by Calculated Risk on 10/29/2024 05:30:00 PM

Tuesday, October 29, 2024

HVS: Q3 2024 Homeownership and Vacancy Rates

The Census Bureau released the Residential Vacancies and Homeownership report for Q3 2024 today.

The results of this survey were significantly distorted by the pandemic in 2020.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. Analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

National vacancy rates in the third quarter 2024 were 6.9 percent for rental housing and 1.0 percent for homeowner housing. The rental vacancy rate was not statistically different from the rate in the third quarter 2023 (6.6 percent) and not statistically different from the rate in the second quarter 2024 (6.6 percent).

The homeowner vacancy rate of 1.0 percent was higher than the rate in the third quarter 2023 (0.8 percent) and not statistically different from the rate in the second quarter 2024 (0.9 percent).

The homeownership rate of 65.6 percent was not statistically different from the rate in the third quarter 2023 (66.0 percent) and virtually the same as the rate in the second quarter 2024 (65.6 percent).

emphasis added

Click on graph for larger image.

Click on graph for larger image.The HVS homeownership rate was unchanged at 65.6% in Q3, from 65.6% in Q2.

The results in Q2 and Q3 2020 were distorted by the pandemic and should be ignored.

The HVS homeowner vacancy increased to 1.0% in Q3 from 0.9% in Q2.

The HVS homeowner vacancy increased to 1.0% in Q3 from 0.9% in Q2. Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

Lawler: Mortgage Rates Have Surged Since the Federal Reserve Cut Interest Rates Last Month

by Calculated Risk on 10/29/2024 01:55:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Mortgage Rates Have Surged Since the Federal Reserve Cut Interest Rates Last Month

Excerpt:

From housing economist Tom Lawler:There is much more in the article.

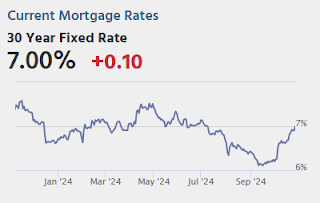

Folks who expected that mortgages rates would decline when the Federal Reserve began cutting its federal funds rate target range have been dazed and confused over the last month and a half. Since the day before the Fed’s 50 bp reduction in its funds rate target on September 18, 30-year MBS yields have surged by 84 to 96 bp, while mortgage rates have jumped by 72 to 89 bp. At the same time intermediate- and longer-term Treasury yields have risen 53 to 67 bp.

There are two main reasons MBS and mortgage rates have risen by more than Treasury rates over this period. First, implied interest rate volatility has surged, as many market participants were caught off-guard by the string of unexpectedly strong economic releases (and slightly higher inflation releases) following the Fed’s rate decision. For example, the BofAML MOVE index, a measure if implied interest rate volatility derived from one-month options on Treasuries across the yield curve, increased from 101.58 on September 17 to 130.92 on October 28, its highest reading since October 30, 2023. (Mortgage investors effectively write a prepayment option to home borrowers, and as such higher implied interest rate volatility increases the premium over Treasuries that investors require to compensate them for prepayment risk.)

And second, MBS option-adjusted spreads, which were at the low-end of the “no Fed MBS intervention” range just prior to the Fed’s action, have since moved higher.

Case-Shiller: National House Price Index Up 4.2% year-over-year in August; Over last 4 months, FHFA Index has increased at a 1.9% Annual Rate

by Calculated Risk on 10/29/2024 10:17:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Up 4.2% year-over-year in August

Excerpt:

S&P/Case-Shiller released the monthly Home Price Indices for August ("August" is a 3-month average of June, July and August closing prices). August closing prices include some contracts signed in April, so there is a significant lag to this data. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in the seasonally adjusted (SA) Case-Shiller National Index was at 0.32% (a 4.0% annual rate), This was the nineteenth consecutive MoM increase in the seasonally adjusted index.

On a seasonally adjusted basis, prices increased month-to-month in 18 of the 20 Case-Shiller cities (prices declined in Tampa and Miami). Seasonally adjusted, San Francisco has fallen 6.8% from the recent peak, Phoenix is down 4.3% from the peak, Portland down 2.7%, and Denver down 2.6%.

BLS: Job Openings "Little Unchanged" at 7.4 million in September

by Calculated Risk on 10/29/2024 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

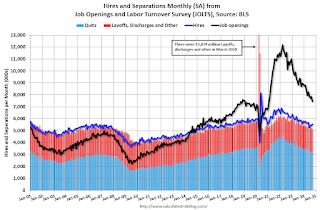

The number of job openings was little changed at 7.4 million on the last business day of September, the U.S. Bureau of Labor Statistics reported today. Over the month, hires changed little at 5.6 million. The number of total separations was unchanged at 5.2 million. Within separations, quits (3.1 million) and layoffs and discharges (1.8 million) changed little.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for September; the employment report this Friday will be for October.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings decreased in September to 7.44 million from 7.86 million in August.

The number of job openings (black) were down 20% year-over-year.

Quits were down 15% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

Case-Shiller: National House Price Index Up 4.2% year-over-year in August

by Calculated Risk on 10/29/2024 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for August ("August" is a 3-month average of June, July and August closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index Records 4.2% Annual Gain in August 2024

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 4.2% annual return for August, down from a 4.8% annual gain in the previous month. The 10-City Composite saw an annual increase of 6.0%, down from a 6.8% annual increase in the previous month. The 20-City Composite posted a year-over-year increase of 5.2%, dropping from a 5.9% increase in the previous month. New York again reported the highest annual gain among the 20 cities with an 8.1% increase in August, followed by Las Vegas and Chicago with annual increases of 7.3% and 7.2%, respectively. Denver posted the smallest year-over-year growth of 0.7%.

...

The pre-seasonally adjusted U.S. National Index, 20-City Composite, and 10-City Composite upward trends reversed in August, with a -0.1% drop for the national index, and the 20-City and 10-City Composites saw -0.3% and -0.4% returns for this month, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0.3%, while the 20-City and 10-City Composite reported a monthly rise of 0.4% and 0.3%, respectively.

“Home price growth is beginning to show signs of strain, recording the slowest annual gain since mortgage rates peaked in 2023,” says Brian D. Luke, CFA, Head of Commodities, Real & Digital Assets. “As students went back to school, home price shoppers appeared less willing to push the index higher than in the summer months. Prices continue to decelerate for the past six months, pushing appreciation rates below their long-run average of 4.8%. After smoothing for seasonality in the data, home prices continued to reach all-time highs, for the 15th month in a row.

“Regionally, all markets continue to remain positive, barely,” Luke continued. “Denver posted the slowest annual gain of all markets this year, dropping below Portland for the first time since the spring. The Northeast remains the best performing region, with the strongest gains for over a year. Currently, only New York, Las Vegas, and Chicago markets are at an all-time high. Comparing average gains of traditional red and blue states highlight a slight advantage for home price markets of blue states. With stronger gains in the Northeast and West than the South, blue states have outperformed red states dating back to July 2023.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index was up 0.3% in August (SA). The Composite 20 index was up 0.4% (SA) in August.

The National index was up 0.3% (SA) in August.

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA was up 6.0% year-over-year. The Composite 20 SA was up 5.2% year-over-year.

The National index SA was up 4.2% year-over-year.

Annual price changes were close to expectations. I'll have more later.

Monday, October 28, 2024

Tuesday: Case-Shiller House Prices, Job Openings

by Calculated Risk on 10/28/2024 07:19:00 PM

It's no mystery that mortgage rates have had a terrible October. As of last Friday, the average lender's top tier 30yr fixed rates were up to 6.90--an increase of more than 0.625% this month. Today's 0.10% increase brings the rate index up to 7.0% exactly which is the highest we've seen since July 10th.Tuesday:

...

This week sees the return of highly relevant economic data with Friday's jobs report being the most important, by far. Each of the past two jobs reports has had a huge impact on rates due to wide deviations from expectations. If Friday's report is anywhere nearly as surprising, the impact on rates should play out on a similar scale. [30 year fixed 7.00%]

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for August. The consensus is for the Composite 20 index to be up 6.0% year-over-year.

• Also at 9:00 AM, FHFA House Price Index for August. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Job Openings and Labor Turnover Survey for September from the BLS.

• Also at 10:00 AM, The Q3 Housing Vacancies and Homeownership report from the Census Bureau.

Employment Report Forecasts

by Calculated Risk on 10/28/2024 04:04:00 PM

The October employment report will be released on Friday. The consensus is for 120,000 jobs added, and for the unemployment rate to be unchanged at 4.1%.

From Goldman Sachs:

We expect payroll growth of 95k in October (vs. 186k 3-month average) because Big Data measures point to slower job growth, we estimate the hurricanes will subtract 40-50k this month, and the Bureau of Labor Statistics reported that strikes will exert a 41k drag. These drags should have less impact on ADP employment, which we expect to rise 115k in October.From BofA:

We forecast an unchanged 4.1% unemployment rate.

We forecast nonfarm payrolls rose by 100k in October. Although this is below consensus, we’d still view it as a solid print, since we estimate that Hurricane Milton and the Boeing strike lowered payrolls by about 50k. ... Meanwhile, the unemployment rate should move back up to 4.2%, partly due in part to hurricane distortions.

A Proposal to Address the Housing Crisis

by Calculated Risk on 10/28/2024 11:02:00 AM

Today, in the Calculated Risk Real Estate Newsletter: A Proposal to Address the Housing Crisis

Brief excerpt:

Economist Adam Ozimek and John Lettieri (CEO, Economic Innovation Group) have a new proposal to address the housing crisis in the United States: How the next president can solve America’s housing crisisThere is much more in the article.U.S. housing costs are out of control. The median home for sale was rarely more than four times the median household income throughout the 1980s and 1990s. But by 2022, it had risen to nearly six times. Renters have not fared better. In 1980, around one third of renters were cost burdened, meaning they spent 30 percent or more of their income on housing. Fully half of renters are cost burdened today.

The main reason housing is too expensive is that we don’t build nearly enough of it.

Housing Oct 28th Weekly Update: Inventory Down 0.2% Week-over-week, Up 31.2% Year-over-year

by Calculated Risk on 10/28/2024 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image. This second inventory graph is courtesy of Altos Research.

This second inventory graph is courtesy of Altos Research.Sunday, October 27, 2024

Sunday Night Futures

by Calculated Risk on 10/27/2024 06:17:00 PM

Weekend:

• Schedule for Week of October 27, 2024

Monday:

• 10:30 AM ET, Dallas Fed Survey of Manufacturing Activity for October. This is the last regional Fed survey for October.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are up 24 and DOW futures are up 134 (fair value).

Oil prices were down over the last week with WTI futures at $71.78 per barrel and Brent at $76.05 per barrel. A year ago, WTI was at $86, and Brent was at $91 - so WTI oil prices are down about 16% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.08 per gallon. A year ago, prices were at $3.48 per gallon, so gasoline prices are down $0.40 year-over-year.