by Calculated Risk on 4/02/2024 08:52:00 PM

Tuesday, April 02, 2024

Wednesday: ADP Employment, ISM Services

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 155,000 payroll jobs added in March, up from 140,000 added in February.

• At 10:00 AM, the ISM Services Index for March.

Vehicles Sales Decrease to 15.5 million SAAR in March; Up 4% YoY

by Calculated Risk on 4/02/2024 04:41:00 PM

Wards Auto released their estimate of light vehicle sales for February: Affordability Front-and-Center in March U.S. Light-Vehicle Sales Gain (pay site).

Combined market share of non-luxury small cars and small and midsize CUVs increased to 42.1% in March from same-month-2023’s 36.5%. Thanks to that boost, total deliveries in March increased year-over-year despite a decline in sales of all pickups, SUVs, vans, midsize cars and luxury-priced cars. The trend was largely true over the entire first quarter, as deliveries of more affordable vehicles led the three-month period to a 5.1% year-over-year gain.

Click on graph for larger image.

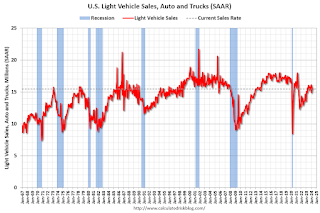

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for March (red).

Sales in March (15.49 million SAAR) were down 2.0% from February, and up 3.8% from March 2023.

Vehicle sales are usually a transmission mechanism for Federal Open Market Committee (FOMC) policy, although far behind housing. This time vehicle sales were more suppressed by supply chain issues and are up year-over-year.

Vehicle sales are usually a transmission mechanism for Federal Open Market Committee (FOMC) policy, although far behind housing. This time vehicle sales were more suppressed by supply chain issues and are up year-over-year.Sales in March were below the consensus forecast.

Freddie Mac House Price Index Increased in February; Up 5.9% Year-over-year

by Calculated Risk on 4/02/2024 01:01:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Increased in February; Up 5.9% Year-over-year

A brief excerpt:

On a year-over-year basis, the National FMHPI was up 5.9% in February, down from up 6.2% YoY in January. The YoY increase peaked at 19.1% in July 2021, and for this cycle, bottomed at up 0.9% YoY in April 2023. ...

As of February, 17 states and D.C. were below their previous peaks, Seasonally Adjusted. The largest seasonally adjusted declines from the recent peak were in West Virginia (-3.1%), Idaho (-2.8%), North Dakota (-2.4%), Oregon (-1.8%), and Nevada (-1.5%).

For cities (Core-based Statistical Areas, CBSA), here are the 30 cities with the largest declines from the peak, seasonally adjusted. Austin continues to be the worst performing city.

BLS: Job Openings Little Changed at 8.8 million in February

by Calculated Risk on 4/02/2024 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

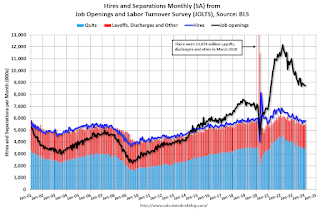

The number of job openings changed little at 8.8 million on the last business day of February, the U.S. Bureau of Labor Statistics reported today. Over the month, the number of hires and total separations were little changed at 5.8 million and 5.6 million, respectively. Within separations, quits (3.5 million) and layoffs and discharges (1.7 million) changed little.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for February; the employment report this Friday will be for March.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings were little changed in February at 8.76 million from 8.75 million in January.

The number of job openings (black) were down 11% year-over-year.

Quits were down 12% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

CoreLogic: US Home Prices Increased 5.5% Year-over-year in February

by Calculated Risk on 4/02/2024 08:00:00 AM

Notes: This CoreLogic House Price Index report is for February. The recent Case-Shiller index release was for January. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic: US Annual Home Price Growth Slows but Still Up by Over 5% in February

• U.S. single-family home prices rose by 5.5% year over year in February and are expected to taper to 3.1% growth by February 2025.This was a smaller YoY increase than the 5.8% reported for January.

• Four of the top five states with the highest annual home price growth are in the Northeast: New Jersey, Rhode Island, Maine and Connecticut

• The five states where home prices remain furthest from the summer 2022 peak are Idaho, Washington, Utah, Vermont and Montana

• The Miami and San Diego metro areas continued to lead the country for annual growth in February, both at about 10%

...

U.S. annual home price growth remained mostly consistent with numbers seen since last fall in February but finally slowed as the residual impact of comparing gains with weak 2022 home prices wore off. CoreLogic projects that year-over-year home price gains will continue to rise at a slower pace for the rest of 2024, which suggests more certainty for potential homebuyers who have been waiting to get a foot in the door. As noted in the most recent US CoreLogic S&P Case-Shiller Index report, an increase in for-sale inventory also benefits potential homebuyers, though affordability remains a concern, particularly if mortgage rates remain elevated throughout the spring homebuying season.

“Home price growth pivoted in February, as the impact of the January 2023 Home Price Index bottom finally faded,” said Dr. Selma Hepp, chief economist for CoreLogic. “As a result, the U.S. should begin to see slowing annual home price gains moving forward.”

“Nevertheless,” Hepp continued, “with a 0.7% increase from January to February 2024, which is almost double the monthly increase recorded before the pandemic, spring home price gains are already off to a strong start despite continued mortgage rate volatility. That said, more inventory finally coming to market will likely translate to more options for buyers and fewer bidding wars, which typically keeps outsized price growth in check. Still, despite affordability challenges, homebuyer demand appears to favor already expensive, coastal markets with a limited availability of properties for sale.”

emphasis added

Monday, April 01, 2024

Tuesday: Job Openings, Vehicle Sales

by Calculated Risk on 4/01/2024 07:31:00 PM

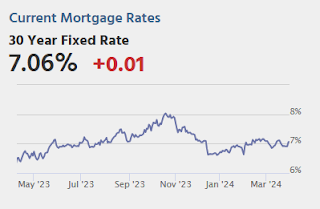

March ended with a streak of some of the flattest day-over-day changes in mortgage rates on record. It was all but certain that the new week/month would bring a change to that sideways trend, but the reality [w]as immediate and abrupt. [30 year fixed 7.05%]Tuesday:

emphasis added

• At 8:00 AM ET, Corelogic House Price index for February.

• At 10:00 AM, Job Openings and Labor Turnover Survey for February from the BLS.

• All Day Light vehicle sales for March. The consensus is for light vehicle sales to be 15.9 million SAAR in March, up from 15.8 million in February (Seasonally Adjusted Annual Rate).

ICE Mortgage Monitor: The Impact of "Golden-Handcuffs" on Mortgage Payments

by Calculated Risk on 4/01/2024 12:21:00 PM

Today, in the Real Estate Newsletter: ICE Mortgage Monitor: The Impact of "Golden-Handcuffs" on Mortgage Payments

Brief excerpt:

Press Release: ICE Mortgage Monitor: Trading Up to a 25% More Expensive Home Would More Than Double the Average Mortgage Holder’s PaymentThere is much more in the article.• From 2000 to 2022, upgrading to a 25% more expensive home would have required the average homeowner to increase their principal and interest payment by roughly 40%, or about $400 per month“Early-payment delinquencies remain elevated”

• Today, that same trade-up buyer’s payment would increase by an average of $1,384 per month, a 103% jump that highlights the real-world pressures keeping current mortgage holders “locked in” to their homes

• Simply giving up their current rate to move across the street to an equivalently priced home in today’s market would result in a nearly 40% increase in P&I – roughly as much as the historical trade-up cost

Here is a graph of the early delinquency rates for Conventional, FHA and VA loans. Conventional loans continue to perform well, but there is concern about FHA and VA loans.

•Early-payment delinquencies remain elevated among recent originations, particularly FHA and VA loan products

• Such delinquencies have edged upward in recent years but remain well below pre-Great Financial Crisis levels, while FHA and conventional mortgages have both improved modestly year over year, with VA loans holding roughly flat

• Though early-payment delinquencies on conventional mortgages remain low, performance of late-2023 FHA and VA loans, originated when rates neared 8% and debt-to-income ratios reached series highs, remain worth watching

Construction Spending Decreased 0.3% in February

by Calculated Risk on 4/01/2024 10:19:00 AM

From the Census Bureau reported that overall construction spending increased:

Construction spending during February 2024 was estimated at a seasonally adjusted annual rate of $2,091.5 billion, 0.3 percent below the revised January estimate of $2,096.9 billion. The February figure is 10.7 percent above the February 2023 estimate of $1,889.6 billionPrivate spending was unchanged and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,617.1 billion, virtually unchanged from the revised January estimate of $1,616.8 billion. ...

In February, the estimated seasonally adjusted annual rate of public construction spending was $474.4 billion, 1.2 percent below the revised January estimate of $480.1 billion.

Click on graph for larger image.

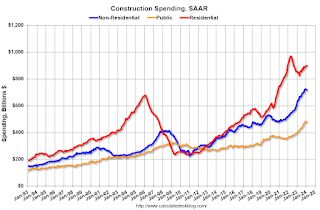

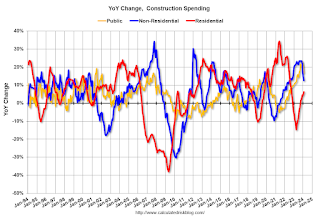

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 7.1% below the recent peak in 2022.

Non-residential (blue) spending is 1.1% below the peak two months ago.

Public construction spending is 1.9% below the peak two months ago.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 6.3%. Non-residential spending is up 12.6% year-over-year. Public spending is up 16.8% year-over-year.

ISM® Manufacturing index Increased to 50.3% in March

by Calculated Risk on 4/01/2024 10:00:00 AM

(Posted with permission). The ISM manufacturing index indicated expansion. The PMI® was at 50.3% in March, up from 47.8% in February. The employment index was at 47.4%, up from 45.9% the previous month, and the new orders index was at 51.4%, up from 49.2%.

From ISM: Manufacturing PMI® at 50.3% March 2024 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in March after contracting for 16 consecutive months, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing expanded slightly in March. This was above the consensus forecast.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The Manufacturing PMI® registered 50.3 percent in March, up 2.5 percentage points from the 47.8 percent recorded in February. The overall economy continued in expansion for the 47th month after one month of contraction in April 2020. (A Manufacturing PMI® above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy.) The New Orders Index moved back into expansion territory at 51.4 percent, 2.2 percentage points higher than the 49.2 percent recorded in February. The March reading of the Production Index (54.6 percent) is 6.2 percentage points higher than February’s figure of 48.4 percent. The Prices Index registered 55.8 percent, up 3.3 percentage points compared to the reading of 52.5 percent in February. The Backlog of Orders Index registered 46.3 percent, the same reading as in February. The Employment Index registered 47.4 percent, up 1.5 percentage points from February’s figure of 45.9 percent.

emphasis added

Housing April 1st Weekly Update: Inventory Up 0.9% Week-over-week, Up 26.0% Year-over-year

by Calculated Risk on 4/01/2024 08:21:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.