by Calculated Risk on 2/21/2025 10:00:00 AM

Friday, February 21, 2025

NAR: Existing-Home Sales Decreased to 4.08 million SAAR in January

From the NAR: Existing-Home Sales Decreased 4.9% in January, But Increased Year-Over-Year for Fourth Consecutive Month

Existing-home sales retreated in January, according to the National Association of REALTORS®. Sales slipped in three major U.S. regions and held steady in the Midwest. Year-over-year, sales rose in three regions and were unchanged in the South.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – descended 4.9% from December to a seasonally adjusted annual rate of 4.08 million in January. Year-over-year, sales improved 2.0% (up from 4 million in January 2024).

...

Total housing inventory registered at the end of January was 1.18 million units, up 3.5% from December and 16.8% from one year ago (1.01 million). Unsold inventory sits at a 3.5-month supply at the current sales pace, up from 3.2 months in December and 3.0 months in January 2024.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1994.

Sales in January (4.08 million SAAR) were down 4.9% from the previous month and were 2.0% above the January 2024 sales rate. This was the fourth consecutive year-over-year increase after declining YoY every month for over 3 years.

According to the NAR, inventory increased to 1.18 million in January from 1.14 million the previous month.

According to the NAR, inventory increased to 1.18 million in January from 1.14 million the previous month.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 16.8% year-over-year (blue) in January compared to January 2024.

Inventory was up 16.8% year-over-year (blue) in January compared to January 2024. Months of supply (red) increased to 3.5 months in January from 3.2 months the previous month.

The sales rate was below the consensus forecast. I'll have more later.

ICE: Mortgage Delinquency Rate Decreased in January

by Calculated Risk on 2/21/2025 08:07:00 AM

• Delinquencies fell 24 basis points (bps) to 3.47% in January; that’s 10 bps higher than last year, but 33 bps below pre-pandemic levels

• Foreclosure starts jumped by 30% and sales rose by 25% in January – driven by an expiration in the VA foreclosure moratorium – with active inventory rising by 7% in the month

• While the number of borrowers past due as a result of last year’s hurricanes has fallen from 58K to 41K in recent months, the financial impact from the recent Los Angeles wildfires is emerging

• An estimated 680 homeowners in the path of the Los Angeles wildfires missed their January mortgage payment, and ICE’s daily mortgage performance data suggests the number of past-due borrowers could surpass 2,800 by the end of February.

• Prepayment activity (SMM) fell to 0.48% in January, its lowest level in nearly a year, driven by the combination of modestly higher rates and the typical seasonal slowdown in home sale activity

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a table from ICE.

Thursday, February 20, 2025

Friday: Existing Home Sales

by Calculated Risk on 2/20/2025 07:01:00 PM

Friday:

• At 10:00 AM ET, Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 4.17 million SAAR, down from 4.24 million.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (Final for February).

Realtor.com Reports Active Inventory Up 27.6% YoY

by Calculated Risk on 2/20/2025 03:25:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For January, Realtor.com reported inventory was up 24.6% YoY, but still down 24.8% compared to the 2017 to 2019 same month levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data for Week Ending Feb. 15, 2025

• Active inventory increased, with for-sale homes 27.6% above year-ago levels

For the 67th consecutive week, the number of homes for sale has increased compared with the same time last year. This week also marked the sixth straight week where the growth rate has increased, fueled by the entrance of many new listings on the market.

• New listings—a measure of sellers putting homes up for sale—increased 5%

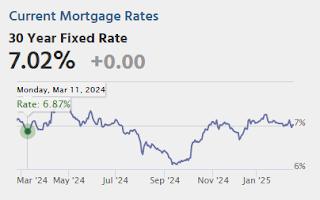

Newly listed inventory increased year over year for the sixth week in a row, as sellers go online for the spring buying season. Despite mortgage rates remaining stubbornly high and many prospective sellers feeling the lock-in effect due to their lower previous rates, new homes are hitting the market at a faster pace than in 2024 at this time.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 67th consecutive week.

California Home Sales Down 1.9% YoY in January; 4th Look at Local Housing Markets

by Calculated Risk on 2/20/2025 12:36:00 PM

Today, in the Calculated Risk Real Estate Newsletter: California Home Sales Down 1.9% YoY in January; 4th Look at Local Housing Markets

A brief excerpt:

Here a few more local markets prior to the NAR release tomorrow.There is much more in the article.

The NAR is scheduled to release January Existing Home sales on Friday, February 21st at 10:00 AM. The consensus is for 4.10 million SAAR, down from 4.24 million in December. Last year, the NAR reported sales in January 2024 at 4.00 million SAAR.

Housing economist Tom Lawler expects the NAR to report sales of 4.09 million SAAR for January.

...

From the California Association of Realtors® (C.A.R.): Elevated mortgage rates drag down January home sales, C.A.R. reportsJanuary’s sales pace fell from the 282,490 homes sold in December and was down 1.9 percent from a year ago, when a revised 259,160 homes were sold on an annualized basis. The January sales level was the lowest in 13 months, and the double-digit month-to-month sales decline was the biggest decrease in 30 months. The year-over-year decline was the first in eight months....

Several local markets - like Illinois, Miami, New Jersey and New York - will report after the NAR release.

LA Ports: Record Inbound Traffic for January

by Calculated Risk on 2/20/2025 09:49:00 AM

This was a new record for imports in January, eclipsing the previous recent (Jan 2022) by 17%!

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic increased 1.9% in January compared to the rolling 12 months ending in December. Outbound traffic was unchanged compared to the rolling 12 months ending the previous month.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday and then decline sharply and bottom in the Winter depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday and then decline sharply and bottom in the Winter depending on the timing of the Chinese New Year. Weekly Initial Unemployment Claims Increase to 219,000

by Calculated Risk on 2/20/2025 08:30:00 AM

The DOL reported:

In the week ending February 15, the advance figure for seasonally adjusted initial claims was 219,000, an increase of 5,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 213,000 to 214,000. The 4-week moving average was 215,250, a decrease of 1,000 from the previous week's revised average. The previous week's average was revised up by 250 from 216,000 to 216,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 215,250.

The previous week was revised up.

Weekly claims were above the consensus forecast.

Wednesday, February 19, 2025

Thursday: Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 2/19/2025 07:24:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for an increase to 216 thousand from 213 thousand last week.

• Also at 8:30 AM, The Philly Fed manufacturing survey for February. The consensus is for a reading of 25.4, down from 44.3.

AIA: Architecture Billings "Billings remain soft to start the new year"

by Calculated Risk on 2/19/2025 04:01:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: ABI January 2025: Architecture firm billings remain soft to start the new year

The AIA/Deltek Architecture Billings Index (ABI) score was 45.6 for the month, slightly above the December score. This means that while a majority of firms still saw their billings decrease in January, the share of firms experiencing that decrease was slightly smaller than in December. Inquiries into new projects continued to grow at the same slow pace as in recent months, but the value of newly signed design contracts declined for the eleventh consecutive month as clients remained cautious about committing to new projects during the ongoing economic uncertainty. (Note that every January, the seasonal adjustment factors for all ABI data series are revised, leading to revisions in recent historical data.)• Northeast (41.1); Midwest (45.6); South (46.0); West (48.8)

Billings were also soft at firms in all regions of the country in January. Firms located in the West saw very modest billings growth in the fourth quarter of 2024, but unfortunately, billings returned to negative territory to start the new year. Business conditions remained softest at firms located in the Northeast, which has been the trend in recent months. And billings softened further at firms located in the South, which saw more encouraging signs last fall, before weakening again. Billings also declined at firms of all specializations in January. Firms with a commercial/industrial specialization continued to be most likely to report softening business conditions, but billings have weakened at firms of all specializations in recent months.

...

The ABI score is a leading economic indicator of construction activity, providing an approximately nine-to-twelve-month glimpse into the future of nonresidential construction spending activity. The score is derived from a monthly survey of architecture firms that measures the change in the number of services provided to clients.

emphasis added

• Sector index breakdown: commercial/industrial (43.1); institutional (47.4); multifamily residential (45.0)

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 45.6 in January, up from 44.1 in December. Anything below 50 indicates a decrease in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment in 2025.

FOMC Minutes: Concern about tariffs, "take time" on any additional Rate Cuts

by Calculated Risk on 2/19/2025 02:00:00 PM

From the Fed: Minutes of the Federal Open Market Committee, January 28–29, 2025. Excerpt:

With regard to the outlook for inflation, participants expected that, under appropriate monetary policy, inflation would continue to move toward 2 percent, although progress could remain uneven. Participants cited various factors as likely to put continuing downward pressure on inflation, including an easing in nominal wage growth, well-anchored longer-term inflation expectations, waning business pricing power, and the Committee's still-restrictive monetary policy stance. A few noted, however, that the current target range for the federal funds rate may not be far above its neutral level. Furthermore, some participants commented that with supply and demand in the labor market roughly in balance and in light of recent productivity gains, labor market conditions were unlikely to be a source of inflationary pressure in the near future. However, other factors were cited as having the potential to hinder the disinflation process, including the effects of potential changes in trade and immigration policy as well as strong consumer demand. Business contacts in a number of Districts had indicated that firms would attempt to pass on to consumers higher input costs arising from potential tariffs. In addition, some participants noted that some market- or survey-based measures of expected inflation had increased recently, although many participants emphasized that longer-term measures of expected inflation had remained well anchored. Some participants remarked that reported inflation at the beginning of the year was harder than usual to interpret because of the difficulties in fully removing seasonal effects, and a couple of participants commented that any increase in reported inflation in the first quarter due to such difficulties would imply a corresponding decrease in reported inflation in other quarters of the year.

...

In discussing the outlook for monetary policy, participants observed that the Committee was well positioned to take time to assess the evolving outlook for economic activity, the labor market, and inflation, with the vast majority pointing to a still-restrictive policy stance. Participants indicated that, provided the economy remained near maximum employment, they would want to see further progress on inflation before making additional adjustments to the target range for the federal funds rate. Participants noted that policy decisions were not on a preset course and were conditional on the evolution of the economy, the economic outlook, and the balance of risks.

emphasis added