by Calculated Risk on 6/25/2024 09:00:00 AM

Tuesday, June 25, 2024

Case-Shiller: National House Price Index Up 6.3% year-over-year in April

S&P/Case-Shiller released the monthly Home Price Indices for April ("April" is a 3-month average of February, March and April closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index Break Prvious Month's All-Time High in April 2024

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.3% annual gain for April, down from a 6.5% annual gain in the previous month. The 10-City Composite saw an annual increase of 8.0%, down from an 8.3% annual increase in the previous month. The 20-City Composite posted a year-over-year increase of 7.2%, dropping from a 7.5% increase in the previous month. San Diego continued to report the highest annual gain among the 20 cities in April with a 10.3% increase this month, followed by New York and Chicago, with increases of 9.4% and 8.7%, respectively. Portland once again held the lowest rank this month for the smallest year-over-year growth, with a 1.7% annual increase in April.

...

The U.S. National Index, the 20-City Composite, and the 10-City Composite upward trends decelerated from last month, with pre-seasonality adjustment increases of 1.2%, 1.36% and 1.38%, respectively.

After seasonal adjustment, the U.S. National Index and 10-City Composite posted the same month-over-month increase of 0.3% and 0.5% respectively as last month, while the 20-City reported a monthly increase of 0.4%.

“For the second consecutive month, we’ve seen our National Index jump at least 1% over its previous all-time high,” says Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. “2024 is closely tracking the strong start observed last year, where March and April posted the largest rise seen prior to a slowdown in the summer and fall. Heading into summer, the market is at an all-time high, once again testing its resilience against the historically more active time of the year.

“Thirteen markets are currently at all-time highs and San Diego reigns supreme once again, topping annual returns for the last six months. The Northeast is the best performing market for the previous nine months, with New York rising 9.4% annually. Sustained outperformance of the Northeast market was last observed in 2011. For the decade that followed, the West and the South held the top posts for performance. It’s now been over a year since we’ve seen the top region come from the South or the West.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index was up 0.5% in April (SA). The Composite 20 index was up 0.4% (SA) in April.

The National index was up 0.3% (SA) in April.

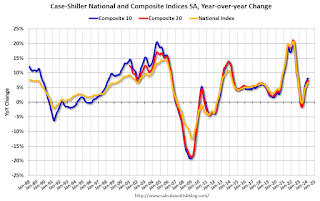

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA was up 8.0% year-over-year. The Composite 20 SA was up 7.2% year-over-year.

The National index SA was up 6.3% year-over-year.

Annual price changes were slightly above expectations. I'll have more later.

Monday, June 24, 2024

Tuesday: Case-Shiller House Prices

by Calculated Risk on 6/24/2024 07:08:00 PM

... ever since last Monday, the average top tier conventional 30yr fixed rate hasn't moved mover than 0.02% on any single day and for the past 3 days, not more than 0.01%. That's a staggering level of "sideways-ness." [30 year fixed 7.02%]Tuesday:

emphasis added

• At 8:30 AM ET, Chicago Fed National Activity Index for May. This is a composite index of other data.

• At 9:00 AM, S&P/Case-Shiller House Price Index for April. The National index was up 6.5% year-over-year in March.

• Also at 9:00 AM, FHFA House Price Index for April. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for June.

• Also at 10:00 AM, State Employment and Unemployment (Monthly) for May 2024.

MBA Survey: Share of Mortgage Loans in Forbearance Decreases Slightly to 0.21% in May

by Calculated Risk on 6/24/2024 04:07:00 PM

From the MBA: Share of Mortgage Loans in Forbearance Decreases Slightly to 0.21% in May

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance declined slightly to 0.21% as of May 31, 2024. According to MBA’s estimate, 105,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 8.2 million borrowers since March 2020.At the end of May, there were about 105,000 homeowners in forbearance plans.

In May 2024, the share of Fannie Mae and Freddie Mac loans in forbearance declined 1 basis point to 0.10%. Ginnie Mae loans in forbearance remained the same relative to the previous month at 0.39%, and the forbearance share for portfolio loans and private-label securities (PLS) also stayed flat at 0.31%.

“The performance of servicing portfolios in May was solid, with about 96 percent of borrowers making their mortgage payments on time,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “There was a slight decline in the performance of post-forbearance loan workouts, but the results were relatively strong with 75 percent of homeowners making their payments in accordance with the workout terms.”

emphasis added

Watch Months-of-Supply!

by Calculated Risk on 6/24/2024 10:50:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Watch Months-of-Supply!

A brief excerpt:

Although inventory is well below normal levels, so are sales. I think we need to keep an eye on months-of-supply. Historically nominal prices declined when months-of-supply approached 6 months - and that is unlikely this year - but we could see months-of-supply back to 2019 levels later this year.There is much more in the article.

What would it take to get months-of-supply back to 2019 levels by mid-year? The following table is a simple exercise. If sales stay depressed at 2023 levels, how much would inventory have to increase to put months-of-supply at 2019 levels?

Housing June 24th Weekly Update: Inventory up 2.2% Week-over-week, Up 37.7% Year-over-year

by Calculated Risk on 6/24/2024 08:12:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, June 23, 2024

Sunday Night Futures

by Calculated Risk on 6/23/2024 06:36:00 PM

Weekend:

• Schedule for Week of June 23, 2024

Monday:

• At 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for June.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are little changed (fair value).

Oil prices were up over the last week with WTI futures at $80.73 per barrel and Brent at $85.24 per barrel. A year ago, WTI was at $69, and Brent was at $74 - so WTI oil prices are up about 17% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.42 per gallon. A year ago, prices were at $3.56 per gallon, so gasoline prices are down $0.14 year-over-year.

Hotels: Occupancy Rate Decreased 0.6% Year-over-year

by Calculated Risk on 6/23/2024 01:04:00 PM

The U.S. hotel industry reported higher performance results from the previous week but mixed comparisons year over year, according to CoStar’s latest data through 15 June. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

9-15 June 2024 (percentage change from comparable week in 2023):

• Occupancy: 70.3% (-0.6%)

• Average daily rate (ADR): US$161.70 (+0.9%)

• Revenue per available room (RevPAR): US$113.62 (+0.3%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Saturday, June 22, 2024

Real Estate Newsletter Articles this Week: Single Family Starts Down Slightly Year-over-year in May; Multi-Family Starts Down 50%

by Calculated Risk on 6/22/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Single Family Starts Down Slightly Year-over-year in May; Multi-Family Starts Down 50%

• NAR: Existing-Home Sales Decreased to 4.11 million SAAR in May

• Lawler: Early Read on Existing Home Sales in May

• 4th Look at Local Housing Markets in May; California Home Sales Down 6% YoY in May

• Comparing the Current Housing Market to the 1978 to 1982 period

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of June 23, 2024

by Calculated Risk on 6/22/2024 08:11:00 AM

The key reports this week are May New Home sales, the third estimate of Q1 GDP, Personal Income and Outlays for May and the April Case-Shiller house price index.

For manufacturing, the June Dallas, Kansas City and Richmond Fed manufacturing surveys will be released.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for June.

8:30 AM ET: Chicago Fed National Activity Index for May. This is a composite index of other data.

9:00 AM: S&P/Case-Shiller House Price Index for April.

9:00 AM: S&P/Case-Shiller House Price Index for April.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The National index was up 6.5% year-over-year in March.

9:00 AM: FHFA House Price Index for April. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for June.

10:00 AM: State Employment and Unemployment (Monthly) for May 2024.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

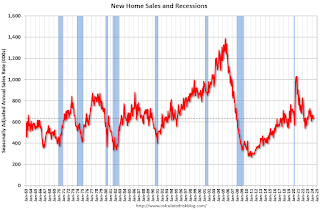

10:00 AM: New Home Sales for May from the Census Bureau.

10:00 AM: New Home Sales for May from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 650 thousand SAAR, up from 634 thousand in April.

During the day: The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 238 thousand last week.

8:30 AM: Gross Domestic Product, 1st quarter 2024 (Third estimate). The consensus is that real GDP increased 1.3% annualized in Q1, unchanged from the second estimate of a 1.3% increase.

8:30 AM: Durable Goods Orders for May from the Census Bureau. The consensus is for a 0.3% increase in durable goods orders.

10:00 AM: Pending Home Sales Index for May. The consensus is for a 0.3% decrease in the index.

11:00 AM: the Kansas City Fed manufacturing survey for June.

8:30 AM ET: Personal Income and Outlays, May 2024. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending.

9:45 AM: Chicago Purchasing Managers Index for June.

10:00 AM: University of Michigan's Consumer sentiment index (Final for June).

Friday, June 21, 2024

June 21st COVID Update: Wastewater Measure Increasing

by Calculated Risk on 6/21/2024 07:02:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week✅ | 316 | 316 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.