by Calculated Risk on 8/19/2024 10:44:00 AM

Monday, August 19, 2024

Lawler: Early Read on Existing Home Sales in July and 3rd Look at Local Housing Markets

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in July and 3rd Look at Local Housing Markets

A brief excerpt:

From housing economist Tom Lawler:There is much more in the article.

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 3.96 million in July, up 1.8% from June’s preliminary pace but down 2.2% from last July’s seasonally adjusted pace.

Unadjusted sales should show an increase from a year ago, with the SA/NSA difference reflecting the higher number of business days this July compared to last July.

Local realtor/MLS reports suggest that the median existing single-family home sales price last month was up by about 3.9% from a year earlier.

CR Note: The National Association of Realtors (NAR) is scheduled to release July Existing Home Sales on Thursday, August 22nd at 10 AM ET. The consensus is for 3.90 million SAAR, up from 3.89 million last month.

...

In July, sales in these markets were up 3.8% YoY. Last month, in June, these same markets were down 12.8% year-over-year Not Seasonally Adjusted (NSA).

Important: There were two more working days in July 2024 compared to July 2023 (22 vs 20), so seasonally adjusted sales will be much lower than the NSA data suggests. This is the opposite of what happened in June.

Sales in all of these markets are down compared to July 2019.

...

More local markets to come!

Housing August 19th Weekly Update: Inventory up 0.8% Week-over-week, Up 40.4% Year-over-year

by Calculated Risk on 8/19/2024 08:12:00 AM

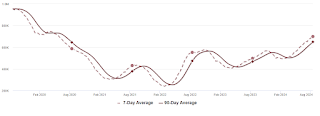

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, August 18, 2024

Sunday Night Futures

by Calculated Risk on 8/18/2024 06:46:00 PM

Weekend:

• Schedule for Week of August 18, 2024

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 6 and DOW futures are up 39 (fair value).

Oil prices were up mostly unchanged over the last week with WTI futures at $76.65 per barrel and Brent at $79.68 per barrel. A year ago, WTI was at $81, and Brent was at $86 - so WTI oil prices are down about 5% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.38 per gallon. A year ago, prices were at $3.84 per gallon, so gasoline prices are down $0.43 year-over-year.

Hotels: Occupancy Rate Increased 0.5% Year-over-year

by Calculated Risk on 8/18/2024 09:12:00 AM

The U.S. hotel industry reported positive comparisons year over year, according to CoStar’s latest data through 10 August. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

4-10 August 2024 (percentage change from comparable week in 2023):

• Occupancy: 68.7% (+0.5%)

• Average daily rate (ADR): US$159.49 (+1.4%)

• Revenue per available room (RevPAR): US$109.51 (+1.9%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Saturday, August 17, 2024

Real Estate Newsletter Articles this Week: Housing Starts Decreased to 1.238 million Annual Rate in July

by Calculated Risk on 8/17/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Housing Starts: Single Family Down Year-15% over-year in July; Multi-Family Down 18% YoY

• Part 1: Current State of the Housing Market; Overview for mid-August 2024

• Part 2: Current State of the Housing Market; Overview for mid-August 2024

• MBA: Mortgage Delinquencies Increased in Q2 2024

• 2nd Look at Local Housing Markets in July

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of August 18, 2024

by Calculated Risk on 8/17/2024 08:11:00 AM

The key reports this week are July New and Existing Home sales.

Fed Chair Jerome Powell will speak on the "Economic Outlook" at the Jackson Hole Symposium on Friday.

The BLS will release the preliminary employment benchmark revision on Wednesday.

No major economic releases scheduled.

No major economic releases scheduled.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: the Bureau of Labor Statistics (BLS) will release the 2024 Preliminary Benchmark Revision to Establishment Survey Data.

During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes, Meeting of July 30-31

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 235 thousand initial claims, up from 227 thousand last week.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 3.90 million SAAR, up from 3.89 million last month.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 3.90 million SAAR, up from 3.89 million last month.The graph shows existing home sales from 1994 through the report last month.

11:00 AM: the Kansas City Fed manufacturing survey for August.

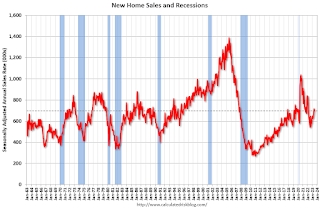

10:00 AM: New Home Sales for July from the Census Bureau.

10:00 AM: New Home Sales for July from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 631 thousand SAAR, up from 617 thousand in June.

Friday, August 16, 2024

August 16th COVID Update: Wastewater Measure Might be Peaking

by Calculated Risk on 8/16/2024 07:31:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week🚩 | 566 | 473 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Early Q3 GDP Tracking: Low-to-Mid 2%

by Calculated Risk on 8/16/2024 01:33:00 PM

From BofA:

We initiated our 3Q US GDP tracker with the July retail sales print. The 3Q GDP tracking estimate went up from our official forecast of 2.5% q/q saar to 2.6% q/q saar. [August 16th update]From Goldman:

emphasis added

We left our Q3 GDP tracking estimate unchanged at +2.4% (quarter-over-quarter annualized) and our Q3 domestic final sales forecast stands at +2.0%. [August 16th estimate]

And from the Altanta Fed: GDPNow

And from the Altanta Fed: GDPNow Housing Starts: Single Family Down Year-15% over-year in July; Multi-Family Down 18% YoY

by Calculated Risk on 8/16/2024 09:28:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Housing Starts: Single Family Down Year-15% over-year in July; Multi-Family Down 18% YoY

A brief excerpt:

Total housing starts in July were below expectations and starts in May and June were revised down. A very weak report.There is much more in the article.

The third graph shows the month-to-month comparison for total starts between 2023 (blue) and 2024 (red).

Total starts were down 16.0% in July compared to July 2023.

The YoY decline in total starts was due to a sharp YoY decrease in both multi-family and single-family starts. Single family starts had been up YoY for 12 consecutive months, although with the revisions, single-family starts in May were down slightly year-over-year.

Housing Starts Decreased to 1.238 million Annual Rate in July

by Calculated Risk on 8/16/2024 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 1,238,000. This is 6.8 percent below the revised June estimate of 1,329,000 and is 16.0 percent below the July 2023 rate of 1,473,000. Single-family housing starts in July were at a rate of 851,000; this is 14.1 percent below the revised June figure of 991,000. The July rate for units in buildings with five units or more was 363,000.

Building Permits:

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 1,396,000. This is 4.0 percent below the revised June rate of 1,454,000 and is 7.0 percent below the July 2023 rate of 1,501,000. Single-family authorizations in July were at a rate of 938,000; this is 0.1 percent below the revised June figure of 939,000. Authorizations of units in buildings with five units or more were at a rate of 408,000 in July.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts since 2000.

Multi-family starts (blue, 2+ units) increased in July compared to June. Multi-family starts were down 18.3% year-over-year.

Single-family starts (red) decreased in July and were 14.8% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery - and the recent collapse and recovery in single-family starts.

Total housing starts in July were below expectations and starts in May and June were revised down. A very weak report.

I'll have more later …