by Calculated Risk on 5/26/2024 08:21:00 AM

Sunday, May 26, 2024

TSA: Airline Travel about 12% Above 2019 Levels to New Record High

The TSA is providing daily travel numbers.

This data is as of May 24th.

Click on graph for larger image.

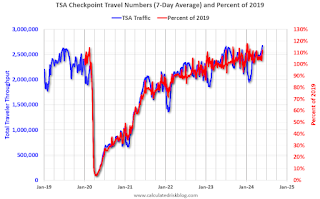

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA (Blue).

The red line is the percent of 2019 for the seven-day average.

Air travel - as a percent of 2019 - is tracking at about 112% of pre-pandemic levels.

Saturday, May 25, 2024

Real Estate Newsletter Articles this Week: New Home Sales Decrease to 634,000 Annual Rate in April

by Calculated Risk on 5/25/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

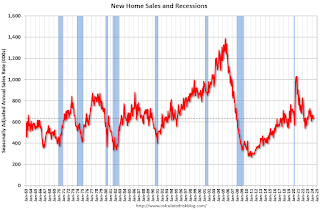

• New Home Sales Decrease to 634,000 Annual Rate in April

• NAR: Existing-Home Sales Decreased to 4.14 million SAAR in April

• Watch Months-of-Supply!

• Single Family Built-for-Rent Up 20% Year-over-year in Q1

• 4th Look at Local Housing Markets in April; California Home Sales Up 4.4% YoY in April

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of May 26, 2024

by Calculated Risk on 5/25/2024 08:11:00 AM

The key reports this week are the second estimate of Q1 GDP, March Case-Shiller house prices, and Personal Income and Outlays for April.

For manufacturing, the May Richmond and Dallas Fed manufacturing surveys will be released.

All US markets will be closed in observance of Memorial Day.

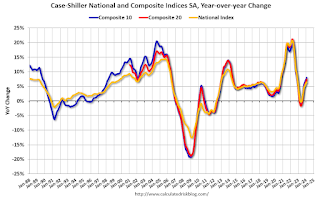

9:00 AM: S&P/Case-Shiller House Price Index for March. The consensus is for the Case-Shiller National Index to increase 6.8% YoY, up from 6.4% YoY in February.

9:00 AM: S&P/Case-Shiller House Price Index for March. The consensus is for the Case-Shiller National Index to increase 6.8% YoY, up from 6.4% YoY in February.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

9:00 AM: FHFA House Price Index for March. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Dallas Fed Survey of Manufacturing Activity for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for May.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 218 thousand initial claims, up from 215 thousand last week.

8:30 AM: Gross Domestic Product, 1st quarter 2023 (Second estimate). The consensus is that real GDP increased 1.2% annualized in Q1, down from the advance estimate of 1.6%.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 0.6% decrease in the index.

8:30 AM ET: Personal Income and Outlays, April 2024. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 2.7% YoY, and core PCE prices up 2.8% YoY.

9:45 AM: Chicago Purchasing Managers Index for May.

Friday, May 24, 2024

May 24th COVID Update: Weekly Deaths at New Pandemic Low!

by Calculated Risk on 5/24/2024 07:11:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 374 | 471 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

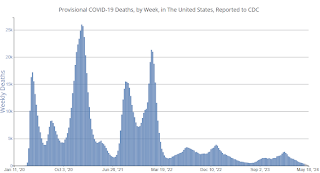

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

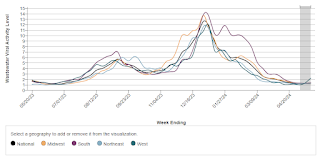

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Q2 GDP Tracking: 1.8% to 3.5%

by Calculated Risk on 5/24/2024 02:21:00 PM

From BofA:

2Q GDP tracking is down a tenth to 1.8% q/q saar. Also, we expect the second print of 1Q GDP to be revised down to 1.2% from 1.6%. [May 24th estimate]From Goldman:

emphasis added

We boosted our Q2 GDP tracking estimate by 0.1pp to +3.2% (qoq ar) and our domestic final sales estimate by the same amount to +2.5%. [May 24th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2024 is 3.5 percent on May 24, down from 3.6 percent on May 16. After recent releases from the US Census Bureau and the National Association of Realtors, the nowcast of second-quarter real gross private domestic investment growth decreased from 5.6 percent to 5.1 percent. [May 24th estimate]

Watch Months-of-Supply!

by Calculated Risk on 5/24/2024 11:16:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Watch Months-of-Supply!

A brief excerpt:

Although inventory is well below normal levels, so are sales. I think we need to keep an eye on months-of-supply. Historically nominal prices declined when months-of-supply approached 6 months - and that is unlikely this year - but we could see months-of-supply back to 2019 levels later this year.There is much more in the article.

What would it take to get months-of-supply back to 2019 levels by mid-year? The following table is a simple exercise. If sales stay depressed at 2023 levels, how much would inventory have to increase to put months-of-supply at 2019 levels?

Hotels: Occupancy Rate Increased 0.2% Year-over-year

by Calculated Risk on 5/24/2024 11:01:00 AM

The U.S. hotel industry reported higher performance from the previous week and positive comparisons year over year, according to CoStar’s latest data through 18 May. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

12-18 May 2024 (percentage change from comparable week in 2023):

• Occupancy: 67.4% (+0.2%)

• Average daily rate (ADR): US$163.11 (+2.6%)

• Revenue per available room (RevPAR): US$109.93 (+2.8%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, black is 2020, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

May Vehicle Sales Forecast: 15.8 million SAAR, Up 2% YoY

by Calculated Risk on 5/24/2024 08:12:00 AM

From WardsAuto: May U.S. Light-Vehicle Sales Tracking to Annualized Rate Flat with April (pay content). Brief excerpt:

There is a good possibility sales end May above expectations, depending on much holiday marketing pulls in additional buyers. Second-quarter sales are pegged at a 15.9 million-unit SAAR, with volume rising 1% from the year-ago period.

emphasis added

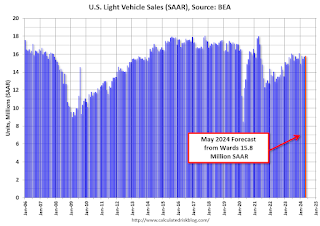

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for May (Red).

On a seasonally adjusted annual rate basis, the Wards forecast of 15.8 million SAAR, would be up 0.4% from last month, and up 1.8% from a year ago.

Thursday, May 23, 2024

Friday: Durable Goods

by Calculated Risk on 5/23/2024 07:09:00 PM

Friday:

• At 8:30 AM ET, Durable Goods Orders for April from the Census Bureau. The consensus is for a 0.6% decrease in durable goods orders.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for May). The consensus is for a reading of 67.4.

Realtor.com Reports Active Inventory Up 35.5% YoY; Most Homes For Sale Since July 2020

by Calculated Risk on 5/23/2024 04:15:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For April, Realtor.com reported inventory was up 30.4% YoY, but still down almost 36% compared to April 2017 to 2019 levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data for Week Ending May 18, 2024

• Active inventory increased, with for-sale homes 35.5% above year-ago levels

For the 28th straight week, there were more homes listed for sale versus the prior year, giving homebuyers more options.

This past week, the inventory of homes for sale grew by 35.5% compared with last year, and it was the highest since July 2020 in the early days of the COVID-19 Pandemic. This growth in inventory is primarily driven by housing markets in the South, which saw a 43.0% year-over-year increase in inventory in April.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 8.1% from one year ago.

Seller activity continued to climb annually last week and accelerated relative to the previous week’s growth. Newly listed homes grew by 8.1% compared with a year ago, an acceleration from the 6.6% growth rate in the previous week.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 28th consecutive week.