by Calculated Risk on 4/30/2024 09:00:00 AM

Tuesday, April 30, 2024

Case-Shiller: National House Price Index Up 6.4% year-over-year in February

S&P/Case-Shiller released the monthly Home Price Indices for February ("February" is a 3-month average of December, January and February closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index’s Upward Trend Persists in February 2024

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.4% annual gain in February, up from a 6.0% rise in the previous month. The 10- City Composite showed an increase of 8.0%, up from a 7.4% increase in the previous month. The 20- City Composite posted a year-over-year increase of 7.3%, up from a 6.6% increase in the previous month. San Diego continued to report the highest year-over-year gain among the 20 cities with an 11.4% increase in February, followed by Chicago and Detroit , with an increase of 8.9%. Portland, though still holding the lowest rank after reporting two consecutive months of the smallest year-over-year growth, had a significant increase in annual gain of 2.2% in February.

...

The U.S. National Index, the 20-City Composite, and the 10-City Composite, for the first time since November 2023, showed a pre-seasonality adjustment increase of 0.6%, 0.9% and 1.0% respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0.4%, while the 20-City and the 10-City Composite both reported month-over-month increases of 0.6%.

“U.S. home prices continued their drive higher,” says Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. “Our National Composite rose by 6% in January, the fastest annual rate since 2022. Stronger gains came from our 10- and 20-City Composite indices, rising 7.4% and 6.6%, respectively. For the second consecutive month, all cities reported increases in annual prices, with San Diego surging 11.2%. On a seasonal adjusted basis, home prices have continued to break through previous all-time highs set last year”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index was up 0.6% in February (SA). The Composite 20 index was up 0.6% (SA) in February.

The National index was up 0.4% (SA) in February.

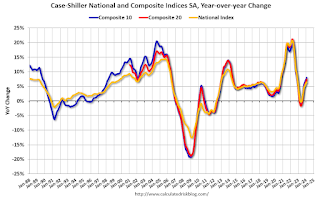

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA was up 8.0% year-over-year. The Composite 20 SA was up 7.3% year-over-year.

The National index SA was up 6.4% year-over-year.

Annual price changes were above expectations. I'll have more later.

Monday, April 29, 2024

Tuesday: Case-Shiller House Prices

by Calculated Risk on 4/29/2024 08:06:00 PM

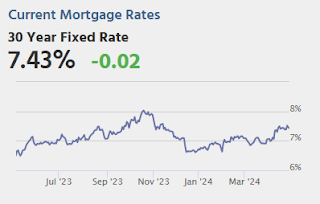

Mortgage rates didn't change much at all over the weekend with the average lender still in the highest territory since November. The average conventional 30yr fixed rate is just under 7.5% for top tier scenarios.Tuesday:

Things could end up changing quite a bit by the end of this week owing to a slew of important events and economic reports. [30 year fixed 7.43%]

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for February. The consensus is for a 6.7% year-over-year increase in the Comp 20 index for February.

• Also at 9:00 AM, FHFA House Price Index for February. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 9:45 AM, Chicago Purchasing Managers Index for April. The consensus is for a reading of 45.0, up from 41.4 in March.

• At 10:00 AM, the Q1 2024 Housing Vacancies and Homeownership from the Census Bureau.

Q1 2024 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 4/29/2024 03:02:00 PM

The BEA released the underlying details for the Q1 advance GDP report on Friday.

The BEA reported that investment in non-residential structures decreased at a 0.1% annual pace in Q1.

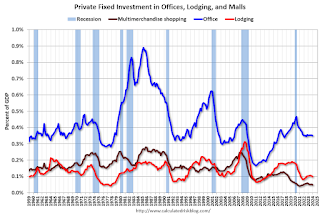

The first graph shows investment in offices, malls and lodging as a percent of GDP.

Investment in offices (blue) increased slightly in Q1 and was up 4.1% year-over-year. And declined slightly as a percent of GDP.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was down about 1% year-over-year in Q1. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment decreased in Q1 compared to Q4, and lodging investment was up 1% year-over-year.

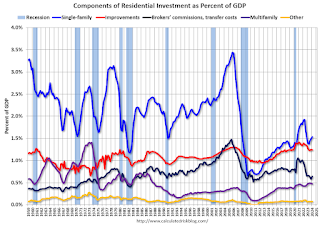

The second graph is for Residential investment components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single-family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).

The second graph is for Residential investment components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single-family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).Investment in single family structures was up to $433 billion (SAAR) (about 1.5% of GDP) and was up 16% year-over-year.

Investment in multi-family structures was down in Q1 compared to Q4 to $133 billion (SAAR), but still up 12% YoY.

Investment in home improvement was at a $351 billion (SAAR) in Q1 (about 1.2% of GDP). Home improvement spending was strong during the pandemic but has declined as a percent of GDP recently.

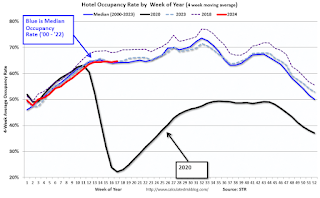

Hotels: Occupancy Rate decreased 0.3% Year-over-year

by Calculated Risk on 4/29/2024 01:11:00 PM

U.S. hotel performance showed mixed results from the previous week, according to CoStar’s latest data through 20 April. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

14-20 April 2024 (percentage change from comparable week in 2023):

• Occupancy: 66.8% (-0.3%)

• Average daily rate (ADR): US$158.60 (+1.5%)

• Revenue per available room (RevPAR): US$105.94 (+1.2%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, black is 2020, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

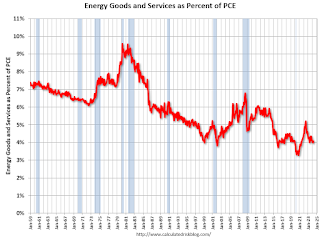

Energy expenditures as a percentage of PCE

by Calculated Risk on 4/29/2024 11:01:00 AM

During the early stages of the pandemic, energy expenditures as a percentage of PCE hit an all-time low of 3.3% of PCE. Then energy expenditures increased to 2018 levels by the end of 2021.

This graph shows expenditures on energy goods and services as a percent of total personal consumption expenditures. This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA.

In general, energy expenditures as a percent of PCE has been trending down for decades. The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

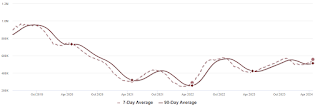

Housing April 29th Weekly Update: Inventory up 2.5% Week-over-week, Up 31.8% Year-over-year

by Calculated Risk on 4/29/2024 08:12:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, April 28, 2024

Sunday Night Futures

by Calculated Risk on 4/28/2024 06:16:00 PM

Weekend:

• Schedule for Week of April 28, 2024

Monday:

• At 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for April.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 4 and DOW futures are up 60 (fair value).

Oil prices were up over the last week with WTI futures at $83.85 per barrel and Brent at $89.50 per barrel. A year ago, WTI was at $77, and Brent was at $81 - so WTI oil prices are up about 8% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.64 per gallon. A year ago, prices were at $3.59 per gallon, so gasoline prices are up $0.05 year-over-year.

Realtor.com Reports Active Inventory Up 31.7% YoY; New Listings Up 13.5% YoY

by Calculated Risk on 4/28/2024 12:39:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For March, Realtor.com reported inventory was up 23.5% YoY, but still down almost 38% compared to March 2017 to 2019 levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data Week Ending April 20, 2024

• Active inventory increased, with for-sale homes 31.7% above year-ago levels.

For the 24th straight week, there were more homes listed for sale versus the prior year, giving homebuyers more options. As mortgage rates have climbed to new 2024 highs, we could see sellers adjust their plans, since nearly three-quarters of potential sellers also play to buy a home. However, the long build-up to listing–80% have been thinking about selling for 1 to 3 years–could mean that this year’s sellers are less-deterred by market fluctuations.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 13.5% from one year ago.

Since February, the number of homes newly listed for sale has surpassed year ago pace by double-digit with the exception of a few weeks around this year’s spring holidays. As reported in the Realtor.com March housing report, newly listed homes trailed behind every prior year except 2023’s record low.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 24th consecutive week.

FOMC Preview: No Change to Fed Funds Rate

by Calculated Risk on 4/28/2024 08:21:00 AM

Most analysts expect there will be no change to the federal funds rate at the meeting this week keeping the target range at 5‑1/4 to 5-1/2 percent. Fed Chair Powell is expected to maintain a slightly hawkish stance during the press conference, since the recent inflation reports were above expectations.

From BofA:

The Fed is less confident about how quickly inflation will slow, but it has not given up on its expectation that it will. We expect the Fed to say it is prepared to keep policy rates where they are for as long as needed to bring inflation down. We also look for the Fed to announce the tapering of balance sheet runoff by cutting the maximum runoff cap on Treasuries in half.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| Mar 2024 | 2.0 to 2.4 | 1.9 to 2.3 | 1.8 to 2.1 | |

| Dec 2023 | 1.2 to 1.7 | 1.5 to 2.0 | 1.8 to 2.0 | |

The unemployment rate was at 3.8% in March, just below the FOMC projections for Q4.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| Mar 2024 | 3.9 to 4.1 | 3.9 to 4.2 | 3.9 to 4.3 | |

| Dec 2023 | 4.0 to 4.2 | 4.0 to 4.2 | 3.9 to 4.3 | |

As of March 2024, PCE inflation increased 2.7 percent year-over-year (YoY). This is at the high end of the FOMC projections for Q4.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| Mar 2024 | 2.3 to 2.7 | 2.1 to 2.2 | 2.0 to 2.1 | |

| Dec 2023 | 2.2 to 2.5 | 2.0 to 2.2 | 2.0 | |

PCE core inflation increased 2.8 percent YoY in March. This is also at the high end of the FOMC projections for Q4 2024.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| Mar 2024 | 2.5 to 2.8 | 2.1 to 2.3 | 2.0 to 2.1 | |

| Dec 2023 | 2.4 to 2.7 | 2.0 to 2.2 | 2.0 to 2.1 | |

Saturday, April 27, 2024

Real Estate Newsletter Articles this Week: New Home Sales Increase to 693,000 Annual Rate in March

by Calculated Risk on 4/27/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• New Home Sales Increase to 693,000 Annual Rate in March

• Lawler: Observations on the Recent Surge in Net International Migration

• Fannie and Freddie: Single Family Serious Delinquency Rate Decreased, Multi-family Decreased in March

• Final Look at Local Housing Markets in March

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.