by Calculated Risk on 9/26/2024 04:19:00 PM

Thursday, September 26, 2024

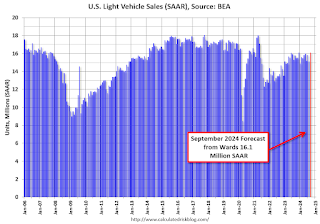

September Vehicle Sales Forecast: 16.1 million SAAR, Up 2% YoY

From WardsAuto: September U.S. Light-Vehicle Sales Forecast for 9-Month-High SAAR Despite Drop in Volume (pay content). Brief excerpt:

If September’s outlook holds true, Q3 sales will decline 1.8% year-over-year. However, deliveries in October-December, goosed by two additional selling days vs. the year-ago period, are forecast to rise 7.4% from like-2023, leaving volume for entire-2024 at 15.9 million, up from 2023’s 15.5 million.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows actual sales from the BEA (Blue), and Wards forecast for September (Red).

On a seasonally adjusted annual rate basis, the Wards forecast of 16.1 million SAAR, would be up 6.4% from last month, and up 2.1% from a year ago.

Inflation Adjusted House Prices 1.5% Below 2022 Peak; Price-to-rent index is 7.8% below 2022 peak

by Calculated Risk on 9/26/2024 12:26:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 1.5% Below 2022 Peak

Excerpt:

It has been over 18 years since the bubble peak. In the July Case-Shiller house price index on Tuesday, the seasonally adjusted National Index (SA), was reported as being 74% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 11% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is 2% above the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $300,000 in January 2010, the price would be $432,000 today adjusted for inflation (44% increase). That is why the second graph below is important - this shows "real" prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index.

...

The second graph shows the same two indexes in real terms (adjusted for inflation using CPI).

In real terms (using CPI), the National index is 1.5% below the recent peak, and the Composite 20 index is 1.8% below the recent peak in 2022. Both indexes increased in July in real terms.

It has now been 26 months since the real peak in house prices. Typically, after a sharp increase in prices, it takes a number of years for real prices to reach new highs (see House Prices: 7 Years in Purgatory)

NAR: Pending Home Sales Increase 0.6% in August; Down 3.0% Year-over-year

by Calculated Risk on 9/26/2024 10:00:00 AM

From the NAR: Pending Home Sales Edged Up 0.6% in August

Pending home sales in August rose 0.6%, according to the National Association of REALTORS®. The Midwest, South and West posted monthly gains in transactions, while the Northeast recorded a loss. Year-over-year, the West registered growth, but the Northeast, Midwest and South declined.This was well below expectations. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in September and October.

The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – increased to 70.6 in August. Year over year, pending transactions were down 3.0%. An index of 100 is equal to the level of contract activity in 2001.

“A slight upward turn reflects a modest improvement in housing affordability, primarily because mortgage rates descended to 6.5% in August,” said NAR Chief Economist Lawrence Yun. “However, contract signings remain near cyclical lows even as home prices keep marching to new record highs.”

...

The Northeast PHSI diminished 4.6% from last month to 61.6, a drop of 2.2% from August 2023. The Midwest index intensified 3.2% to 70.0 in August, down 3.6% from one year ago.

The South PHSI grew 0.1% to 83.6 in August, receding 5.3% from the prior year. The West index increased 3.2% in August to 58.0, up 2.7% from August 2023.

emphasis added

Weekly Initial Unemployment Claims Decrease to 218,000

by Calculated Risk on 9/26/2024 08:39:00 AM

The DOL reported:

In the week ending September 21, the advance figure for seasonally adjusted initial claims was 218,000, a decrease of 4,000 from the previous week's revised level. The previous week's level was revised up by 3,000 from 219,000 to 222,000. The 4-week moving average was 224,750, a decrease of 3,500 from the previous week's revised average. The previous week's average was revised up by 750 from 227,500 to 228,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 224,750.

The previous week was revised up.

Weekly claims were below the consensus forecast.

Q2 GDP Growth Unrevised at 3.0% Annual Rate

by Calculated Risk on 9/26/2024 08:30:00 AM

Real gross domestic product (GDP) increased at an annual rate of 3.0 percent in the second quarter of 2024, according to the "third" estimate released by the U.S. Bureau of Economic Analysis. In the first quarter, real GDP increased 1.6 percent (revised).Here is a Comparison of Third and Second Estimates. PCE growth was revised down from 2.9% to 2.8%. Residential investment was revised down from -2.0% to -2.8%.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was also 3.0 percent. The update primarily reflected upward revisions to private inventory investment and federal government spending that were offset by downward revisions to nonresidential fixed investment and exports. Imports, which are a subtraction in the calculation of GDP, were revised up.

emphasis added

Wednesday, September 25, 2024

Thursday: GDP, Unemployment Claims, Durable Goods, Fed Chair Powell, Pending Home Sales

by Calculated Risk on 9/25/2024 07:13:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 226 thousand initial claims, up from 219 thousand last week.

• Also at 8:30 AM, Gross Domestic Product, 2nd Quarter 2024 (Third Estimate), and Corporate Profits (Revised) The consensus is that real GDP increased 3.0% annualized in Q2, unchanged from the second estimate of 3.0%.

• Also at 8:30 AM, Durable Goods Orders for August from the Census Bureau. The consensus is for a 2.8% decrease in durable goods orders.

• At 9:20 AM, Speech, Fed Chair Jerome Powell, Opening Remarks (via pre-recorded video), At the 2024 U.S. Treasury Market Conference, Federal Reserve Bank of New York, New York, N.Y.

• At 10:00 AM, Pending Home Sales Index for August. The consensus is 3.1% increase in the index.

• At 11:00 AM, the Kansas City Fed manufacturing survey for September.

ICE: Mortgage Delinquency Rate Decreased in August

by Calculated Risk on 9/25/2024 02:21:00 PM

• The national delinquency rate fell 3 basis points (bps) to 3.34% in August, dropping 0.9% for the month but up 5.1% from last year

• The number of borrowers a single payment past due dropped by -26K, while 60-day delinquencies rose marginally by 1K

• Serious delinquencies (loans 90+ days past due but not in active foreclosure) rose 14K (+3.3%) to a six-month high, but remain historically low

• Foreclosure starts fell by 9% from the month prior and remain 32% below their 2019 levels

• Active foreclosure inventory also improved in the month, with the share of mortgages in foreclosure hitting the second-lowest level on record outside of the COVID-19 moratorium

• 5.6K foreclosure sales were completed nationally in August – a +2.6% month-over-month increase, yet down -18.1% from last year and 58% below 2019 levels Prepayment activity (SMM) rose to 0.62% – a level not seen in two years (August 2022) – on easing rates, rising by 4.7% from July and 18.0% from last year

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a table from ICE.

New Home Sales Decrease to 716,000 Annual Rate in August; Median New Home Price is Down 9% from the Peak

by Calculated Risk on 9/25/2024 11:02:00 AM

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales Decrease to 716,000 Annual Rate in August

Brief excerpt:

The Census Bureau reported New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 716 thousand. The previous three months were revised up.There is much more in the article.

...

The next graph shows new home sales for 2023 and 2024 by month (Seasonally Adjusted Annual Rate). Sales in August 2024 were up 9.8% from August 2023.

New home sales, seasonally adjusted, have increased year-over-year in 16 of the last 17 months.

New Home Sales Decrease to 716,000 Annual Rate in August

by Calculated Risk on 9/25/2024 10:00:00 AM

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 716 thousand.

The previous three months were revised up.

Sales of new single-family houses in August 2024 were at a seasonally adjusted annual rate of 716,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 4.7 percent below the revised July rate of 751,000, but is 9.8 percent above the August 2023 estimate of 652,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales were close to pre-pandemic levels.

The second graph shows New Home Months of Supply.

The months of supply increased in August to 7.8 months from 7.3 months in July.

The months of supply increased in August to 7.8 months from 7.3 months in July. The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020.

This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of August was 467,000. This represents a supply of 7.8 months at the current sales rate."Sales were above expectations of 700 thousand SAAR, and sales for the three previous months were revised up. I'll have more later today.

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 9/25/2024 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 11.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending September 20, 2024.

The Market Composite Index, a measure of mortgage loan application volume, increased 11.0 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 11 percent compared with the previous week. The Refinance Index increased 20 percent from the previous week and was 175 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 0.4 percent compared with the previous week and was 2 percent higher than the same week one year ago.

“Mortgage applications increased to their highest level since July 2022, boosted by a 20 percent increase in refinance applications after a large increase the prior week. The 30-year fixed rate decreased for the eighth straight week to 6.13 percent, while the FHA rate decreased to 5.99 percent, breaking the psychologically important 6 percent level,” Joel Kan, MBA’s Vice President and Deputy Chief Economist. “As a result of lower rates, week-over-week gains for both conventional and government refinance applications increased sharply. The refinance share of applications is now at 55.7 percent, and while the level of refinance activity is still modest compared to prior refi waves, they now account for the majority of applications, given the seasonal slowdown in purchase activity.”

Added Kan, “Average loan sizes were higher both for purchase and refinance applications, which pushed the overall average loan size to its highest in the survey’s history at $413,100.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 6.13 percent from 6.15 percent, with points increasing to 0.57 from 0.56 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is up 2.0% year-over-year unadjusted.