by Calculated Risk on 1/08/2025 09:58:00 AM

Wednesday, January 08, 2025

Wholesale Used Car Prices Decreased in December; Up 0.4% Year-over-year

From Manheim Consulting today: Wholesale Used-Vehicle Prices Decreased in December

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) were lower in December compared to November. The Manheim Used Vehicle Value Index (MUVVI) fell to 204.8, an increase of 0.4% from a year ago. The seasonal adjustment to the index reduced the change for the month, as non-seasonally adjusted values declined at a higher rate. The non-adjusted price in December decreased by 0.8% compared to November, moving the unadjusted average price up 0.3% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

ADP: Private Employment Increased 122,000 in December

by Calculated Risk on 1/08/2025 08:15:00 AM

From ADP: ADP National Employment Report: Private employers added 122,000 jobs in December

“The labor market downshifted to a more modest pace of growth in the final month of 2024, with a slowdown in both hiring and pay gains. Health care stood out in the second half of the year, creating more jobs than any other sector.This was below the consensus forecast of 143,000. The BLS report will be released Friday, and the consensus is for 150,000 non-farm payroll jobs added in December.

emphasis added

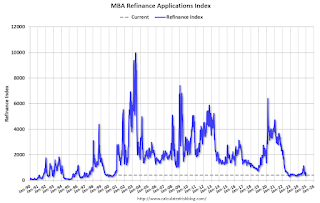

MBA: Mortgage Applications Decreased in Weekly Survey

by Calculated Risk on 1/08/2025 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 3, 2025. This week’s results include an adjustment for the New Year’s holiday.

The Market Composite Index, a measure of mortgage loan application volume, decreased 3.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 47 percent compared with the previous week. The Refinance Index increased 2 percent from the previous week and was 6 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 7 percent from one week earlier. The unadjusted Purchase Index increased 43 percent compared with the previous week and was 15 percent lower than the same week one year ago.

“Applications decreased last week as rising mortgage rates continued to discourage buyers from entering the market and put a damper on purchase activity. The 30-year fixed rate increased for the fourth consecutive week, reaching 6.99 percent – the highest rate since July 2024,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Purchase applications declined for both conventional and government loans and dropped to the slowest weekly pace since February 2024. Refinance applications increased despite higher rates, but the increase was compared to recent low levels and was entirely driven by an increase in VA refinances, which continue to show weekly swings.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) increased to 6.99 percent from 6.97 percent, with points decreasing to 0.68 from 0.72 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate remained unchanged from last week.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 15% year-over-year unadjusted.

Tuesday, January 07, 2025

Wednesday: ADP Employment

by Calculated Risk on 1/07/2025 08:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 143,000, down from 146,000 jobs added in November.

CoreLogic: US Home Prices Increased 3.4% Year-over-year in November

by Calculated Risk on 1/07/2025 04:49:00 PM

Notes: This CoreLogic House Price Index report is for November. The recent Case-Shiller index release was for October. The CoreLogic HPI is a three-month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic: Northeastern, New England States Continue to Lead US for Annual Home Price Growth in November

• The national home price gain was 3.4% year over year in November 2024, down from the 5.2% growth recorded in the same month of 2023.This was the same YoY increase as reported for October.

• Home prices are projected to rise by 3.8% annually by November 2025 after hitting a new high this spring.

• Northeastern and New England states took the top five spots for year-over-year appreciation.

• Seventeen states posted new price peaks in November.

...

U.S. home price gains remained static since the summer of 2022 in November, but 17 states reached new highs ...

“Heading into the end of the year, home prices remained relatively flat though showing some marginal improvement from the weakness seen heading into the fall and following reduced homebuyer demand amid the summer mortgage rate surge,” said CoreLogic Chief Economist Selma Hepp. “Nevertheless, the cooling home price growth trend is expected to continue well into 2025 partly due to the base effect and comparison with strong early 2023 appreciation and partly because of the expectations of higher mortgage rates over the course of 2025,” Hepp continued. “Regionally, variations persist, as some more affordable areas – including smaller metros in the Midwest – remain in high demand and continue to see upward home price pressures.”

emphasis added

This map is from the report.

Nationally, home prices increased by 3.4% year over year in November. No state posted an annual home price decline. The states with the highest increases year over year were New Jersey (up by 7.8%) and Rhode Island (up by 7.3%).

Asking Rents Mostly Unchanged Year-over-year

by Calculated Risk on 1/07/2025 01:48:00 PM

Today, in the Real Estate Newsletter: Asking Rents Mostly Unchanged Year-over-year

Brief excerpt:

Another monthly update on rents.This is much more in the article.

Tracking rents is important for understanding the dynamics of the housing market. Slower household formation and increased supply (more multi-family completions) has kept asking rents under pressure. ...

Welcome to the January 2025 Apartment List National Rent Report. The national median monthly rent closed out 2024 at $1,373 in December, after declining by 0.6 percent, or $8, from the prior month. Year-over-year rent growth nationally also currently stands at -0.6 percent, meaning that the typical apartment is currently renting for slightly less than it was one year ago. ...

Realtor.com: 16th Consecutive Month with Year-over-year Decline in Rents

In November 2024, the U.S. median rent continued to decline year-over-year for the sixteenth month in a row, down $19 or -1.1% year-over-year for 0-2 bedroom properties across the top 50 metros, faster than the rate of -0.8% seen in October 2024.

ISM® Services Index Increases to 54.1% in December

by Calculated Risk on 1/07/2025 12:28:00 PM

(Posted with permission). The ISM® Services index was at 54.1%, up from 52.1% last month. The employment index decreased to 51.4%, from 51.5%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 54.1% December 2024 Services ISM® Report On Business®

Economic activity in the services sector expanded for the sixth consecutive month in December, say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®. The Services PMI® registered 54.1 percent, indicating expansion for the 52nd time in 55 months since recovery from the coronavirus pandemic-induced recession began in June 2020.This was above consensus expectations.

The report was issued today by Steve Miller, CPSM, CSCP, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In December, the Services PMI® registered 54.1 percent, 2 percentage points higher than November’s figure of 52.1 percent. The reading in December marked the 10th time the composite index has been in expansion territory this year. The Business Activity Index registered 58.2 percent in December, 4.5 percentage points higher than the 53.7 percent recorded in November, indicating a sixth consecutive month of expansion and finishing the year with its third-highest reading for 2024. The New Orders Index recorded a reading of 54.2 percent in December, 0.5 percentage point higher than November’s figure of 53.7 percent. The Employment Index remained in expansion territory for the fifth time in six months; the reading of 51.4 percent is a 0.1-percentage point decrease compared to the 51.5 percent recorded in November.

emphasis added

BLS: Job Openings "Little Unchanged" at 8.1 million in November

by Calculated Risk on 1/07/2025 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 8.1 million on the last business day of November, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and total separations were little changed at 5.3 million and 5.1 million, respectively. Within separations, quits (3.1 million) decreased, but layoffs and discharges (1.8 million) changed little.The following graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for November; the employment report this Friday will be for December.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The spike in layoffs and discharges in March 2020 is labeled, but off the chart to better show the usual data.

Jobs openings increased in November to 8.10 million from 7.84 million in October.

The number of job openings (black) were down 9% year-over-year.

Quits were down 13% year-over-year. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

Trade Deficit increased to $78.2 Billion in November

by Calculated Risk on 1/07/2025 08:30:00 AM

The Census Bureau and the Bureau of Economic Analysis reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $78.2 billion in November, up $4.6 billion from $73.6 billion in October, revised.

November exports were $273.4 billion, $7.1 billion more than October exports. November imports were $351.6 billion, $11.6 billion more than October imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports and imports increased in November.

Exports are up 6.6% year-over-year; imports are up 9.4% year-over-year.

Both imports and exports have generally increased recently.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, exports of petroleum products are positive and have been increasing.

The trade deficit with China increased to $25.0 billion from $21.6 billion a year ago. It is likely some importers are trying to beat potential tariffs.

Monday, January 06, 2025

Tuesday: Trade Deficit, Job Openings, ISM Services

by Calculated Risk on 1/06/2025 08:11:00 PM

The bond market and interest rates have arrived at the first full week of the new year almost exactly where they left off before the X-mas/New Year holiday weeks. ... Although the past 2 weeks have been uneventful for rates, the next 2 weeks will be heavily influenced by incoming economic data. There are several honorable mentions over the next few days before getting to this week's headliner on Friday: the jobs report. [30 year fixed 7.10%]Tuesday:

emphasis added

• At 8:30 AM ET, Trade Balance report for November from the Census Bureau. The consensus is the trade deficit to be $77.5 billion. The U.S. trade deficit was at $73.8 billion in October.

• At 10:00 AM, Job Openings and Labor Turnover Survey for November from the BLS.

• Also at 10:00 AM, the ISM Services Index for December.