by Calculated Risk on 5/06/2024 02:01:00 PM

Monday, May 06, 2024

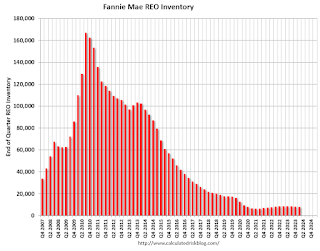

Fannie "Real Estate Owned" inventory Decreased in Q1 2024

Fannie reported results for Q1 2024. Here is some information on single-family Real Estate Owned (REOs).

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie Real Estate Owned (REO).

This is well below the normal level of REOs for Fannie, and there will not be a huge wave of foreclosures.

ICE Mortgage Monitor: Annual home price growth eased in March; "For-sale inventory has been growing sharply across Florida"

by Calculated Risk on 5/06/2024 11:01:00 AM

Today, in the Real Estate Newsletter: ICE Mortgage Monitor: Annual home price growth eased in March

Brief excerpt:

Press Release: ICE Mortgage Monitor: Historically Strong Home Price Growth Pushes U.S. Mortgage Holders’ Tappable Equity to Record $11TThere is much more in the article.Here is the year-over-year in house prices according to the ICE Home Price Index (HPI). The ICE HPI is a repeat sales index. Black Knight reports the median price change of the repeat sales. The index was up 5.6% year-over-year in March, down from 6.0% YoY in February.

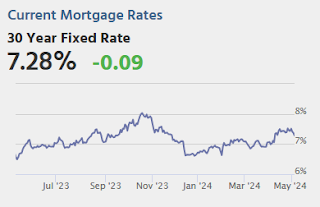

• Home price growth slowed in March, driven by a tightening of both mortgage rates and home affordability, but continues to remain historically strong

• Annual home price growth eased from an upwardly revised 6.0% in February to +5.6% in March, with prices rising by a seasonally adjusted +0.42% in the month, down from a revised +0.58% in February

• On a non-adjusted basis, prices were up +1.2% in March, more than 25% above the 25-year March average of +0.96%

• March marked the third straight month of above average monthly growth, after monthly gains fell below the 25-year average in five of the final six months of 2023, dampened by elevated interest rates

• While rising interest rates suppressed purchase demand and allowed modest inventory growth this spring, prices have remained resilient so far

• That said, adjusted monthly growth continuing at or near its currently rate would result in modestly slowing annual home price growth as we move into summer

Housing May 6th Weekly Update: Inventory up 0.6% Week-over-week, Up 33.1% Year-over-year

by Calculated Risk on 5/06/2024 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, May 05, 2024

Sunday Night Futures

by Calculated Risk on 5/05/2024 06:50:00 PM

Weekend:

• Schedule for Week of May 5, 2024

Monday:

• At 2:00 PM ET, Senior Loan Officer Opinion Survey on Bank Lending Practices for April.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 10 and DOW futures are up 80 (fair value).

Oil prices were up over the last week with WTI futures at $78.11 per barrel and Brent at $82.96 per barrel. A year ago, WTI was at $71, and Brent was at $76 - so WTI oil prices are up about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.62 per gallon. A year ago, prices were at $3.52 per gallon, so gasoline prices are up $0.10 year-over-year.

Hotels: Occupancy Rate decreased 1.2% Year-over-year

by Calculated Risk on 5/05/2024 08:21:00 AM

As expected with Passover, U.S. hotel performance came in lower than the previous week and comparable period last year, according to CoStar’s latest data through 27 April. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

21-27 April 2024 (percentage change from comparable week in 2023):

• Occupancy: 65.7% (-1.2%)

• Average daily rate (ADR): US$154.44 (-1.3%)

• Revenue per available room (RevPAR): US$101.42 (-2.5%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, black is 2020, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Saturday, May 04, 2024

Real Estate Newsletter Articles this Week: National House Price Index Up 6.4% year-over-year in February

by Calculated Risk on 5/04/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Case-Shiller: National House Price Index Up 6.4% year-over-year in February

• Inflation Adjusted House Prices 2.4% Below Peak

• Lawler: Update on Mortgage Rates and Spreads and also New / Renewal Rents

• Freddie Mac House Price Index Increased in March; Up 6.6% Year-over-year

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of May 5, 2024

by Calculated Risk on 5/04/2024 08:11:00 AM

This will be a very light week for economic data.

2:00 PM: Senior Loan Officer Opinion Survey on Bank Lending Practices for April.

No major economic releases scheduled.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 206 thousand initial claims, down from 208 thousand last week.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for May).

Friday, May 03, 2024

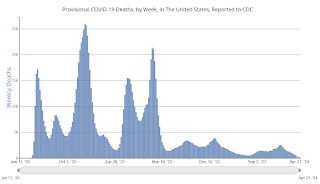

May 3rd COVID Update: Deaths Continue to Decline

by Calculated Risk on 5/03/2024 07:11:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 573 | 678 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Q2 GDP Tracking: Solid Early Look

by Calculated Risk on 5/03/2024 03:21:00 PM

From Goldman:

We lowered our Q2 GDP tracking estimate by 0.1pp to +3.3% (qoq ar) and our domestic final sales estimate by the same amount to +2.7% (qoq ar). [May 2nd estimate]And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2024 is 3.3 percent on May 2, unchanged from May 1 after rounding. [May 2nd estimate]

Inflation Adjusted House Prices 2.4% Below Peak; Price-to-rent index is 7.5% below 2022 peak

by Calculated Risk on 5/03/2024 12:24:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 2.4% Below Peak

Excerpt:

It has been over 17 years since the bubble peak. In the February Case-Shiller house price index released on Tuesday, the seasonally adjusted National Index (SA), was reported as being 71% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 10% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is 1% above the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $300,000 in January 2010, the price would be $429,000 today adjusted for inflation (43% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index

...

The second graph shows the same two indexes in real terms (adjusted for inflation using CPI).

In real terms (using CPI), the National index is 2.4% below the recent peak, and the Composite 20 index is 3.1% below the recent peak in 2022. Both indexes were mostly flat in February in real terms.

In real terms, national house prices are 10.2% above the bubble peak levels. There is an upward slope to real house prices, and it has been over 17 years since the previous peak, but real prices are historically high.