by Calculated Risk on 4/15/2024 08:37:00 AM

Monday, April 15, 2024

Retail Sales Increased 0.7% in March

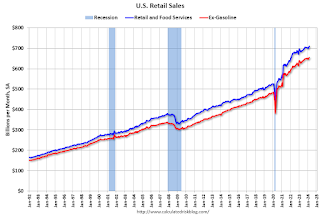

On a monthly basis, retail sales were up 0.7% from February to March (seasonally adjusted), and sales were up 4.0 percent from March 2023.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for March 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $709.6 billion, up 0.7 percent from the previous month, and up 4.0 percent above March 2023. ... The January 2024 to February 2024 percent change was revised from up 0.6 percent to up 0.9 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.6% in March.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.4% on a YoY basis.

The increase in sales in March was above expectations, and, sales in January and February were revised up.

The increase in sales in March was above expectations, and, sales in January and February were revised up.

Housing April 15th Weekly Update: Inventory up 2.6% Week-over-week, Up 29.6% Year-over-year

by Calculated Risk on 4/15/2024 08:01:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, April 14, 2024

Monday: Retail Sales, NY Fed Mfg, Homebuilder Survey

by Calculated Risk on 4/14/2024 11:57:00 PM

Weekend:

• Schedule for Week of April 14, 2024

Monday:

• At 8:30 AM ET, Retail sales for March is scheduled to be released. The consensus is for a 0.3% increase in retail sales.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of -9.0, up from -20.9.

• At 10:00 AM, The April NAHB homebuilder survey. The consensus is for a reading of 51, unchanged from 51. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 14 and DOW futures are up 78 (fair value).

Oil prices were up over the last week with WTI futures at $85.66 per barrel and Brent at $90.45 per barrel. A year ago, WTI was at $83, and Brent was at $87 - so WTI oil prices are up slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.61 per gallon. A year ago, prices were at $3.65 per gallon, so gasoline prices are down $0.04 year-over-year.

Saturday, April 13, 2024

By Request: Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 4/13/2024 09:25:00 PM

Note: I used to post this monthly, but I stopped during the COVID-19 pandemic. I've received a number of requests lately to post this again, so here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

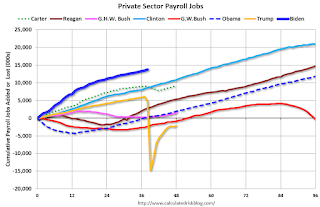

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter, George H.W. Bush and Trump only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr. Clinton (light blue) served for eight years without a recession. And there was a pandemic related recession in 2020.

First, here is a table for private sector jobs. The previous top two private sector terms were both under President Clinton.

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Biden | 13,7351 |

| Clinton 1 | 10,876 |

| Clinton 2 | 10,094 |

| Obama 2 | 9,926 |

| Reagan 2 | 9,351 |

| Carter | 9,039 |

| Reagan 1 | 5,363 |

| Obama 1 | 1,907 |

| GHW Bush | 1,507 |

| GW Bush 2 | 443 |

| GW Bush 1 | -820 |

| Trump | -2,192 |

| 1After 38 months. | |

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

Private sector employment increased by 9,039,000 under President Carter (dashed green), by 14,714,000 under President Reagan (dark red), 1,507,000 under President G.H.W. Bush (light purple), 20,970,000 under President Clinton (light blue), lost 377,000 under President G.W. Bush, and gained 11,833,000 under President Obama (dark dashed blue). During Trump's term (Orange), the economy lost 2,135,000 private sector jobs.

A big difference between the presidencies has been public sector employment. Note: the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, 2010 and 2020.

A big difference between the presidencies has been public sector employment. Note: the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, 2010 and 2020. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However, the public sector declined significantly while Mr. Obama was in office (down 263,000 jobs). During Trump's term, the economy lost 528,000 public sector jobs.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Biden | 1,4821 |

| Reagan 2 | 1,438 |

| Carter | 1,304 |

| Clinton 2 | 1,242 |

| GHW Bush | 1,127 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Clinton 1 | 692 |

| Obama 2 | 447 |

| Reagan 1 | -24 |

| Trump | -528 |

| Obama 1 | -710 |

| 1After 36 months. | |

Real Estate Newsletter Articles this Week: Current State of the Housing Market

by Calculated Risk on 4/13/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Current State of the Housing Market; Overview for mid-April 2024

• Part 2: Current State of the Housing Market; Overview for mid-April 2024

• 2nd Look at Local Housing Markets in March

• An Update on the House Price Battle Royale: Low Inventory vs Affordability

• 1st Look at Local Housing Markets in March

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of April 14, 2024

by Calculated Risk on 4/13/2024 08:11:00 AM

The key reports this week are March Retail Sales, Housing Starts and Existing Home Sales.

For manufacturing, the March Industrial Production report, and NY and Philly Fed surveys will be released this week.

8:30 AM: Retail sales for March is scheduled to be released. The consensus is for a 0.3% increase in retail sales.

8:30 AM: Retail sales for March is scheduled to be released. The consensus is for a 0.3% increase in retail sales. This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 2.0% on a YoY basis in February.

8:30 AM: The New York Fed Empire State manufacturing survey for April. The consensus is for a reading of -9.0, up from -20.9.

10:00 AM: The April NAHB homebuilder survey. The consensus is for a reading of 51, unchanged from 51. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM ET: Housing Starts for March.

8:30 AM ET: Housing Starts for March. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.480 million SAAR, down from 1.521 million SAAR in February.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for March.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 78.5%.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 217 thousand initial claims, up from 211 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for April. The consensus is for a reading of 0.0, down from 3.2.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 4.20 million SAAR, down from 4.38 million.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 4.20 million SAAR, down from 4.38 million.The graph shows existing home sales from 1994 through the report last month.

10:00 AM: State Employment and Unemployment (Monthly) for March 2024

Friday, April 12, 2024

April 12th COVID Update: Weekly Deaths Decreased

by Calculated Risk on 4/12/2024 07:22:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Hospitalized2 | 6,576 | 7,510 | ≤3,0001 | |

| Deaths per Week2 | 961 | 1,030 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Hospitalized and Deaths ✅ Goal met. | ||||

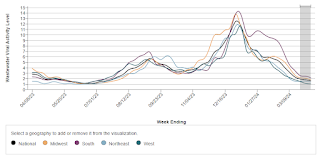

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Part 2: Current State of the Housing Market; Overview for mid-April 2024

by Calculated Risk on 4/12/2024 12:55:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-April 2024

A brief excerpt:

On Wednesday, in Part 1: Current State of the Housing Market; Overview for mid-April 2024 I reviewed home inventory, housing starts and sales.There is much more in the article.

In Part 2, I will look at house prices, mortgage rates, rents and more.

...

Other measures of house prices suggest prices will be up about the same YoY in the February Case-Shiller index. The NAR reported median prices were up 5.7% YoY in February, up from 4.9% YoY in January. ICE reported prices were up 5.7% YoY in February, down from 5.8% YoY in January, and Freddie Mac reported house prices were up 5.9% YoY in February, down from 6.2% YoY in January.

The FMHPI and the NAR median prices appear to be leading indicators for Case-Shiller. Based on recent monthly data, and the FMHPI, the YoY change in the Case-Shiller index will likely be about the same YoY in February as in January.

Price increases have slowed! Over the last 3 months, this FMHPI has only increased at a 1.7% annual rate.

Q1 GDP Tracking: Around 2%

by Calculated Risk on 4/12/2024 11:04:00 AM

From BofA:

Since our update last week, 1Q GDP tracking is down one-tenth to 1.9% q/q saar. [Apr 12th estimate]From Goldman:

emphasis added

We left our Q1 GDP tracking estimate unchanged at +2.5% (qoq ar) and our Q1 domestic final sales forecast unchanged at +2.6% (qoq ar). [Apr 10th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2024 is 2.4 percent on April 10, down from 2.5 percent on April 4. [April 10th estimate]

Hotels: Occupancy Rate Increased 4.7% Year-over-year

by Calculated Risk on 4/12/2024 08:11:00 AM

U.S. hotel performance showed mixed results from the previous week but positive comparisons year over year, according to CoStar’s latest data through 6 April. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

31 March through 6 April 2024 (percentage change from comparable week in 2023):

• Occupancy: 64.1% (+4.7%)

• Average daily rate (ADR): US$156.96 (+2.1%)

• Revenue per available room (RevPAR): US$100.59 (+6.9%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, black is 2020, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.