by Calculated Risk on 6/15/2024 02:11:00 PM

Saturday, June 15, 2024

Real Estate Newsletter Articles this Week: Low Level of Delinquencies and Foreclosures

At the Calculated Risk Real Estate Newsletter this week:

• Q1 Update: Delinquencies, Foreclosures and REO

• Part 1: Current State of the Housing Market; Overview for mid-June 2024

• Part 2: Current State of the Housing Market; Overview for mid-June 2024

• 3rd Look at Local Housing Markets in May

• 2nd Look at Local Housing Markets in May

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of June 16, 2024

by Calculated Risk on 6/15/2024 08:11:00 AM

The key reports this week are May Retail Sales, Housing Starts and Existing Home Sales.

For manufacturing, Industrial Production, and the NY and Philly Fed manufacturing surveys, will be released this week.

8:30 AM: The New York Fed Empire State manufacturing survey for June. The consensus is for a reading of -13.0, up from -15.6.

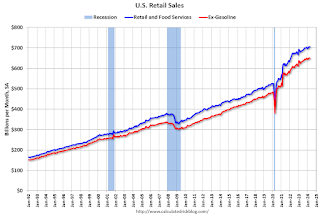

8:30 AM: Retail sales for May is scheduled to be released. The consensus is for a 0.3% increase in retail sales.

8:30 AM: Retail sales for May is scheduled to be released. The consensus is for a 0.3% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

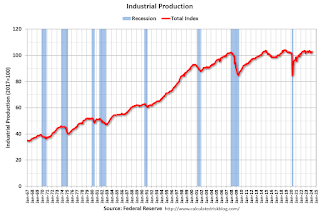

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 78.6%.

All US markets will be closed in observance of Juneteenth National Independence Day

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: The June NAHB homebuilder survey. The consensus is for a reading of 46, up from 45 last month. Any number above 50 indicates that more builders view sales conditions as poor than good.

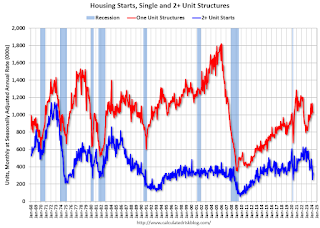

8:30 AM ET: Housing Starts for May.

8:30 AM ET: Housing Starts for May. This graph shows single and total housing starts since 1968.

The consensus is for 1.380 million SAAR, up from 1.360 million SAAR in April.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, down from 242 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for June. The consensus is for a reading of 4.5, unchanged from 4.5 last month.

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 4.10 million SAAR, down from 4.14 million.

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 4.10 million SAAR, down from 4.14 million.The graph shows existing home sales from 1994 through the report last month.

Friday, June 14, 2024

June 14th COVID Update: Weekly Deaths at New Pandemic Low!

by Calculated Risk on 6/14/2024 07:23:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week✅ | 311 | 314 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Q2 GDP Tracking: 1.8% to 3.1%

by Calculated Risk on 6/14/2024 02:01:00 PM

From BofA:

Since last week,1Q GDP tracking is down from 1.6% q/q saar to 1.5% q/q saar and 2Q GDP tracking is up two-tenths to 1.8%. [June 14th estimate]From Goldman:

emphasis added

Our 2024Q2 GDP growth tracking estimate is now down to 2.1% (vs. the Atlanta Fed at 3.1%) and our 2024 Q4/Q4 GDP growth forecast is now down to 2% but still above consensus. [June 10th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2024 is 3.1 percent on June 7, up from 2.6 percent on June 6. [June 7th estimate]

3rd Look at Local Housing Markets in May

by Calculated Risk on 6/14/2024 09:46:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in May

A brief excerpt:

The National Association of Realtors (NAR) is scheduled to release May Existing Home Sales on Friday June 21st at 10 AM ET. The early consensus is for 4.10 million SAAR, down from 4.14 million in April, and down from 4.23 million in May 2023.There is much more in the article.

...

In May, sales in these markets were down 0.6% YoY. Last month, in April, these same markets were up 7.6% year-over-year Not Seasonally Adjusted (NSA). However, there were two more working days in April 2024 than in April 2023, so seasonally adjusted, sales were down YoY last month.

Sales in all of these markets are down compared to May 2019.

...

This is a small year-over-year decrease NSA for these markets. There were the same number of working days in May 2024 compared to May 2023, so the year-over-year change in the seasonally adjusted sales will be about the same as the NSA data suggests.

...

Many more local markets to come!

Hotels: Occupancy Rate Decreased 0.1% Year-over-year

by Calculated Risk on 6/14/2024 08:11:00 AM

The U.S. hotel industry reported higher performance results from the previous week but mixed comparisons year over year, according to CoStar’s latest data through 8 June. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

2-8 June 2024 (percentage change from comparable week in 2023):

• Occupancy: 69.1% (-0.1%)

• Average daily rate (ADR): US$160.90 (+1.8%)

• Revenue per available room (RevPAR): US$111.26 (+1.7%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Thursday, June 13, 2024

Realtor.com Reports Active Inventory Up 36.0% YoY

by Calculated Risk on 6/13/2024 05:55:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For April, Realtor.com reported inventory was up 35.2% YoY, but still down almost 34% compared to April 2017 to 2019 levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data for Week Ending June 8, 2024

• Active inventory increased, with for-sale homes 36.0% above year-ago levels

For the 31st straight week, there were more homes listed for sale versus the prior year, giving homebuyers more options. This past week, the inventory of homes for sale grew by 36.0% compared with last year. This growth in inventory is primarily driven by housing markets in the South, which saw a 47.2% year-over-year increase in inventory in May.

• New listings—a measure of sellers putting homes up for sale—were up this week, by 8.0% from one year ago

Seller activity continued to climb annually last week, accelerating compared to the previous two weeks’ growth. With recent mortgage rates fluctuating around 7%, potential sellers are closely monitoring these changes and adjusting their listing decisions accordingly.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 31st consecutive week.

A Very Early Look at 2025 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 6/13/2024 02:01:00 PM

The BLS reported yesterday:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 3.3 percent over the last 12 months to an index level of 308.163 (1982-84=100). For the month, the index increased 0.1 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U and is not seasonally adjusted (NSA).

• In 2023, the Q3 average of CPI-W was 301.236.

The 2023 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled is for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 3.3% year-over-year in May, and although this is very early - we need the data for July, August and September - my very early guess is COLA will probably be between 2.5% and 3.0% this year, the smallest increase since 1.3% in 2021.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one-year lag. The National Average Wage Index is not available for 2023 yet, although we know wages increased solidly in 2023. If wages increased 5% in 2023, then the contribution base next year will increase to around $177,000 in 2025, from the current $168,600.

Remember - this is a very early look. What matters is average CPI-W, NSA, for all three months in Q3 (July, August and September).

Part 2: Current State of the Housing Market; Overview for mid-June 2024

by Calculated Risk on 6/13/2024 10:49:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-June 2024

A brief excerpt:

Yesterday, in Part 1: Current State of the Housing Market; Overview for mid-June 2024 I reviewed home inventory, housing starts and sales.There is much more in the article.

In Part 2, I will look at house prices, mortgage rates, rents and more.

...

Other measures of house prices suggest prices will be up about the same YoY in the April Case-Shiller index. The NAR reported median prices were up 5.7% YoY in April, up from 4.7% YoY in March. ICE reported prices were “cooling”, but still up 5.1% YoY in April, down from 5.7% YoY in March, and Freddie Mac reported house prices were up 6.5% YoY in April, down from 6.6% YoY in March.

Here is a comparison of year-over-year change in the FMHPI, median house prices from the NAR, and the Case-Shiller National index.

The FMHPI and the NAR median prices appear to be leading indicators for Case-Shiller. Based on recent monthly data, and the FMHPI, the YoY change in the Case-Shiller index will likely be about the same YoY in April as in March.

Weekly Initial Unemployment Claims Increase to 242,000

by Calculated Risk on 6/13/2024 08:30:00 AM

The DOL reported:

In the week ending June 8, the advance figure for seasonally adjusted initial claims was 242,000, an increase of 13,000 from the previous week's unrevised level of 229,000. The 4-week moving average was 227,000, an increase of 4,750 from the previous week's unrevised average of 222,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 227,000.

The previous week was unrevised.

Weekly claims were much higher than the consensus forecast.