by Calculated Risk on 6/03/2024 06:55:00 PM

Monday, June 03, 2024

Vehicles Sales Increase to 15.9 million SAAR in May; Up 2.5% YoY

Wards Auto released their estimate of light vehicle sales for May: May U.S. Light-Vehicle Sales Continue 2024 Trend of Slow, Steady Growth (pay site).

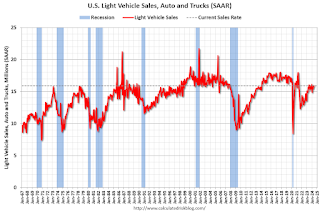

Further confirming as a theme for 2024, growth in May largely was centered in the most affordable CUV and car segments. Other sectors during the first five months of 2024 have either recorded sporadic gains or fell into steady decline, including some, such as fullsize pickups, that are coming off lengthy periods of strong results. So far in 2024, market strength is with more affordable small and midsize CUVs and small sedans.

Click on graph for larger image.

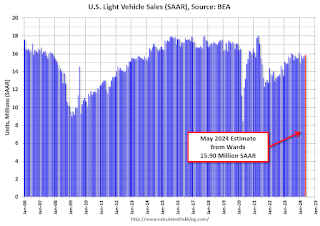

Click on graph for larger image.This graph shows light vehicle sales since 2006 from the BEA (blue) and Wards Auto's estimate for May (red).

Sales in May (15.90 million SAAR) were up 1.0% from April, and up 2.5% from May 2023.

Sales in May were at the consensus forecast.

Sales in May were at the consensus forecast.

Freddie Mac House Price Index Increased in April; Up 6.5% Year-over-year

by Calculated Risk on 6/03/2024 01:17:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Increased in April; Up 6.5% Year-over-year

A brief excerpt:

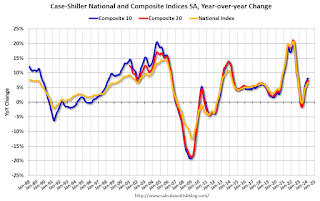

On a year-over-year basis, the National FMHPI was up 6.5% in April, down from up 6.6% YoY in March. The YoY increase peaked at 19.1% in July 2021, and for this cycle, bottomed at up 0.9% YoY in April 2023. ...

As of April, 9 states and D.C. were below their previous peaks, Seasonally Adjusted. The largest seasonally adjusted declines from the recent peak were in Idaho (-2.1%), Hawaii (-1.4%), Utah (-1.1%), and D.C. (-1.1%).

For cities (Core-based Statistical Areas, CBSA), here are the 30 cities with the largest declines from the peak, seasonally adjusted. Austin continues to be the worst performing city.

ICE Mortgage Monitor: "Home Prices Cool for Second Straight Month in April"

by Calculated Risk on 6/03/2024 10:20:00 AM

Today, in the Real Estate Newsletter: ICE Mortgage Monitor: "Home Prices Cool for Second Straight Month in April"

Brief excerpt:

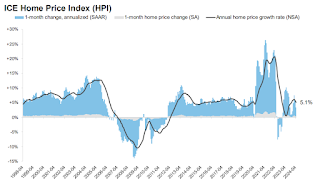

Press Release: ICE Mortgage Monitor: Home Prices Cool for Second Straight Month in April as Purchase Demand Softens, Inventory Deficits ImproveThere is much more in the article.Here is the year-over-year in house prices according to the ICE Home Price Index (HPI). The ICE HPI is a repeat sales index. Black Knight reports the median price change of the repeat sales. The index was up 5.1% year-over-year in April, down from 5.7% YoY in March.

• Home price growth cooled for the second straight month in April as elevated interest rates resulted in softer demand and improved inventory

▪ The annual home price growth rate cooled to 5.1% from a revised 5.7% in March, and as high as 6.1% back in February

▪ Unadjusted prices rose by 0.88% in the month, falling slightly below their -year same-month average for the first time this year

▪ Adjusted for seasonality, prices rose by 0.28% in the month (down from 0.45% in March), equivalent to a 3.4% seasonally adjusted annualized rate SAAR, suggesting annual home price gains will continue to ease in coming months

▪ If adjusted monthly gains continue at their current pace, annual home price growth would be below 4.25% by June and below 4% by July

Construction Spending Decreased 0.1% in April

by Calculated Risk on 6/03/2024 10:18:00 AM

From the Census Bureau reported that overall construction spending decreased:

Construction spending during April 2024 was estimated at a seasonally adjusted annual rate of $2,099.0 billion, 0.1 percent below the revised March estimate of $2,101.5 billion. The April figure is 10.0 percent (±1.5 percent) above the April 2023 estimate of $1,907.8 billion.Private and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,611.9 billion, 0.1 percent below the revised March estimate of $1,613.3 billion. ...

In April, the estimated seasonally adjusted annual rate of public construction spending was $487.1 billion, 0.2 percent below the revised March estimate of $488.2 billion.

Click on graph for larger image.

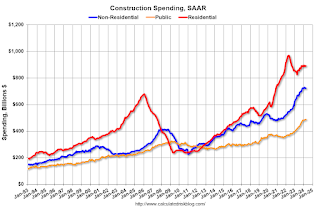

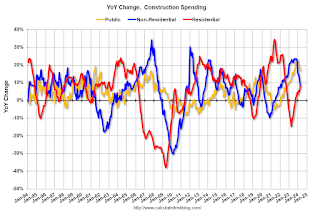

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 8.2% below the recent peak in 2022.

Non-residential (blue) spending is 1.0% below the peak two months ago.

Public construction spending is 0.2% below the peak last month.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 8.0%. Non-residential spending is up 8.3% year-over-year. Public spending is up 16.8% year-over-year.

ISM® Manufacturing index Decreased to 48.7% in May

by Calculated Risk on 6/03/2024 10:00:00 AM

(Posted with permission). The ISM manufacturing index indicated expansion. The PMI® was at 48.7% in May, down from 49.2% in April. The employment index was at 51.1%, up from 48.6% the previous month, and the new orders index was at 45.4%, down from 49.1%.

From ISM: Manufacturing PMI® at 48.7%; May 2024 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in May for the second consecutive month and the 18th time in the last 19 months, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing contracted in May. This was below the consensus forecast.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The Manufacturing PMI® registered 48.7 percent in May, down 0.5 percentage point from the 49.2 percent recorded in April. The overall economy continued in expansion for the 49th month after one month of contraction in April 2020. (A Manufacturing PMI® above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy.) The New Orders Index remained in contraction territory, registering 45.4 percent, 3.7 percentage points lower than the 49.1 percent recorded in April. The May reading of the Production Index (50.2 percent) is 1.1 percentage points lower than April’s figure of 51.3 percent. The Prices Index registered 57 percent, down 3.9 percentage points compared to the reading of 60.9 percent in April. The Backlog of Orders Index registered 42.4 percent, down 3 percentage points compared to the 45.4 percent recorded in April. The Employment Index registered 51.1 percent, up 2.5 percentage points from April’s figure of 48.6 percent.

emphasis added

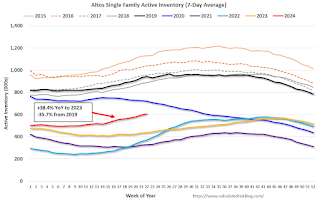

Housing June 3rd Weekly Update: Inventory up 1.7% Week-over-week, Up 38.4% Year-over-year

by Calculated Risk on 6/03/2024 08:12:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, June 02, 2024

Monday: ISM Mfg, Construction Spending, Vehicle Sales

by Calculated Risk on 6/02/2024 06:15:00 PM

Weekend:

• Schedule for Week of June 2, 2024

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for May. The consensus is for the ISM to be at 49.7, up from 49.2 in April.

• Also at 10:00 AM, Construction Spending for April. The consensus is for a 0.2% increase in construction spending.

• Late: Light vehicle sales for May. The consensus is for light vehicle sales to be 15.9 million SAAR in May, up from 15.7 million in April (Seasonally Adjusted Annual Rate).

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 4 and DOW futures are up 27 (fair value).

Oil prices were down over the last week with WTI futures at $76.85 per barrel and Brent at $81.00 per barrel. A year ago, WTI was at $72, and Brent was at $76 - so WTI oil prices are up about 7% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.50 per gallon. A year ago, prices were at $3.54 per gallon, so gasoline prices are down $0.04 year-over-year.

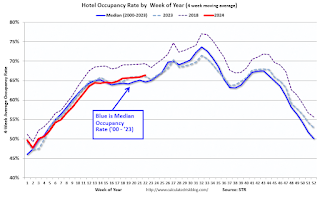

Hotels: Occupancy Rate Increased 1.6% Year-over-year

by Calculated Risk on 6/02/2024 08:21:00 AM

The U.S. hotel industry reported mixed performance results from the previous week but positive comparisons year over year, according to CoStar’s latest data through 25 May. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

19-25 May 2024 (percentage change from comparable week in 2023):

• Occupancy: 67.7% (+1.6%)

• Average daily rate (ADR): US$160.67 (+2.3%)

• Revenue per available room (RevPAR): US$108.73 (+3.9%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Saturday, June 01, 2024

Real Estate Newsletter Articles this Week: House Price Index Up 6.5% year-over-year in March

by Calculated Risk on 6/01/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Case-Shiller: National House Price Index Up 6.5% year-over-year in March

• Inflation Adjusted House Prices 2.2% Below Peak

• Fannie and Freddie: Single Family Serious Delinquency Rate Decreased in April, Multi-family Increased Slightly

• Final Look at Local Housing Markets in April and a Look Ahead to May Sales

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of June 2, 2024

by Calculated Risk on 6/01/2024 08:11:00 AM

The key report scheduled for this week is the May employment report.

Other key reports include the May ISM Manufacturing, Vehicle Sales and April trade balance.

10:00 AM: ISM Manufacturing Index for May. The consensus is for the ISM to be at 49.7, up from 49.2 in April.

10:00 AM: Construction Spending for April. The consensus is for a 0.2% increase in construction spending.

Late: Light vehicle sales for May.

Late: Light vehicle sales for May.The consensus is for light vehicle sales to be 15.9 million SAAR in May, up from 15.7 million in April (Seasonally Adjusted Annual Rate).

10:00 AM ET: Job Openings and Labor Turnover Survey for April from the BLS.

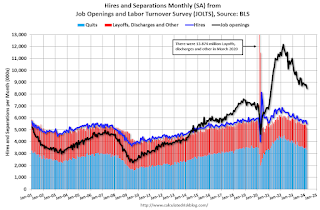

10:00 AM ET: Job Openings and Labor Turnover Survey for April from the BLS. This graph shows job openings (black line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in March to 8.49 million from 8.81 million in February. The number of job openings (black) were down 12% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 174,000 payroll jobs added in May, down from 192,000 in April.

10:00 AM: the ISM Services Index for May. The consensus is for a reading of 50.5, up from 59.4.

8:30 AM: Trade Balance report for April from the Census Bureau.

8:30 AM: Trade Balance report for April from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum.

The consensus is the trade deficit to be $69.7 billion. The U.S. trade deficit was at $69.4 Billion in March.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, down from 219 thousand last week.

8:30 AM: Employment Report for May. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.

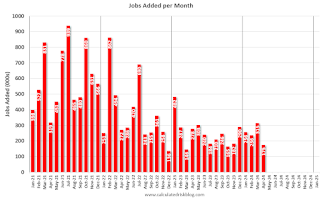

8:30 AM: Employment Report for May. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.There were 175,000 jobs added in April, and the unemployment rate was at 3.9%.

This graph shows the jobs added per month since January 2021.

12:00 PM: Q1 Flow of Funds Accounts of the United States from the Federal Reserve.