by Calculated Risk on 6/27/2024 08:30:00 AM

Thursday, June 27, 2024

Q1 GDP Growth Revised Up to 1.4% Annual Rate

From the BEA: Gross Domestic Product (Third Estimate), Corporate Profits (Revised Estimate), and GDP by Industry, First Quarter 2024

Real gross domestic product (GDP) increased at an annual rate of 1.4 percent in the first quarter of 2024 (table 1), according to the "third" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2023, real GDP increased 3.4 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised down from 2.0% to 1.5%. Residential investment was revised up from 15.4% to 16.0%.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 1.3 percent. The upward revision primarily reflected a downward revision to imports, which are a subtraction in the calculation of GDP, and upward revisions to nonresidential fixed investment and government spending. These revisions were partly offset by a downward revision to consumer spending (refer to "Updates to GDP").

The increase in real GDP primarily reflected increases in consumer spending, residential fixed investment, nonresidential fixed investment, and state and local government spending that were partly offset by a decrease in private inventory investment. Imports increased.

emphasis added

Wednesday, June 26, 2024

Thursday: GDP, Unemployment Claims, Durable Goods, Pending Home Sales

by Calculated Risk on 6/26/2024 07:26:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 238 thousand last week.

• Also at 8:30 AM, Gross Domestic Product, 1st quarter 2024 (Third estimate). The consensus is that real GDP increased 1.3% annualized in Q1, unchanged from the second estimate of a 1.3% increase.

• Also at 8:30 AM, Durable Goods Orders for May from the Census Bureau. The consensus is for a 0.3% increase in durable goods orders.

• At 10:00 AM, Pending Home Sales Index for May. The consensus is for a 0.3% decrease in the index.

• At 11:00 AM, the Kansas City Fed manufacturing survey for June.

AIA: Architecture Billings Declined in May; Multi-family Billings Decline for 22nd Consecutive Month

by Calculated Risk on 6/26/2024 01:46:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: ABI May 2024: Business conditions at architecture firms continue to soften

The AIA/Deltek Architecture Billings Index (ABI) score declined to 42.4 for the month, as more firms reported a decrease in billings in May than in April. In addition, there is increasing softness in the pipeline of new work coming into firms. While inquiries into new projects continued to increase, they did so at a slower pace than in recent months. And the value of new signed design contracts declined further in May, following a small decrease in April. Despite the fact that the high inflation of the last few years has largely receded, elevated interest rates continue to cause hesitation among many clients.• Northeast (47.7); Midwest (41.7); South (46.0); West (46.3)

Firm billings remained soft across all regions and sectors as well in May. Billings declined at firms in all regions of the country for the fourth consecutive month, as conditions remained weakest at firms located in the Midwest. Business conditions also softened further in May at firms with an institutional specialization, while fewer firms with commercial/industrial and multifamily residential specializations reported a decline in billings in May than in April. However, a majority of firms of both specializations still reported weak business conditions.

...

The ABI score is a leading economic indicator of construction activity, providing an approximately nine-to-twelve-month glimpse into the future of nonresidential construction spending activity. The score is derived from a monthly survey of architecture firms that measures the change in the number of services provided to clients.

emphasis added

• Sector index breakdown: commercial/industrial (48.2); institutional (43.2); multifamily residential (47.3)

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 42.4 in May, down from 48.3 in April. Anything below 50 indicates a decrease in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment in 2024.

New Home Sales Decrease to 619,000 Annual Rate in May; Median New Home Price is Down 9% from the Peak

by Calculated Risk on 6/26/2024 10:56:00 AM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales Decrease to 619,000 Annual Rate in May

Brief excerpt:

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 619 thousand, however the three previous months were revised up sharply.There is much more in the article.

...

The next graph shows new home sales for 2023 and 2024 by month (Seasonally Adjusted Annual Rate). Sales in May 2024 were down 16.5% from May 2023.

This year-over-year decline followed 13 consecutive months with a year-over-year increase. In May 2023, seasonally adjusted sales hit the high for the year, so this was a difficult comparison.

New Home Sales Decrease to 619,000 Annual Rate in May

by Calculated Risk on 6/26/2024 10:00:00 AM

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 619 thousand.

The previous three months were revised up sharply.

Sales of new single‐family houses in May 2024 were at a seasonally adjusted annual rate of 619,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 11.3 percent below the revised April rate of 698,000 and is 16.5 percent below the May 2023 estimate of 741,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales were close to pre-pandemic levels.

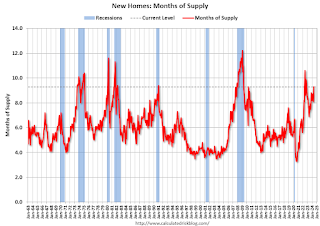

The second graph shows New Home Months of Supply.

The months of supply increased in May to 9.3 months from 8.1 months in April.

The months of supply increased in May to 9.3 months from 8.1 months in April. The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of May was 481,000. This represents a supply of 9.3 months at the current sales rate."Sales were well below expectations of 650 thousand SAAR, however sales for the three previous months were revised up significantly. I'll have more later today.

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 6/26/2024 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending June 21, 2024. This week’s results include an adjustment for the Juneteenth holiday.

The Market Composite Index, a measure of mortgage loan application volume, increased 0.8 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 10 percent compared with the previous week. The Refinance Index was essentially unchanged from the previous week and was 26 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index decreased 10 percent compared with the previous week and was 13 percent lower than the same week one year ago.

“Mortgage rates were mostly lower last week, with the 30-year fixed rate declining slightly to 6.93 percent, the lowest level in more than three months,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Lower rates, however, were still not enough to entice refinance borrowers back, as most continue to hold mortgages with considerably lower rates.”

Added Kan, “Purchase applications did see a small increase after adjusting for the Juneteenth holiday. Government purchase loans, primarily FHA and VA, saw gains of more than 2 percent over the previous week, as homebuyers in those segments sought to take advantage of the recent rate relief.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 6.93 percent from 6.94 percent, with points unchanged at 0.61 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 13% year-over-year unadjusted.

Tuesday, June 25, 2024

Wednesday: New Home Sales

by Calculated Risk on 6/25/2024 08:48:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, New Home Sales for May from the Census Bureau. The consensus is for 650 thousand SAAR, up from 634 thousand in April.

• During the day, The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

June Vehicle Sales Forecast: 15.9 million SAAR, Down 1% YoY

by Calculated Risk on 6/25/2024 05:48:00 PM

From WardsAuto: June U.S. Light-Vehicle Sales Likely Reduced by Cyberattack (pay content). Brief excerpt:

Unknown is how many unit sales in June might be lost because of the attack. Not all affected dealers stopped selling vehicles and many that did have since resumed, often manually processing sales and finding alternative ways to deliver vehicles to customers. Another unknown is how many buyers might have switched to an unaffected dealer to make a purchase. The bright side is that any lost sales in June likely will be made up in July.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for May (Red).

On a seasonally adjusted annual rate basis, the Wards forecast of 15.9 million SAAR, would be unchanged from last month, and down 1.0% from a year ago.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 6/25/2024 01:35:00 PM

Two key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern. This was because distressed sales (at lower price points) happened at a steady rate all year, while regular sales followed the normal seasonal pattern. This made for larger swings in the seasonal factor during the housing bust.

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through March 2024). The seasonal pattern was smaller back in the '90s and early '00s and increased once the bubble burst.

The seasonal swings declined following the bust, however the pandemic price surge changed the month-over-month pattern.

The swings in the seasonal factors were decreasing following the bust but have increased again recently - this time without a surge in distressed sales.

Comments on April House Prices, FHFA: House Prices Increased 0.2% in April

by Calculated Risk on 6/25/2024 09:47:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Up 6.3% year-over-year in April; FHFA: House Prices Increased 0.2% in April, up 6.3% YoY

Excerpt:

S&P/Case-Shiller released the monthly Home Price Indices for April ("April" is a 3-month average of February, March and April closing prices). April closing prices include some contracts signed in December, so there is a significant lag to this data. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in the seasonally adjusted (SA) Case-Shiller National Index was at 0.26%. This was the fifteenth consecutive MoM increase, but this tied December as the smallest MoM increase in the last 14 month.

On a seasonally adjusted basis, prices increased month-to-month in 16 of the 20 Case-Shiller cities. Seasonally adjusted, San Francisco has fallen 7.8% from the recent peak, Seattle is down 6.0% from the peak, Portland down 3.7%, and Phoenix is down 3.7%.