by Calculated Risk on 1/10/2025 01:02:00 PM

Friday, January 10, 2025

Q4 GDP Tracking: 1.8% to 2.7% Range

From BofA:

Since our last weekly publication, our 4Q GDP tracking estimate has moved down three tenths to 1.8% q/q saar. The final estimate of 3Q GDP came in at 3.1% q/q saar, close to our tracking of 3.0%. [Jan 10th estimate]From Goldman:

emphasis added

We left our Q4 GDP tracking estimate unchanged at +2.3% (quarter-over-quarter annualized) and our Q4 domestic final sales forecast unchanged at +2.3%. [Jan 7th estimate]And from the Atlanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2024 is 2.7 percent on January 9, unchanged from January 7 after rounding. After the wholesale trade report from the US Census Bureau, the nowcast of fourth-quarter real gross private domestic investment growth increased from -0.6 percent to -0.4 percent. [Jan 9th estimate]

Comments on December Employment Report

by Calculated Risk on 1/10/2025 09:47:00 AM

The headline jobs number in the December employment report was well above expectations, however, October and November payrolls were revised down by 8,000 combined. The participation rate was unchanged, the employment population ratio increased, and the unemployment rate decreased to 4.1%.

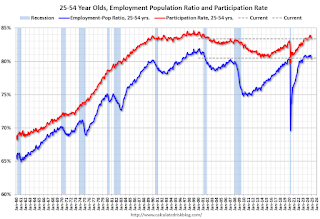

Prime (25 to 54 Years Old) Participation

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate is impacted by both cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 years old participation rate decreased in December at 83.4% from 83.5% in November.

Average Hourly Wages

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES).

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees from the Current Employment Statistics (CES). Wage growth has trended down after peaking at 5.9% YoY in March 2022 and was at 3.9% YoY in December.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of people employed part time for economic reasons, at 4.4 million, changed little in December and is little different from a year earlier. These individuals would have preferred full-time employment but were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in December to 4.36 million from 4.47 million in November. This is close to the pre-pandemic levels.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 7.5% from 7.7% in the previous month. This is down from the record high in April 2020 of 22.9% and up from the lowest level on record (seasonally adjusted) in December 2022 (6.6%). (This series started in 1994). This measure is above the 7.0% level in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.51 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.65 million the previous month.

This is above pre-pandemic levels.

Job Streak

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2020 | 113 |

| 2 tie | 20241 | 48 |

| 2 tie | 1990 | 48 |

| 4 | 2007 | 46 |

| 5 | 1979 | 45 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Summary:

The headline jobs number in the December employment report was well above expectations, however, October and November payrolls were revised down by 8,000 combined. The participation rate was unchanged, the employment population ratio increased, and the unemployment rate decreased to 4.1%.

December Employment Report: 256 thousand Jobs, 4.1% Unemployment Rate

by Calculated Risk on 1/10/2025 08:30:00 AM

From the BLS: Employment Situation

Total nonfarm payroll employment increased by 256,000 in December, and the unemployment rate changed little at 4.1 percent, the U.S. Bureau of Labor Statistics reported today. Employment trended up in health care, government, and social assistance. Retail trade added jobs in December, following a job loss in November.

...

The change in total nonfarm payroll employment for October was revised up by 7,000, from +36,000 to +43,000, and the change for November was revised down by 15,000, from +227,000 to +212,000. With these revisions, employment in October and November combined is 8,000 lower than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the jobs added per month since January 2021.

Payrolls for October and November were revised down 8 thousand, combined.

The second graph shows the year-over-year change in total non-farm employment since 1968.

The second graph shows the year-over-year change in total non-farm employment since 1968.In December, the year-over-year change was 2.23 million jobs. Employment was up solidly year-over-year (Although the annual benchmark revision will lower the year-over-year change).

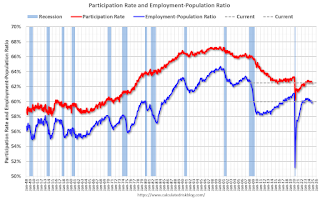

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged at 62.5% in December, from 62.5% in November. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate was unchanged at 62.5% in December, from 62.5% in November. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 60.0% from 59.8% in November (blue line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased to 4.1% in December from 4.2% in November.

This was well above consensus expectations; however, October and November payrolls were revised down by 8,000 combined.

Thursday, January 09, 2025

Friday: Employment Report

by Calculated Risk on 1/09/2025 07:46:00 PM

• At 8:30 AM ET, Employment Report for December. The consensus is for 160,000 jobs added, and for the unemployment rate to be unchanged at 4.2%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for January)

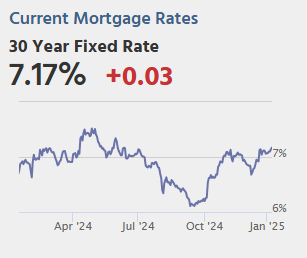

The Housing Bubble and Mortgage Debt as a Percent of GDP

by Calculated Risk on 1/09/2025 11:44:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Update: The Housing Bubble and Mortgage Debt as a Percent of GDP

A brief excerpt:

Two years ago, I wrote The Housing Bubble and Mortgage Debt as a Percent of GDP. Here is an update to a couple of graphs. The bottom line remains the same: There will not be cascading price declines in this cycle due to distressed sales.There is much more in the article.

In a 2005 post, I included a graph of household mortgage debt as a percent of GDP. Several readers asked if I could update the graph.

First, from February 2005 (20 years ago!):The following chart shows household mortgage debt as a % of GDP. Although mortgage debt has been increasing for years, the last four years have seen a tremendous increase in debt. Last year alone mortgage debt increased close to $800 Billion - almost 7% of GDP. ...And a serious problem is what happened!

Many homeowners have refinanced their homes, in essence using their homes as an ATM.

It wouldn't take a RE bust to impact the general economy. Just a slowdown in both volume (to impact employment) and in prices (to slow down borrowing) might push the general economy into recession. An actual bust, especially with all of the extensive sub-prime lending, might cause a serious problem.

December Employment Preview

by Calculated Risk on 1/09/2025 08:55:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for December. The consensus is for 160,000 jobs added, and for the unemployment rate to be unchanged at 4.2%.

There were 227,000 jobs added in November, and the unemployment rate was at 4.2%.

We expect a below-consensus 125k increase in payrolls (vs. +160k consensus) in December. We are below consensus because 1) Big Data indicators point to slower job growth in December and 2) we estimate that an unfavorable calendar configuration could be a 50k drag. ... We forecast that the unemployment rate edged up to 4.3%.From BofA:

emphasis added

We expect nonfarm payrolls to rise by 175k in Dec after coming in at 227k in Nov (Exhibit 1). This above-consensus (160k) forecast is driven by initial jobless claims remaining extremely low in Dec. In terms of the HH survey, we expect some payback in Dec for two consecutive months of weak employment. This should keep the u-rate at 4.2%.• ADP Report: The ADP employment report showed 122,000 private sector jobs were added in December. This was below consensus forecasts and suggests job gains below consensus expectations, however, in general, ADP hasn't been very useful in forecasting the BLS report.

• ISM Surveys: Note that the ISM indexes are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased to was at 45.3%, down from 48.1%. This would suggest about 45,000 jobs lost in manufacturing. The ADP report indicated 11,000 manufacturing jobs lost in December.

The ISM® services employment index decreased to 51.4% from 51.5%. This would suggest 110,000 jobs added in the service sector. Combined this suggests 65,000 jobs added, far below consensus expectations. (Note: The ISM surveys have been way off recently)

• Unemployment Claims: The weekly claims report showed more initial unemployment claims during the reference week at 220,000 in December compared to 215,000 in November. This suggests slightly more layoffs in December compared to November.

Weekly Initial Unemployment Claims Decrease to 201,000

by Calculated Risk on 1/09/2025 08:30:00 AM

This was released yesterday (due to National Day of Mourning). The DOL reported:

In the week ending January 4, the advance figure for seasonally adjusted initial claims was 201,000, a decrease of 10,000 from the previous week's unrevised level of 211,000. The 4-week moving average was 213,000, a decrease of 10,250 from the previous week's unrevised average of 223,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 213,000.

The previous week was unrevised

Weekly claims were lower than the consensus forecast.

Wednesday, January 08, 2025

Thursday: National Day of Mourning for former President Jimmy Carter, Unemployment Claims

by Calculated Risk on 1/08/2025 08:12:00 PM

• The US NYSE and the NASDAQ will be closed in observance of a National Day of Mourning for former President Jimmy Carter.

• At 6:00 AM ET, NFIB Small Business Optimism Index for December.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for a decrease to 210 thousand from 211 thousand last week.

Leading Index for Commercial Real Estate Increased 10% in December

by Calculated Risk on 1/08/2025 04:15:00 PM

From Dodge Data Analytics: Dodge Momentum Index Grows 10% in December

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, grew 10.2% in December to 212.0 (2000=100) from the revised November reading of 192.3. Over the month, commercial planning increased 14.2% while institutional planning improved 2.5%.

“Commercial activity rebounded strongly in December, thanks to a re-acceleration in data center and warehouse planning activity,” stated Sarah Martin, associate director of forecasting at Dodge Construction Network. “Overall, the strong performance of the Momentum Index this past year is expected to support nonresidential construction spending throughout 2025.”

On the commercial side, data center and warehouse planning drove much of the growth this month, while stronger healthcare and education activity supported the institutional portion. In December, the DMI was up 19% when compared to year-ago levels. The commercial segment was up 30% from December 2023, while the institutional segment was flat over the same period. The influence of data centers on the DMI this year has been substantial. If we remove all data center projects in 2023 and 2024, commercial planning would be up 8% from year-ago levels, and the entire DMI would be up 5%.

...

The DMI is a monthly measure of the value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 212.0 in December, up from 192.3 the previous month.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests a slowdown in early 2025, but a pickup in mid-2025.

FOMC Minutes: "The process [of reaching inflation target] could take longer than previously anticipated"

by Calculated Risk on 1/08/2025 02:38:00 PM

From the Fed: Minutes of the Federal Open Market Committee, December 17–18, 2024. Excerpt:

With regard to the outlook for inflation, participants expected that inflation would continue to move toward 2 percent, although they noted that recent higher-than-expected readings on inflation, and the effects of potential changes in trade and immigration policy, suggested that the process could take longer than previously anticipated. Several observed that the disinflationary process may have stalled temporarily or noted the risk that it could. A couple of participants judged that positive sentiment in financial markets and momentum in economic activity could continue to put upward pressure on inflation. All participants judged that uncertainty about the scope, timing, and economic effects of potential changes in policies affecting foreign trade and immigration was elevated. Reflecting that uncertainty, participants took varied approaches in accounting for these effects. A number of participants indicated that they incorporated placeholder assumptions to one degree or another into their projections. Other participants indicated that they did not incorporate such assumptions, and a few participants did not indicate whether they incorporated such assumptions.

emphasis added