by Calculated Risk on 9/10/2024 11:22:00 AM

Tuesday, September 10, 2024

Leading Index for Commercial Real Estate Increased 3% in August

From Dodge Data Analytics: Dodge Momentum Index Rises 3% in August

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, increased 2.9% in August to 220.4 (2000=100) from the revised July reading of 214.2. Over the month, commercial planning expanded 1.9% and institutional planning improved 5.7%.

“Owners and developers continued to prime the planning queue in August, ahead of next year’s anticipated stronger market conditions,” stated Sarah Martin, associate director of forecasting at Dodge Construction Network. “With the Fed’s September rate cut all but finalized, the influence of selective lending standards and inflation should moderate next year, alongside a modest upgrade to consumer demand. As a result, stronger planning activity was widespread in August, with most nonresidential sectors seeing growth.”

Commercial planning saw another month of broad-based improvements. After slowing down in recent years, warehouse projects have gained momentum over the last three months. Hotels and retail planning have been steadily expanding as well. Data centers continued to dominate large project activity, but the rate at which planning projects entered the queue in August moderated after several months of very strong growth. On the institutional side, healthcare was the primary driver of this past month’s expansion, followed by recreational planning. In August, the DMI was 31% higher than in August of 2023. The commercial segment was up 42% from year-ago levels, while the institutional segment was up 8% over the same period.

...

The DMI is a monthly measure of the value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

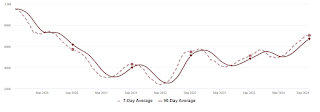

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 220.4 in August, up from 214.2 the previous month.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests a slowdown in 2024 and early 2025, but a pickup in mid-2025.

ICE Mortgage Monitor: House Price Growth Slows, Inventory Surges in Florida and Texas

by Calculated Risk on 9/10/2024 08:22:00 AM

Today, in the Real Estate Newsletter: ICE Mortgage Monitor: House Price Growth Slows, Inventory Surges in Florida and Texas

Brief excerpt:

The local data I track is indicating that Florida and Texas inventory is above normal, whereas inventory is still low in most of the country.

• Every major market has more inventory for sale that at the same time last year, with the largest improvements in the state of Florida, along with individual markets, including Denver, Seattle, and parts of Texas

• More than 1 in 5 markets are now back to, or above, 2017-2019 inventory levels, with markets like Lakeland, Austin, San Antonio, Denver, and Palm Bay all having at least 25% more homes for sale than typical for this time of year

Monday, September 09, 2024

Tuesday: Misc

by Calculated Risk on 9/09/2024 07:13:00 PM

The average lender's top tier 30yr fixed rate fell to the lowest level since April 2023 last week. That's down more than 1.25% over the past 5 months. ... Today brought a significantly smaller improvement, but an improvement on a long-term low technically makes another long-term low.[30 year fixed 6.55%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for August.

• At 8:00 AM, Corelogic House Price index for July

1st Look at Local Housing Markets in August

by Calculated Risk on 9/09/2024 11:30:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in August

A brief excerpt:

NOTE: The tables for active listings, new listings and closed sales all include a comparison to August 2019 for each local market (some 2019 data is not available).There is much more in the article.

This is the first look at several early reporting local markets in August. I’m tracking over 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Closed sales in August were mostly for contracts signed in June and July when 30-year mortgage rates averaged 6.92% and 6.85%, respectively (Freddie Mac PMMS).

...

In August, sales in these markets were up 6.6% YoY. Last month, in July, these same markets were up 5.8% year-over-year Not Seasonally Adjusted (NSA).

Important: There was one fewer working day in August 2024 compared to August 2023 (22 vs 23), so seasonally adjusted sales up be up more than NSA sales. Last month, in July 2024, there were two more working days compared to July 2023 (22 vs 20), so seasonally adjusted sales were lower than the NSA data suggests.

Sales in all of these markets are down significantly compared to July 2019.

...

This was just a several early reporting markets. Many more local markets to come!

Wholesale Used Car Prices Increased in August; Down 3.9% Year-over-year

by Calculated Risk on 9/09/2024 09:08:00 AM

From Manheim Consulting today: Wholesale Used-Vehicle Prices Increased in August

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) were higher in August compared to July. The Manheim Used Vehicle Value Index (MUVVI) rose to 203.9, a decline of 3.9% from a year ago. The seasonal adjustment to the index mitigated the impact on the month, resulting in values that rose 1.2% month over month. The non-adjusted price in August increased by 2.2% compared to July, moving the unadjusted average price down 4.6% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Housing Sept 9th Weekly Update: Inventory Down 0.1% Week-over-week, Up 38.0% Year-over-year

by Calculated Risk on 9/09/2024 08:17:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, September 08, 2024

Sunday Night Futures

by Calculated Risk on 9/08/2024 07:33:00 PM

Weekend:

• Schedule for Week of September 8, 2024

• House Price Weekend: Case-Shiller: National House Price Index Up 5.4% year-over-year in June

• Inflation Adjusted House Prices 1.6% Below 2022 Peak

• Freddie Mac House Price Index Increased Slightly in July; Up 4.4% Year-over-year

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 4 and DOW futures are down 32 (fair value).

Oil prices were up mostly unchanged over the last week with WTI futures at $67.67 per barrel and Brent at $71.06 per barrel. A year ago, WTI was at $88, and Brent was at $92 - so WTI oil prices are down about 24% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.24 per gallon. A year ago, prices were at $3.80 per gallon, so gasoline prices are down $0.56 year-over-year.

Freddie Mac House Price Index Increased Slightly in July; Up 4.4% Year-over-year

by Calculated Risk on 9/08/2024 12:15:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Freddie Mac House Price Index Increased Slightly in July; Up 4.4% Year-over-year

A brief excerpt:

Freddie Mac reported that its “National” Home Price Index (FMHPI) increased 0.05% month-over-month on a seasonally adjusted (SA) basis in June. On a year-over-year basis, the National FMHPI was up 4.4% in July, down from up 5.2% YoY in June. The YoY increase peaked at 19.1% in July 2021, and for this cycle, bottomed at up 0.9% YoY in May 2023. ...

As of July, 17 states and D.C. were below their previous peaks, Seasonally Adjusted. The largest seasonally adjusted declines from the recent peak were in Idaho (-4.2%), Arizona (-1.9%), Arkansas (-1.8), Florida (-1.6%), Texas (-1.3%), and Colorado (-1.1%).

For cities (Core-based Statistical Areas, CBSA), here are the 30 cities with the largest declines from the peak, seasonally adjusted. Austin continues to be the worst performing city. However, 10 of the 30 worst performing cities are now in Florida!

Inflation Adjusted House Prices 1.6% Below 2022 Peak; Price-to-rent index is 7.7% below 2022 peak

by Calculated Risk on 9/08/2024 10:52:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 1.9% Below 2022 Peak

Excerpt:

It has been over 18 years since the bubble peak. In the June Case-Shiller house price index released last week, the seasonally adjusted National Index (SA), was reported as being 73% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 11% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is 2% above the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $300,000 in January 2010, the price would be $432,000 today adjusted for inflation (44% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index.

...

The second graph shows the same two indexes in real terms (adjusted for inflation using CPI).

In real terms (using CPI), the National index is 1.6% below the recent peak, and the Composite 20 index is 2.0% below the recent peak in 2022. Both indexes increased in June in real terms boosted by the slight month-over-month decline in inflation in June.

Saturday, September 07, 2024

Case-Shiller: National House Price Index Up 5.4% year-over-year in June; FHFA House Price Index Declined Slightly month-over-month in June

by Calculated Risk on 9/07/2024 06:50:00 PM

Today, in the Calculated Risk Real Estate Newsletter: House Price Weekend: Case-Shiller: National House Price Index Up 5.4% year-over-year in June

Excerpt:

S&P/Case-Shiller released the monthly Home Price Indices for June ("June" is a 3-month average of April, May and June closing prices). June closing prices include some contracts signed in February, so there is a significant lag to this data. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in the seasonally adjusted (SA) Case-Shiller National Index was at 0.16%. This was the seventeenth consecutive MoM increase, but this was the smallest MoM increase in the last 16 months.

On a seasonally adjusted basis, prices increased month-to-month in 15 of the 20 Case-Shiller cities. Seasonally adjusted, San Francisco has fallen 6.8% from the recent peak, Phoenix is down 4.5% from the peak, Seattle down 4.0%, and Portland is down 3.4%.