by Calculated Risk on 12/16/2024 08:11:00 AM

Monday, December 16, 2024

Housing Dec 16th Weekly Update: Inventory down 1.1% Week-over-week, Up 26.6% Year-over-year

Click on graph for larger image.

Click on graph for larger image. This second inventory graph is courtesy of Altos Research.

This second inventory graph is courtesy of Altos Research.Sunday, December 15, 2024

Sunday Night Futures

by Calculated Risk on 12/15/2024 07:15:00 PM

Weekend:

• Schedule for Week of December 15, 2024

Monday:

• 8:30 AM: The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of 5.8, down from 31.2.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $71.12 per barrel and Brent at $74.41 per barrel. A year ago, WTI was at $71, and Brent was at $77 - so WTI oil prices are unchanged year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.98 per gallon. A year ago, prices were at $3.04 per gallon, so gasoline prices are down $0.06 year-over-year.

FOMC Preview: Fed to Cut Rates 25bp

by Calculated Risk on 12/15/2024 10:22:00 AM

Most analysts expect the FOMC will cut the federal funds rate at the meeting this week by 25bp lowering the target range to 4 1/4 to 4 1/2 percent. However, most market participants now expect the FOMC to pause in January and are split on a rate cut at the March meeting.

We expect the Fed to cut rates by 25bp at its Dec meeting. Powell is likely to point to a slower pace of cuts thereafter, including a pause in Jan, in his presser. The dot plot should show three cuts in 2025 and a higher neutral rate. Consistent with this, we think the macro forecasts will indicate slightly stronger inflation next year, and higher longer run growth. Policymakers won’t account for the Trump agenda in their base case, but the balance of risks should give a sense of their assessment of potential policy changes.

emphasis added

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | 2027 |

| Sept 2024 | 1.9 to 2.1 | 1.8 to 2.2 | 1.9 to 2.3 | 1.8 to 2.1 |

| June 2024 | 1.9 to 2.3 | 1.8 to 2.2 | 1.8 to 2.1 | --- |

The unemployment rate was at 4.2% in November (and 4.1%). This is below the low end of the September projections for Q4.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | 2027 |

| Sept 2024 | 4.3 to 4.4 | 4.2 to 4.5 | 4.0 to 4.4 | 4.0 to 4.4 |

| June 2024 | 3.9 to 4.2 | 3.9 to 4.3 | 3.9 to 4.3 | --- |

As of October 2024, PCE inflation increased 2.3 percent year-over-year (YoY). This is in the middle of the September projection range.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | 2027 |

| Sept 2024 | 2.2 to 2.4 | 2.1 to 2.2 | 2.0 | 2.0 |

| June 2024 | 2.5 to 2.9 | 2.2 to 2.4 | 2.0 to 2.1 | --- |

PCE core inflation increased 2.8 percent YoY in October. This was slightly above the range of FOMC projections for Q4.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | 2027 |

| Sept 2024 | 2.6 to 2.7 | 2.1 to 2.3 | 2.0 | 2.0 |

| June 2024 | 2.8 to 3.0 | 2.3 to 2.4 | 2.0 to 2.1 | --- |

Saturday, December 14, 2024

Real Estate Newsletter Articles this Week: "Home ATM" Mostly Closed

by Calculated Risk on 12/14/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Part 1: Current State of the Housing Market; Overview for mid-December 2024

• Part 2: Current State of the Housing Market; Overview for mid-December 2024

• The "Home ATM" Mostly Closed in Q3

• 2nd Look at Local Housing Markets in November

• Q3 Update: Delinquencies, Foreclosures and REO

• ICE Mortgage Monitor: Refinance Activity Increased Especially for Rate/Term Refinances

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of December 15, 2024

by Calculated Risk on 12/14/2024 08:11:00 AM

The key economic reports this week are Retail Sales, Housing Starts, Existing Home Sales, the 3rd estimate of Q3 GDP, and November Personal income and outlays.

For manufacturing, November Industrial Production, and the December New York, Philly and Kansas City Fed surveys will be released this week.

The FOMC meets this week and is expected to cut rates by 25bp.

8:30 AM: The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of 5.8, down from 31.2.

8:30 AM ET: Retail sales for November will be released. The consensus is for a 0.5% increase in retail sales.

8:30 AM ET: Retail sales for November will be released. The consensus is for a 0.5% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.This graph shows industrial production since 1967.

The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to increase to 77.2%.

10:00 AM: The December NAHB homebuilder survey.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for November.

8:30 AM: Housing Starts for November. This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.344 million SAAR, up from 1.311 million SAAR.

During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. The Fed is expected to cut rates 25bp at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 232 thousand initial claims, down from 242 thousand last week.

8:30 AM: Gross Domestic Product, 3rd quarter 2024 (Third estimate). The consensus is for real GDP at 2.8% annualized, unchanged from the second estimate of 2.8%.

8:30 AM: the Philly Fed manufacturing survey for December. The consensus is for a reading of 2.2, up from -6.0.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 3.97 million SAAR, up from 3.96 million.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 3.97 million SAAR, up from 3.96 million.The graph shows existing home sales from 1994 through the report last month.

11:00 AM: the Kansas City Fed manufacturing survey for December.

8:30 AM: Personal Income and Outlays for November. The consensus is for a 0.4% increase in personal income, and for a 0.5% increase in personal spending. And for the PCE price index to increase 0.2%, and the Core PCE price index to increase 0.2%. PCE prices are expected to be up 2.5% YoY, and core PCE prices up 2.9% YoY.

10:00 AM: University of Michigan's Consumer sentiment index (Final for December).

10:00 AM: State Employment and Unemployment (Monthly) for November 2024

Friday, December 13, 2024

December 13th COVID Update: COVID in Wastewater Increasing

by Calculated Risk on 12/13/2024 07:36:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 384 | 488 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Part 2: Current State of the Housing Market; Overview for mid-December 2024

by Calculated Risk on 12/13/2024 01:04:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-December 2024

A brief excerpt:

Earlier this week, in Part 1: Current State of the Housing Market; Overview for mid-December 2024 I reviewed home inventory, housing starts and sales.There is much more in the article.

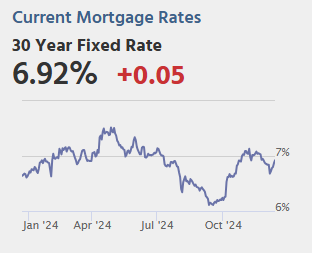

In Part 2, I will look at house prices, mortgage rates, rents and more.

...

The Case-Shiller National Index increased 3.9% year-over-year (YoY) in September and will be about the same YoY in the October report (based on other data).

...

Other measures of house prices suggest prices will be up about the same YoY in the October Case-Shiller index as in the September report. The NAR reported median prices were up 4.0% YoY in October, up from 3.6% YoY in September.

ICE reported prices were up 3.0% YoY in October, up from 2.9% YoY in September, and Freddie Mac reported house prices were up 3.7% YoY in October, down from 3.8% YoY in September.

Q3 Update: Delinquencies, Foreclosures and REO

by Calculated Risk on 12/13/2024 09:57:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Q3 Update: Delinquencies, Foreclosures and REO

A brief excerpt:

We will NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble) for two key reasons: 1) mortgage lending has been solid, and 2) most homeowners have substantial equity in their homes.There is much more in the article.

...

This graph shows the nominal dollar value of Residential REO for FDIC insured institutions based on the Q3 FDIC Quarterly Banking Profile released yesterday. Note: The FDIC reports the dollar value and not the total number of REOs.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) was mostly unchanged YOY from $747 million in Q3 2023 to $765 million in Q3 2024. This is historically extremely low.

Q4 GDP Tracking: 2.1% to 3.3% Range

by Calculated Risk on 12/13/2024 07:55:00 AM

From BofA:

Since our last weekly publication, our 3Q GDP tracking estimate has moved up a tenth to 3.0% q/q saar. Additionally, our 4Q US GDP tracker was unchanged at 2.1% q/q saar. [Dec 13th estimate]From Goldman:

emphasis added

We left our Q4 GDP tracking and domestic final sales estimates unchanged at +2.4% and +2.0%, respectively. [Dec 5th estimate]And from the Atlanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2024 is 3.3 percent on December 5, up from 3.2 percent on December 2. After recent releases from the US Census Bureau, the Institute for Supply Management, and the US Bureau of Economic Analysis, the nowcast of fourth-quarter real gross private domestic investment growth increased from 1.2 percent to 1.8 percent. [Dec 5th estimate]

Thursday, December 12, 2024

Friday: No major economic releases scheduled

by Calculated Risk on 12/12/2024 09:52:00 PM

Friday:

• No major economic releases scheduled.