by Calculated Risk on 6/27/2024 03:47:00 PM

Thursday, June 27, 2024

Realtor.com Reports Active Inventory Up 36.1% YoY

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For April, Realtor.com reported inventory was up 35.2% YoY, but still down almost 34% compared to April 2017 to 2019 levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data for Week Ending June 22, 2024

• Active inventory increased, with for-sale homes 36.1% above year-ago levels.

For the 33rd week in a row, the number of for-sale homes grew compared with one year ago. This past week, the inventory of homes for sale grew by 36.1% compared with last year, essentially the same gap as in recent weeks. While recent inventory growth is substantial compared to a year ago, it highlights just how far inventory had fallen. Even after recent growth, active inventory in May was down more than 30% from typical pre-pandemic levels.

• New listings–a measure of sellers putting homes up for sale–were up this week, by 7.4% from one year ago.

Seller activity is up compared to one year ago, but momentum has waned from recent weeks and earlier this year. Realtor.com analysis shows that 87% of outstanding mortgages have a rate below 6%. If these homeowners sell, they are relinquishing relatively inexpensive debt for today’s roughly 7% mortgage rates, a costly proposition. As rates ease, they will cause less drag on the ‘move or stay’ calculus, and we are likely to see an increase in seller interest.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 32nd consecutive week.

Inflation Adjusted House Prices 2.3% Below Peak; Price-to-rent index is 7.6% below 2022 peak

by Calculated Risk on 6/27/2024 12:46:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 2.3% Below Peak

Excerpt:

It has been 18 years since the bubble peak. In the April Case-Shiller house price index released on Tuesday, the seasonally adjusted National Index (SA), was reported as being 73% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 10% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is 1% above the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $300,000 in January 2010, the price would be $432,000 today adjusted for inflation (44% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index.

...

The second graph shows the same two indexes in real terms (adjusted for inflation using CPI).

In real terms (using CPI), the National index is 2.3% below the recent peak, and the Composite 20 index is 3.0% below the recent peak in 2022. Both indexes were mostly unchanged in April in real terms.

NAR: Pending Home Sales Decrease 2.1% in May; Down 6.6% Year-over-year

by Calculated Risk on 6/27/2024 10:00:00 AM

From the NAR: Pending Home Sales Dropped 2.1% in May

Pending home sales in May slipped 2.1%, according to the National Association of REALTORS®. The Midwest and South posted monthly losses in transactions while the Northeast and West recorded gains. Year-over-year, all U.S. regions registered reductions.This was well below expectations. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in June and July.

The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – decreased to 70.8 in May. Year over year, pending transactions were down 6.6%. An index of 100 is equal to the level of contract activity in 2001.

“The market is at an interesting point with rising inventory and lower demand,” said NAR Chief Economist Lawrence Yun. “Supply and demand movements suggest easing home price appreciation in upcoming months. Inevitably, more inventory in a job-creating economy will lead to greater home buying, especially when mortgage rates descend.”

...

The Northeast PHSI ascended 1.1% from last month to 63.6, a decline of 2.3% from May 2023. The Midwest index dropped 0.4% to 70.4 in May, down 5.6% from one year ago.

The South PHSI lowered 5.5% to 83.7 in May, falling 10.4% from the prior year. The West index increased 1.4% in May to 56.7, down 2.1% from May 2023.

emphasis added

Weekly Initial Unemployment Claims Decrease to 233,000

by Calculated Risk on 6/27/2024 08:35:00 AM

The DOL reported:

In the week ending June 22, the advance figure for seasonally adjusted initial claims was 233,000, a decrease of 6,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 238,000 to 239,000. The 4-week moving average was 236,000, an increase of 3,000 from the previous week's revised average. The previous week's average was revised up by 250 from 232,750 to 233,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 236,000.

The previous week was revised up.

Weekly claims were lower than the consensus forecast.

Q1 GDP Growth Revised Up to 1.4% Annual Rate

by Calculated Risk on 6/27/2024 08:30:00 AM

From the BEA: Gross Domestic Product (Third Estimate), Corporate Profits (Revised Estimate), and GDP by Industry, First Quarter 2024

Real gross domestic product (GDP) increased at an annual rate of 1.4 percent in the first quarter of 2024 (table 1), according to the "third" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2023, real GDP increased 3.4 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised down from 2.0% to 1.5%. Residential investment was revised up from 15.4% to 16.0%.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 1.3 percent. The upward revision primarily reflected a downward revision to imports, which are a subtraction in the calculation of GDP, and upward revisions to nonresidential fixed investment and government spending. These revisions were partly offset by a downward revision to consumer spending (refer to "Updates to GDP").

The increase in real GDP primarily reflected increases in consumer spending, residential fixed investment, nonresidential fixed investment, and state and local government spending that were partly offset by a decrease in private inventory investment. Imports increased.

emphasis added

Wednesday, June 26, 2024

Thursday: GDP, Unemployment Claims, Durable Goods, Pending Home Sales

by Calculated Risk on 6/26/2024 07:26:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 238 thousand last week.

• Also at 8:30 AM, Gross Domestic Product, 1st quarter 2024 (Third estimate). The consensus is that real GDP increased 1.3% annualized in Q1, unchanged from the second estimate of a 1.3% increase.

• Also at 8:30 AM, Durable Goods Orders for May from the Census Bureau. The consensus is for a 0.3% increase in durable goods orders.

• At 10:00 AM, Pending Home Sales Index for May. The consensus is for a 0.3% decrease in the index.

• At 11:00 AM, the Kansas City Fed manufacturing survey for June.

AIA: Architecture Billings Declined in May; Multi-family Billings Decline for 22nd Consecutive Month

by Calculated Risk on 6/26/2024 01:46:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: ABI May 2024: Business conditions at architecture firms continue to soften

The AIA/Deltek Architecture Billings Index (ABI) score declined to 42.4 for the month, as more firms reported a decrease in billings in May than in April. In addition, there is increasing softness in the pipeline of new work coming into firms. While inquiries into new projects continued to increase, they did so at a slower pace than in recent months. And the value of new signed design contracts declined further in May, following a small decrease in April. Despite the fact that the high inflation of the last few years has largely receded, elevated interest rates continue to cause hesitation among many clients.• Northeast (47.7); Midwest (41.7); South (46.0); West (46.3)

Firm billings remained soft across all regions and sectors as well in May. Billings declined at firms in all regions of the country for the fourth consecutive month, as conditions remained weakest at firms located in the Midwest. Business conditions also softened further in May at firms with an institutional specialization, while fewer firms with commercial/industrial and multifamily residential specializations reported a decline in billings in May than in April. However, a majority of firms of both specializations still reported weak business conditions.

...

The ABI score is a leading economic indicator of construction activity, providing an approximately nine-to-twelve-month glimpse into the future of nonresidential construction spending activity. The score is derived from a monthly survey of architecture firms that measures the change in the number of services provided to clients.

emphasis added

• Sector index breakdown: commercial/industrial (48.2); institutional (43.2); multifamily residential (47.3)

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 42.4 in May, down from 48.3 in April. Anything below 50 indicates a decrease in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment in 2024.

New Home Sales Decrease to 619,000 Annual Rate in May; Median New Home Price is Down 9% from the Peak

by Calculated Risk on 6/26/2024 10:56:00 AM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales Decrease to 619,000 Annual Rate in May

Brief excerpt:

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 619 thousand, however the three previous months were revised up sharply.There is much more in the article.

...

The next graph shows new home sales for 2023 and 2024 by month (Seasonally Adjusted Annual Rate). Sales in May 2024 were down 16.5% from May 2023.

This year-over-year decline followed 13 consecutive months with a year-over-year increase. In May 2023, seasonally adjusted sales hit the high for the year, so this was a difficult comparison.

New Home Sales Decrease to 619,000 Annual Rate in May

by Calculated Risk on 6/26/2024 10:00:00 AM

The Census Bureau reports New Home Sales in May were at a seasonally adjusted annual rate (SAAR) of 619 thousand.

The previous three months were revised up sharply.

Sales of new single‐family houses in May 2024 were at a seasonally adjusted annual rate of 619,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 11.3 percent below the revised April rate of 698,000 and is 16.5 percent below the May 2023 estimate of 741,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales were close to pre-pandemic levels.

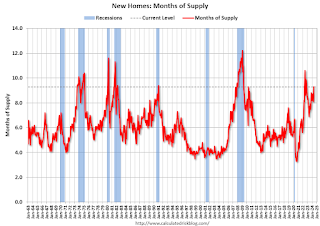

The second graph shows New Home Months of Supply.

The months of supply increased in May to 9.3 months from 8.1 months in April.

The months of supply increased in May to 9.3 months from 8.1 months in April. The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of May was 481,000. This represents a supply of 9.3 months at the current sales rate."Sales were well below expectations of 650 thousand SAAR, however sales for the three previous months were revised up significantly. I'll have more later today.

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 6/26/2024 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending June 21, 2024. This week’s results include an adjustment for the Juneteenth holiday.

The Market Composite Index, a measure of mortgage loan application volume, increased 0.8 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 10 percent compared with the previous week. The Refinance Index was essentially unchanged from the previous week and was 26 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index decreased 10 percent compared with the previous week and was 13 percent lower than the same week one year ago.

“Mortgage rates were mostly lower last week, with the 30-year fixed rate declining slightly to 6.93 percent, the lowest level in more than three months,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Lower rates, however, were still not enough to entice refinance borrowers back, as most continue to hold mortgages with considerably lower rates.”

Added Kan, “Purchase applications did see a small increase after adjusting for the Juneteenth holiday. Government purchase loans, primarily FHA and VA, saw gains of more than 2 percent over the previous week, as homebuyers in those segments sought to take advantage of the recent rate relief.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 6.93 percent from 6.94 percent, with points unchanged at 0.61 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 13% year-over-year unadjusted.