by Calculated Risk on 5/16/2024 08:32:00 AM

Thursday, May 16, 2024

Housing Starts Increased to 1.360 million Annual Rate in April

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in April were at a seasonally adjusted annual rate of 1,360,000. This is 5.7 percent above the revised March estimate of 1,287,000, but is 0.6 percent below the April 2023 rate of 1,368,000. Single‐family housing starts in April were at a rate of 1,031,000; this is 0.4 percent below the revised March figure of 1,035,000. The April rate for units in buildings with five units or more was 322,000.

Building Permits:

Privately‐owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,440,000. This is 3.0 percent below the revised March rate of 1,485,000 and is 2.0 percent below the April 2023 rate of 1,470,000. Single‐family authorizations in April were at a rate of 976,000; this is 0.8 percent below the revised March figure of 984,000. Authorizations of units in buildings with five units or more were at a rate of 408,000 in April.

emphasis added

Click on graph for larger image.

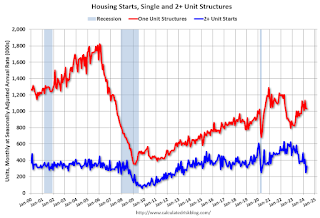

Click on graph for larger image.The first graph shows single and multi-family housing starts since 2000.

Multi-family starts (blue, 2+ units) increased in April compared to March. Multi-family starts were down 33.1% year-over-year.

Single-family starts (red) decreased slightly in April and were up 17.7% year-over-year.

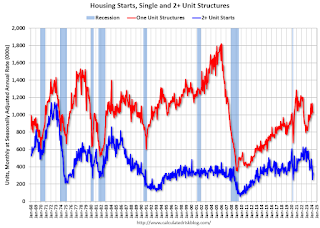

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery - and the recent collapse and recovery in single-family starts.

Total housing starts in April were above expectations, however, starts in February and March were revised down.

I'll have more later …

Weekly Initial Unemployment Claims Decrease to 222,000

by Calculated Risk on 5/16/2024 08:30:00 AM

The DOL reported:

In the week ending May 11, the advance figure for seasonally adjusted initial claims was 222,000, a decrease of 10,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 231,000 to 232,000. The 4-week moving average was 217,750, an increase of 2,500 from the previous week's revised average. The previous week's average was revised up by 250 from 215,000 to 215,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 217,750.

The previous week was revised up.

Weekly claims were at the consensus forecast.

Wednesday, May 15, 2024

Thursday: Housing Starts, Unemployment Claims, Industrial Production, Philly Fed Mfg

by Calculated Risk on 5/15/2024 07:01:00 PM

Thursday:

• At 8:30 AM ET, Housing Starts for April. The consensus is for 1.410 million SAAR, up from 1.321 million SAAR in March.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 222 thousand initial claims, down from 231 thousand last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for May. The consensus is for a reading of 8.0, down from 15.5.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for April. The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to be unchanged at 78.4%.

Cleveland Fed: Median CPI increased 0.3% and Trimmed-mean CPI increased 0.3% in April

by Calculated Risk on 5/15/2024 11:58:00 AM

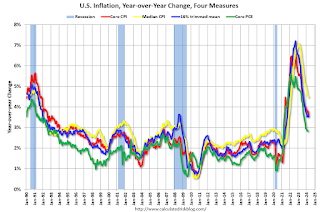

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% in April. The 16% trimmed-mean Consumer Price Index increased 0.3%. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details. Rent and Owner's equivalent rent are still very high, and if we exclude rent, median CPI would be around 2% year-over-year.

NAHB: Builder Confidence Declined in May

by Calculated Risk on 5/15/2024 10:00:00 AM

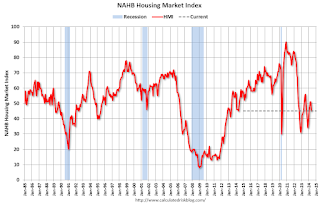

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 45, down from 51 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

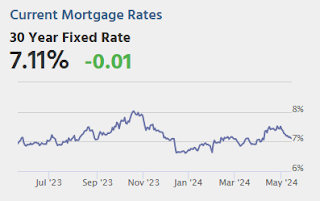

From the NAHB: Higher Mortgage Rates Hammer Builder Confidence in May

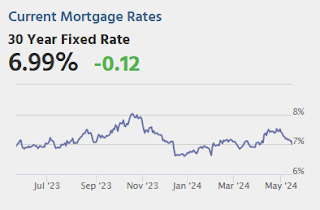

With mortgage rates averaging above 7% for the past four weeks per data from Freddie Mac, builder sentiment posted its first decline since November 2023.

Builder confidence in the market for newly built single-family homes was 45 in May, down six points from April, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today.

“The market has slowed down since mortgage rates increased and this has pushed many potential buyers back to the sidelines,” said NAHB Chairman Carl Harris, a custom home builder from Wichita, Kan. “We are also concerned about the recent codes rules that require HUD and USDA to insure mortgages for new single-family homes only if they are built to the 2021 International Energy Conservation Code. This will further increase the cost of construction in a market that sorely needs more inventory for first-time and first-generation buyers.”

“A lack of progress on reducing inflation pushed long-term interest rates higher in the first quarter and this is acting as a drag on builder sentiment,” said NAHB Chief Economist Robert Dietz. “The last leg in the inflation fight is to reduce shelter inflation, and this can only occur if builders are able to construct more attainable, affordable housing.”

The May HMI survey also revealed that 25% of builders cut home prices to bolster sales in May, ending four months of consecutive declines in this metric. However, the average price reduction in May held steady at 6% for the 11th straight month. Meanwhile, the use of sales incentives ticked up to 59% in May from a reading of 57% in April.

...

All three HMI component indices posted declines in May. The HMI index charting current sales conditions in May fell six points to 51, the component measuring sales expectations in the next six months fell nine points to 51 and the gauge charting traffic of prospective buyers declined four points to 30.

Looking at the three-month moving averages for regional HMI scores, the Midwest increased three points to 49, the Northeast fell two points to 61, the South dropped two points to 49 and the West posted a four-point decline to 43.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was below the consensus forecast.

YoY Measures of Inflation: Services, Goods and Shelter

by Calculated Risk on 5/15/2024 09:02:00 AM

Here are a few measures of inflation:

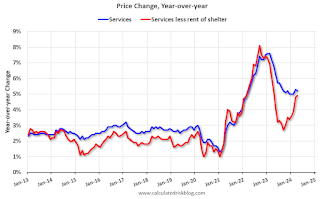

The first graph is the one Fed Chair Powell had mentioned when services less rent of shelter was up around 8% year-over-year. This declined, but has turned up recently, and is now up 4.9% YoY.

This graph shows the YoY price change for Services and Services less rent of shelter through April2024.

Services less rent of shelter was up 4.9% YoY in April, up from 4.8% YoY in March.

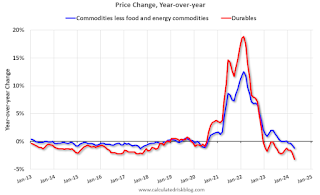

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.Commodities less food and energy commodities were at -1.2% YoY in April, down from -0.7% YoY in March.

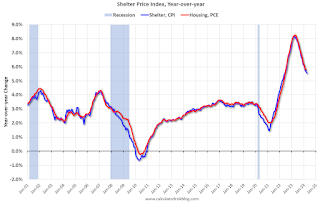

Here is a graph of the year-over-year change in shelter from the CPI report (through April) and housing from the PCE report (through March)

Here is a graph of the year-over-year change in shelter from the CPI report (through April) and housing from the PCE report (through March)Shelter was up 5.5% year-over-year in April, down from 5.6% in March. Housing (PCE) was up 5.79% YoY in March, down slightly from 5.85% in February.

Core CPI ex-shelter was up 2.1% YoY in April, down from 2.4% in March.

Retail Sales "Unchanged" in April

by Calculated Risk on 5/15/2024 08:41:00 AM

On a monthly basis, retail sales were "virtually unchanged" from March to April (seasonally adjusted), and sales were up 3.0 percent from April 2023.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for April 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $705.2 billion, virtually unchanged from the previous month, but up 3.0 percent above April 2023. ... The February 2024 to March 2024 percent change was revised from up 0.7 percent to up 0.6 percent (±0.1 percent).

emphasis added

Click on graph for larger image.

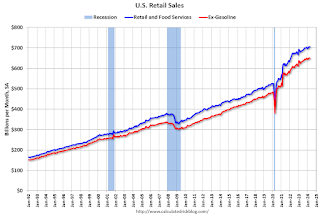

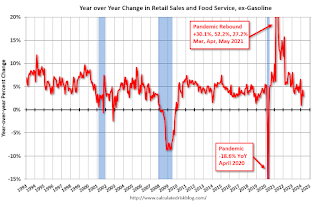

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.2% in April.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 3.0% on a YoY basis.

The change in sales in April was below expectations, and, sales in February and March were revised down.

The change in sales in April was below expectations, and, sales in February and March were revised down.

BLS: CPI Increased 0.3% in April; Core CPI increased 0.3%

by Calculated Risk on 5/15/2024 08:30:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in April on a seasonally adjusted basis, after rising 0.4 percent in March, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.4 percent before seasonal adjustment.The change in both CPI and core CPI were at expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The index for shelter rose in April, as did the index for gasoline. Combined, these two indexes contributed over seventy percent of the monthly increase in the index for all items. The energy index rose 1.1 percent over the month. The food index was unchanged in April. The food at home index declined 0.2 percent, while the food away from home index rose 0.3 percent over the month.

The index for all items less food and energy rose 0.3 percent in April, after rising 0.4 percent in each of the 3 preceding months. Indexes which increased in April include shelter, motor vehicle insurance, medical care, apparel, and personal care. The indexes for used cars and trucks, household furnishings and operations, and new vehicles were among those that decreased over the month.

The all items index rose 3.4 percent for the 12 months ending April, a smaller increase than the 3.5-percent increase for the 12 months ending March. The all items less food and energy index rose 3.6 percent over the last 12 months. The energy index increased 2.6 percent for the 12 months ending April. The food index increased 2.2 percent over the last year.

emphasis added

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 5/15/2024 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

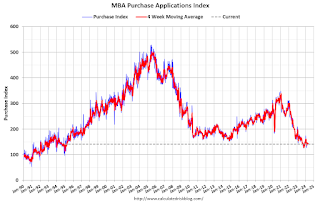

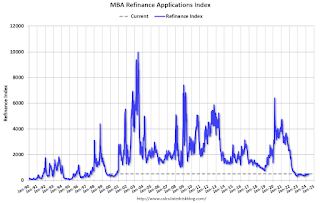

Mortgage applications increased 0.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 10, 2024.

The Market Composite Index, a measure of mortgage loan application volume, increased 0.5 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 0.3 percent compared with the previous week. The Refinance Index increased 5 percent from the previous week and was 7 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 14 percent lower than the same week one year ago.

“Treasury yields continued to move lower last week and mortgage rates declined for the second week in a row, with the 30-year fixed rate down 10 basis points to 7.08 percent, the lowest level since early April,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “The decline in rates led to a small boost to refinance applications, including another strong week for VA refinances. However, the overall level of refinance activity remains low. Purchase applications decreased, driven largely by a 9 percent drop in FHA purchase applications. Conventional home purchase applications were down around one percent.

Added Kan, “While the downward move in rates benefits prospective homebuyers, mortgage rates are still much higher than they were a year ago, while for-sale inventory remains tight.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 7.08 percent from 7.18 percent, with points decreasing to 0.63 from 0.65 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 14% year-over-year unadjusted.

Tuesday, May 14, 2024

Wednesday: CPI, Retail Sales, NY Fed Mfg, Homebuilder Survey

by Calculated Risk on 5/14/2024 07:38:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for April from the BLS. The consensus is for 0.3% increase in CPI (up 3.4% YoY), and a 0.3% increase in core CPI (up 3.6% YoY).

• Also at 8:30 AM, Retail sales for April is scheduled to be released. The consensus is for 0.4% increase in retail sales.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for May. The consensus is for a reading of -10.8, up from -14.3.

• At 10:00 AM, The May NAHB homebuilder survey. The consensus is for a reading of 51 unchanged from 51 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.