by Calculated Risk on 6/07/2024 08:30:00 AM

Friday, June 07, 2024

May Employment Report: 272 thousand Jobs, 4.0% Unemployment Rate

From the BLS:

Total nonfarm payroll employment increased by 272,000 in May, and the unemployment rate changed little at 4.0 percent, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in several industries, led by health care; government; leisure and hospitality; and professional, scientific, and technical services.

...

The change in total nonfarm payroll employment for March was revised down by 5,000, from +315,000 to +310,000, and the change for April was revised down by 10,000, from +175,000 to +165,000. With these revisions, employment in March and April combined is 15,000 lower than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the jobs added per month since January 2021.

Payrolls for March and April were revised down 15 thousand, combined.

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In May, the year-over-year change was 2.76 million jobs. Employment was up solidly year-over-year.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased to 62.5% in May, from 62.7% in April. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate decreased to 62.5% in May, from 62.7% in April. This is the percentage of the working age population in the labor force. The Employment-Population ratio decreased to 60.1% from 60.2% (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate increased to 4.0% in May from 3.9% in April.

This was well above consensus expectations; however, March and April payrolls were revised down by 15,000 combined.

Thursday, June 06, 2024

Friday: Employment Report, Q1 Flow of Funds

by Calculated Risk on 6/06/2024 07:47:00 PM

Friday:

• At 8:30 8:30 AM ET, Employment Report for May. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.

12:00 PM: Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

May Employment Preview

by Calculated Risk on 6/06/2024 04:01:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for May. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.9%.

There were 175,000 jobs added in April, and the unemployment rate was at 3.9%.

From Goldman Sachs economist Spencer Hill

We estimate nonfarm payrolls rose by 160k in May, somewhat below consensus ... We estimate that the unemployment rate was unchanged on a rounded basis at 3.9%.From BofA:

emphasis added

The May employment report is likely to show a healthy but better-balanced labor market. Nonfarm payrolls likely rose by 200k ...Strong hiring is likely to result in the unemployment rate edging down a tenth to 3.8%, and wage growth will likely remain at 3.9% y/y.• ADP Report: The ADP employment report showed 152,000 private sector jobs were added in May. This was below consensus forecasts and suggests job gains slightly below consensus expectations, however, in general, ADP hasn't been very useful in forecasting the BLS report.

• ISM Surveys: Note that the ISM indexes are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index increased to 51.1%, up from 48.6% the previous month. This would suggest about 15,000 jobs lost in manufacturing. The ADP report indicated 20,000 manufacturing jobs lost in May.

The ISM® services employment index increased to 47.1%, from 45.9%. This would suggest few jobs added in the service sector. Combined this suggests few jobs added in May, far below consensus expectations.

• Unemployment Claims: The weekly claims report showed about the same number of initial unemployment claims during the reference week at 216,000 in May compared to 212,000 in April. This suggests a similar number of layoffs in May compared to April.

1st Look at Local Housing Markets in May

by Calculated Risk on 6/06/2024 01:34:00 PM

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in May

A brief excerpt:

NOTE: The tables for active listings, new listings and closed sales all include a comparison to May 2019 for each local market (some 2019 data is not available).There is much more in the article.

This is the first look at several early reporting local markets in May. I’m tracking over 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Closed sales in May were mostly for contracts signed in March and April when 30-year mortgage rates averaged 6.82% and 6.99%, respectively (Freddie Mac PMMS). This is down from the 7%+ mortgage rates in the August through November period (although rates are now back above 7% again).

...

In May, sales in these markets were up 3.3% YoY. Last month, in April, these same markets were up 8.2% year-over-year Not Seasonally Adjusted (NSA).

Sales in all of these markets are down compared to May 2019.

...

This is a year-over-year increase NSA for these early reporting markets. There were the same number of working days in May 2024 compared to May 2023, so the year-over-year change in the seasonally adjusted sales will be about the same as the NSA data suggests.

...

This was just a few early reporting markets. Many more local markets to come!

Realtor.com Reports Active Inventory Up 35.5% YoY

by Calculated Risk on 6/06/2024 11:41:00 AM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For April, Realtor.com reported inventory was up 35.2% YoY, but still down almost 34% compared to April 2017 to 2019 levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data for Week Ending June 1, 2024

• Active inventory increased, with for-sale homes 35.5% above year-ago levels

For the 30th straight week, there were more homes listed for sale versus the prior year, giving homebuyers more options. This past week, the inventory of homes for sale grew by 35.5% compared with last year. This growth in inventory is primarily driven by housing markets in the South, which saw a 47.2% year-over-year increase in inventory in May.

• New listings—a measure of sellers putting homes up for sale—were up this week, by 2.1% from one year ago

Seller activity continued to climb annually last week but decelerated relative to the previous week’s growth. Newly listed homes grew by 2.1% compared with a year ago, a slowdown from the 3.6% growth rate in the previous week.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 30th consecutive week.

Trade Deficit Increased to $74.6 Billion in April

by Calculated Risk on 6/06/2024 08:46:00 AM

The Census Bureau and the Bureau of Economic Analysis reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $74.6 billion in April, up $6.0 billion from $68.6 billion in March, revised.

April exports were $263.7 billion, $2.1 billion more than March exports. April imports were $338.2 billion, $8.0 billion more than March imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Both exports imports increased in April.

Exports are up 5.1% year-over-year; imports are up 4.5% year-over-year.

Both imports and exports decreased sharply due to COVID-19 and then bounced back - imports and exports have generally increased recently.

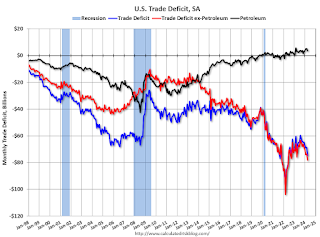

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, exports of petroleum products are positive and have been increasing.

The trade deficit with China increased to $20.1 billion from $20.0 billion a year ago.

Weekly Initial Unemployment Claims Increase to 229,000

by Calculated Risk on 6/06/2024 08:30:00 AM

The DOL reported:

In the week ending June 1, the advance figure for seasonally adjusted initial claims was 229,000, an increase of 8,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 219,000 to 221,000. The 4-week moving average was 222,250, a decrease of 750 from the previous week's revised average. The previous week's average was revised up by 500 from 222,500 to 223,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 222,250.

The previous week was revised up.

Weekly claims were higher than the consensus forecast.

Wednesday, June 05, 2024

Thursday: Trade Deficit, Unemployment Claims

by Calculated Risk on 6/05/2024 07:01:00 PM

Thursday:

• At 8:30 AM ET, Trade Balance report for April from the Census Bureau. The consensus is the trade deficit to be $69.7 billion. The U.S. trade deficit was at $69.4 Billion in March.

• Also at 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, down from 219 thousand last week.

Update: Lumber Prices Down Slightly YoY

by Calculated Risk on 6/05/2024 01:01:00 PM

SPECIAL NOTE: The CME group discontinued the Random Length Lumber Futures contract on May 16, 2023. I've now switched to a new physically-delivered Lumber Futures contract that was started in August 2022.

This graph shows CME random length framing futures through last August (blue), and the new physically-delivered Lumber Futures (LBR) contract starting in August 2022 (Red).

ISM® Services Index Increases to 53.8% in May

by Calculated Risk on 6/05/2024 10:00:00 AM

(Posted with permission). The ISM® Services index was at 53.8%, up from 49.4% last month. The employment index increased to 47.1%, from 45.9%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 53.8% May 2024 Services ISM® Report On Business®

Economic activity in the services sector grew in May after contracting in April for the first time since December 2022, say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®. The Services PMI® registered 53.8 percent, indicating sector expansion for the 46th time in 48 months.The PMI was above expectations.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In May, the Services PMI® registered 53.8 percent, 4.4 percentage points higher than April’s reading of 49.4 percent. The contraction in April ended a string of 15 months of services sector growth following a composite index reading of 49 percent in December 2022; the last contraction before that was in May 2020 (45.4 percent). The Business Activity Index registered 61.2 percent in May, which is 10.3 percentage points higher than the 50.9 percent recorded in April. The New Orders Index expanded in May for the 17th consecutive month after contracting in December 2022 for the first time since May 2020; the figure of 54.1 percent is 1.9 percentage points higher than the April reading of 52.2 percent. The Employment Index contracted for the fifth time in six months, though at a slower rate in May with a reading of 47.1 percent, a 1.2-percentage point increase compared to the 45.9 percent recorded in April.

emphasis added