by Calculated Risk on 8/17/2024 08:11:00 AM

Saturday, August 17, 2024

Schedule for Week of August 18, 2024

The key reports this week are July New and Existing Home sales.

Fed Chair Jerome Powell will speak on the "Economic Outlook" at the Jackson Hole Symposium on Friday.

The BLS will release the preliminary employment benchmark revision on Wednesday.

No major economic releases scheduled.

No major economic releases scheduled.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: the Bureau of Labor Statistics (BLS) will release the 2024 Preliminary Benchmark Revision to Establishment Survey Data.

During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes, Meeting of July 30-31

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 235 thousand initial claims, up from 227 thousand last week.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 3.90 million SAAR, up from 3.89 million last month.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 3.90 million SAAR, up from 3.89 million last month.The graph shows existing home sales from 1994 through the report last month.

11:00 AM: the Kansas City Fed manufacturing survey for August.

10:00 AM: New Home Sales for July from the Census Bureau.

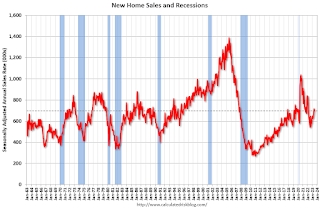

10:00 AM: New Home Sales for July from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 631 thousand SAAR, up from 617 thousand in June.

Friday, August 16, 2024

August 16th COVID Update: Wastewater Measure Might be Peaking

by Calculated Risk on 8/16/2024 07:31:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week🚩 | 566 | 473 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Early Q3 GDP Tracking: Low-to-Mid 2%

by Calculated Risk on 8/16/2024 01:33:00 PM

From BofA:

We initiated our 3Q US GDP tracker with the July retail sales print. The 3Q GDP tracking estimate went up from our official forecast of 2.5% q/q saar to 2.6% q/q saar. [August 16th update]From Goldman:

emphasis added

We left our Q3 GDP tracking estimate unchanged at +2.4% (quarter-over-quarter annualized) and our Q3 domestic final sales forecast stands at +2.0%. [August 16th estimate]

And from the Altanta Fed: GDPNow

And from the Altanta Fed: GDPNow Housing Starts: Single Family Down Year-15% over-year in July; Multi-Family Down 18% YoY

by Calculated Risk on 8/16/2024 09:28:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Housing Starts: Single Family Down Year-15% over-year in July; Multi-Family Down 18% YoY

A brief excerpt:

Total housing starts in July were below expectations and starts in May and June were revised down. A very weak report.There is much more in the article.

The third graph shows the month-to-month comparison for total starts between 2023 (blue) and 2024 (red).

Total starts were down 16.0% in July compared to July 2023.

The YoY decline in total starts was due to a sharp YoY decrease in both multi-family and single-family starts. Single family starts had been up YoY for 12 consecutive months, although with the revisions, single-family starts in May were down slightly year-over-year.

Housing Starts Decreased to 1.238 million Annual Rate in July

by Calculated Risk on 8/16/2024 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 1,238,000. This is 6.8 percent below the revised June estimate of 1,329,000 and is 16.0 percent below the July 2023 rate of 1,473,000. Single-family housing starts in July were at a rate of 851,000; this is 14.1 percent below the revised June figure of 991,000. The July rate for units in buildings with five units or more was 363,000.

Building Permits:

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 1,396,000. This is 4.0 percent below the revised June rate of 1,454,000 and is 7.0 percent below the July 2023 rate of 1,501,000. Single-family authorizations in July were at a rate of 938,000; this is 0.1 percent below the revised June figure of 939,000. Authorizations of units in buildings with five units or more were at a rate of 408,000 in July.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts since 2000.

Multi-family starts (blue, 2+ units) increased in July compared to June. Multi-family starts were down 18.3% year-over-year.

Single-family starts (red) decreased in July and were 14.8% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery - and the recent collapse and recovery in single-family starts.

Total housing starts in July were below expectations and starts in May and June were revised down. A very weak report.

I'll have more later …

Thursday, August 15, 2024

Friday: Housing Starts

by Calculated Risk on 8/15/2024 07:20:00 PM

Thursday:

• At 8:30 AM ET, Housing Starts for July. The consensus is for 1.342 million SAAR, down from 1.353 million SAAR in June.

• At 10:00 AM, State Employment and Unemployment (Monthly) for July 2024

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for August)

Realtor.com Reports Active Inventory Up 35.5% YoY

by Calculated Risk on 8/15/2024 04:30:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For July, Realtor.com reported inventory was up 36.6% YoY, but still down 30.6% compared to April 2017 to 2019 levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data for Week Ending August 10, 2024

• Active inventory increased, with for-sale homes 35.5% above year-ago levels.

For the 40th week in a row, the number of for-sale homes grew compared with one year ago. While the gap with last year has generally been increasing, helping propel inventory to a post-pandemic high in July, this past week the rise was 35.5%, slightly more modest than the rate observed in the prior week..

• New listings–a measure of sellers putting homes up for sale-dipped this week by 2.2% from one year ago.

Despite mortgage rates dropping to their lowest level in over a year, sellers continued to show negative sentiment, leading to a yearly decline in new listings for a second week in a row.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 40th consecutive week.

MBA: Mortgage Delinquencies Increased in Q2 2024

by Calculated Risk on 8/15/2024 12:57:00 PM

Today, in the Calculated Risk Real Estate Newsletter: MBA: Mortgage Delinquencies Increased in Q2 2024

A brief excerpt:

From the MBA: Mortgage Delinquencies Increase in the Second Quarter of 2024There is much more in the article.The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.97 percent of all loans outstanding at the end of the second quarter of 2024, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.The following graph shows the percent of loans delinquent by days past due. Overall delinquencies increased in Q2. The sharp increase in 2020 in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

The percent of loans in the foreclosure process decreased year-over-year from 0.53 percent in Q2 2023 to 0.43 percent in Q2 2024 (red) and remains historically low.

...

The primary concern is the increase in 30- and 60-day delinquency rates, and even though the rate is historically low, it has increased from 2.30% in Q2 2023 to 2.96% in Q2 2024. I don’t think this increase is much of a worry, but it is something to watch.

NAHB: Builder Confidence Declined in August

by Calculated Risk on 8/15/2024 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 39, down from 41 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Moves Lower as Market Waits for Rate Cuts

A lack of affordability and buyer hesitation stemming from elevated interest rates and high home prices contributed to a decline in builder sentiment in August.

Builder confidence in the market for newly built single-family homes was 39 in August, down two points from a downwardly revised reading of 41 in July, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This is the lowest reading since December 2023.

“Challenging housing affordability conditions remain the top concern for prospective home buyers in the current reading of the HMI, as both present sales and traffic readings showed weakness,” said NAHB Chairman Carl Harris, a custom home builder from Wichita, Kan. “The only sustainable way to effectively tame high housing costs is to implement policies that allow builders to construct more attainable, affordable housing.”

Almost three-quarters of the responses to the August HMI were collected during the first week of the month when interest rates averaged 6.73%, according to Freddie Mac. Mortgage rates declined notably the following week to 6.47%, the lowest reading since May 2023.

“With current inflation data pointing to interest rate cuts from the Federal Reserve and mortgage rates down markedly in the second week of August, buyer interest and builder sentiment should improve in the months ahead,” said NAHB Chief Economist Robert Dietz.

The August HMI survey also revealed that 33% of builders cut home prices to bolster sales in August, above the July rate of 31% and the highest share in all of 2024. However, the average price reduction in August held steady at 6% for the 14th straight month. Meanwhile, the use of sales incentives increased to 64% in August from 61% in July, and this was the highest level since April 2019.

...

The HMI index charting current sales conditions in August fell two points to 44 and the gauge charting traffic of prospective buyers also declined by two points to 25. The component measuring sales expectations in the next six months increased one point to 49.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell four points to 52, the Midwest dropped four points to 39, the South decreased two points to 42 and the West held steady at 37.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was below the consensus forecast.

Industrial Production Decreased 0.6% in July

by Calculated Risk on 8/15/2024 09:15:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production fell 0.6 percent in July after increasing 0.3 percent in June. Early July shutdowns concentrated in the petrochemical and related industries due to Hurricane Beryl held down the growth of industrial production by an estimated 0.3 percentage point. Manufacturing output stepped down 0.3 percent as the index for motor vehicles and parts fell nearly 8 percent; manufacturing excluding motor vehicles and parts rose 0.3 percent. The index for mining moved sideways while the index for utilities decreased 3.7 percent. At 102.9 percent of its 2017 average, total industrial production in July was 0.2 percent below its year-earlier level. Capacity utilization moved down to 77.8 percent in July, a rate that is 1.9 percentage points below its long-run (1972–2023) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 77.8% is 1.9% below the average from 1972 to 2022. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased to 102.9. This is above the pre-pandemic level.

Industrial production was below consensus expectations.