by Calculated Risk on 10/28/2024 07:19:00 PM

Monday, October 28, 2024

Tuesday: Case-Shiller House Prices, Job Openings

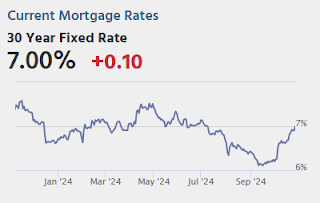

It's no mystery that mortgage rates have had a terrible October. As of last Friday, the average lender's top tier 30yr fixed rates were up to 6.90--an increase of more than 0.625% this month. Today's 0.10% increase brings the rate index up to 7.0% exactly which is the highest we've seen since July 10th.Tuesday:

...

This week sees the return of highly relevant economic data with Friday's jobs report being the most important, by far. Each of the past two jobs reports has had a huge impact on rates due to wide deviations from expectations. If Friday's report is anywhere nearly as surprising, the impact on rates should play out on a similar scale. [30 year fixed 7.00%]

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for August. The consensus is for the Composite 20 index to be up 6.0% year-over-year.

• Also at 9:00 AM, FHFA House Price Index for August. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Job Openings and Labor Turnover Survey for September from the BLS.

• Also at 10:00 AM, The Q3 Housing Vacancies and Homeownership report from the Census Bureau.

Employment Report Forecasts

by Calculated Risk on 10/28/2024 04:04:00 PM

The October employment report will be released on Friday. The consensus is for 120,000 jobs added, and for the unemployment rate to be unchanged at 4.1%.

From Goldman Sachs:

We expect payroll growth of 95k in October (vs. 186k 3-month average) because Big Data measures point to slower job growth, we estimate the hurricanes will subtract 40-50k this month, and the Bureau of Labor Statistics reported that strikes will exert a 41k drag. These drags should have less impact on ADP employment, which we expect to rise 115k in October.From BofA:

We forecast an unchanged 4.1% unemployment rate.

We forecast nonfarm payrolls rose by 100k in October. Although this is below consensus, we’d still view it as a solid print, since we estimate that Hurricane Milton and the Boeing strike lowered payrolls by about 50k. ... Meanwhile, the unemployment rate should move back up to 4.2%, partly due in part to hurricane distortions.

A Proposal to Address the Housing Crisis

by Calculated Risk on 10/28/2024 11:02:00 AM

Today, in the Calculated Risk Real Estate Newsletter: A Proposal to Address the Housing Crisis

Brief excerpt:

Economist Adam Ozimek and John Lettieri (CEO, Economic Innovation Group) have a new proposal to address the housing crisis in the United States: How the next president can solve America’s housing crisisThere is much more in the article.U.S. housing costs are out of control. The median home for sale was rarely more than four times the median household income throughout the 1980s and 1990s. But by 2022, it had risen to nearly six times. Renters have not fared better. In 1980, around one third of renters were cost burdened, meaning they spent 30 percent or more of their income on housing. Fully half of renters are cost burdened today.

The main reason housing is too expensive is that we don’t build nearly enough of it.

Housing Oct 28th Weekly Update: Inventory Down 0.2% Week-over-week, Up 31.2% Year-over-year

by Calculated Risk on 10/28/2024 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image. This second inventory graph is courtesy of Altos Research.

This second inventory graph is courtesy of Altos Research.Sunday, October 27, 2024

Sunday Night Futures

by Calculated Risk on 10/27/2024 06:17:00 PM

Weekend:

• Schedule for Week of October 27, 2024

Monday:

• 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for October. This is the last regional Fed survey for October.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 24 and DOW futures are up 134 (fair value).

Oil prices were down over the last week with WTI futures at $71.78 per barrel and Brent at $76.05 per barrel. A year ago, WTI was at $86, and Brent was at $91 - so WTI oil prices are down about 16% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.08 per gallon. A year ago, prices were at $3.48 per gallon, so gasoline prices are down $0.40 year-over-year.

CES Strike Report: Strikes will Negatively Impact October Employment

by Calculated Risk on 10/27/2024 10:15:00 AM

Employment in October will be negatively impacted by Hurricane Milton and the Boeing strike.

This shows a total of 44,000 workers on strike in October.

[U]nfortunately, it won't be easy to interpret the October jobs report to be released just before the next FOMC meeting. This report will most likely show a significant but temporary loss of jobs from the two recent hurricanes and the strike at Boeing. I expect these factors may reduce employment growth by more than 100,000 this month, and there may be a small effect on the unemployment rate, but I'm not sure it will be that visible.

Saturday, October 26, 2024

Real Estate Newsletter Articles this Week: New Home Sales Increase to 738,000 Annual Rate in September

by Calculated Risk on 10/26/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• New Home Sales Increase to 738,000 Annual Rate in September

• NAR: Existing-Home Sales Decreased to 3.84 million SAAR in September, New Cycle Low

• Lawler: Update on the “Neutral” Rate and Early Read on September Existing Home Sales

• NMHC on Apartments: "Looser market conditions for the ninth consecutive quarter"

• California Home Sales Up 5% SA YoY in September

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of October 27, 2024

by Calculated Risk on 10/26/2024 08:11:00 AM

Boo!

The key reports this week are the advance estimate of Q3 GDP and the October employment report.

Other key indicators include Personal Income and Outlays and PCE prices for September, the Case-Shiller house prices for August, October ISM manufacturing and services indexes, and October vehicle sales.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for October. This is the last regional Fed survey for October.

9:00 AM ET: S&P/Case-Shiller House Price Index for August. The consensus is for the Composite 20 index to be up 6.0% year-over-year.

9:00 AM ET: S&P/Case-Shiller House Price Index for August. The consensus is for the Composite 20 index to be up 6.0% year-over-year.This graph shows the year-over-year change in the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

9:00 AM: FHFA House Price Index for August. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Job Openings and Labor Turnover Survey for September from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for September from the BLS. This graph shows job openings (black line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in August to 8.04 million from 7.71 million in July.

The number of job openings (black) were down 14% year-over-year. Quits were down 14% year-over-year.

10:00 AM: The Q3 Housing Vacancies and Homeownership report from the Census Bureau.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 108,000 jobs added, down from 143,000 in September.

8:30 AM: Gross Domestic Product, 3rd quarter 2024 (advance estimate). The consensus is that real GDP increased 3.0% annualized in Q3, unchanged from 3.0% in Q2.

10:00 AM: Pending Home Sales Index for September. The consensus is 1.0% decrease in the index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, up from 227 thousand last week.

8:30 AM ET: Personal Income and Outlays for September. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.3%. PCE prices are expected to be up 2.1% YoY, and core PCE prices up 2.6% YoY.

9:45 AM: Chicago Purchasing Managers Index for October. The consensus is for a reading of 46.0, down from 46.6 in September.

8:30 AM: Employment Report for October. The consensus is for 120,000 jobs added, and for the unemployment rate to be unchanged at 4.1%.

8:30 AM: Employment Report for October. The consensus is for 120,000 jobs added, and for the unemployment rate to be unchanged at 4.1%.There were 254,000 jobs added in September, and the unemployment rate was at 4.1%.

This graph shows the jobs added per month since January 2021.

10:00 AM: ISM Manufacturing Index for October. The consensus is for 47.6, up from 47.2.

10:00 AM: Construction Spending for September. The consensus is for no change in spending.

All day: Light vehicle sales for October.

All day: Light vehicle sales for October.The consensus is for sales of 15.8 million SAAR, unchanged from 15.8 million SAAR in September (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

Friday, October 25, 2024

October 25th COVID Update: Wastewater Measure Continues to Decline

by Calculated Risk on 10/25/2024 07:11:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 958 | 1,042 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Philly Fed: State Coincident Indexes Increased in 34 States in September (3-Month Basis)

by Calculated Risk on 10/25/2024 01:27:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for September 2024. Over the past three months, the indexes increased in 34 states, decreased in 10 states, and remained stable in six, for a three-month diffusion index of 48. Additionally, in the past month, the indexes increased in 36 states, decreased in seven states, and remained stable in seven, for a one-month diffusion index of 58. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed’s U.S. index increased 0.7 percent over the past three months and 0.3 percent in September.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three-month change in the Philly Fed state coincident indicators. This map was all red during the worst of the Pandemic and also at the worst of the Great Recession.

The map is mostly positive or unchanged on a three-month basis.

Source: Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. In September, 39 states had increasing activity including minor increases.