by Calculated Risk on 9/20/2024 09:01:00 AM

Friday, September 20, 2024

Hotels: Occupancy Rate Decreased 1.7% Year-over-year

The U.S. hotel industry reported mostly negative year-over-year comparisons, according to CoStar’s latest data through 14 September. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

8-14 September 2024 (percentage change from comparable week in 2023):

• Occupancy: 66.6% (-1.7%)

• Average daily rate (ADR): US$162.05 (+0.2%)

• Revenue per available room (RevPAR): US$107.86 (-1.4%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Thursday, September 19, 2024

Friday: Misc

by Calculated Risk on 9/19/2024 07:15:00 PM

Friday:

• At 10:00 AM ET, State Employment and Unemployment (Monthly) for August 2024

Realtor.com Reports Active Inventory Up 33.0% YoY

by Calculated Risk on 9/19/2024 02:48:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For August, Realtor.com reported inventory was up 5.8% YoY, but still down 26.4% compared to the 2017 to 2019 same month levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data for Week Ending Sept. 14, 2024

• Active inventory increased, with for-sale homes 33.0% above year-ago levels

For the 45th consecutive week dating to November 2023, the number of listings for sale has grown year over year, and this week continues a string of growth rates in the mid-30% range that started in April. This is a slight decrease from last week’s gain of 33.4%. As we discussed above and below, it’s important to note that much of the increase in inventory is due to listings accumulating on a slow market rather than a surge in new listings.

• New listings—a measure of sellers putting homes up for sale—ticked up by 6.6% from one year ago

As the recent easing of mortgage rates kept encouraging many sellers to return to the market, the year-over-year growth in new listings continued this week. With mortgage rates nearly 1 percentage point lower than last year and the announcement of a rate cut, we expect sellers’ motivation to sell could continue to rise this fall. In addition, as rates are likely to be even lower in 2025, a larger increase in listing activity is expected next spring.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 45th consecutive week.

NAR: Existing-Home Sales Decreased to 3.86 million SAAR in August; Median House Prices Increased 3.1% Year-over-Year

by Calculated Risk on 9/19/2024 11:15:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 3.86 million SAAR in August

Excerpt:

Sales Year-over-Year and Not Seasonally Adjusted (NSA)

The fourth graph shows existing home sales by month for 2023 and 2024.

Sales declined 4.2% year-over-year compared to August 2023. This was the thirty-sixth consecutive month with sales down year-over-year.

NAR: Existing-Home Sales Decreased to 3.86 million SAAR in August

by Calculated Risk on 9/19/2024 10:00:00 AM

From the NAR: Existing-Home Sales Declined 2.5% in August

In August 2024, existing-home sales fell in the South, West, and Northeast, while the Midwest registered no change. Year-over-year, sales slipped in three regions but remained stable in the Northeast.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1994.

Sales in August (3.86 million SAAR) were down 2.5% from the previous month and were 4.2% below the August 2023 sales rate.

According to the NAR, inventory increased to 1.35 million in August from 1.34 million the previous month.

According to the NAR, inventory increased to 1.35 million in August from 1.34 million the previous month.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 22.7% year-over-year (blue) in August compared to August 2023.

Inventory was up 22.7% year-over-year (blue) in August compared to August 2023. Months of supply (red) increased to 4.2 months in August from 4.1 months the previous month.

The sales rate was at the consensus forecast. I'll have more later.

Weekly Initial Unemployment Claims Decrease to 219,000

by Calculated Risk on 9/19/2024 08:30:00 AM

The DOL reported:

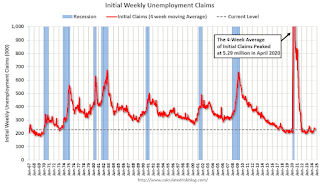

In the week ending September 14, the advance figure for seasonally adjusted initial claims was 219,000, a decrease of 12,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 230,000 to 231,000. The 4-week moving average was 227,500, a decrease of 3,500 from the previous week's revised average. The previous week's average was revised up by 250 from 230,750 to 231,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 230,750.

The previous week was revised up.

Weekly claims were below the consensus forecast.

Wednesday, September 18, 2024

Thursday: Unemployment Claims, Philly Fed Mfg, Existing Home Sales

by Calculated Risk on 9/18/2024 07:29:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 235 thousand initial claims, up from 230 thousand last week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for September. The consensus is for a reading of 2.0, up from -7.0.

• At 10:00 AM, Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 3.85 million SAAR, down from 3.95 million in July.

FOMC Projections

by Calculated Risk on 9/18/2024 02:12:00 PM

Statement here.

Fed Chair Powell press conference video here or on YouTube here, starting at 2:30 PM ET.

Here are the projections. Since the last projections were released, economic growth has been above expectations, the unemployment rate is slightly above expectations, and inflation lower than expected (although there are some "base effects" that might push PCE inflation up a little later this year).

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | 2027 |

| Sept 2024 | 1.9 to 2.1 | 1.8 to 2.2 | 1.9 to 2.3 | 1.8 to 2.1 |

| June 2024 | 1.9 to 2.3 | 1.8 to 2.2 | 1.8 to 2.1 | --- |

The unemployment rate was at 4.2% in August and the projections for Q4 2024 were revised up.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | 2027 |

| Sept 2024 | 4.3 to 4.4 | 4.2 to 4.5 | 4.0 to 4.4 | 4.0 to 4.4 |

| June 2024 | 3.9 to 4.2 | 3.9 to 4.3 | 3.9 to 4.3 | --- |

As of July 2024, PCE inflation increased 2.5 percent year-over-year (YoY). The projections for PCE inflation were revised down.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | 2027 |

| Sept 2024 | 2.2 to 2.4 | 2.1 to 2.2 | 2.0 | 2.0 |

| June 2024 | 2.5 to 2.9 | 2.2 to 2.4 | 2.0 to 2.1 | --- |

PCE core inflation increased 2.6 percent YoY in July. The projections for core PCE inflation were about the same.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | 2027 |

| Sept 2024 | 2.6 to 2.7 | 2.1 to 2.3 | 2.0 | 2.0 |

| June 2024 | 2.8 to 3.0 | 2.3 to 2.4 | 2.0 to 2.1 | --- |

FOMC Statement: 50bp Rate Cut

by Calculated Risk on 9/18/2024 02:00:00 PM

Fed Chair Powell press conference video here or on YouTube here, starting at 2:30 PM ET.

FOMC Statement:

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have slowed, and the unemployment rate has moved up but remains low. Inflation has made further progress toward the Committee's 2 percent objective but remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee has gained greater confidence that inflation is moving sustainably toward 2 percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.

In light of the progress on inflation and the balance of risks, the Committee decided to lower the target range for the federal funds rate by 1/2 percentage point to 4-3/4 to 5 percent. In considering additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Michael S. Barr; Raphael W. Bostic; Lisa D. Cook; Mary C. Daly; Beth M. Hammack; Philip N. Jefferson; Adriana D. Kugler; and Christopher J. Waller. Voting against this action was Michelle W. Bowman, who preferred to lower the target range for the federal funds rate by 1/4 percentage point at this meeting.

emphasis added

AIA: Architecture Billings Declined in August; Multi-family Billings Declined for 25th Consecutive Month

by Calculated Risk on 9/18/2024 11:51:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture firm billings remained sluggish in August, as the AIA/Deltek Architecture Billings Index (ABI) score declined to 45.7

It has now been nearly two years since firms saw sustained growth. However, clients are still expressing interest in new projects, as inquiries into work have continued to increase during that period. However, those inquiries remain challenging to convert to actual new projects in the pipeline, as the value of newly signed design contracts declined for the fifth consecutive month in August.• Northeast (48.2); Midwest (46.6); South (46.8); West (45.7)

Business conditions softened in all regions of the country in August, with firms located in the West reporting the softest conditions for the second consecutive month. Billings were flat at firms located in the Northeast for the previous two months but dipped back into negative territory again this month. Firms of all specializations also saw declining billings in August, with conditions remaining particularly soft at firms with a multifamily residential specialization.

...

The ABI score is a leading economic indicator of construction activity, providing an approximately nine-to-twelve-month glimpse into the future of nonresidential construction spending activity. The score is derived from a monthly survey of architecture firms that measures the change in the number of services provided to clients.

emphasis added

• Sector index breakdown: commercial/industrial (46.6); institutional (47.4); multifamily residential (44.0)

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 45.7 in August, down from 48.2 in July. Anything below 50 indicates a decrease in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment into 2025.