by Calculated Risk on 5/19/2024 06:14:00 PM

Sunday, May 19, 2024

Sunday Night Futures

Weekend:

• Schedule for Week of May 19, 2024

Monday:

• At 10:30 AM ET, Speech, Fed Vice Chair Philip Jefferson, U.S. Economic Outlook and Housing Price Dynamics, At the Mortgage Bankers Association (MBA) Secondary and Capital Markets Conference, New York, N.Y.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 6 and DOW futures are up 39 (fair value).

Oil prices were up over the last week with WTI futures at $80.06 per barrel and Brent at $83.98 per barrel. A year ago, WTI was at $72, and Brent was at $75 - so WTI oil prices are up about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.57 per gallon. A year ago, prices were at $3.53 per gallon, so gasoline prices are up $0.04 year-over-year.

The Top Ten Job Streaks: Current Streak is in 5th Place

by Calculated Risk on 5/19/2024 09:50:00 AM

For fun:

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2020 | 113 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 40 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Saturday, May 18, 2024

Real Estate Newsletter Articles this Week: Housing Starts Increased to 1.360 million Annual Rate in April

by Calculated Risk on 5/18/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

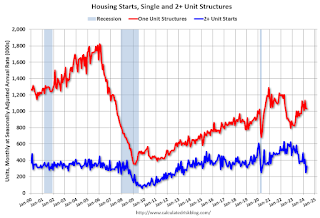

• Single Family Starts Up 18% Year-over-year in March; Multi-Family Starts Down Sharply YoY

• Lawler: Early Read on Existing Home Sales in April & 3rd Look at Local Housing Markets

• Part 2: Current State of the Housing Market; Overview for mid-May 2024

• MBA: Mortgage Delinquencies Increased Slightly in Q1 2024

• 2nd Look at Local Housing Markets in April

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of May 19, 2024

by Calculated Risk on 5/18/2024 08:11:00 AM

The key reports this week are April New and Existing Home Sales.

10:30 AM: Speech, Fed Vice Chair Philip Jefferson, U.S. Economic Outlook and Housing Price Dynamics, At the Mortgage Bankers Association (MBA) Secondary and Capital Markets Conference, New York, N.Y.

No major economic releases scheduled.

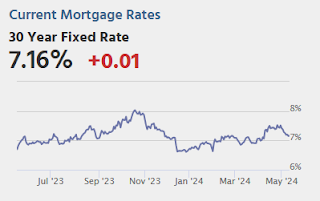

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

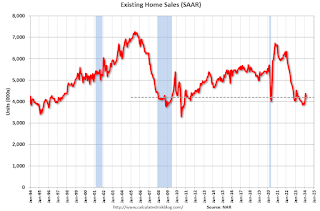

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 4.18 million SAAR, down from 4.19 million.

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 4.18 million SAAR, down from 4.19 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 4.23 million SAAR.

During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes, Minutes Meeting of April 30-May 1, 2024

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, down from 222 thousand last week.

8:30 AM ET: Chicago Fed National Activity Index for April. This is a composite index of other data.

10:00 AM: New Home Sales for April from the Census Bureau.

10:00 AM: New Home Sales for April from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 680 thousand SAAR, down from 693 thousand SAAR in March.

11:00 AM: the Kansas City Fed manufacturing survey for May.

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 0.6% decrease in durable goods orders.

10:00 AM: University of Michigan's Consumer sentiment index (Final for May). The consensus is for a reading of 67.4.

Friday, May 17, 2024

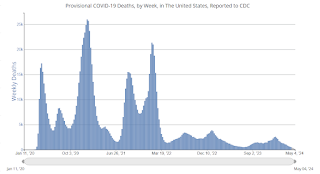

May 17th COVID Update: Weekly Deaths at New Pandemic Low!

by Calculated Risk on 5/17/2024 07:13:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 443 | 532 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

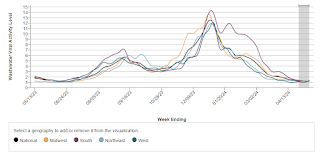

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Hotels: Occupancy Rate Increased 2.1% Year-over-year

by Calculated Risk on 5/17/2024 01:12:00 PM

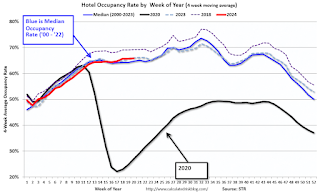

The U.S. hotel industry reported higher performance from the previous week and positive comparisons year over year, according to CoStar’s latest data through 11 May. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

5-11 May 2024 (percentage change from comparable week in 2023):

• Occupancy: 66.1% (+2.1%)

• Average daily rate (ADR): US$162.14 (+4.4%)

• Revenue per available room (RevPAR): US$107.24 (+6.6%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, black is 2020, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Lawler: Early Read on Existing Home Sales in April & 3rd Look at Local Housing Markets

by Calculated Risk on 5/17/2024 09:43:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in April & 3rd Look at Local Housing Markets

A brief excerpt:

From housing economist Tom Lawler:There is much more in the article.

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 4.23 million in April, up 1.0% from March’s preliminary pace and up 0.2% from last April’s seasonally adjusted pace. Unadjusted sales should show a significantly larger YOY % increase, as there were two more business days this April compared to last April.

Local realtor/MLS reports suggest that the median existing single-family home sales price last month was up by about 6% from last April.

CR Note: The NAR is scheduled to release April existing home sales on Wednesday, May 22nd. The consensus is for 4.18 million SAAR, down from 4.19 million in March.

...

This is a year-over-year increase NSA for these markets. However, there were two more working days in April 2024 compared to April 2023, so sales Seasonally Adjusted will be lower year-over-year than Not Seasonally Adjusted sales.

If sales increased YoY in April, this will be the first YoY increase since August 2021, following 31 consecutive months with a YoY decline in sales.

Early Q2 GDP Tracking: 1.9% to 3.6%

by Calculated Risk on 5/17/2024 08:23:00 AM

From BofA:

2Q US GDP tracking is down a tenth from our official forecast of 2.0% q/q saar to 1.9% q/q saar [May 17th estimate]From Goldman:

emphasis added

We raised our Q2 GDP tracking estimate by 0.2pp to +3.2% (qoq ar) and our domestic final sales estimate by 0.1pp to +2.5%, but we lowered our past-quarter GDP tracking estimate for Q1 by 0.1pp to +1.2% (vs. +1.6% originally reported). [May 16th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2024 is 3.6 percent on May 16, down from 3.8 percent on May 15. [May 16th estimate]

Thursday, May 16, 2024

Realtor.com Reports Active Inventory Up 35.0% YoY; Most Home For Sale Since August 2020

by Calculated Risk on 5/16/2024 05:07:00 PM

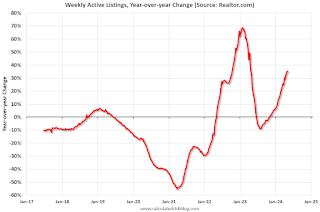

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For April, Realtor.com reported inventory was up 30.4% YoY, but still down almost 36% compared to April 2017 to 2019 levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data for Week Ending May 11, 2024

• Active inventory increased, with for-sale homes 35.0% above year-ago levels.

For the 27th straight week, there were more homes listed for sale versus the prior year, giving homebuyers more options. In fact, last week saw the highest number of homes for sale since August 2020, a significant milestone. Though new listing activity has softened, the recent strength in listing activity means buyers are seeing more homes for sale than they have in almost 4 years. Though buyers are seeing more options at a national level, inventory abundance varies geographically. The South leads the way in inventory growth, with a 43.0% increase in inventory annually in April, while the Northeast saw inventory increase just 4.0%.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 6.6% from one year ago.

Seller activity continued to climb annually last week and accelerated relative to the previous week’s growth. However, the annual increase in new listings was lower than almost every week back to early February, signifying a slowdown in new listings growth. .

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 27th consecutive week.

MBA: Mortgage Delinquencies Increased Slightly in Q1 2024

by Calculated Risk on 5/16/2024 12:01:00 PM

Today, in the Calculated Risk Real Estate Newsletter: MBA: Mortgage Delinquencies Increased Slightly in Q1 2024

A brief excerpt:

From the MBA: Mortgage Delinquencies Increase Slightly in the First Quarter of 2024There is much more in the article.The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.94 percent of all loans outstanding at the end of the first quarter of 2024, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.The following graph shows the percent of loans delinquent by days past due. Overall delinquencies increased slightly in Q1. The sharp increase in 2020 in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

The percent of loans in the foreclosure process decreased year-over-year from 0.57 percent in Q1 2023 to 0.46 percent in Q1 2024 (red), even with the end of the foreclosure moratoriums, and remains historically low.

...

The primary concern is the increase in 30- and 60-day delinquency rates, and even though the rate is historically low, it has increased from 2.32% in Q1 2023 to 2.92% in Q1 2024. I don’t think this increase is much of a worry, but it is something to watch.