by Calculated Risk on 10/07/2024 09:40:00 AM

Monday, October 07, 2024

Wholesale Used Car Prices Decreased in September; Down 5.3% Year-over-year

From Manheim Consulting today: Wholesale Used-Vehicle Prices Declined in September

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) were lower in September compared to August. The Manheim Used Vehicle Value Index (MUVVI) fell to 203.0, a decline of 5.3% from a year ago. The seasonal adjustment to the index amplified the change for the month, as non-seasonally adjusted values fell slightly. The non-adjusted price in September decreased by 0.1% compared to August, moving the unadjusted average price down 4.9% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

Housing Oct 7th Weekly Update: Inventory up 0.4% Week-over-week, Up 36.7% Year-over-year

by Calculated Risk on 10/07/2024 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image. This second inventory graph is courtesy of Altos Research.

This second inventory graph is courtesy of Altos Research.Sunday, October 06, 2024

Sunday Night Futures

by Calculated Risk on 10/06/2024 07:34:00 PM

Weekend:

• Schedule for Week of October 6, 2024

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $73.98 per barrel and Brent at $77.59 per barrel. A year ago, WTI was at $83, and Brent was at $88 - so WTI oil prices are down about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.13 per gallon. A year ago, prices were at $3.71 per gallon, so gasoline prices are down $0.58 year-over-year.

Moody's: Retail Vacancy Rate Decreased Slightly in Q3

by Calculated Risk on 10/06/2024 08:14:00 AM

Note: I covered apartments and offices in the newsletter: Moody's: Apartment Vacancy Rate Unchanged in Q3; Office Vacancy Rate at Record High

From Moody’s Analytics economists: Multifamily Performance Steadied, Office Stress Continued to Manifest, Retail Vacancy Declined, And Industrial Cooled Down

The Q3 2024 data indicated a slight decrease in the longstanding 10.4% vacancy rate for the retail sector, dropping to 10.3% this quarter. Asking rents saw a marginal increase of 0.3% to $21.85, while effective rents rose by 0.4% to $24.87 per square foot. Consumer spending in the third quarter has thus far exceeded expectations, particularly in July, which experienced a 1.1% increase. Although August saw a modest 0.1% increase, it surpassed the anticipated -0.2% decrease. These results were propelled by robust performance in online purchases and core retail sales, excluding automobiles, gasoline, building materials, and food services, alongside a decline in the unemployment rate following four consecutive monthly increases.

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual).

This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Saturday, October 05, 2024

Real Estate Newsletter Articles this Week: Freddie Mac House Price Index Increased Slightly in August

by Calculated Risk on 10/05/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• FHFA’s National Mortgage Database: Outstanding Mortgage Rates, LTV and Credit Scores

• Moody's: Apartment Vacancy Rate Unchanged in Q3; Office Vacancy Rate at Record High

• Freddie Mac House Price Index Increased Slightly in August; Up 3.7% Year-over-year

• Asking Rents Mostly Unchanged Year-over-year

• Final Look at Local Housing Markets in August and a Look Ahead to September Sales

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of October 6, 2024

by Calculated Risk on 10/05/2024 08:11:00 AM

The key economic report this week is September CPI.

Other key indicators include September PPI and the August trade deficit.

No major economic releases scheduled.

6:00 AM: NFIB Small Business Optimism Index for September.

8:30 AM: Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $71.4 billion in August, from $78.8 billion in July.

8:30 AM: Trade Balance report for August from the Census Bureau. The consensus is for the deficit to be $71.4 billion in August, from $78.8 billion in July.This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

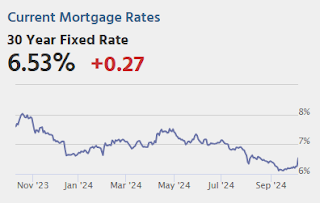

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: FOMC Minutes, Minutes Meeting of September 17-18, 2024

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 228 thousand initial claims, up from 225 thousand last week.

8:30 AM: The Consumer Price Index for September from the BLS. The consensus is for a 0.1% increase in CPI, and a 0.2% increase in core CPI. The consensus is for CPI to be up 2.3% year-over-year and core CPI to be up 3.2% YoY.

8:30 AM: The Producer Price Index for September from the BLS. The consensus is for a 0.1% increase in PPI, and a 0.2% increase in core PPI.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for October).

Friday, October 04, 2024

October 4th COVID Update: Wastewater Measure Declines Further

by Calculated Risk on 10/04/2024 07:00:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 1,120 | 1,287 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Q3 GDP Tracking: Around 3%

by Calculated Risk on 10/04/2024 03:41:00 PM

From BofA:

Since our last weekly publication, our 3Q GDP tracking estimate is up three-tenths to 2.6% q/q saar. [Oct 4th estimate]From Goldman:

emphasis added

We left our Q3 GDP tracking estimate unchanged at +3.2% (quarter-over-quarter annualized) and our domestic final sales estimate unchanged at +2.8%. [Oct 3rd estimate]And from the Atlanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2024 is 2.5 percent on October 1, down from 3.1 percent on September 27. [Oct 1st estimate]

Asking Rents Mostly Unchanged Year-over-year

by Calculated Risk on 10/04/2024 12:37:00 PM

Today, in the Real Estate Newsletter: Asking Rents Mostly Unchanged Year-over-year

Brief excerpt:

Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand)....

Slower household formation and increased supply (more multi-family completions) has kept asking rents under pressure. ...

Welcome to the October 2024 Apartment List National Rent Report. The national median rent dipped by 0.5% in September, as we turn the corner into the slow season for the rental market. The median rent nationally now stands at $1,405, and we’re likely to see that number continue to dip modestly through the remainder of the year.

Realtor.com: 13th Consecutive Month with Year-over-year Decline in Rents

In August 2024, the U.S. median rent continued to decline year over year for the 13th month in a row, down $5, or -0.3%, year over year for 0-2 bedroom properties across the top 50 metros

Comments on September Employment Report

by Calculated Risk on 10/04/2024 09:16:00 AM

The headline jobs number in the September employment report was well above expectations, and July and August payrolls were revised up by 72,000 combined. The participation rate was unchanged, the employment population ratio increased, and the unemployment rate decreased to 4.1%.

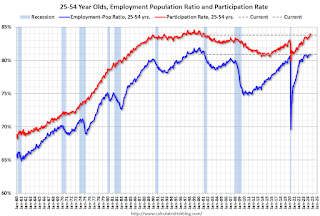

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 years old participation decreased in September to 83.8% from 83.9% in August.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 4.0% YoY in September.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons changed little at 4.6 million in September. This measure is up from 4.1 million a year earlier. These individuals would have preferred full-time employment but were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in September to 4.62 million from 4.83 million in August. This is above the pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 7.7% from 7.9% in the previous month. This is down from the record high in April 2020 of 23.0% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.5%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.63 million workers who have been unemployed for more than 26 weeks and still want a job, up from 1.53 million the previous month.

This is above pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 tie | 1979 | 45 |

| 4 tie | 20241 | 45 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline jobs number in the September employment report was well above expectations, and July and August payrolls were revised up by 72,000 combined. The participation rate was unchanged, the employment population ratio increased, and the unemployment rate decreased to 4.1%.