by Calculated Risk on 4/05/2024 11:59:00 AM

Friday, April 05, 2024

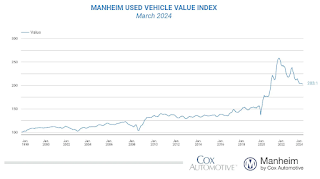

Wholesale Used Car Prices Declined in March; Down 14.7% Year-over-year

From Manheim Consulting today: Wholesale Used-Vehicle Prices Declined in March

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) were down in March compared to February. The Manheim Used Vehicle Value Index (MUVVI) fell to 203.1, a decline of 14.7% from a year ago. The decline in the index was driven by the seasonal adjustment, resulting in a 0.4% month-over-month decrease. The non-adjusted price in March increased by 3.1% compared to February, moving the unadjusted average price down 11.4% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Comments on March Employment Report

by Calculated Risk on 4/05/2024 09:10:00 AM

The headline jobs number in the March employment report was above expectations; and January and February payrolls were revised up by 22,000 combined. The participation rate and the employment population ratio both increased, and the unemployment rate decreased to 3.8%.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 years old participation rate decreased in March to 83.4% from 83.5% in February, and the 25 to 54 employment population ratio was unchanged at to 80.7% from 80.7% the previous month.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.1% YoY in March.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.3 million, changed little in March. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in March to 4.31 million from 4.36 million in February. This is at pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that was unchanged at 7.3% from 7.3% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.246 million workers who have been unemployed for more than 26 weeks and still want a job, up from 1.203 million the previous month.

This is close to pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 39 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline jobs number in the March employment report was above expectations; and January and February payrolls were revised up by 22,000 combined. The participation rate and the employment population ratio both increased, and the unemployment rate decreased to 3.8%. Another strong report.

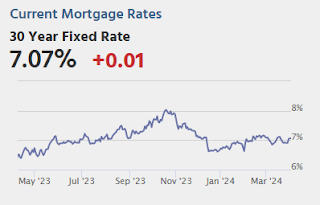

March Employment Report: 303 thousand Jobs, 3.8% Unemployment Rate

by Calculated Risk on 4/05/2024 08:30:00 AM

From the BLS:

Total nonfarm payroll employment rose by 303,000 in March, and the unemployment rate changed little at 3.8 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, government, and construction.

...

The change in total nonfarm payroll employment for January was revised up by 27,000, from +229,000 to +256,000, and the change for February was revised down by 5,000, from +275,000 to +270,000. With these revisions, employment in January and February combined is 22,000 higher than previously reported.

emphasis added

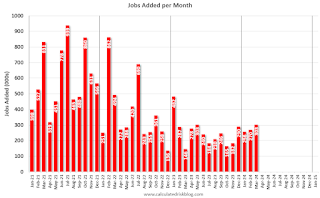

Click on graph for larger image.

Click on graph for larger image.The first graph shows the jobs added per month since January 2021.

Payrolls for January and February were revised up 22 thousand, combined.

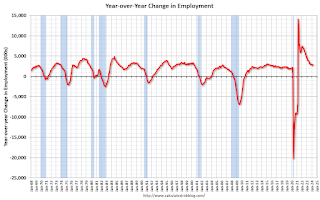

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In March, the year-over-year change was 2.93 million jobs. Employment was up solidly year-over-year.

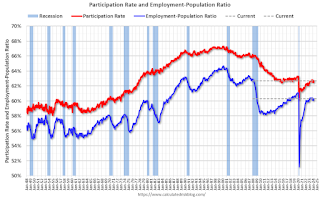

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was increased to 62.7% in March, from 62.5% in February. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate was increased to 62.7% in March, from 62.5% in February. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 60.3% from 60.1% (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased to 3.8% in March from 3.9% in February.

This was well above consensus expectations; and January and February payrolls were revised up by 22,000 combined.

Thursday, April 04, 2024

Friday: Employment Report

by Calculated Risk on 4/04/2024 08:33:00 PM

Friday:

• At 8:30 AM ET, 8:30 AM: Employment Report for March. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.

March Employment Preview

by Calculated Risk on 4/04/2024 05:03:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for March. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.

There were 275,000 jobs added in February, and the unemployment rate was at 3.9%.

From Goldman Sachs economist Spencer Hill

We estimate nonfarm payrolls rose by 240k in March—above consensus ... We estimate that the unemployment rate fell one tenth to 3.8% ... We assume a flat-to-up labor force participation rate of 62.5%. We estimate average hourly earnings rose 0.25% month-over-month, which would lower the year-on-year rate by three tenths to 4.0%—somewhat below consensus.From BofA:

emphasis added

In the March employment report, we forecast nonfarm payrolls to rise by 200k. Despite solid employment, we do not expect to see signs of an economy that is overheating. We think average hourly earnings likely rose by 0.3% m/m, or 4.1% y/y, and average weekly hours likely ticked higher to 34.4. Finally, we expect the unemployment rate to remain at 3.9% and for the participation rate to rise by one-tenth to 62.6%.• ADP Report: The ADP employment report showed 184,000 private sector jobs were added in March. This suggests job gains slightly above consensus expectations, however, in general, ADP hasn't been very useful in forecasting the BLS report.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index increased in 47.4%, up from 45.9% the previous month. This would suggest about 35,000 jobs lost in manufacturing. The ADP report indicated 1,000 manufacturing jobs added in March.

The ISM® services employment index decreased to 48.5%, from 8.0%. This would suggest about 35,000 jobs added in the service sector. Combined this suggests few jobs added in March, far below consensus expectations.

• Unemployment Claims: The weekly claims report showed a larger number of initial unemployment claims during the reference week from 202,000 in February to 212,000 in March. This suggests slightly more layoffs in March compared to February.

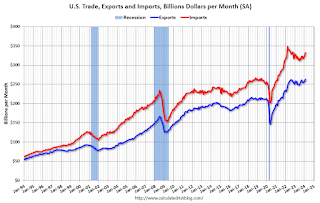

Realtor.com Reports Active Inventory UP 25.0% YoY; New Listings Down 7.8% YoY

by Calculated Risk on 4/04/2024 02:44:00 PM

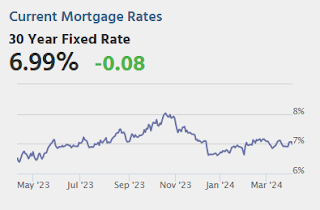

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For February, Realtor.com reported inventory was up 23.5% YoY, but still down almost 38% compared to March 2017 to 2019 levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data Week Ending March 30, 2024

• Active inventory increased, with for-sale homes 25.0% above year ago levels.

For an 21st straight week, active listings registered above prior year level, which means that today’s home shoppers are able to consider more options for existing homes for sale. However, the number of homes on the market is still down 37.9% compared to what was typical in 2017 to 2019.

• New listings–a measure of sellers putting homes up for sale–fell this week due to the Easter holiday, by 7.8% from one year ago.

After 22 consecutive weeks of growing new listings, newly listed homes fell below the previous year’s level. However, this decline is in part due to how the Easter holiday fell this year compared to last year. Even without the impact of the Holiday, the annual growth rate of new listings took a step back compared to the last couple of months. Taking a broader look, the number of new homes for sale remains historically small, even with recent improvements.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 21st consecutive week following 20 consecutive weeks with a YoY decrease in inventory.

Moody's: Apartment Vacancy Rate Unchanged in Q1; Office Vacancy Rate at Record High

by Calculated Risk on 4/04/2024 11:37:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Moody's: Apartment Vacancy Rate Unchanged in Q1; Office Vacancy Rate at Record High

A brief excerpt:

From Moody’s:There is much more in the article.The office sector slashed its vacancy record set just a quarter ago and marched another 20 bps closer to the 20% mark. Sitting at 19.8% in Q1 2024, this new record high vacancy rate is 50 bps above the recessionary peaks recorded in 1986 and 1991. Another quarter of vacancy increase emphasizes the long-term ramifications of hybrid work models, despite positive employment and GDP trends in the current economic cycle. ...Moody’s Analytics reported that the office vacancy rate was at 19.8% in Q1 2024, up from 19.6% in Q4 2023. This is a new record high, and above the 19.3% during the S&L crisis.

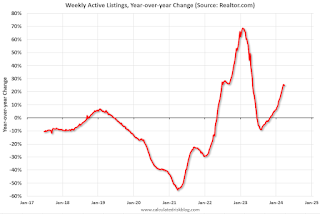

Trade Deficit at $68.9 Billion in February

by Calculated Risk on 4/04/2024 08:44:00 AM

The Census Bureau and the Bureau of Economic Analysis reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $68.9 billion in February, up $1.3 billion from $67.6 billion in January, revised.

February exports were $263.0 billion, $5.8 billion more than January exports. February imports were $331.9 billion, $7.1 billion more than January imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports imports increased in February.

Exports are up 4.1% year-over-year; imports are up 2.8% year-over-year.

Both imports and exports decreased sharply due to COVID-19 and then bounced back - imports and exports have increased recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, exports of petroleum products are positive and have been increasing.

The trade deficit with China increased to $19.9 billion from $19.0 billion a year ago.

Weekly Initial Unemployment Claims Increase to 221,000

by Calculated Risk on 4/04/2024 08:30:00 AM

The DOL reported:

In the week ending March 30, the advance figure for seasonally adjusted initial claims was 221,000, an increase of 9,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 210,000 to 212,000. The 4-week moving average was 214,250, an increase of 2,750 from the previous week's revised average. The previous week's average was revised up by 500 from 211,000 to 211,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 214,250.

The previous week was revised up.

Weekly claims were higher than the consensus forecast.

Wednesday, April 03, 2024

Thursday: Unemployment Claims, Trade Deficit

by Calculated Risk on 4/03/2024 07:41:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 208 thousand initial claims, down from 210 thousand last week.

• Also at 8:30 AM: Trade Balance report for February from the Census Bureau. The consensus is the trade deficit to be $66.5 billion. The U.S. trade deficit was at $67.4 billion in January.