by Calculated Risk on 11/17/2024 06:57:00 PM

Sunday, November 17, 2024

Sunday Night Futures

Weekend:

• Schedule for Week of November 17, 2024

Monday:

• At 10:00 AM ET, The November NAHB homebuilder survey. The consensus is for a reading of 42, down from 44. Any number below 50 indicates that more builders view sales conditions as poor than good.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 5 and DOW futures are down 39 (fair value).

Oil prices were down over the last week with WTI futures at $66.78 per barrel and Brent at $70.91 per barrel. A year ago, WTI was at $76, and Brent was at $81 - so WTI oil prices are down about 12% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.03 per gallon. A year ago, prices were at $3.29 per gallon, so gasoline prices are down $0.26 year-over-year.

Hotels: Occupancy Rate Decreased 3.5% Year-over-year

by Calculated Risk on 11/17/2024 08:57:00 AM

As projected for election week, the U.S. hotel industry reported negative year-over-year performance comparisons, according to CoStar’s latest data through 9 November. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

3-9 November 2024 (percentage change from comparable week in 2023):

• Occupancy: 62.6% (-3.5%)

• Average daily rate (ADR): US$156.11 (-0.1%)

• Revenue per available room (RevPAR): US$97.73 (-3.5%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Saturday, November 16, 2024

Real Estate Newsletter Articles this Week: Watch Months-of-Supply!

by Calculated Risk on 11/16/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Part 1: Current State of the Housing Market; Overview for mid-November 2024

• Part 2: Current State of the Housing Market; Overview for mid-November 2024

• NY Fed: Mortgage Originations by Credit Score, Delinquencies Increase, Foreclosures Remain Low

• 2nd Look at Local Housing Markets in October

• Watch Months-of-Supply!

• Lawler: Early Read on Existing Home Sales in October

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of November 17, 2024

by Calculated Risk on 11/16/2024 08:11:00 AM

The key economic reports this week are Housing Starts and Existing Home sales.

For manufacturing, the November Philly and Kansas City Fed surveys, will be released this week.

10:00 AM: The November NAHB homebuilder survey. The consensus is for a reading of 42, down from 44. Any number below 50 indicates that more builders view sales conditions as poor than good.

8:30 AM: Housing Starts for October.

8:30 AM: Housing Starts for October. This graph shows single and total housing starts since 1968.

The consensus is for 1.338 million SAAR, down from 1.354 million SAAR.

10:00 AM: State Employment and Unemployment (Monthly) for October 2024

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 222 thousand initial claims, up from 217 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for November. The consensus is for a reading of 5.0, down from 10.3.

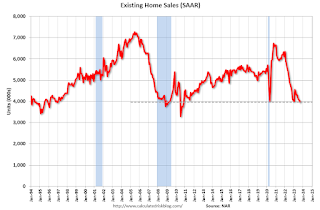

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 3.88 million SAAR, up from 3.84 million in September.

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 3.88 million SAAR, up from 3.84 million in September.The graph shows existing home sales from 1994 through the report last month.

11:00 AM: the Kansas City Fed manufacturing survey for November.

10:00 AM: University of Michigan's Consumer sentiment index (Final for November).

Friday, November 15, 2024

November 15th COVID Update: COVID in Wastewater Continues to Decline

by Calculated Risk on 11/15/2024 07:46:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 675 | 783 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Lawler: Early Read on Existing Home Sales in October

by Calculated Risk on 11/15/2024 03:22:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in October

A brief excerpt:

From housing economist Tom Lawler:There is much more in the article.

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 3.97 million in October, up 3.4% from September’s preliminary pace and up 3.1% from last October’s seasonally adjusted pace. Unadjusted sales should show a moderately higher YOY % gain, reflecting this October’s higher business day count compared to last October’s.

Local realtor/MLS reports suggest that the median existing single-family home sales price last month was up by about 4.7% from a year earlier.

CR Note: The NAR is scheduled to release October Existing Home sales on Thursday, Nov 21st at 10:00 AM. The consensus is for 3.88 million SAAR, up from 3.84 million in September. Last year, the NAR reported sales in October 2023 at 3.85 million SAAR. This will be the first year-over-year gain since August 2021 following 37 months with a year-over-year decline.

Q4 GDP Tracking: Mid 2% Range

by Calculated Risk on 11/15/2024 02:40:00 PM

From BofA:

Next week, we will initiate our 4Q GDP tracker after the October retail sales print today and October industrial production, housing starts, existing home sales and September business inventories will impact our 3Q and 4Q tracking estimate. [Current forecast 2.0%, Nov 15th]From Goldman:

emphasis added

Following this morning’s retail sales and industrial production reports, we lowered our Q4 GDP tracking estimate by 0.1pp to +2.5% (quarter-over-quarter annualized) and left our Q4 domestic final sales forecast unchanged on a rounded basis at +2.0%. [Nov 15th estimate]And from the Atlanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2024 is 2.5 percent on November 15, unchanged from November 7 after rounding. After recent releases from the US Census Bureau, the US Bureau of Labor Statistics, and the Federal Reserve Board of Governors, an increase in the nowcast of fourth-quarter real personal consumption expenditures growth was offset by a decrease in the nowcast of fourth-quarter real gross private domestic investment growth. [Nov 15th estimate]

Part 2: Current State of the Housing Market; Overview for mid-November 2024

by Calculated Risk on 11/15/2024 11:40:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-November 2024

A brief excerpt:

Yesterday, in Part 1: Current State of the Housing Market; Overview for mid-November 2024 I reviewed home inventory, housing starts and sales.There is much more in the article.

In Part 2, I will look at house prices, mortgage rates, rents and more.

...

The Case-Shiller National Index increased 4.2% year-over-year in August and will likely slow further in the September report (based on other data).

The MoM increase in the seasonally adjusted (SA) Case-Shiller National Index was at 0.32% (a 4.0% annual rate), This was the nineteenth consecutive MoM increase in the seasonally adjusted index.

Industrial Production Decreased 0.3% in October

by Calculated Risk on 11/15/2024 09:15:00 AM

Earlier from the Fed: Industrial Production and Capacity Utilization

Industrial production (IP) decreased 0.3 percent in October after declining 0.5 percent in September. A strike at a major producer of civilian aircraft held down total IP growth by an estimated 0.3 percentage point in September and 0.2 percentage point in October. Hurricane Milton and the lingering effects of Hurricane Helene together reduced October IP growth 0.1 percentage point. In October, manufacturing output moved down 0.5 percent, the index for mining rose 0.3 percent, and the index for utilities gained 0.7 percent. At 102.3 percent of its 2017 average, total IP in October was 0.3 percent below its year-earlier level. Capacity utilization moved down to 77.1 percent in October, a rate that is 2.6 percentage points below its long-run (1972–2023) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 77.1% is 2.6% below the average from 1972 to 2023. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased to 102.3. This is above the pre-pandemic level.

Industrial production was below consensus expectations.

Retail Sales Increased 0.4% in October

by Calculated Risk on 11/15/2024 08:30:00 AM

On a monthly basis, retail sales increased 0.4% from September to October (seasonally adjusted), and sales were up 2.8 percent from October 2023.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for October 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $718.9 billion, an increase of 0.4 percent from the previous month, and up 2.8 percent from October 2023. ... The August 2024 to September 2024 percent change was revised from up 0.4 percen to up 0.8 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline was up 0.4% in October.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 3.5% on a YoY basis.

The change in sales in October were above expectations, and sales in August and September were revised up, combined.

The change in sales in October were above expectations, and sales in August and September were revised up, combined.