by Calculated Risk on 11/30/2024 08:11:00 AM

Saturday, November 30, 2024

Schedule for Week of December 1, 2024

The key report this week is the November employment report on Friday.

Other key indicators include the October Trade Deficit, the November ISM manufacturing index and November vehicle sales.

10:00 AM: ISM Manufacturing Index for November. The consensus is for 47.5%, up from 46.5%.

10:00 AM: Construction Spending for October. The consensus is for 0.2% increase in spending.

All day: Light vehicle sales for November.

All day: Light vehicle sales for November.The consensus is for 16.0 million SAAR in November, unchanged from the BEA estimate of 16.04 million SAAR in October (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967.

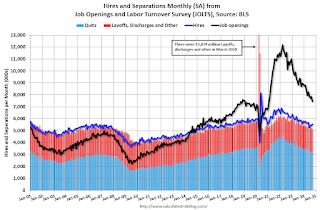

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (black line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in September to 7.44 million from 7.86 million in August.

The number of job openings (black) were down 20% year-over-year. Quits were down 15% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 166,000 jobs added, down from 233,000 in October.

10:00 AM: the ISM Services Index for November. The consensus is for 55.5, down from 56.0.

1:45 PM: Discussion, Fed Chair Jerome Powell, Moderated Discussion, At the New York Times DealBook Summit, New York, N.Y.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 213 thousand last week.

8:30 AM: Trade Balance report for October from the Census Bureau.

8:30 AM: Trade Balance report for October from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $78.8 billion. The U.S. trade deficit was at $84.4 billion in September.

8:30 AM: Employment Report for November. The consensus is for 183,000 jobs added, and for the unemployment rate to be unchanged at 4.1%.

8:30 AM: Employment Report for November. The consensus is for 183,000 jobs added, and for the unemployment rate to be unchanged at 4.1%.There were 12,000 jobs added in October, and the unemployment rate was at 4.1%.

This graph shows the jobs added per month since January 2021.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for December).

Friday, November 29, 2024

Hotels: Occupancy Rate Increased 21.7% Year-over-year due to Timing of Thanksgiving

by Calculated Risk on 11/29/2024 12:21:00 PM

Due to the Thanksgiving calendar shift, the U.S. hotel industry reported higher year-over-year performance comparisons, according to CoStar’s latest data through 23 November. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

17-23 November 2024 (percentage change from comparable week in 2023):

• Occupancy: 59.7% (+20.7%)

• Average daily rate (ADR): US$150.49 (+8.6%)

• Revenue per available room (RevPAR): US$89.80 (+31.1%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Q4 GDP Tracking: Mid 2% Range

by Calculated Risk on 11/29/2024 09:11:00 AM

From Goldman:

Following [Wednesday]’s data, we have left our Q4 GDP tracking estimate unchanged at +2.4% (quarter-over-quarter annualized) and our Q4 domestic final sales forecast unchanged at +2.0%. [Nov 27th estimate]And from the Atlanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2024 is 2.7 percent on November 27, up from 2.6 percent on November 19. After this morning's personal income and outlays release from the US Bureau of Economic Analysis, the nowcast of fourth-quarter real personal consumption expenditures growth increased from 2.8 percent to 3.0 percent. [Nov 27th estimate]

Thursday, November 28, 2024

Five Economic Reasons to be Thankful

by Calculated Risk on 11/28/2024 08:47:00 AM

Here are five economic reasons to be thankful this Thanksgiving. (Hat Tip to Neil Irwin who started doing this years ago)

1) The Unemployment Rate is at 4.1%

The unemployment rate is up from 3.4% in April 2023 - and that matched the lowest unemployment rate since 1969!

The dashed line on the graph is the current 4-week average.

3) Mortgage Debt as a Percent of GDP has Fallen Significantly

This graph shows household mortgage debt as a percent of GDP.

This graph shows household mortgage debt as a percent of GDP. Mortgage debt is up $2.34 trillion from the peak during the housing bubble, but, as a percent of GDP is at 45.9% - down from Q1 - and down from a peak of 73.3% of GDP during the housing bust.

4) Mortgage Delinquency Rate Near the Lowest Level since at least 1979

The percent of loans in the foreclosure process are close to the record low.

5) Household Debt burdens at Low Levels (ex-pandemic)

This graph, based on data from the Federal Reserve, shows the Household Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

This graph, based on data from the Federal Reserve, shows the Household Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).This data suggests aggregate household cash flow is in a solid position.

Wednesday, November 27, 2024

Realtor.com Reports Active Inventory Up 26.5% YoY

by Calculated Risk on 11/27/2024 05:16:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For October, Realtor.com reported inventory was up 29.2% YoY, but still down 21.1% compared to the 2017 to 2019 same month levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data for Week Ending Nov. 23, 2024

• Active inventory increased, with for-sale homes 26.5% above year-ago levels

For the 55th consecutive week, the number of homes for sale has increased compared to the same time last year. The nationwide market is slowly rebounding to pre-pandemic levels of inventory. Buyers currently have far more options than they did a few years ago, but with prices and mortgage rates remaining high, not as many of them are within their budget. New listings showed a much more modest increase, so most of this inventory growth is the result of homes sitting on the market for longer.

• New listings—a measure of sellers putting homes up for sale—climbed 2.8% this week compared with one year ago

The number of newly listed homes for sale continued to grow this week, the fourth in a row with year-over-year new listing growth over 1.5%. This is an encouraging sign that even amid a high mortgage rate environment, some sellers are willing to list their homes and make a move. We’ve talked extensively about the lock-in effect, where homeowners who secured a low-rate mortgage in recent years are reluctant to move out and give that favorable financing up, and there are only two cures for this issue. The first, lower mortgage rates, doesn’t appear to be coming any time soon. The second, time, is finally starting to take effect, as the simple reality that people eventually have to move will force new homes onto the market even if their sellers don’t love the mortgage rate they’ll get on their next purchase.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 55th consecutive week.

Fannie and Freddie: Single Family and Multi-Family Serious Delinquency Rates Increased in October

by Calculated Risk on 11/27/2024 01:15:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Fannie and Freddie: Single Family and Multi-Family Serious Delinquency Rates Increased in October

Excerpt:

Single-family serious delinquencies increased slightly in October, and multi-family serious delinquencies increased.

...

Multi-Family Delinquencies Increased, Fannie Rate Matches Highest Since 2011 (ex-Pandemic)

...

Freddie Mac reported that the Single-Family serious delinquency rate in October was 0.55%, up from 0.54% September. Freddie's rate is up slightly year-over-year from 0.54% in October 2023. This is below the pre-pandemic lows.

...

Fannie Mae reported that the Single-Family serious delinquency rate in October was 0.52%, unchanged from 0.52% in September. The serious delinquency rate is down year-over-year from 0.53% in October 2023. This is also below the pre-pandemic lows.

Personal Income increased 0.6% in October; Spending increased 0.4%

by Calculated Risk on 11/27/2024 10:13:00 AM

The BEA released the Personal Income and Outlays, October 2024 report for October:

Personal income increased $147.4 billion (0.6 percent at a monthly rate) in October, according to estimates released today by the U.S. Bureau of Economic Analysis. Disposable personal income (DPI), personal income less personal current taxes, increased $144.1 billion (0.7 percent) and personal consumption expenditures (PCE) increased $72.3 billion (0.4 percent).The October PCE price index increased 2.3 percent year-over-year (YoY), up from 2.1 percent YoY in September, and down from the recent peak of 7.0 percent in June 2022.

The PCE price index increased 0.2 percent in October. Excluding food and energy, the PCE price index increased 0.3 percent. Real DPI increased 0.4 percent and real PCE increased 0.1 percent; goods increased less than 0.1 percent and services increased 0.2 percent.

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through October 2024 (2017 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was above expectations, and PCE was at expectations.

NAR: Pending Home Sales Increase 2.0% in October; Up 5.4% Year-over-year

by Calculated Risk on 11/27/2024 10:03:00 AM

From the NAR: Pending Home Sales Climbed 2.0% in October, Third Straight Month of Gains

Pending home sales ascended in October – the third consecutive month of increases – according to the National Association of REALTORS®. All four major U.S. regions experienced month-over-month gains in transactions, with the Northeast leading the way. Year-over-year, contract signings increased in all four U.S. regions, led by the West.Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in November and December.

The Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on contract signings – elevated 2.0% to 77.4 in October. Year-over-year, pending transactions expanded 5.4%. An index of 100 is equal to the level of contract activity in 2001.

"Homebuying momentum is building after nearly two years of suppressed home sales." said NAR Chief Economist Lawrence Yun. "Even with mortgage rates modestly rising despite the Federal Reserve's decision to cut the short-term interbank lending rate in September, continuous job additions and more housing inventory are bringing more consumers to the market."

...

he Northeast PHSI jumped 4.7% from last month to 68.7, up 7.2% from October 2023. The Midwest index grew 4.0% to 77.8 in October, up 1.8% from the previous year.

The South PHSI increased 0.9% to 90.0 in October, up 2.5% from a year ago. The West index edged higher by 0.2% from the prior month to 64.1, up 16.8% from October 2023.

emphasis added

Q3 GDP Growth Unrevised at 2.8% Annual Rate

by Calculated Risk on 11/27/2024 08:36:00 AM

From the BEA: Gross Domestic Product, Third Quarter 2024 (Second Estimate) and Corporate Profits (Preliminary)

Real gross domestic product (GDP) increased at an annual rate of 2.8 percent in the third quarter of 2024, according to the "second" estimate released by the U.S. Bureau of Economic Analysis. In the second quarter, real GDP increased 3.0 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised down from 3.7% to 3.5%. Residential investment was revised up from -5.1% to -5.0%.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was also 2.8 percent. The update primarily reflected upward revisions to private inventory investment and nonresidential fixed investment as well as downward revisions to exports and consumer spending. Imports, which are a subtraction in the calculation of GDP, were revised down.

emphasis added

Weekly Initial Unemployment Claims Decrease to 213,000

by Calculated Risk on 11/27/2024 08:33:00 AM

The DOL reported:

In the week ending November 23, the advance figure for seasonally adjusted initial claims was 213,000, a decrease of 2,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 213,000 to 215,000. The 4-week moving average was 217,000, a decrease of 1,250 from the previous week's revised average. The previous week's average was revised up by 500 from 217,750 to 218,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 217,000.

The previous week was revised up.

Weekly claims were below the consensus forecast.

Last 10 Posts

In Memoriam: Doris "Tanta" Dungey

Archive

Econbrowser

Pettis: China Financial Markets

NY Times Upshot

The Big Picture

| Privacy Policy |

| Copyright © 2007 - 2025 CR4RE LLC |

| Excerpts NOT allowed on x.com |