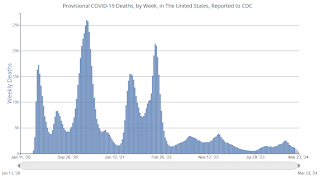

March 29th COVID Update: Weekly Deaths Decreased

by Calculated Risk on 3/29/2024 07:17:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 8,584 | 10,326 | ≤3,0001 | |

| Deaths per Week2 | 1,164 | 1,234 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

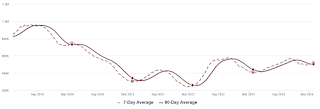

Click on graph for larger image.

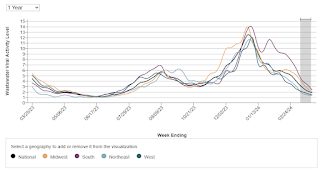

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.FHFA’s National Mortgage Database: Outstanding Mortgage Rates, LTV and Credit Scores

by Calculated Risk on 3/29/2024 02:09:00 PM

Today, in the Calculated Risk Real Estate Newsletter: FHFA’s National Mortgage Database: Outstanding Mortgage Rates, LTV and Credit Scores

A brief excerpt:

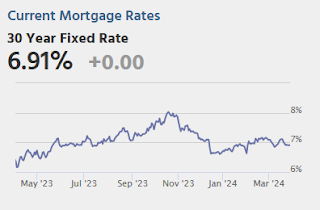

Here are some graphs on outstanding mortgages by interest rate, the average mortgage interest rate, borrowers’ credit scores and current loan-to-value (LTV) from the FHFA’s National Mortgage Database through Q4 2023 (released this morning).There is much more in the article.

...

Here is some data showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q4 2023.

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. The percent of outstanding loans under 4% peaked in Q1 2022 at 65.3% (now at 58.1%), and the percent under 5% peaked at 85.6% (now at 77.0%). These low existing mortgage rates makes it difficult for homeowners to sell their homes and buy a new home since their monthly payments would increase sharply. This is a key reason existing home inventory levels are so low. See: "The Lock-In Effect of Rising Mortgage Rates"

The percent of loans over 6% bottomed in Q2 2022 at 7.2% and has increased to 13.4% in Q4 2023.

Q1 GDP Tracking: Just Over 2%

by Calculated Risk on 3/29/2024 11:47:00 AM

From BofA:

1Q GDP tracking remained at 2.2% q/q saar largely due to downward revisions to core capital goods orders and shipments and lower than expected core capital goods shipments being offset by higher than expected manufacturing inventories in the February durable goods print [Mar 28th estimate]From Goldman:

emphasis added

After incorporating this morning’s data and yesterday’s GDP release, we have increased our Q1 GDP tracking estimate by 0.3pp to +2.1% (qoq ar), reflecting stronger consumption growth and a larger contribution from inventory accumulation that more than offset a slightly wider trade deficit. Our Q1 domestic final sales forecast now stands at +2.9% (qoq ar). [Mar 29th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2024 is 2.3 percent on March 29, up from 2.1 percent on March 26. After recent releases from the US Census Bureau and the US Bureau of Economic Analysis, the nowcast of first-quarter real personal consumption expenditures growth increased from 1.9 percent to 2.6 percent, while the nowcast of the contribution of the change in real net exports to first-quarter real GDP growth decreased from -0.16 percentage points to -0.47 percentage points. [March 29th estimate]

PCE Measure of Shelter Slows to 5.8% YoY in February

by Calculated Risk on 3/29/2024 08:56:00 AM

Here is a graph of the year-over-year change in shelter from the CPI report and housing from the PCE report this morning, both through February 2024.

Since asking rents are mostly flat year-over-year, these measures will continue to slow over the next year.

The second graph shows PCE prices, Core PCE prices and Core ex-housing over the last 6 months (annualized):

Key measures are slightly above the Fed's target on a 6-month basis.

Key measures are slightly above the Fed's target on a 6-month basis.PCE Price Index: 2.5%

Core PCE Prices: 2.9%

Core minus Housing: 2.3%