by Calculated Risk on 8/02/2024 08:30:00 AM

Friday, August 02, 2024

July Employment Report: 114 thousand Jobs, 4.3% Unemployment Rate

From the BLS: Employment Situation

The unemployment rate rose to 4.3 percent in July, and nonfarm payroll employment edged up by 114,000, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in health care, in construction, and in transportation and warehousing, while information lost jobs.

...

The change in total nonfarm payroll employment for May was revised down by 2,000, from +218,000 to +216,000, and the change for June was revised down by 27,000, from +206,000 to +179,000. With these revisions, employment in May and June combined is 29,000 lower than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the jobs added per month since January 2021.

Payrolls for May and June were revised down 29 thousand, combined.

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In July, the year-over-year change was 2.51 million jobs. Employment was up solidly year-over-year.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased to 62.7% in July, from 62.6% in June. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased to 62.7% in July, from 62.6% in June. This is the percentage of the working age population in the labor force. The Employment-Population ratio decreased to 60.0% from 60.1% in June (blue line).I'll have more later ...

Thursday, August 01, 2024

Friday: Employment Report

by Calculated Risk on 8/01/2024 07:40:00 PM

Friday:

• At 8:30 AM ET, Employment Report for July. The consensus is for 175,000 jobs added, and for the unemployment rate to be unchanged at 4.1%

July Employment Preview

by Calculated Risk on 8/01/2024 03:01:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for July. The consensus is for 175,000 jobs added, and for the unemployment rate to be unchanged at 4.1%.

There were 206,000 jobs added in June, and the unemployment rate was at 4.1%.

From Goldman Sachs:

We estimate nonfarm payrolls rose by 165k in July, below consensus of +175k ... While an influx of labor supply at the start of summer typically leads to an acceleration in seasonally-adjusted job growth when the labor market is tight, alternative measures of job growth indicate a pace of job creation below the recent payrolls trend, and we assume a 15k drag from Hurricane Beryl. ... We estimate that the unemployment rate was unchanged at 4.1%—in line with consensus.From BofA:

emphasis added

Like the broader economy, the labor market is cooling but not cool. Nonfarm payrolls likely rose by a solid 225k in July after coming in at 206k in June. We look for the unemployment rate and labor force participation rate to remain unchanged at 4.1% and 62.6%, respectively.• ADP Report: The ADP employment report showed 122,000 private sector jobs were added in July. This was below consensus forecasts and suggests job gains below consensus expectations, however, in general, ADP hasn't been very useful in forecasting the BLS report.

• ISM Surveys: Note that the ISM indexes are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index was at 43.4%, down from 49.3% the previous month. This would suggest about 50,000 jobs lost in manufacturing. The ADP report indicated 4,000 manufacturing jobs lost in July.

The ISM® services employment index has not been released yet.

• Unemployment Claims: The weekly claims report showed more initial unemployment claims during the reference week at 245,000 in July compared to 239,000 in June. This suggests more layoffs in July compared to June.

Inflation Adjusted House Prices 1.9% Below 2022 Peak; Price-to-rent index is 7.6% below 2022 peak

by Calculated Risk on 8/01/2024 11:35:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 1.9% Below 2022 Peak

Excerpt:

It has been 18 years since the bubble peak. In the May Case-Shiller house price index released on Tuesday, the seasonally adjusted National Index (SA), was reported as being 73% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 11% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is 2% above the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $300,000 in January 2010, the price would be $432,000 today adjusted for inflation (44% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index.

...

The second graph shows the same two indexes in real terms (adjusted for inflation using CPI).

In real terms (using CPI), the National index is 1.9% below the recent peak, and the Composite 20 index is 2.5% below the recent peak in 2022. Both indexes increased slightly in May in real terms.

Construction Spending Decreased 0.3% in June

by Calculated Risk on 8/01/2024 10:30:00 AM

From the Census Bureau reported that overall construction spending decreased:

Construction spending during June 2024 was estimated at a seasonally adjusted annual rate of $2,148.4 billion, 0.3 percent below the revised May estimate of $2,154.8 billion. The June figure is 6.2 percent above the June 2023 estimate of $2,023.0 billion.Both private and public spending decreased:

emphasis added

pending on private construction was at a seasonally adjusted annual rate of $1,664.6 billion, 0.3 percent below the revised May estimate of $1,668.8 billion. ...

In June, the estimated seasonally adjusted annual rate of public construction spending was $483.9 billion, 0.4 percent below the revised May estimate of $486.0 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential (red) spending is 5.4% below the recent peak in 2022.

Non-residential (blue) spending is 0.4% below the peak in January 2024.

Public construction spending is 0.6% below the peak in April 2024.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 7.3%. Non-residential spending is up 4.2% year-over-year. Public spending is up 7.3% year-over-year.

ISM® Manufacturing index Decreased to 46.8% in July

by Calculated Risk on 8/01/2024 10:00:00 AM

(Posted with permission). The ISM manufacturing index indicated expansion. The PMI® was at 46.8% in July, down from 48.5% in June. The employment index was at 43.4%, down from 49.3% the previous month, and the new orders index was at 47.1%, down from 49.3%.

From ISM: Manufacturing PMI® at 46.8% July 2024 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in July for the fourth consecutive month and the 20th time in the last 21 months, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.This suggests manufacturing contracted in July. This was below the consensus forecast.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The Manufacturing PMI® registered 46.8 percent in July, down 1.7 percentage points from the 48.5 percent recorded in June. The overall economy continued in expansion for the 51st month after one month of contraction in April 2020. (A Manufacturing PMI® above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy.) The New Orders Index remained in contraction territory, registering 47.4 percent, 1.9 percentage points lower than the 49.3 percent recorded in June. The July reading of the Production Index (45.9 percent) is 2.6 percentage points lower than June’s figure of 48.5 percent. The Prices Index registered 52.9 percent, up 0.8 percentage point compared to the reading of 52.1 percent in June. The Backlog of Orders Index registered 41.7 percent, equaling its June reading. The Employment Index registered 43.4 percent, down 5.9 percentage points from June’s figure of 49.3 percent.

emphasis added

Weekly Initial Unemployment Claims Increase to 249,000

by Calculated Risk on 8/01/2024 08:30:00 AM

The DOL reported:

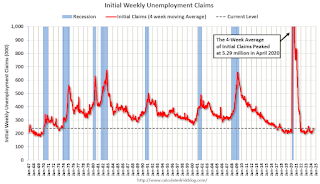

In the week ending July 27, the advance figure for seasonally adjusted initial claims was 249,000, an increase of 14,000 from the previous week's unrevised level of 235,000. The 4-week moving average was 238,000, an increase of 2,500 from the previous week's unrevised average of 235,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 238,000.

The previous week was unrevised.

Weekly claims were higher than the consensus forecast.

Wednesday, July 31, 2024

Thursday: Unemployment Claims, ISM Mfg, Construction Spending, Vehicle Sales

by Calculated Risk on 7/31/2024 07:16:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, down from 235 thousand last week.

• At 10:00 AM, ISM Manufacturing Index for July. The consensus is for the ISM to be at 49.0, up from 48.5 in June.

• At 10:00 AM, Construction Spending for June. The consensus is for a 0.2% increase in construction spending.

• Late, Light vehicle sales for July from the BEA. The consensus is for light vehicle sales to be 16.2 million SAAR in July, up from 15.3 million in June (Seasonally Adjusted Annual Rate).

FOMC Statement: No Change to Fed Funds Rate

by Calculated Risk on 7/31/2024 02:00:00 PM

Fed Chair Powell press conference video here or on YouTube here, starting at 2:30 PM ET.

FOMC Statement:

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have moderated, and the unemployment rate has moved up but remains low. Inflation has eased over the past year but remains somewhat elevated. In recent months, there has been some further progress toward the Committee's 2 percent inflation objective.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals continue to move into better balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent;. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Michael S. Barr; Raphael W. Bostic; Michelle W. Bowman; Lisa D. Cook; Mary C. Daly; Austan D. Goolsbee; Philip N. Jefferson; Adriana D. Kugler; and Christopher J. Waller. Austan D. Goolsbee voted as an alternate member at this meeting.

emphasis added

Freddie Mac House Price Index Increased Slightly in June; Up 5.1% Year-over-year

by Calculated Risk on 7/31/2024 10:51:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Increased Slightly in June; Up 5.1% Year-over-year

A brief excerpt:

Freddie Mac reported that its “National” Home Price Index (FMHPI) increased 0.06% month-over-month on a seasonally adjusted (SA) basis in June. On a year-over-year basis, the National FMHPI was up 5.1% in June, down from up 5.7% YoY in May. The YoY increase peaked at 19.1% in July 2021, and for this cycle, bottomed at up 0.9% YoY in May 2023. ...

As of June, 19 states and D.C. were below their previous peaks, Seasonally Adjusted. The largest seasonally adjusted declines from the recent peak were in Idaho (-4.2%), Montana (-2.5%), Arkansas (-2.0), Texas (-1.7%), Hawaii (-1.7%) and Utah (-1.6%).

For cities (Core-based Statistical Areas, CBSA), here are the 30 cities with the largest declines from the peak, seasonally adjusted. Austin continues to be the worst performing city.