by Calculated Risk on 6/13/2024 10:49:00 AM

Thursday, June 13, 2024

Part 2: Current State of the Housing Market; Overview for mid-June 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-June 2024

A brief excerpt:

Yesterday, in Part 1: Current State of the Housing Market; Overview for mid-June 2024 I reviewed home inventory, housing starts and sales.There is much more in the article.

In Part 2, I will look at house prices, mortgage rates, rents and more.

...

Other measures of house prices suggest prices will be up about the same YoY in the April Case-Shiller index. The NAR reported median prices were up 5.7% YoY in April, up from 4.7% YoY in March. ICE reported prices were “cooling”, but still up 5.1% YoY in April, down from 5.7% YoY in March, and Freddie Mac reported house prices were up 6.5% YoY in April, down from 6.6% YoY in March.

Here is a comparison of year-over-year change in the FMHPI, median house prices from the NAR, and the Case-Shiller National index.

The FMHPI and the NAR median prices appear to be leading indicators for Case-Shiller. Based on recent monthly data, and the FMHPI, the YoY change in the Case-Shiller index will likely be about the same YoY in April as in March.

Weekly Initial Unemployment Claims Increase to 242,000

by Calculated Risk on 6/13/2024 08:30:00 AM

The DOL reported:

In the week ending June 8, the advance figure for seasonally adjusted initial claims was 242,000, an increase of 13,000 from the previous week's unrevised level of 229,000. The 4-week moving average was 227,000, an increase of 4,750 from the previous week's unrevised average of 222,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 227,000.

The previous week was unrevised.

Weekly claims were much higher than the consensus forecast.

Wednesday, June 12, 2024

Thursday: Unemployment Claims, PPI

by Calculated Risk on 6/12/2024 07:56:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 226 thousand initial claims, down from 229 thousand last week.

• Also at 8:30 AM, The Producer Price Index for May from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.3% increase in core PPI.

FOMC Statement and Projections: No Change to Fed Funds Rate

by Calculated Risk on 6/12/2024 03:51:00 PM

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated. In recent months, there has been modest further progress toward the Committee's 2 percent inflation objective.Here are the projections. Since the last projections were released, the economy has performed close to FOMC expectations.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals have moved toward better balance over the past year. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Michael S. Barr; Raphael W. Bostic; Michelle W. Bowman; Lisa D. Cook; Mary C. Daly; Philip N. Jefferson; Adriana D. Kugler; Loretta J. Mester; and Christopher J. Waller.

emphasis added

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| June 2024 | 1.9 to 2.3 | 1.8 to 2.2 | 1.8 to 2.1 | |

| Mar 2024 | 2.0 to 2.4 | 1.9 to 2.3 | 1.8 to 2.1 | |

The unemployment rate was at 4.0% in April and the projections for Q4 2024 were revised up slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| June 2024 | 3.9 to 4.2 | 3.9 to 4.3 | 3.9 to 4.3 | |

| Mar 2024 | 3.9 to 4.1 | 3.9 to 4.2 | 3.9 to 4.3 | |

As of April 2024, PCE inflation increased 2.7 percent year-over-year (YoY). The projections for PCE inflation were revised up.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| June 2024 | 2.5 to 2.9 | 2.2 to 2.4 | 2.0 to 2.1 | |

| Mar 2024 | 2.3 to 2.7 | 2.1 to 2.2 | 2.0 to 2.1 | |

PCE core inflation increased 2.8 percent YoY in April. The projections for core PCE inflation were revised up.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| June 2024 | 2.8 to 3.0 | 2.3 to 2.4 | 2.0 to 2.1 | |

| Mar 2024 | 2.5 to 2.8 | 2.1 to 2.3 | 2.0 to 2.1 | |

Part 1: Current State of the Housing Market; Overview for mid-June 2024

by Calculated Risk on 6/12/2024 12:16:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-June 2024

A brief excerpt:

This 2-part overview for mid-May provides a snapshot of the current housing market.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

Here is a graph of new listing from Realtor.com’s May 2024 Monthly Housing Market Trends Report showing new listings were up 6.2% year-over-year in May. New listings are still well below pre-pandemic levels. From Realtor.com:

However, sellers continued to list their homes in higher numbers this May as newly listed homes were 6.2% above last year’s levels. While a notable deceleration from last month’s 12.2% growth rate, it marks the seventh month of increasing listing activity after a 17-month streak of decline.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but still below normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be above 7%.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

Cleveland Fed: Median CPI increased 0.2% and Trimmed-mean CPI increased 0.1% in May

by Calculated Risk on 6/12/2024 11:30:00 AM

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% in May. The 16% trimmed-mean Consumer Price Index increased 0.1%. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details.

YoY Measures of Inflation: Services, Goods and Shelter

by Calculated Risk on 6/12/2024 08:50:00 AM

Here are a few measures of inflation:

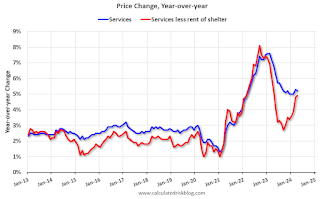

The first graph is the one Fed Chair Powell had mentioned when services less rent of shelter was up around 8% year-over-year. This declined, but has turned up recently, and is now up 5.0% YoY.

This graph shows the YoY price change for Services and Services less rent of shelter through May 2024.

Services less rent of shelter was up 5.0% YoY in May, up from 4.9% YoY in April.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.Commodities less food and energy commodities were at -1.7% YoY in May, down from -1.2% YoY in April.

Here is a graph of the year-over-year change in shelter from the CPI report (through May) and housing from the PCE report (through April)

Here is a graph of the year-over-year change in shelter from the CPI report (through May) and housing from the PCE report (through April)Shelter was up 5.4% year-over-year in May, down from 5.5% in April. Housing (PCE) was up 5.6% YoY in April, down slightly from 5.8% in March.

Core CPI ex-shelter was up 1.9% YoY in May, down from 2.1% in April.

BLS: CPI Unchanged in May; Core CPI increased 0.2%

by Calculated Risk on 6/12/2024 08:30:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in May on a seasonally adjusted basis, after rising 0.3 percent in April, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.3 percent before seasonal adjustment.The change in both CPI and core CPI were below expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

More than offsetting a decline in gasoline, the index for shelter rose in May, up 0.4 percent for the fourth consecutive month. The index for food increased 0.1 percent in May. The food away from home index rose 0.4 percent over the month, while the food at home index was unchanged. The energy index fell 2.0 percent over the month, led by a 3.6-percent decrease in the gasoline index.

The index for all items less food and energy rose 0.2 percent in May, after rising 0.3 percent the preceding month. Indexes which increased in May include shelter, medical care, used cars and trucks, and education. The indexes for airline fares, new vehicles, communication, recreation, and apparel were among those that decreased over the month.

The all items index rose 3.3 percent for the 12 months ending May, a smaller increase than the 3.4-percent increase for the 12 months ending April. The all items less food and energy index rose 3.4 percent over the last 12 months. The energy index increased 3.7 percent for the 12 months ending May. The food index increased 2.1 percent over the last year.

emphasis added

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 6/12/2024 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 15.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending June 7, 2024.

The Market Composite Index, a measure of mortgage loan application volume, increased 15.6 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 26 percent compared with the previous week. The Refinance Index increased 28 percent from the previous week and was 28 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 9 percent from one week earlier. The unadjusted Purchase Index increased 19 percent compared with the previous week and was 12 percent lower than the same week one year ago.

“Mortgage rates were trending lower over the course of last week until a stronger than anticipated employment report resulted in a bounce back, with the weekly average for the 30- year fixed mortgage rate decreasing to 7.02 percent,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “Lower rates earlier in the week meant a strong increase in refinance activity, particularly for VA borrowers, who jumped on the chance to lower their rates. Overall refinance activity was more than 27 percent above one year ago.”

Added Fratantoni, “On a seasonally adjusted basis and compared to the holiday-adjusted level from the prior week, purchase activity also increased. Multiple data sources are now indicating that home inventory levels, while still historically low, are up significantly from last year at this time. This is good news for many prospective homebuyers who have been frustrated by the lack of homes on the market.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 7.02 percent from 7.07 percent, with points unchanged at 0.65 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 12% year-over-year unadjusted.

Tuesday, June 11, 2024

Wednesday: CPI, FOMC Statement

by Calculated Risk on 6/11/2024 07:11:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for May from the BLS. The consensus is for 0.2% increase in CPI (up 3.4% YoY), and a 0.3% increase in core CPI (up 3.5% YoY).

• At 2:00 PM, FOMC Statement. The FOMC is expected to leave the Fed Funds rate unchanged at this meeting.

• Also at 2:00 PM, FOMC Projections This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.